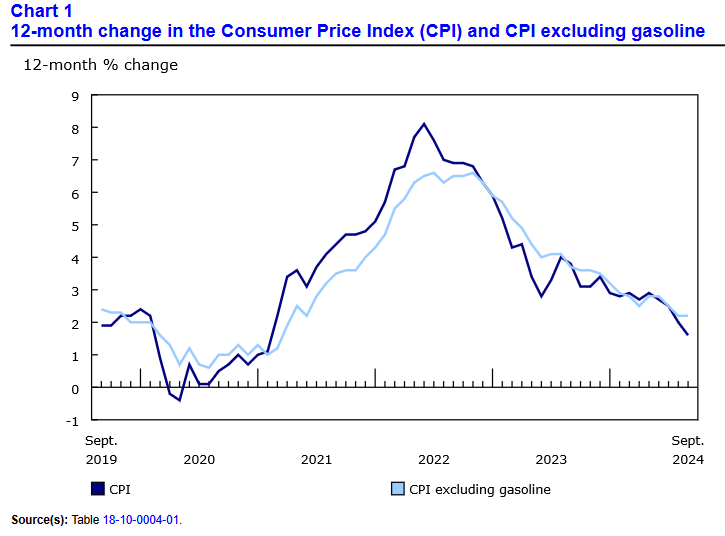

Canada’s consumer price index (CPI) rose by 1.6% year over year (Y-o-Y) in September, down from 2.0% Y-o-Y in August, and the weakest print since February 2021. Statistics Canada (StatsCan) published the data at 8:30 a.m. ET on October 15, 2024, via The Daily report. On a monthly basis, the CPI declined by 0.4% in September, as gasoline prices sunk by 7.1%.

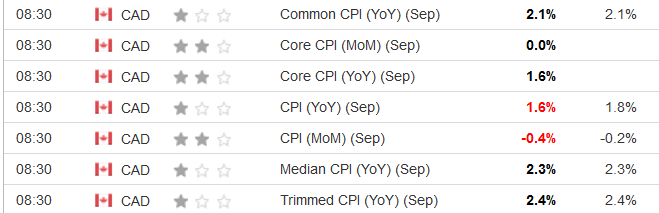

The data largely aligned with economists’ consensus estimates, although some weakness was present. The table below is courtesy of Investing.com. The left column represents September’s figures, while the right column represents forecasters’ expectations. As you can see, most metrics (marked in black) met expectations, while the monthly and annual headline CPIs (marked in red) missed expectations. Consequently, the Bank of Canada (BoC) should be pleased that inflation is under control, which allows for more focus on boosting economic growth.

To that point, BoC Governor Tiff Macklem said on Sep. 24, “With the continued progress we’ve seen on inflation, it is reasonable to expect further cuts in our policy rate. The timing and pace will be determined by incoming data and our assessment of what those data mean for future inflation.”

He added: “We want to keep inflation close to the center of the 1% to 3% inflation-control band. We need to stick the landing.”

Thus, with today’s data supporting that outcome, the BoC’s overnight lending rate should continue its downward trajectory.

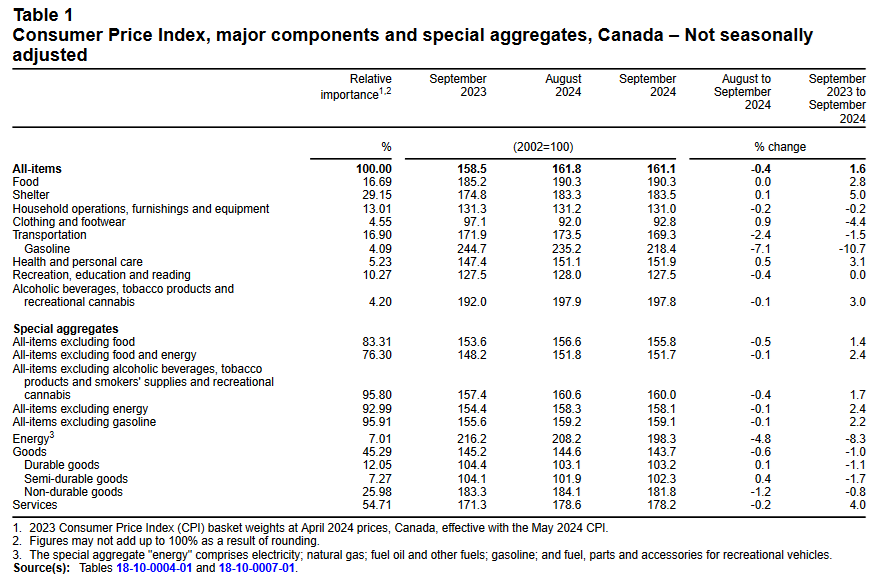

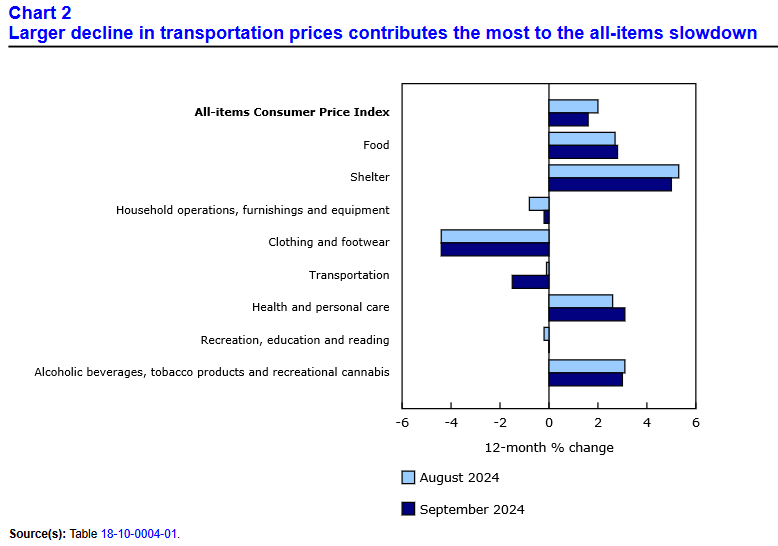

In September 2024, gasoline and transportation prices were noticeable laggards, while household products, reading/recreation, and alcohol/tobacco showcased small monthly declines.

Mixed Core CPI Results in September 2024

Core measures of the CPI showed some strength in September 2024, with the CPI-common index rising to +2.1% (from +1.9%), the CPI-median stalling at +2.3% (from +2.3%), and the CPI-trim holding firm at +2.4% (from +2.4%). These measures exclude the impacts of food and energy, and the BoC places heavy emphasis on core measures because they provide a smoothed distribution of overall inflation.

Please note that food and energy prices are highly volatile and price spikes can occur for reasons outside of the BoC’s control. In contrast, core inflation is largely driven by consumer demand and gives the BoC a better sense of how the Canadian economy is functioning.

Mixed Sector Performances

While shelter inflation slowed and transportation was a major underperformer, food prices jumped alongside health and personal care. Clothing and household products also exhibited some relative strength.

For context, the eight sectors include food, shelter, household operations, furnishings and equipment, clothing and footwear, transportation, health and personal care items, recreation and education expenses, and alcohol and tobacco products.

Grocery Inflation Stays Strong Y-o-Y

Food inflation rose by 2.4% Y-o-Y in September, matching the print from August, and outperforming the headline CPI for the second straight month.

Fresh or frozen beef (+9.2%), edible fats and oils (+7.8%), and eggs (+5.0%) were the primary at-home culprits, while restaurant inflation also jumped by 3.5% and surpassed August’s 3.4% figure.

When In Doubt, Cut?

With conflicting economic data supporting both sides of the debate, Wall Street veterans are convinced that several rate cuts are on the horizon.

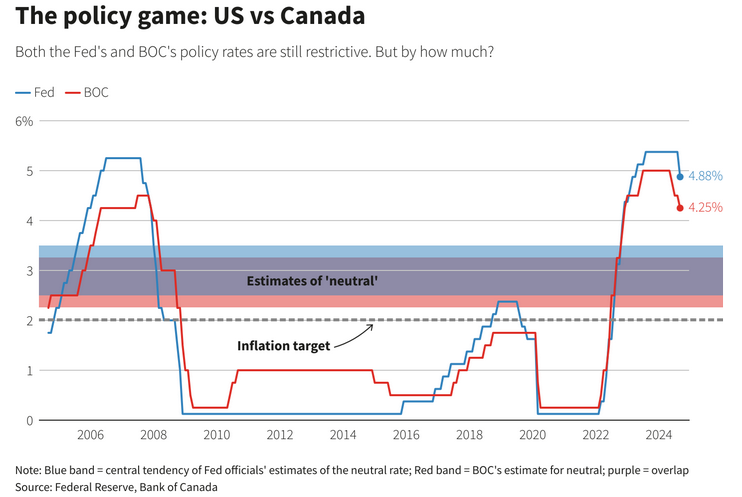

Royce Mendes, Managing Director and Head of Macro Strategy at Desjardins, said on Oct. 11, “We expect the Bank of Canada will cut rates by 50 basis points this month, with the domestic economy underperforming and significant challenges on the horizon. Moving faster towards the neutral-rate range would be an insurance policy against inflation sustainably falling below target.”

However, Adam Button, Chief Currency Analyst at ForexLive, noted, “If Canada begins to miss its inflation target to the downside, that is a scenario that would lead to significant currency depreciation because the Bank of Canada would have the green light to cut rates at a time when the U.S. isn’t feeling that pressure.”

As a result, the BoC must consider several factors when making monetary policy decisions.

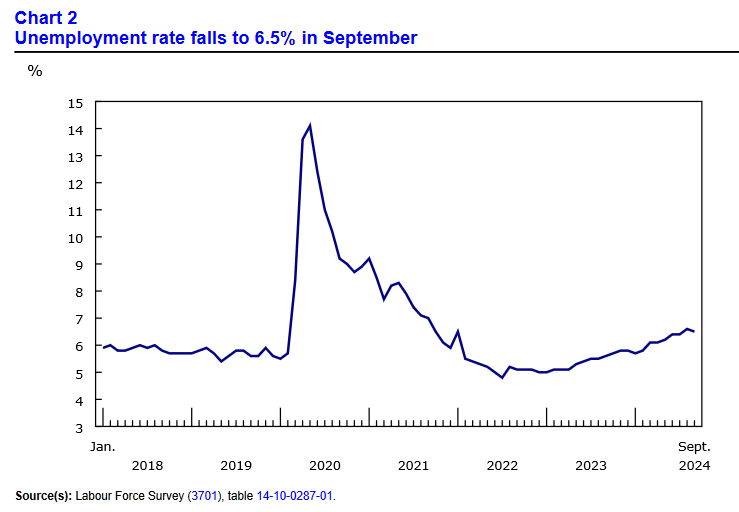

Speaking of which, Statistics Canada reported on Oct. 11 that “Employment rose by 47,000 (+0.2%) in September while the unemployment rate fell 0.1 percentage points to 6.5%.”

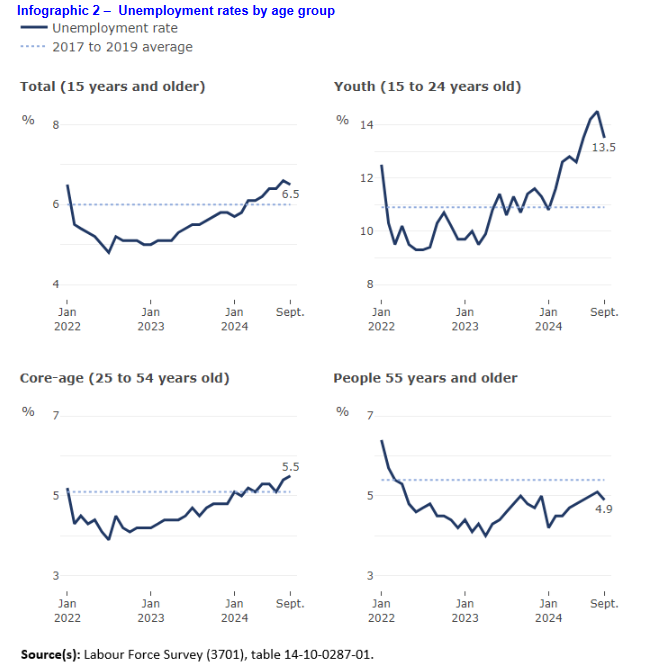

Moreover, even though a troubling trend exists among prime-age workers in Canada (aged 25-54), the unemployment rate for the three other age cohorts declined in September. Therefore, the BoC will have to decide which data points deserve the highest priority.

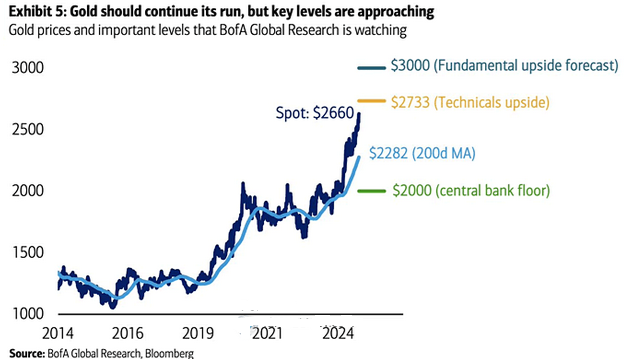

Overall, the inflation outlook became more constructive on Oct. 15, and all signs point to looser monetary policy in the months ahead. And with gold a primary beneficiary from lower interest rates, increased liquidity, and higher government spending, Bank of America believes the bullion bull market has plenty of room to run. Its team told clients that the fundamental upside remains near $3,000, and technical analysis points to a rally near $2,750. Consequently, gold could continue shining in 2025.

Furthermore, precious metals assets such as gold and silver have typically held their value more reliably than stocks during periods of high inflation. In today’s economic environment, physical assets and commodities such as real estate and precious metals may provide a strategic hedge.

Dedicating a small portion of one’s TFSA or RRSP portfolio to precious metals may help mitigate some of the negative effects of inflation. If you want to get started with investing in metals such as gold and silver, read our free guide to gold buying in Canada in 2024 today.