Axis Auto Finance is one of the most well-known companies in the Canadian auto financing market. The company is known for offering loans to people with all kinds of credit history. Axis is a CLA-certified lender and adheres to high ethical standards in its lending practices. In this article, we will go over the background of the company, the services they provide, customer feedback, and whether Axis is the right choice for obtaining your car loan.

☝ IMPORTANT 2025 TIPS:

➔ Do you have outstanding debts? Are they out of control? Consolidated Credit Canada might be able to help. Contact the organization for debt relief up to 50%.

➔ Need a loan but receive a rejection from the bank? Consider using an alternative lender; CompareHub can help connect you. (Expect to pay extra interest!)

Brief Company Overview

Axis has earned its reputation as the one of the goto auto loan companies in Canada for people with bad credit or those who have no credit at all. Axis aims to provide auto loans to people of all categories with easy application, reasonable interest rates, and an easy payment structure. Here’s some key information about Axis:

- Official Name: Axis Auto Finance

- Website: www.axisfinancegroup.com

- Phone Number: 1-855-964-5626

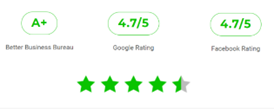

- BBB Rating: A+

- Google Reviews: 4.7/5 stars (5000+ reviews)

- Headquarters: Oakville, Canada

Pros:

- Approval for All Credit Types: Axis Auto Finance specializes in helping customers with bad credit or no credit history at all secure car loans. This is a significant advantage if you have a low credit score and struggle to get financing from traditional lenders. When you have sizable outstanding debts, it is often best to avoid taking on new loans. Instead, reach out to a debt relief organization like Consolidated Credit Canada.

Cons:

- Higher Interest Rates: Beware! Axis offers loans starting at high interest rates, with APRs as high as 25% to 30% for customers with bad credit. This means that your monthly payments could be significantly higher than with other lenders.

- Used Cars Only: Axis only finances pre-owned vehicles, so if you’re looking for a new car, you’ll need to explore other options.

- Limited Availability: Axis is primarily available in Ontario, so if you’re in another province, you might not have access to their services

Can Axis Help You Secure an Auto Loan?

Indeed they can, Axis is among the most well known auto loan lenders for Canadians who may have a bad credit score or have no credit score at all. Axis operates under the CLA code to make sure that all customers are protected by receiving fair and responsible lending services. Whether you are purchasing a brand new car or a used car, Axis has products that have been designed to fit your budget.

If Axis is not the right choice for you, use CompareHub by Loans Canada to obtain an alternative loan with a different lender.

Key Features

Axis is a lender of choice due to its several key features, some of which include:

Auto Loans for Everyone

What makes Axis appealing is that the company offers credit facilities to clients regardless of their credit status. The approval process of their loans is fast and efficient and it is open to everyone.

Easy and quick approval of the online application

It is easy to apply for a loan. It is very easy to apply for an auto loan online and the decision is made within 24-48 hours after applying.

Pre-Approval for Auto Loans

In order to make the car buying process even easier, Axis offers pre-approval on loans to its customers. Pre-approval helps you to know how much you will be approved for before you begin to look for cars; it positions you to bargain with car dealers and purchase the car of your desire within your limit.

Flexible Loan Terms

Repayment of the loans is also flexible and usually takes 36 to 72 months to complete. Customers have the chance to choose the payment plan that they deem most suitable for them.

Customer Feedback and Reviews

To get a better sense of the customer experience, we looked at various reviews and feedback from real clients who have used Axis’s services.

Google Reviews: 4.7/5 Stars

Axis has a 4.7 rating on Google and has more than 5000 reviews. People often compliment the company for its outstanding customer service and easy-to-fill loan application forms. Several reviewers also like the short approval time and how Axis assists people with low credit scores to get the financing they need.

Final Thoughts: Should You Consider Axis?

If you are in search of an auto loan and have been rejected by conventional banks because of your bad credit score, then Axis is a good place to go. They have a CLA certification that guarantees the right approach to lending, and their high customer satisfaction score proves it. Being an online company, Axis has a very short and easy application process that allows customers to get a loan as soon as possible.

Like any other financial product, it is wise to compare the available options. With adjustable loan terms and no down payment requirements, Axis is a suitable choice for Canadian borrowers to get easy auto loans. For other alternative loan options, reach out to CompareHub.

☝ IMPORTANT 2025 TIPS:

➔ Do you have outstanding debts? Are they out of control? Consolidated Credit Canada might be able to help. Contact the organization for debt relief up to 50%.

➔ Need a loan but receive a rejection from the bank? Consider using an alternative lender; CompareHub can help connect you. (Expect to pay extra interest!)

FAQ

What types of credit does Axis Auto Finance accept? A: Axis deals with clients who have good credit, bad credit or no credit at all. They are particularly involved in second chance financing for people who might have been turned down by other lenders. If you have been rejected due to your existing debt levels, consider if debt relief from Consolidated Credit Canada is the right option for your situation.

How long does it take to get approved for a loan? A: In most cases, Axis provides loan approval within 24 to 48 hours.

Does Axis require a down payment? A: No down payment is required when taking loans from Axis, but the interest rates on the loans may be slightly high.

Can I refinance my current auto loan with Axis? A: Yes, at Axis, you can refinance your current loan to either get a lower interest rate or decrease your monthly payments.