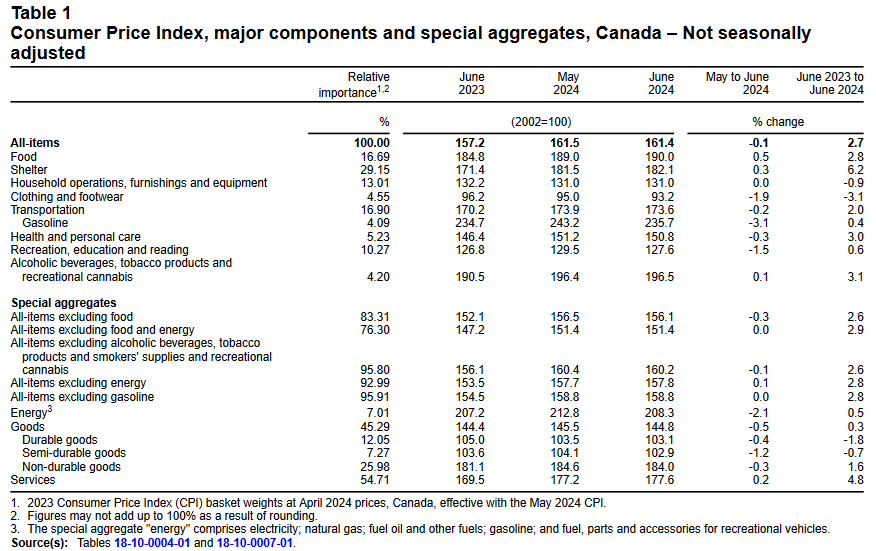

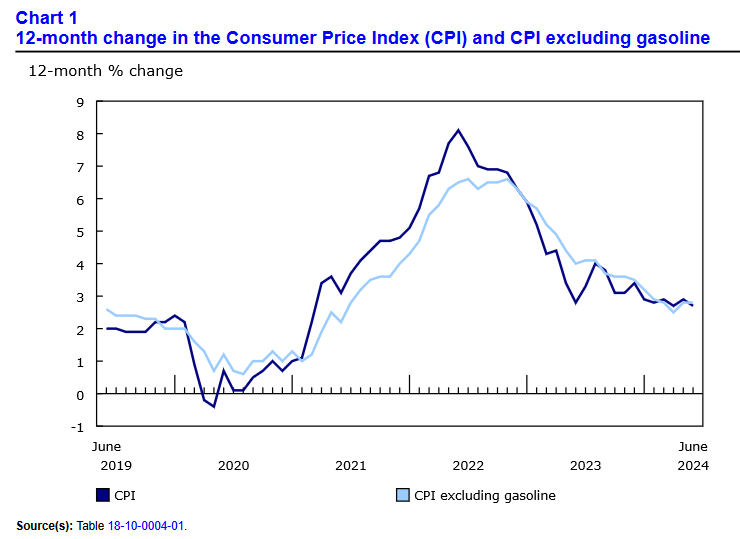

Canada’s consumer price index (CPI) rose by 2.7% year over year (Y-o-Y) in June, a drop from the 2.9% Y-o-Y recorded in May. Statistics Canada (StatsCan) published the data at 8:30 a.m. ET on July 16, 2024, via The Daily report. On a monthly basis, the CPI declined by 0.1% in June, a sharp drop from May’s 0.6% rise.

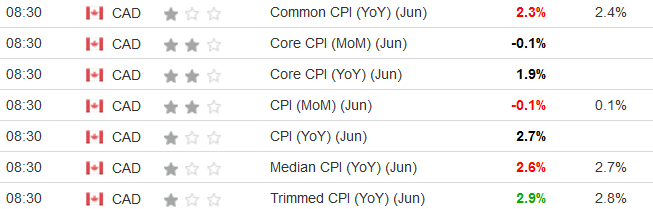

Underperformance also occurred across most metrics, as the CPI data came in below economists’ consensus estimates. For example, the table below is courtesy of Investing.com. The left column represents June’s figures, while the right column represents forecasters’ expectations. As you can see, only the trimmed CPI (marked in green) was higher than expected, while most of the figures (marked in red) were unexpectedly low. The black figures matched economists’ consensus expectations. As a result, the deceleration could convince the Bank of Canada (BoC) that another rate cut is warranted.

On June 24, BoC Governor Tiff Macklem said that declining inflation alongside resilient growth is a cause for optimism. “This is the soft-landing scenario. It has always been a narrow path, and we have yet to fully stick the landing. We are not yet back to 2%, and we can’t rule out new bumps along the way. But increasingly, we look to be on our way.”

In June 2024, the slowdown in month-over-month headline inflation was supported by lower prices for travel tours (-11.1%) and gasoline (-3.1%).

Core CPI Falls in June 2024

Core measures of the CPI in June 2024 were constructive, with the CPI-common index falling to +2.3% (from +2.4%), the CPI-median falling to +2.6% (from +2.7%), and the CPI-trim holding at +2.9% (from +2.9%). These measures exclude the impacts of food and energy, and the BoC places heavy emphasis on core measures because they provide a smoothed distribution of overall inflation.

Please note that food and energy prices are highly volatile and price spikes can occur for reasons outside of the BoC’s control. In contrast, core inflation is largely driven by consumer demand and gives the BoC a better sense of how the Canadian economy is functioning.

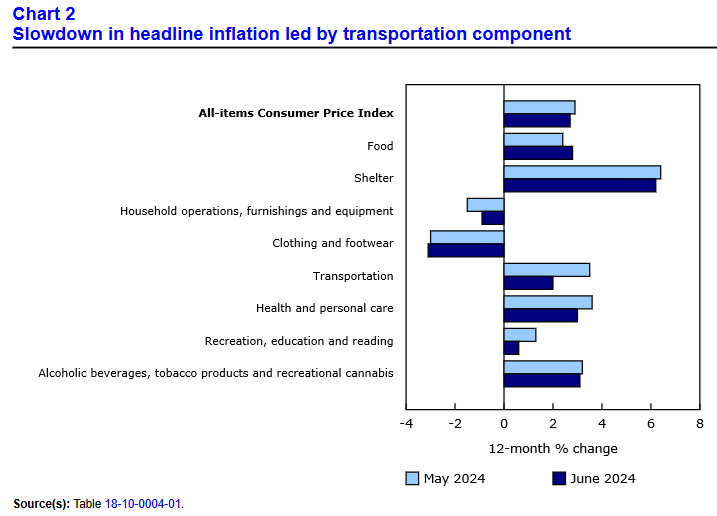

Inflation Slows Across 6 of 8 Major Sectors

On a Y-o-Y basis, weaker readings occurred across six of the eight prominent categories. These include food, shelter, household operations, furnishings and equipment, clothing and footwear, transportation, health and personal care items, recreation and education expenses, and alcohol and tobacco products.

Clothing and household products recorded outright deflation once again, while shelter, transportation, health and personal care, recreation, education, and reading, as well as alcohol and tobacco prices recorded slower inflation.

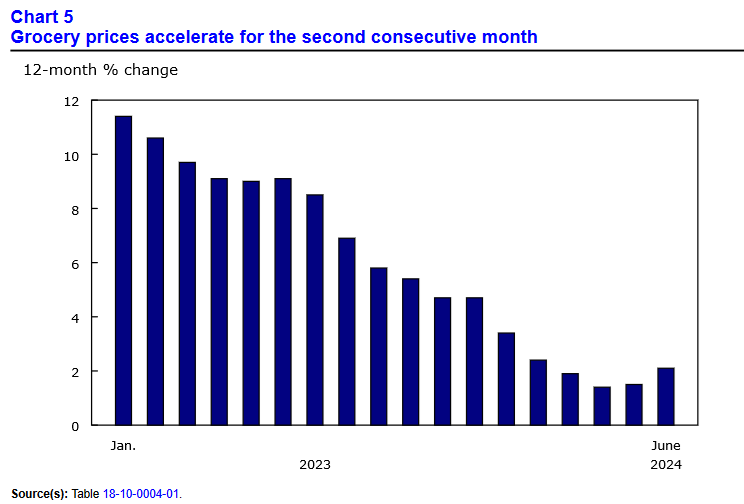

Grocery Inflation Jumps in June

Food inflation rose by 2.1% Y-o-Y in June, up from the 1.5% rise in May. Moreover, from June 2021 to June 2024, grocery inflation has increased by 21.9%. This month’s acceleration was driven by higher prices for dairy products (+2.0%), fresh vegetables (+3.8%), non-alcoholic beverages (+5.6%), as well as preserved fruit and fruit preparations (+9.5%). Conversely, prices for fresh fruit dropped by 5.2% Y-o-Y in June versus 2.8% in May.

Mixed Signals For the Bank of Canada?

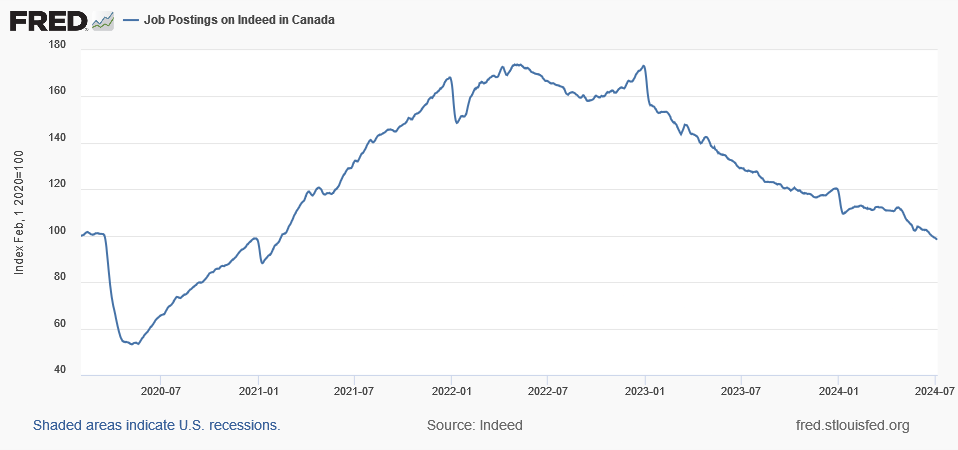

With inflation mostly consolidating within the BoC’s 1% to 3% target range, economists are convinced that more rate cuts are on the horizon. Supporting the thesis, Canadian job openings on Indeed fell below their February 2020 level recently for the first time since the pandemic ended. As a result, the Canadian job market continues to slow.

Furthermore, Macklem highlighted the dynamic on June 24, noting how “the slowdown in hiring has led to increases in unemployment for younger workers and newcomers to Canada. These workers are feeling the effects of slower growth more than others, and we need to recognize this.” Thus, while he added that immigration “has been a big success for us” and “let’s not lose sight of that,” he conceded that the federal government needs to be “focused on smart immigration policy going forward” to balance labour supply and demand.

As a secondary issue, gasoline prices were down by 3.1% in June, but that could reverse in July, as higher oil prices increase costs at the pump. Consequently, oil is an important variable that may create headaches for the BoC. Likewise, the continued rise in grocery prices further complicates the outlook. Therefore, while higher interest rates have hit low-income Canadians the hardest, it remains a balancing act for the BoC to determine the right solutions at the right time.

Overall, the inflation slowdown is welcome news for Canadians, as lower interest rates should make large purchases more affordable to finance. If the trend continues, the BoC could be on its way to a historically elusive soft landing.

To protect your wealth as the drama unfolds, precious metals assets such as gold and silver have typically held their value more reliably than stocks during periods of high inflation. In today’s economic environment, physical assets and commodities such as real estate and precious metals may provide a strategic hedge against inflation. Given gold and silver’s recent strength, several market participants have adopted a similar view, as both have been top performers in 2024.

Dedicating a small portion of one’s TFSA or RRSP portfolio to precious metals may help mitigate some of the negative effects of inflation. If you want to get started with investing in metals such as gold and silver, read our free guide to gold buying in Canada in 2024 today.