Consolidated Credit Canada – Legit Debt Relief Service? Read Our 2025 Review…

Consolidated Credit Canada (www.consolidatedcreditcanada.ca) is the country's largest non-profit when it comes to debt relief. With offices in almost every province in territory, they provide credit counseling and debt consolidation services to Canadians who want to lower and/or pay off...

Read More

Borrowell: Is It Really Free? We Review This Canadian Credit Report Monitoring Tool for 2025

Borrowell (https://borrowell.com/) is making waves in Canada as a "free" credit monitoring and score improvement. But is it actually "free"? And is it even helpful? In this review, I’ll break down what Borrowell offers, how it works, to help you...

Read More

Nyble – Legit for Loans & Credit Building? (2025 Review)

Should you consider Nyble (www.nyble.com) instead of a traditional loan? I think you should. Especially if you need a small loan (up to $250) and want to pay 0% interest. Nyble also offers credit building tools. In this review, we'll...

Read More

Farber Debt Solutions – We Review This Canadian Licensed Insolvency Trustee (2025 Update)

Credit: Farber Debt Solutions Dealing with debts can be overwhelming, and many Canadians struggle to find a solution that helps them regain financial stability. One of the most trusted names in debt relief is Farber Debt Solutions. The firm is...

Read More

Credit Counselling Society – Is This a Good Debt Counsellor in Canada for 2025? Let’s Review…

The Credit Counselling Society (CCS) is one of the leading non-profit credit counselling agencies in Canada, which helps people facing debt problems. CCS was founded in 1996 and offers debt counselling, DMPs, and other financial education services. In this article...

Read More

Credit Verify – Is It Good for Credit Monitoring in 2025? Read Our Review.

Image Credit: CreditVerify.ca Keeping an eye on your credit score is a smart move if you’re worried about your finances. One service that you can use to monitor and improve your credit score is Credit Verify. In this review, we'll...

Read More

Koho Credit Building Review – Is It Legit in 2025?

Need to improve your credit score and access to a quick cash advance at the same time? With KOHO's credit-builder loans aimed to enhance your appeal to potential lenders, you might have just found your answer. Now, does it deliver...

Read More

Understanding R8 Credit Ratings: What You Need to Know

If there is a set of keys to unlocking your financial opportunities in Canada, then your credit rating is certainly one of them. Your rating determines your ability to access loans, credit cards, and even rental housing. But you may...

Read More

Understanding R9 Credit Ratings: What You Need to Know

Credit ratings in Canada play a major role in shaping your finances. They impact everything from loan approvals to interest rates, influencing your access to credit. Among these ratings, R9 is the most severe indicator of financial distress. It tells...

Read More

Understanding R7 Credit Ratings: What You Need to Know

Credit ratings act as tools to help manage your finances. They give an overview of how responsible you are with your money and can impact your ability to get a loan approval with a favourable interest rate. One of these...

Read More

Understanding R5 Credit Ratings: What You Need to Know

While they may not be top of mind, our credit ratings are a key part of our finances. They act as a snapshot of a borrower’s creditworthiness, influencing a wide range of financial opportunities. Their importance spans from loan approvals...

Read More

Understanding R4 Credit Ratings: What You Need to Know

Credit ratings play a fundamental role in personal finance. Why? Because they are an indicator of our creditworthiness. These ratings influence loan approvals and affect everything from interest rates to financial opportunities. Among the various possibilities, an R4 credit rating...

Read More

Understanding R3 Credit Ratings: What You Need to Know

Lenders view our financial reliability through the lens of a credit rating. This is because our rating determines creditworthiness. An R3, for example, may indicate the inability to manage debt effectively. Here, I will answer the question, “What is R3...

Read More

Understanding R2 Credit Ratings: What You Need to Know

Credit ratings in Canada play a crucial role in determining your creditworthiness. They affect many aspects from loan approvals to interest rates on mortgages. Given they have this much influence over your financial well-being, it is integral to have a...

Read More

Understanding R1 Credit Ratings: What You Need to Know

Is your credit rating something you check frequently, like your bank balance? It’s not for me. If you are similar to most Canadians, then it is probably safe to assume you don’t check your rating either. While your credit rating...

Read More

Understanding R0 Credit Ratings: What You Need to Know

Do you think about your credit rating daily? No? Me neither! Though we may not think about it often, it doesn’t mean our credit rating is unimportant. In fact, it’s the opposite. Credit ratings are necessary for determining financial health....

Read More

Debt Consolidation or Consumer Proposal: What Should You Choose to Alleviate Debt?

Handling high amounts of debt is never a fun thing, especially when one has to work hard to pay many loans, credit cards or even overdue bills. If you find yourself at a point where you cannot pay your debts...

Read More

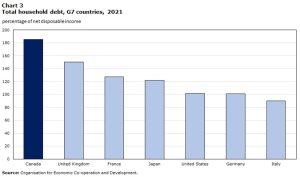

Debt Consolidation vs Consumer Proposal in Canada: What’s Best?

Debt is a reality many Canadians live with. The household debt-to-income ratios have continued to soar. The household debt-to-income ratio reached 184.5% in early 2023, meaning Canadians owed $1.85 for every dollar of disposable income. If you are feeling buried under financial...

Read More

How to Improve Your Canadian Credit Score – 10 Tips To Follow Immediately

Your credit score is a critical factor that determines whether you qualify for a mortgage, auto loan, line of credit, or other lending vehicles. And if unfortunate circumstances hurt your score and made it difficult to obtain financing, there are...

Read More

Money Mentors – Best Choice in Alberta for Debt Relief? Read Our 2025 Review…

Dealing with debt can feel overwhelming, but organizations like Money Mentors offer much-needed relief, especially for residents of Alberta. Founded in 1997, Money Mentors is a non-profit organization that specializes in credit counseling, debt management, and financial education. It is...

Read More