If your business needs capital but credit seems out of reach, there are solutions. By using company assets like machinery, inventory, receivables, or others as collateral, lenders may be more willing to extend financing. But, with different options available, where can you find the best asset-based lenders in BC?

Top 5 Asset & Equipment Lenders in BC

| Company | Highlights |

| Banks & Credit Unions (RBC, TD, VanCity, etc) |

Best rates in BC, but stricter credit requirements. Longer application and funding time. |

| Swoop Funding (business and equipment lender) |

Alternative BC lender that specializes in equipment and asset lending. Can provide larger loans than others (1mm+). Fast funding. |

| MicroCapital (broker) |

Works with 35 BC lenders to offer you different options.Fast funding (24h-72h) and accepts lower credit profiles. |

| LoansCanada (broker) |

Works with 50+ BC lenders to find the best rates your company can qualify for. Fast funding (24h-72h) & Low Credit Scores Accepted… |

| Journey Capital (alternative lender) | Well-rated business & startup lender in BC. Accepts low credit scores. Funding in 24h-72h. |

IMPORTANT TIP: shop around! Ask at least 2-3 BC-based lenders to give you a quote before you decide who to go with for financing.

What Is Asset-Based Financing?

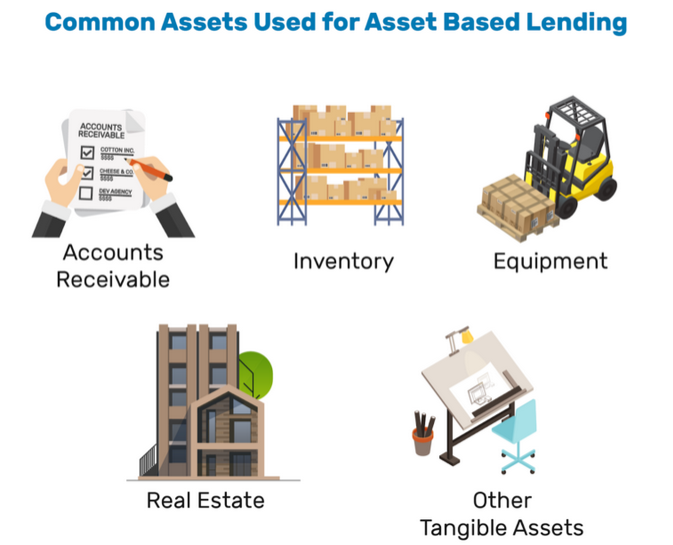

Like a mortgage, where your home is used as collateral, asset-based financing uses company assets to reduce lenders’ risk. By securing the proceeds against marketable items, lenders can seize those items and sell them if you don’t repay the debt. The terms protect creditors in case of default and increases their likelihood of lending you money.

The downsides are that you typically receive less money than your collateral is worth. For example, if you need $50,000 for a renovation, the loan-to-value (LTV) ratio could range from 60% to 80%, which means you’ll likely qualify for a $30,000 to $40,000 loan. The deal is structured this way to protect lenders in case they have to seize and sell your asset quickly. In that event, they may receive below-market offers, which is why a lower LTV ratio is used for additional protection.

Another issue is interest costs. If your business takes on an asset-based loan, interest charges of 10% or more can result in cash flow crunches, which hurts operational efficiency. As a result, you should consider several factors before applying for asset-based financing.

To learn more about how the process works, please see our Asset-Backed Financing Guide.

Are Unsecured Loans An Option?

If you’ve been denied several times for a business line of credit in Vancouver, Victoria, Surrey, Kelowna, Kamloops or any other major city in BC, you may think an asset-based loan is your only option. However, improving your credit score is a strategy that pays off over the long term.

If personal credit problems have been a part of your life, lenders will often view the missteps negatively. In other words, if you’ve defaulted on personal loans, why would your business operate any differently?

To avoid this stigma, there are several steps you can take to repair your credit score and demonstrate the initiative required to obtain better terms and rates. And while material progress won’t happen overnight, The Government of Canada notes that “it takes 30 to 90 days for information to be updated in your credit report.” As a result, you can build momentum and move the needle in the right direction.

For material changes to your credit score, it will likely take much longer. Although, our guide on How to Improve Your Canadian Credit Score includes 10 helpful tips that can be implemented at little or no expense. Consequently, we believe this is the best route for business owners considering asset-based loans.

Where Can I Find Asset-Based Loans In BC?

If you have a healthy credit score, traditional banks are a great place to begin your search for an asset-based loan. The Big 5 — RBC, TD, BMO, CIBC, and Scotiabank — have operations across the country and have solid reputations.

As a secondary option, alternative lenders fill the areas the Big 5 avoids and may be best for small businesses with lower revenues. The best approach is to compare their rates with other lenders to obtain the cheapest financing.

If you have poor credit, improving your score should be the first step, as banks and alternative lenders will likely issue asset-based loans with unfavourable terms.

Below are some Canadian resources where you can search for an asset-based loan:

1. Top Five Banks & Credit Unions

You might want to check with any of the top five banks or any major credit union in BC first to see if you can qualify with them, as they have the best rates and terms. For instance, the Royal Bank of Canada (RBC) has been active in asset-backed lending since 1999 and caters to small, medium, and large-sized companies. As a result, it’s a great place to inquire about an asset-based loan.

Furthermore, it’s secured revolving lines of credit come with the following benefits:

- The LTV ratio can reach upwards of 90% for accounts receivable and appraised inventory

- You can obtain term loans based on fixed assets’ appraised values

- The bank may purchase customer invoices at 100% of their face value

- Loans are available in Canadian, U.S., and other currencies

2. Swoop Funding (Specialized Equipment & Asset-Based Lender)

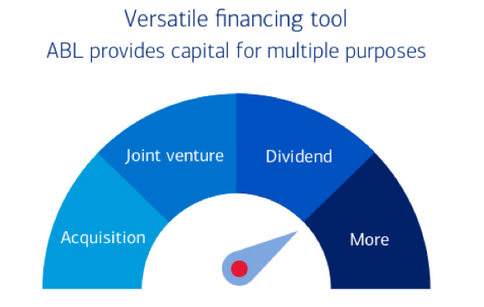

Swoop Funding specializes in equipment, machinery and asset-based funding in British Columbia. They are a broker that works directly with banks, private lenders and other financial institutions to help businesses of all sizes secure an asset-backed loan.

Whether you need to purchase new equipment, acquire a business, hire staff, or launch a new product, Swoop Canada offers asset-based loans with competitive interest rates and limited covenants. Qualifying assets include:

- Accounts Receivable

- Inventory

- Invoices

- Equipment

- Property

Swoop has offices across Canada and primarily provides financing for manufacturing, construction, wholesaling, transportation, and business services companies.

One of Swoop’s main advantages is that they can do larger loans than other lenders. In fact, they can offer loans larger than 1 million dollars, while most other alternative asset-based lenders in BC will generally offer loans between 5k to 300k. Swoop is also relatively easy to work with as they can work with lower credit scores.

3. LoansCanada (Broker working with 50+ Lenders)

Loans Canada offers a variety of business loans, including equipment and asset-backed loans. The company is a broker and their website acts as a loan search and comparison engine, connecting businesses with lenders. Here’s a summary of the types of business loans available through Loans Canada:

- Merchant Cash Advances – These provide an advance on future credit and debit card sales, making them ideal for businesses with steady sales that need quick cash. Repayments are a percentage of daily or monthly sales, allowing flexible payback aligned with income.

- Lines of Credit – Similar to a credit card, a line of credit provides access to a revolving amount of funds. This option is suitable for managing cash flow fluctuations, paying operational expenses, or purchasing inventory.

- Commercial Mortgages – For businesses looking to purchase or refinance real estate or large-scale commercial properties, commercial mortgages provide long-term financing options, using the property as collateral.

- Secured Business Loans – Loans backed by business assets, such as equipment or property, offer lower interest rates and higher borrowing limits. They are suitable for purchasing assets or funding business expansion.

- Equipment Loans – These loans are designed specifically for acquiring business equipment. The equipment itself often acts as collateral, and ownership transfers to the business once the loan is repaid.

Loans Canada emphasizes ease of application, offering a simple online process with quick approvals. Businesses can borrow amounts ranging from $500 to $500,000, depending on the loan type and the lender’s assessment of the business’s credit profile and revenue

4. Accord Financial

Specializing in accounts receivable financing, Accord Financial provides asset-based loans in the U.S. and Canada. The firm may advance up to 90% of the face value of your outstanding invoices, and it’s a great service for some small and medium-sized enterprises.

Financing ranges from $1 million to $20 million, and the company tailors its products for businesses that don’t qualify for bank loans. Other benefits include:

- Financing to help your business grow or expand

- Reduce your cash flow cycle by filling the gaps between cash inflows and outflows

- Mitigate issues when one customer makes up a large portion of your business sales

- Counter seasonal fluctuations in accounts receivable collections

5. Commercial Capital LLC

With plenty of experience in the transportation, construction, staffing, and consulting industries, Commercial Capital LLC specializes in invoice, freight bill, construction, and purchase order financing. The service is great for:

- Small and mid-sized businesses in need of working capital

- Paying drivers, purchasing fuel, and meeting other financial obligations while awaiting payment for shipping invoices

- Subcontractors with commercial clients, general contractors, and builders who typically pay in 30 to 90 days

- Re-sellers who fill large orders and need to cover direct supplier expenses

In addition, interest rates are as low as 1.15%, but vary depending on your business’s volume and industry.

6. Meridian OneCap Credit Corporation

With a regional office in Vancouver, Meridian OneCap offers equipment leasing and financing solutions in BC. Sporting decades of industry expertise, beneficial purchase plans include:

- Enhancing cash flow with potential 100% LTV ratios

- Match repayment terms to the asset’s expected life

- Bundle soft costs like delivery and installation into one payment plan

Moreover, MeridianOneCap helps finance equipment purchases across several industries, including:

- Manufacturing

- Agricultural

- Medical

- Technology systems

- Fitness

- Automotive

- Communication

- Construction

- Industrial

- Transportation

- Waste management

As a result, MeridianOneCap is a worthwhile resource for most businesses, and it’s also a member of the Canadian Lenders Association (CLA).

7. Fincap Financial Group

Whether it’s equipment financing, factoring, or working capital loans, Fincap Financial Group is an online broker with more than 30 representatives across Canada and more than 25 financing partners.

The firm specializes in heavy equipment financing that requires large capital outlays. There are several eligible equipment options to choose from, with assets ranging from forest trucks, tractor-trailers, cranes, compactors, excavators, backhoes, bailers, forklifts, and much more.

Furthermore, Fincap Financial Group is also a CLA member.

Conclusion

Asset-based financing is more of a niche product, so it’s rare to find local lenders. Typically, large traditional banks, alternative lenders, and private debt firms dominate the asset-based loan market, using their size and scale to reduce risk.

To determine the right solution for your business, you should shop around at multiple lenders to determine which offers the lowest financing rates and the best terms.

In addition, taking steps to repair your credit score will make your application even more attractive, and could limit the inquiry process and lead to faster approvals.