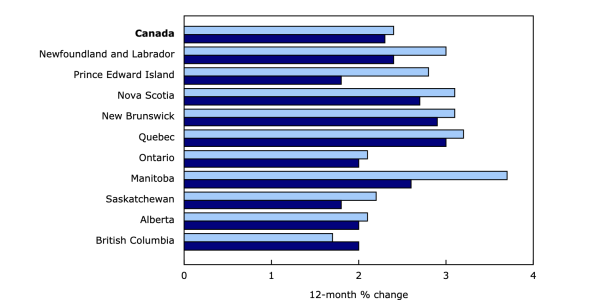

Canada’s consumer price index (CPI) increased by 2.3% year over year (Y-o-Y) in January, below the 2.4% Y-o-Y from December. Statistics Canada (StatsCan) published the … Read More

Wippy – Legit Auto Loan Provider? (2026 Review)

Wippy (www.wippy.com) is a Canada-based auto loan company, specifically targeting those with bad to average credit profiles or those that were rejected by mainstream banks … Read More

Northlake Financial Review – Is This Auto Loan Provider Legit? (2026 Review)

If you’re considering alternative auto financing options in Canada, Northlake Financial might have crossed your radar. The company operates as a certified CLA-certified lender, which adds … Read More

Prefera Finance – Should You Choose This Auto Loan Provider? (2026 Review)

Prefera Finance provides several financing options for purchasing automobiles and recreational vehicles. The company has a reputation for providing loans to people who have been … Read More

Consolidated Credit Canada: Good for Debt Relief? (2026 Review + Comparison)

If you’re feeling buried by debt, I would start with a “one-stop” assessment where you can hear your options clearly in plain English. That’s why … Read More

Journey Capital – Good Choice for Business Loans? (2026 Review)

Turned away by banks and credit unions? Journey Capital (www.journeycapitalfunding.ca) can be a solid choice for small to medium-sized businesses looking for flexible funding solutions. … Read More

Merchant Growth – Good Lender for Business Loans? (2026 Review)

If you’re searching for a Merchant Growth review because a bank said “no” (or you just need money fast), you’re not alone. A lot of … Read More

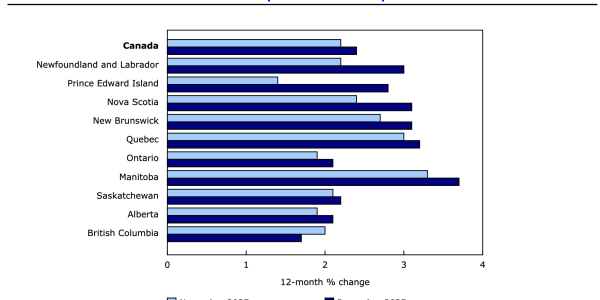

The Consumer Price Index Falls (-0.2%) in December 2025, Rises to 2.4% Y-o-Y

Canada’s consumer price index (CPI) increased by 2.4% year over year (Y-o-Y) in December, above the 2.2% Y-o-Y realized in November. Statistics Canada (StatsCan) published … Read More

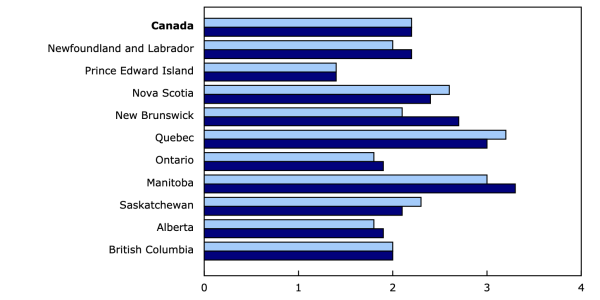

The Consumer Price Index Rises (+0.1%) in November 2025, Holds at 2.2% Y-o-Y

Canada’s consumer price index (CPI) increased by 2.2% year over year (Y-o-Y) in November, matching the 2.2% Y-o-Y rise in October. Statistics Canada (StatsCan) published … Read More

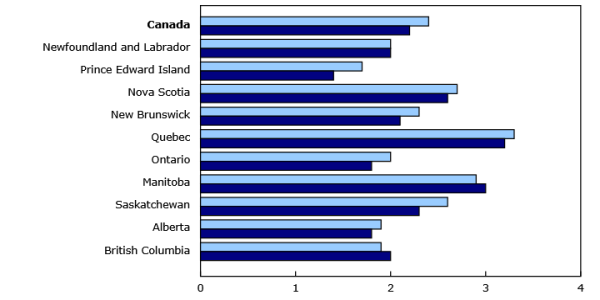

The Consumer Price Index Rises (+0.2%) in October 2025, Falls to 2.2% Y-o-Y

Canada’s consumer price index (CPI) increased by 2.2% year over year (Y-o-Y) in October, down from 2.4% Y-o-Y in September. Statistics Canada (StatsCan) published the … Read More