Getting an auto loan when you have a bad credit, or no credit history at all, may sound impossible, but Canada has many subprime lenders to help such customers acquire a car of vehicle. Each provider offers unique features, which are configurable in terms of options.

Compare Rates Online Now

| ☝IMPORTANT 2025 TIPS: ➔ Crumbling under debt? Avoid getting more loans. Check if you qualify for up to 50% debt relief with Consolidated Credit Canada. ➔ Rejected by banks for your car loan and absolutely need this loan? Check CompareHub to see if you qualify with other loans from alternative lenders. (Expect Higher Rates!) |

If you have been rejected by banks and are looking for alternative lending options to buy your vehicle, below is a comparison table of some of the top alternative car loan providers for Canadians with low credit (or no credit).

Comparison Table for Auto Lenders in 2025

| Lender | Highlights |

|---|---|

| Axis Auto Finance | – Approves all credit types. – Flexible repayment terms (36-72 months). – Trade-in options to reduce borrowing needs. – Cons: Higher interest rates, used cars only. |

| Wippy | – 0% interest financing options. – No credit checks required. – Cons: Penalties for missed payments; collateral required (e.g., your car). |

| Econommi | – Unique interest-free leasing model. – Accessible to bad/no credit applicants. – Cons: Limited dealership network; smaller review base online. |

| Northlake Financial | – Strong dealership network. – Flexible loan terms with pre-approval process. – Cons: Occasional slow customer service responses. |

| Canada Drives | – Fast online application with vehicle delivery. – CLA certified for ethical lending. – Cons: Limited vehicle inventory; higher interest rates for poor credit. |

| Carma Auto Finance | – Accessible loans regardless of credit score. – Flexible repayment options. – Cons: Higher interest rates for subprime borrowers; mixed customer service reviews. |

| Quantifi Lending Inc. | – Easy online application with quick approvals. – Open to poor credit applicants. – Cons: Higher interest rates for subprime loans; customer service delays. |

| Loans Canada | – Broad range of loan types. – In-depth loan selection guides available. – Cons: Some lenders conduct hard credit checks; higher rates for poor credit. |

| Prefera Finance | – Customizable repayment plans (weekly/bi-weekly/monthly). – Accessible to bad credit borrowers. – Cons: High interest rates; slow service responses reported. |

| Auto Capital Canada | – No-down-payment options. – Offers refinancing services. – Cons: High interest rates; mixed customer reviews on service transparency. |

| ➔ Rejected by banks? Compare rates from multiple lenders with a service like CompareHub from Loans Canada. (Expect Higher Rates Than Banks) |

Now, in the rest of the article, we’ll provide you with s a detailed ranking and review of these ten best auto loan lenders for the bad and no credit check applicants in Canada. We have ranked the companies based on their fees and customer reviews. By the end of this guide, you will be in a good position to decide on the best option to take for your auto financing.

10 Auto Loans in Canada for Bad & No Credit Applicants

1. Axis Auto Finance

Why Axis Auto Finance is ranked #1: High positive feedback from customers. Strong overall value with flexible terms.

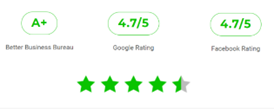

Rating: (4.7/5 on Google)

Axis Auto Finance is at the top of this list as it meets the needs of many borrowers and helps borrowers rebuild credit with flexible repayment terms and clarity of loan terms. Read our full review of the lender here.

Key Features:

Approval for all credit types: What makes Axis attractive as an organization is the fact that it extends credit facilities to clients regardless of their credit status. The approval process of their loans is fast and efficient and it is open to everyone.

Flexible repayment terms: The repayment of the loans is also flexible and takes 36 to 72 months to complete. Customers have the chance to choose the payment plan that they deem most suitable for them.

Trade-in options: Borrowers can also use trade-in option to reduce the amount they borrow from the lenders.

Disadvantages:

Higher interest rates: Some of the borrowers may be charged a higher rate based on their credit scores.

Used cars only: Axis only provides funding for used cars.

2. Wippy

Why It’s #2: Interest-free loans are appealing.

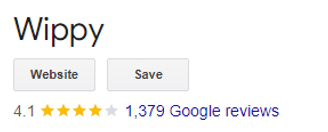

Rating: (Google 4.1/5) (Trustpilot 1.9/5)

Wippy has gained a reputation for their no credit check financing. WippyPay is the primary product of Wippy, which is a BNPL wallet that enables consumers to pay for car repair, upgrade, and maintenance services in Ontario.

Key Features:

Interest-free Loan Options: Unlike other firms in the industry, Wippy offers 0% interest deals. Note that their site markets 0% and instant approvals with no credit check, but they also take security over the vehicle (a lien under PPSA) per their borrower/terms pages.These plans are appropriate for customers who wish to pay little to take a car repair or maintenance loan.

No Credit Check: Wippy is ideal for those who wish to take out loans for their cars without affecting their credit rating.

Drawbacks:

Penalties for missed payments: Borrowers stand the danger of losing their cars as it is needed for collateral.

3. Econommi

Why It’s #3: Unique interest-free leasing and high-positive feedback from customers. Note that this is an interest-free / fixed-fee lease model (not a typical auto loan). We are also talking about a limited network here and most info we gathered comes from the company itself.

Rating: (4.8/5 on Google)

Econommi has shown its interest-free leasing model as a cheap option for people with bad credit. The lender is certified by the CLA and therefore it has a high standard of ethics when it comes to loans.

Key Features:

Interest-Free Leasing: The interest-free leasing model is one of the important factors that users can receive. The interest-free model makes it possible for the customer to comfortably afford monthly installments without the financial strain that most auto loans create.

Available to People with a Bad Credit Score: Econommi comes with an unconventional credit scoring system and makes leasing available to individuals with low or no credit scores.

Drawbacks:

Limited dealership network: Fewer loan options in comparison with rivals.

Smaller review base: Little customer feedback on the internet.

4. Northlake Financial

Why It’s #4: Broad dealership network and flexible terms.

Rating: (4.3/5 on Google)

Northlake Financial has a strong dealership network, meaning that the borrowers can easily find vehicles in their budget. Northlake Financial is a good company for subprime borrowers. The lender operates in all the provinces of Canada and pre-approves the dealerships for financing. The repayment options are flexible and are determined by the needs of the borrower.

Pros of choosing Northlake:

Pre-approval process: The borrowers can know their financing limits before going shopping.

Flexible loan terms: Northlake offers flexible loan terms, allowing customers to choose repayment terms as per their financial situation.

Partnerships with dealerships: One of the core competitive strengths of the company is strong links with dealerships throughout Canada, so borrowers can search for and purchase a car with ease.

Drawbacks:

Customer service concerns: Occasionally borrowers complain of slow response time.

5. Canada Drives

Why It’s #5: Strong convenience and good customer feedback, but higher interest rates hurt subprime affordability.

Rating: (4.3/5 on Google, 3.4/5 on TrustPilot)

Canada Drives provides car financing to Canadians, particularly to those with poor credit histories. The platform partners with a vast network of dealerships and lenders to help consumers, regardless of their credit score, get the car of their choice.

Advantages of Canada Drives:

Short Application Time: The online application is fast and easy, and most customers get pre-approval in minutes. This speed makes Canada Drives perfect for people who need to get financing for a car as fast as possible.

Vehicle Delivery: The company used to offer vehicle delivery. That program ended when Canada Drives exited online car sales in 2023; today they match shoppers with local dealers and financing online (no delivery). Update the copy and remove delivery.

CLA Membership: Canada Drives is a member of the Canadian Lenders Association, which means that they have to uphold some basic standards of ethics in lending.

Disadvantages:

Limited vehicle inventory: Choices may be restricted to certain dealerships.

Higher interest rates: Borrowers with poor credit may pay more.

6. Carma Auto Finance

Why Carma Auto Finance is ranked #6: Accessible loans for bad credit with flexible terms but higher rates impact affordability.

Rating: (4.1/5 on Google)

Carma Auto Finance excels in providing affordable car loans and is always ready to provide approval within a short period, making it suitable for car buyers. We did a detailed review of Carma Auto Finance here.

Key Features:

Accessible Loan Regardless of Credit Score: One of the biggest reasons for choosing Carma Auto Finance is that it offers credit to those with bad credit. This makes Carma useful to anyone who may not be in a position to obtain any funding from traditional financial institutions.

Flexible Loan Terms: Carma also gives borrowers the right to select the most convenient method of repaying the loan. This goes a long way in making car ownership cheap and thus within the reach of many potential consumers.

Disadvantages:

Higher interest rates for subprime borrowers: Rates may be steep for bad credit applicants.

Customer service limitations: Some of the borrowers have complained that they have had challenges in accessing representatives.

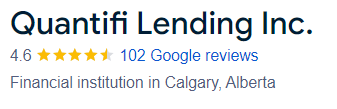

7. Quantifi Lending Inc.

Why Quantifi Lending Inc. is ranked #7: Easy application and quick approval, though rates for subprime applicants weigh it down.

Rating: (4.6/5 on Google)

Quantifi Lending offers flexible loan options and caters to borrowers with poor credit through quick approvals and transparent terms. Read our detailed review of this lender here.

Key Features:

Accessible to Borrowers with Poor Credit: Another advantage of selecting Quantifi is that the firm is open to working with all kinds of clients, irrespective of their credit scores.

Simple Application Process: The application process is very easy and since it is an online application, it can be done anywhere and approval can also be done within a short time if the borrower needs the money urgently.

Cons of Quantifi Lending:

Higher interest rates: Subprime borrowers pay higher interest rates.

Customer service concerns: People have criticized the customer service for taking long time to reply back.

8. Loans Canada

Why Loans Canada is ranked #8: Wide range of loans, though borrowers face high rates and hard credit checks with some lenders.

Rating: (4.0/5 on Google)

Loans Canada provides access to a vast network of lenders and helps Canadians get the right financing and build credit.

Key Features:

Range of Loan Types: LoansCanada enlists a wide range of loan types, from home loans to insurance and business loans.

In-depth Guides: On the LoansCanada website, users will be able to read extensive manuals on how to choose the right type of loan.

Cons of choosing Loans Canada:

Higher interest rates: Borrowers with low credit rating may be charged higher rates.

Third-party lenders: Some lenders may ask for credit checks and you can expect them to do a hard credit check.

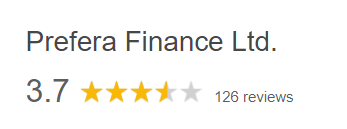

9. Prefera Finance

Why It’s #9: Customizable plans for bad credit borrowersbut suffers from high interest rates and delayed service responses. Note that the BBB currently lists them as not accredited.

Rating: (3.7/5 on Google)

Prefera Finance provides several financing options for purchasing automobiles and recreational vehicles. Prefera Finance specializes in financing not only cars but also motorcycles, boats, and trailers.

Key Features:

Accessible for Poor Credit Borrowers: Prefera Finance can be favorable for those who face problems with getting a loan from conventional financial institutions because of their bad credit score.

Customizable Payment Plans: The company allows customers to choose from weekly, bi-weekly, or monthly payment schedules.

Drawbacks:

Higher interest rates: Costs may be steep for subprime borrowers.

Customer service delays: Some reports of slow responses.

BBB currently lists them as not accredited

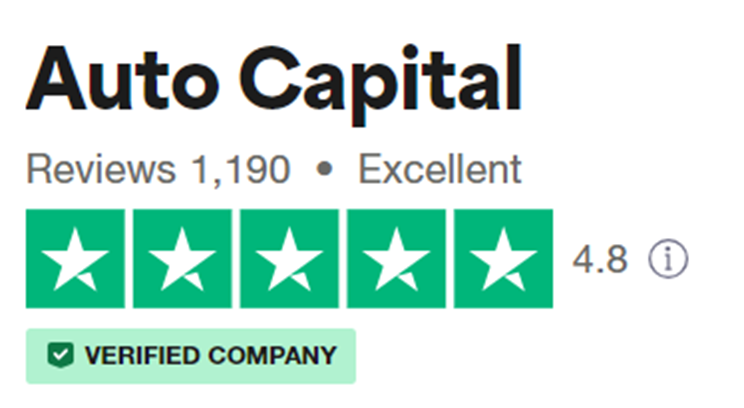

10. Auto Capital Canada

Why Auto Capital Canada is ranked #10: Appeals to no-down-payment applicants but ranks low due to high rates and some negative reviews.

Auto Capital focuses on second-chance financing, offering no-down-payment options and refinancing services for existing loans.

Key Features:

Credit Approvals for All Credit Cases: Auto Capital has built a reputation for offering auto loans to individuals in all sorts of credit situations. This means that no matter your credit score, Auto Capital has got your back as far as financing is concerned.

Easy and Quick Application: The application process is quite simple, which involves filling out an online application form where a customer can apply for a loan and make a decision, speeding up the time it takes to get behind the wheel of a new vehicle.

Drawbacks:

High interest rates: Common for subprime loans.

Inconsistent feedback: Mixed reviews on customer service and transparency.

Conclusion

One thing to remember: always check your interest rates and how compare with other lenders! Also, note that Canada’s criminal interest rate is 35% APR (effective Jan 1, 2025), and several provinces (e.g., Alberta, Québec) have high-cost credit rules that can apply to auto/instalment loans.

To choose an auto loan provider, it is crucial to compare features, as well as the terms and costs of an auto loan provider. Some of the popular options include Axis Auto Finance, Northlake Financial and Canada Drives due to the various and wide services they offer and the friendly terms for borrowers. It is advised to look at your own unique needs and then select provider that is offering the best loan options for your specific needs.