Square One Insurance is, just like PolicyMe, a digital-first insurance provider in Canada specializing in providing customizable home and tenant insurance policies. Established in 2011, … Read More

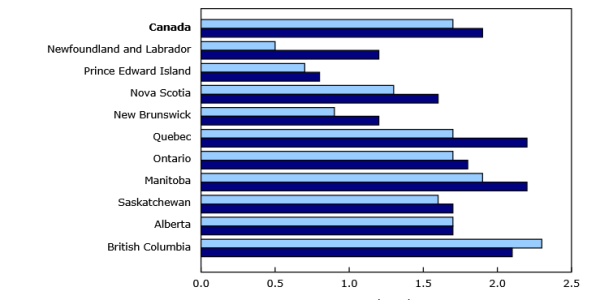

The Consumer Price Index Rises (+0.1%) in June 2025, Hits 1.9% Y-O-Y

Canada’s consumer price index (CPI) increased by 1.9% year over year (Y-o-Y) in June, up from 1.7% Y-o-Y in May and April. Statistics Canada (StatsCan) … Read More

Borrowell: Is It Really Free? We Review This Canadian Credit Report Monitoring Tool for 2025

Borrowell (https://borrowell.com/) is making waves in Canada as a “free” credit monitoring and score improvement. But is it actually “free”? And is it even helpful? … Read More

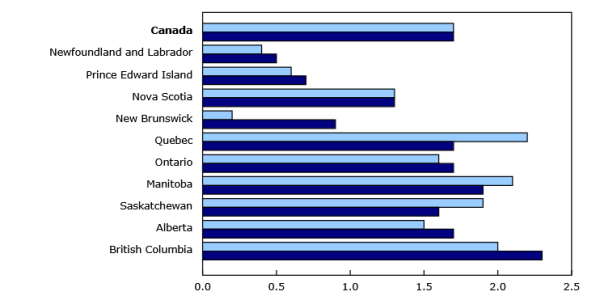

The Consumer Price Index Rises (+0.6%) in May 2025, Holds At 1.7% Y-O-Y

Canada’s consumer price index (CPI) increased by 1.7% year over year (Y-o-Y) in May, matching April’s print, and declining from 2.3% in March and 2.6% … Read More

Payday Loans in Alberta: An Honest Guide

For many Albertans facing unexpected financial shortfalls, payday loans can seem like a quick and easy solution. These short-term, high-cost loans are designed to bridge … Read More

Fairstone Review: Is This Lender Right For You?

Fairstone is one of Canada’s oldest and largest non-bank lenders, offering personal loans and secured lending options to Canadians with fair to poor credit. But … Read More

iCASH Review: Yay or Nay for Loans? (2025 Update)

iCASH is a Canadian online payday loan provider that offers short-term and very high interest loans to people with a wide range of credit scores. … Read More

LendCare Canada Review: Should You Get a Loan or Financing With Them?

LendCare is a Canadian point-of-sale financing company that partners with businesses across the country to offer fast and accessible loans for big-ticket items—ranging from dental … Read More

Business Insurance Comparison: Zensurance vs. TD Insurance

If you’re a Canadian entrepreneur looking to protect your small business, you’ve likely come across both Zensurance and TD Insurance in your search. But how … Read More

Swoop Funding: Good Small Business Lender in Canada? (2025 Review)

Swoop Funding is an online business lending platform that has recently expanded its services to Canada (originally from the UK). It’s basically a marketplace for … Read More