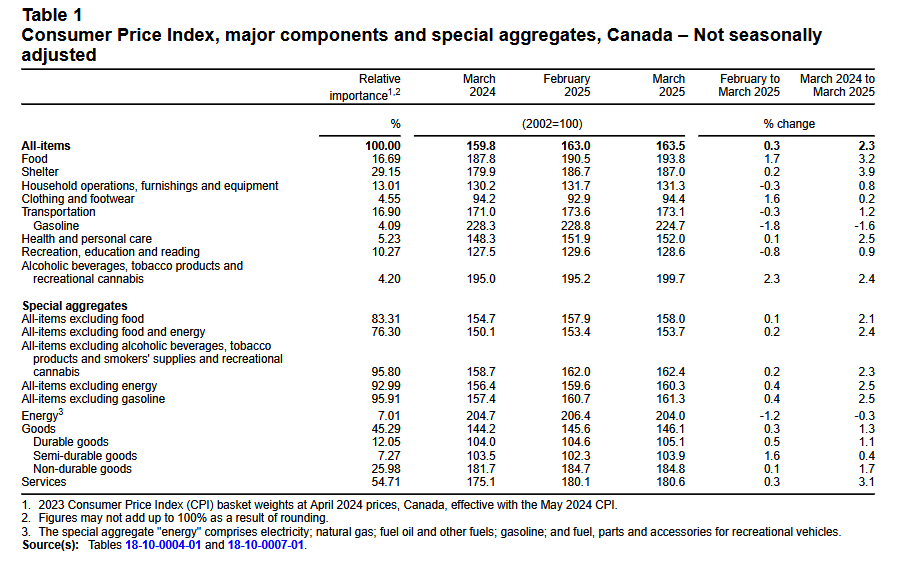

Canada’s consumer price index (CPI) increased by 2.3% year over year (Y-o-Y) in March, decelerating from 2.6% in February. Statistics Canada (StatsCan) published the data at 8:30 a.m. ET on April 15, 2025, via The Daily report. On a monthly basis, the CPI rose by 0.3%, although, “the end of the temporary break on the Goods and Services Tax (GST)/Harmonized Sales Tax (HST) on February 15 put upward pressure on prices for eligible products in March compared with February.”

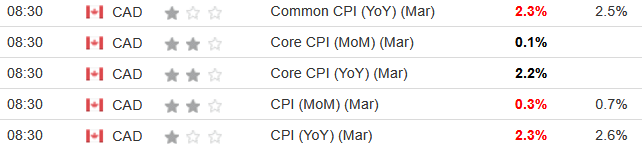

Despite the tax adjustments, most metrics missed economists’ consensus estimates. The table below is courtesy of Investing.com. The left column represents March’s figures, while the right column represents forecasters’ expectations. As you can see, today’s data was relatively calm.

On the flip side, mixed economic indicators have created an uncertain economic path. While realized GDP growth has outperformed the Bank of Canada’s (BoC) expectations, caution could be warranted to prevent unwanted effects from the global tariff conflict.

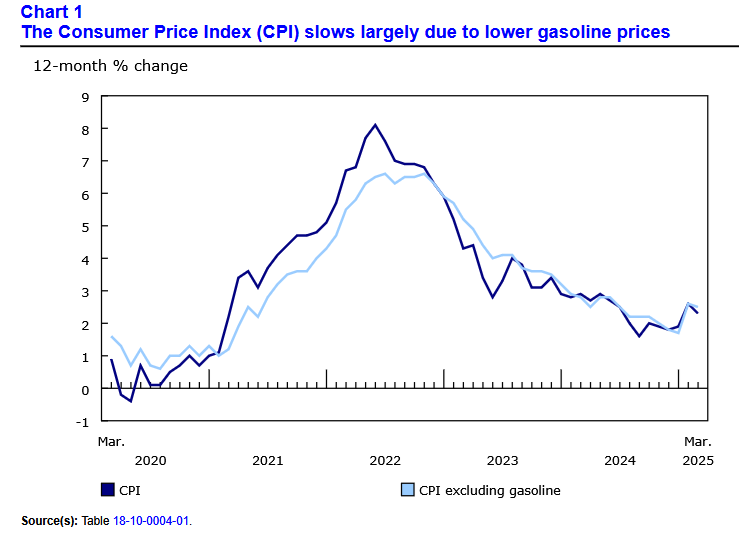

In March, the CPI slowdown was mainly “driven by lower prices for travel tours and gasoline. Excluding gasoline, the CPI rose by 2.5% following a 2.6% increase (ex-gasoline) in February.”

Core CPI Cools in March

Core measures of the CPI softened in March, with the CPI-common index falling to +2.3% (from +2.5%), the CPI-median holding at +2.9% (from +2.9%), and the CPI-trim falling to +2.8% (from +2.9%). These measures exclude the impacts of food and energy, and the BoC places heavy emphasis on core measures because they provide a smoothed distribution of overall inflation.

Please note that food and energy prices are highly volatile and price spikes can occur for reasons outside of the BoC’s control. In contrast, core inflation is mainly driven by consumer demand and gives the BoC a better sense of how the Canadian economy is functioning.

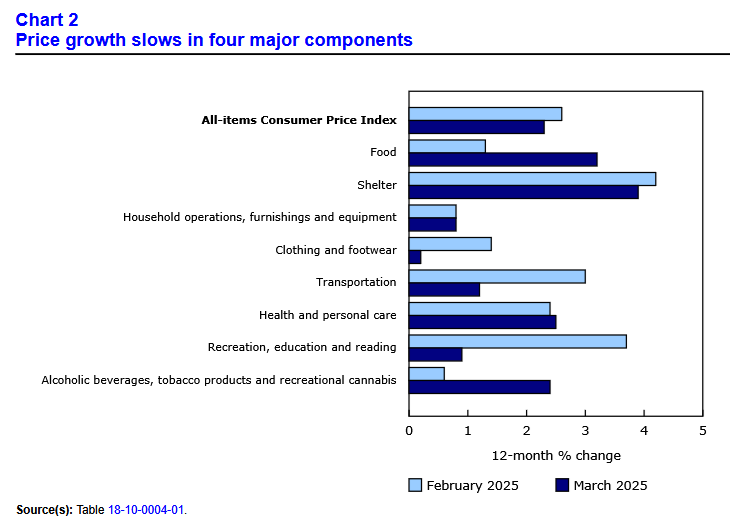

Sector Mix

Four of the major sectors recorded Y-o-Y price increases in March, with food, alcohol and tobacco, and household items the noticeable outliers.

For context, the eight sectors include food, shelter, household operations, furnishings and equipment, clothing and footwear, transportation, health and personal care items, recreation and education expenses, and alcohol and tobacco products.

Grocery Comeback

After declining by 0.5% in January and recording its first Y-o-Y drop since May 2017, food inflation rose by 1.1% MoM in February, and now, 1.7% MoM in March. Similarly, restaurant inflation increased by 3.2% Y-o-Y in March, after falling by 1.7% in February. The rise was largely driven by the end of the tax holiday.

BoC On Hold?

As the U.S. ratchets up trade tensions with other countries, Canada and Mexico have been the primary beneficiaries. The Trump Administration has agreed to adhere to the parameters of the USMCA, which largely exempts both regions from the tariff drama.

As a result, economists expect the BoC to maintain its overnight lending rate on Apr. 16, as the economic outlook is now less troubling than previously feared.

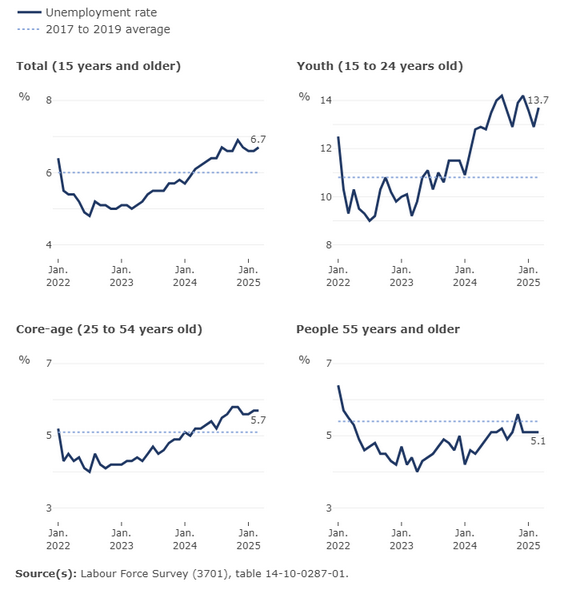

Moreover, mixed economic indicators support a cautious approach to future rate cuts. For example, Statistics Canada’s latest Labour Force Survey showed that Canada lost 33,000 jobs in March and the unemployment rate rose to 6.7%. Despite that, the release stated how during the 2008/2009 global financial crisis, the peak monthly layoff rate was 2%. In contrast, the layoff rate was 0.7% in March 2025, which “was little changed from the same period in 2024 (0.8%) and the same as the pre-pandemic February-to-March average recorded from 2017 to 2019 (0.7%).”

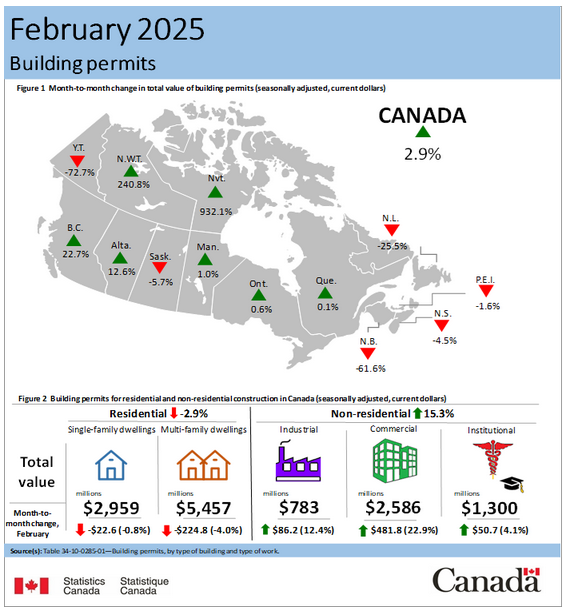

Furthermore, while the latest building permits release showed a decline in residential construction intentions, cyclical industries outperformed. An excerpt read:

“The national value of non-residential building permits increased by $618.7 million (+15.3%) to $4.7 billion in February, rebounding after four consecutive months of declines…. The growth in Canada’s non-residential sector was spread across its three components in February, with gains in the commercial (+$481.8 million), industrial (+$86.2 million), and institutional (+$50.7 million) subsectors. The industrial component ticked up in February 2025, after trending downward since September 2024.”

Consequently, the rise in industrial commitments highlights how developers have turned bullish on the Canadian manufacturing sector.

As for the financial markets, stocks remain caught between oversold conditions and uncertainty over future tariff policy. Yet, with gold benefiting from the turmoil, the yellow metal continues to hit new record highs.

Goldman Sachs raised its mid-2026 price target to $4,000 and told clients that gold could hit $4,500 if the U.S.-China trade war morphs into a deeper crisis. Thus, gold remains a strategic hedge against further uncertainty.

On top of that, precious metals assets such as gold and silver have typically held their value more reliably than stocks during periods of high inflation and global uncertainty. In today’s polarised environment, physical assets and commodities such as real estate and precious metals may provide a strategic hedge.

Dedicating a small portion of one’s TFSA or RRSP portfolio to precious metals may help mitigate some of the negative effects of inflation. If you want to get started with investing in metals such as gold and silver, read our free guide to gold buying in Canada in 2024 today.

In addition, the rise in cyclical building permits could be a sign that brighter days are ahead for the Canadian economy. To help support future growth, Clara Capital provides working capital loans and merchant cash advances that can finance short-term obligations. Similarly, Journey Capital offers affordable term loans and lines of credit that are great for long-term capital projects. Whatever your preference, there are several reputable lenders available to help your business reach its potential.