Canada Drives is a company that provides car financing to Canadians, particularly to those with poor credit or no credit history. As a CLA certified lender, the company has undergone through a rigorous process to ensure best practices in lending. While the company’s CLA-certification and promise to assist those with bad credit sounds appealing, we will be digging beyond the surface and look at other aspects such as the loan process, and repayment structure. We will also review the feedback provided by the company’s customers to get a better understanding of how the firm operates.

☝ IMPORTANT 2025 TIP:

➔ Do you have trouble making your debt payments? Don’t get another loan that can dig your debt hole even deeper. You may have access to 50% debt relief through Consolidated Credit Canada. (note: credit score will be negatively impacted)

Brief Overview of Canada Drives

Canada Drives was established in 2010 and has helped Canadians apply for auto loans online without having to visit a dealership. The platform partners with a vast network of dealerships and lenders to help consumers, regardless of their credit score, get the car of their choice.

Key Information About Canada Drives:

- Official Name: Canada Drives

- Website: www.canadadrives.ca

- Phone Number: 1-888-877-2898

- Google Reviews: 4.2/5 stars (4,135+ reviews)

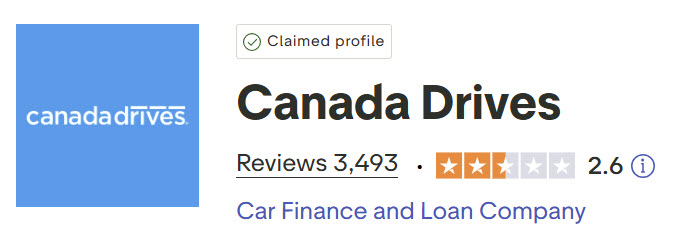

- TrustPilot Reviews: 2.6/5 stars (3,482+ reviews)

- Reddit: Mostly negative reviews (see this thread)

- BBB: 1.55/5 stars (see their profile)

- Headquarters: Vancouver, British Columbia

How Canada Drives Works

Canada Drives provides an online platform for Canadians to easily find and finance a car in a few clicks. Here’s a breakdown of the process:

Online Application: The first thing that has to be done is to complete a short online form. Canada Drives asks for your basic personal information and your financial details in order to evaluate your loan application. The process of applying is simple, and it only takes about a few minutes to fill in the form.

Loan Pre-Approval: After applying, you will be connected with lenders and offered pre-approval options by Canada Drives. At this step, you will get to know the amount of financing you are eligible for.

Vehicle Selection: After pre-approval, Canada Drives introduces you to their dealership list, where you can get a variety of cars that suit your budget and financing terms.

Vehicle Delivery: Another interesting aspect of Canada Drives is that the company can bring the car of your choice to your doorstep. This service is currently offered in major cities in Canada.

Loan Finalization: After choosing your vehicle, Canada Drives assists you in finalizing the loan details such as interest rates, loan period, and monthly payments.

Pros of Using Canada Drives

There are several key advantages to choosing Canada Drives:

You Can Get Auto-Financing Even If You Have a Bad Credit Score

Canada Drives deals with everyone regardless of their credit history. The company is willing to work with people who have been declined by other companies. However, if you already struggle to meet your current loan payments, we recommend you focus on debt relief rather than taking out any new loans. If you are overwhelmed with your debt load, you can contact Consolidated Credit Canada for debt relief.

Short Application Time

The online application is fast and easy, and most customers get pre-approval in minutes. This speed makes Canada Drives perfect for people who need to get financing for a car as fast as possible.

Vehicle Delivery

Not only does the company provide a car loan, it also delivers the vehicle to your doorstep. This saves a lot of time that would otherwise be spent at a dealership, and you can do it all from the comfort of your home.

CLA Certification

Canada Drives is accredited by the Canadian Lenders Association, which means that they uphold some basic standards of ethics in lending.

Cons of Using Canada Drives

While Canada Drives offers many benefits, there are a few potential drawbacks to consider.

Higher Interest Rates for People With a Bad Credit History

Canada drives charges higher interest rates for people with a bad credit history. This is not something unique to Canada Drives and is done by most lenders. Any borrower should, therefore, ensure that he or she goes through the terms of the loan so that they can manage the payments as per the terms. You can also consider using other lenders to compare your options. Reach out to CompareHub by Loans Canada.

Limited Physical Presence

Canada Drives predominantly relies on the internet, so there is little to no face-to-face contact. Although the customer service team is always ready to attend to the customers through phone and email, some customers may wish to meet in person, which may be difficult.

Vehicle Selection

The vehicles available for financing through Canada Drives may be limited. This may be a downside if you are looking for a specific make or model.

Customer Feedback and Reviews

Canada Drives has been well received by Canadian consumers and the company has received mostly positive feedback across various sites. Below is a summary of what customers are posting about their experiences with Canada Drives.

Google Reviews: 4.2/5 Stars

Canada Drives has garnered more than 4,135 reviews on Google and has a rating of 4.2. The ease of application is frequently commended by customers, as well as the friendliness of the representatives and the ability to have cars delivered to their homes. Many reviewers appreciated how Canada Drives helped them secure financing despite having poor credit.

TrustPilot Reviews: 3.3/5 Stars

On TrustPilot, Canada Drives has 2.6 stars from over 3,482 customers. Some of the raters have complained about the company’s loan process, high rates and the quality of the vehicles. The company’s lack of inventory and higher prices compared to the offline market were highlighted as the major concerns by customers.

Is Canada Drives Right for You?

Canada Drives is perfect for those who need a quick, simple, and convenient method of getting a car loan. People living in Canada who do not meet standard car financing requirements find the platform convenient due to its principles of openness, inclusiveness, and customer orientation.

However, you need to make sure that you read the terms of the loan well, especially if you have a low credit score. The interest charged to you can be at a higher rate compared to people with a good credit score.

If you think a different lender might be better for your circumstances, consider using CompareHub to find other financing options.

Final Thoughts

If you want to get a loan for a car through an easy process, an don’t qualify for better options such as banks or financing from the dealership directly, then an alternative lender like Canada Drives could be a good choice, but beware of their rates and ensure you can afford to pay them back. The platform is completely online and gives you the opportunity to get approval within a few hours. Their CLA certification adds an extra layer of trust, ensuring ethical and transparent lending practices.

Learn more and see if you qualify for their auto loans on: www.canadadrives.ca

☝ IMPORTANT 2025 TIPS:

➔ Do you have trouble making your debt payments? You may have access to 50% debt relief through Consolidated Credit Canada.

➔ Need financing but don’t qualify for a conventional loan? CompareHub can help you connect with an alternative lender. (Alternative loans have higher interest rates, though!)

FAQ

Can Canada Drives help me if I have bad credit? A: Yes, Canada Drives specializes in helping individuals with bad credit or no credit secure auto financing. We strongly recommend you focus on clearing your debts before taking on new liabilities, though. Reach out to Consolidated Credit Canada for more information.

How long does the loan approval process take? A: The approval process is fast, and many customers receive pre-approval within minutes of submitting their application.

Do Canada Drives offer vehicle delivery? A: Yes, Canada Drives offers home vehicle delivery in select cities, allowing customers to complete their car purchase without visiting a dealership.

What are the interest rates like with Canada Drives? A: Interest rates vary depending on your credit profile, but borrowers with poor credit may face higher interest rates due to the increased risk for lenders.

Is Canada Drives a CLA-certified lender? A: Yes, Canada Drives is certified by the Canadian Lenders Association, ensuring that they adhere to ethical lending practices.