In a challenging macroeconomic environment, access to capital can vary across industries. And with small businesses often hurt the most when institutions tighten their lending standards, asset-based financing helps mitigate these challenges by using collateral as a form of surety. But, is it a worthwhile solution for your Alberta business?

Best Places for Asset-Backed Financing in AB?

#1 – Top Five Banks (RBC, BMO, TD, ScotiaBank, CIBC). Why? They generall have the best rates, you need a good credit profile. Alberta-based Credit Unions are also a good place to inquire about this type of financing. They include: ATB Financial, Servus Credit Union, Connect First Credit Union, First Calgary Financial. Keep reading for more details on the best financial institutions that offer asset backed loans.

#2 – Swoop Funding – this company provides equipment and machinery loans for Alberta businesses of all sizes, and they work with various banks as well in their roster. They accept lower credit scores and are faster and more flexible than banks.

#3 – Journey Capital – Another well-reviewed Canadian business lender that may offer equipment loans in AB. They approve lower credit scores, as low as 550. Pretty competitive with Merchant Growth in terms of approval time and rates too.

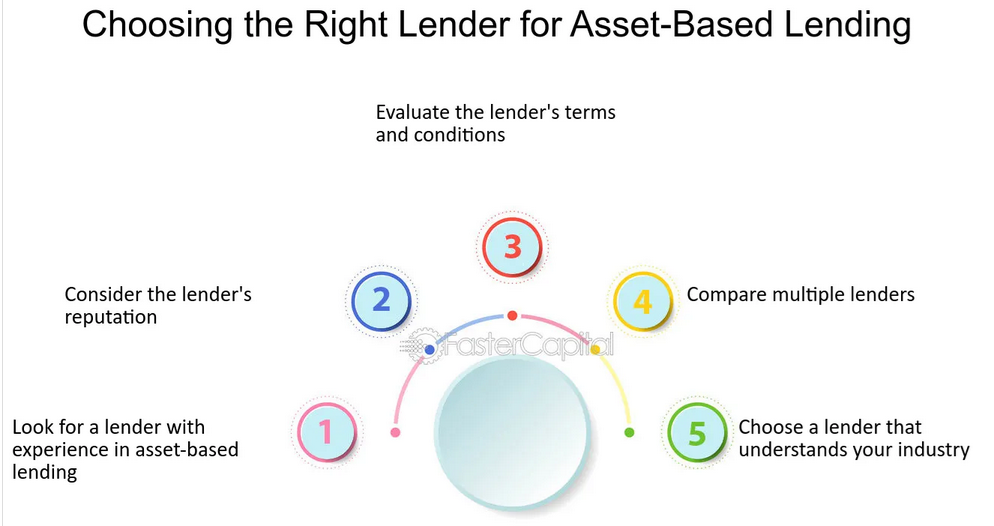

IMPORTANT TIP: shop around! Ask at least 2-3 lenders to give you a quote before you decide who to go with for financing.

How Does Asset-Based Financing Work?

Unlike a personal loan, credit card, or traditional line of credit, asset-based financing underwrites the loan with collateral, which is similar to a mortgage. The strategy provides lenders with the peace of mind that if the borrower defaults, the financier can seize the collateral and sell it on the open market. The proceeds allow the lender to recoup the principal from the defaulted loan.

To further protect the lender, loan-to-value (LTV) ratios are considerably less than 100%. Typically, the percentage ranges from 60% to 80%, which means $100,000 of collateral will net you a loan of $60,000 to $80,000. Lenders use the ‘margin of safety’ to ensure that if a default occurs, they can sell the collateral quickly and recoup the loan proceeds. As a result, it’s imperative to only consider an asset-backed loan in Alberta if you can repay the funds.

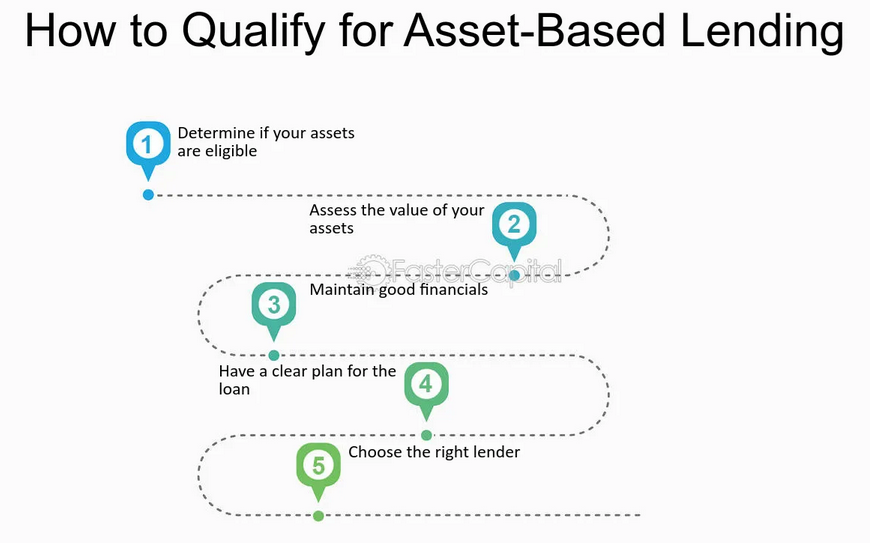

Qualifying assets typically include inventory, accounts receivables, machinery, property, invoices, and other balance sheet assets. Lends will scrutinize the condition and/or value of the asset to determine its liquidity and the potential risks of extending financing.

How Important Is My Credit Score?

Whether it’s a business or personal loan, your individual credit score can play a key role in the terms and cost of credit. When you have a poor credit score, lenders deem you at a higher risk of default, which results in a higher interest rate to compensate for the additional risk.

When applying for an asset-based loan in Alberta, the same challenges can arise. Despite posting collateral, a weak credit score can result in lower LTV ratios and stricter loan covenants. Regarding the latter, rigid terms could mean maintaining minimum financial ratios or limiting other forms of debt financing.

As such, we believe it’s wise to improve your credit score before searching for an asset-backed loan in Alberta. To make the endeavor as easy as possible, our guide on How to Improve Your Canadian Credit Score includes 10 reliable strategies to boost the metric. The Government of Canada notes that “it takes 30 to 90 days for information to be updated in your credit report.” Therefore, you can build momentum in short order.

In contrast, increasing your credit score from 400 to 700 will take more time. It’s a long-term commitment and should be viewed as a gradual process. However, if you follow the 10 tips outlined in our guide, you can achieve success.

Where Can I Find Asset-Based Loans In Alberta?

For applicants with higher credit scores, traditional banks should be atop your list when searching for an asset-based loan in Alberta. The Big 5 — RBC, TD, BMO, CIBC, and Scotiabank — operate nationwide and have the size and scale to meet your needs.

As a fallback option, alternative lenders may be the best resource for small businesses in Alberta. Since the Big 5 cator to larger companies, alternative lenders may be the only choice if you’re an upstart or have low revenues.

If a bad credit score is holding you back, improving the metric is advised before applying for asset-based financing in Alberta. Remember, taking out a high-interest loan will likely worsen the situation by creating cash flow problems. Consequently, securing the lowest rate and best terms should be a top priority.

Below, we curated a list of institutions where Albertans can find asset-based loans:

1. Royal Bank of Canada

With operations across the globe, the Royal Bank of Canada (RBC) has participated in asset-backed lending since 1999. Moreover, RBC works with small, medium, and large-sized companies, so it may suit all applicants.

In addition, its secured revolving lines of credit have the following features:

- LTV ratios can reach 90% for accounts receivable and appraised inventory

- Fixed assets’ appraised values can be used for term loan collateral

- Customer invoices can be priced at 100% of their face value

- You can obtain financing in several currencies, including CAD, USD, and others

2. Canadian Imperial Bank of Commerce

Second on the list, the Canadian Imperial Bank of Commerce (CIBC) issues asset-backed loans in Alberta, and qualifying collateral includes accounts receivable, inventory, property, machinery, and others. Moreover, limited or no financial covenants are available for some applicants.

The only pitfall of CIBC is that medium and large businesses are its primary client base, so small businesses may be out of luck.

3. Roynat Capital

As a division of Scotiabank, Roynat Capital provides asset-based financing in Alberta. The strategy is typically used for asset purchases, financing acquisitions or expansions, succession plans, and balance sheet recapitalizations.

Furthermore, working capital loans can also finance growth, product development, eliminate cash shortfalls, or be used to pay employees. As a result, you should contact Roynat Capital directly to determine the right solution and terms for your business.

4. Liquid Capital

As one of North America’s leading alternative lenders, Liquid Capital provides asset-based financing in Alberta. Loans are backed by real estate, equipment, or other assets, and the secured line of credit is repaid in monthly installments.

Financing can reach upwards of $10 million, and you also obtain strategic guidance to assist your business with operational difficulties. Liquid Capital has a large network of alternative funding professionals across Canada and the U.S., and its advisers understand local markets.

The only downside is Liquid Capital requires a strong or higher credit score to qualify. As a result, the policy highlights the importance of reading our guide.

5. Servus Credit Union

As Alberta’s largest credit union, Servus provides asset-based loans to businesses across all industries. You can apply for fixed or floating-rate loans for business construction, acquisitions, expansions, and equipment financing.

But, please note the repayment terms, the percentage of advance, and required collateral depend on the cash flow of your business.

6. Canadian Western Bank

Since its humble beginnings in Edmonton, Alberta, in 1984, Canadian Western Bank (CWB) specializes in construction, forestry, oil field services, and transportation equipment financing. To apply, you need the following information:

- Three years of financial statements, plus interim financial statements if your fiscal year-end was more than six months prior

- Details about your operations

- Details about the equipment you want to purchase.

In addition, CWB mainly works with mid to large-market businesses, so it’s best for established companies with higher revenues. But, it is a member of the Canadian Lenders Association (CLA), which promotes ethical credit practices across Canada.

7. QuickFi

As a 100% digital solution, QuickFi aims to disrupt the equipment financing market by reducing challenges for small and medium-sized businesses. Promoting a faster and dramatically preferred borrower experience, companies in Alberta can obtain equipment loans in as little as three minutes.

Through its relationships with original equipment manufacturers (OEMs) and banks, special terms and rates often aren’t available elsewhere.

The company also boasts “bank level security,” and is a CLA member institution.

Conclusion

If you need asset-based financing in Alberta, reliable solutions are available. However, since large traditional banks, alternative lenders, and private debt firms dominate the market, local firms tend to focus more on consumer loans. Check out our Top Equipment Loans for Canadian Startups article for more options that cover the entire country, not just AB.

To find the best product and obtain the best terms, it’s wise to submit several applications and inquire about which firms offer the lowest financing rates and the fewest covenants. Remember, loan covenants limit how you can utilize your capital, so it’s essential to understand the ramifications before signing on the dotted line.

Finally, taking the time to repair your credit score can enhance your asset-based loan application and potentially shorten the due diligence process, leading to faster approvals.