Borrowell (https://borrowell.com/) is making waves in Canada as a “free” credit monitoring and score improvement. But is it actually “free”? And is it even helpful? In this review, I’ll break down what Borrowell offers, how it works, to help you decide whether it’s worth signing up in 2025

⚠️ Struggling with High Debt?

If you’re overloaded with credit card debt, payday loans, or overdue bills, improving your credit score alone might not be enough.

Click here to see if you qualify for FREE debt relief with Consolidated Credit Canada

— you could reduce your monthly payments by up to 50% without a loan or bankruptcy.

Whether it’s a mortgage, auto loan, line of credit, or credit card, your credit score is a critical factor that determines the terms, interest rate, and whether or not you gain approval. And while most Canadians understand the purpose of credit scores, many are unaware of how Borrowell can help them build and maintain a better credit profile, for free. A stronger profile can be helpful when trying to obtain financing from an alternative lender.

Moreover, with our Inflation Calculator CPI tables highlighting the impact of rising prices, competition for credit has increased. Consequently, optimizing your credit score is essential to avoid being left behind. And with Borrowell aiming to provide this service for free, is it a trustworthy resource?

☝IMPORTANT 2025 TIPS:

➔ Laden with existing debt? Consolidated Credit Canada can help. Reach out as you may qualify for up to 50% debt relief.

About the Company

- URL: https://borrowell.com/

- Phone: (416)800-0950

- Email: info@borrowell.com

- Company HQ: Toronto, ON.

- Google Play Reviews: 4.4/5 stars (25,301 reviews)

- TrustPilot Reviews: 4.0/5 stars (110 reviews)

- Apple Store Reviews: 4.8/5 stars (53,851 reviews)

- BBB Reviews: 2.59/5 stars (27 reviews)

Borrowell Pros and Cons:

For a quick outline of Borrowell Canada’s strengths and weaknesses, consult our list below:

Pros:

- Free to view credit score and report

- Great reviews from its customers

- Free credit coaching

- Builds financial and credit knowledge

- No credit card needed

- Cancel anytime

- Great customer service

Cons:

- May encounter ads for partner products

- Aggressive email marketing tactics

What is Borrowell?

Borrowell provides free weekly credit scores and report monitoring to over three million Canadians, while also offering personalized financial product recommendations, and affordable tools to help individuals increase their credit scores. Furthermore, the company actively works to detect, prevent, and investigate fraud to ensure that Borrowell is safe and secure.

In addition, the company generates revenue through affiliate marketing by recommending products such as loans, savings accounts, and other financial services that align with your credit profile, Then, if you choose to purchase a recommended product, Borrowell Canada receives a referral fee.

If not, you can still access your credit report for free and take advantage of the free educational material. This can be helpful if you are already working with a debt relief organization like Consolidated Credit Canada.

What Is a Good Credit Score?

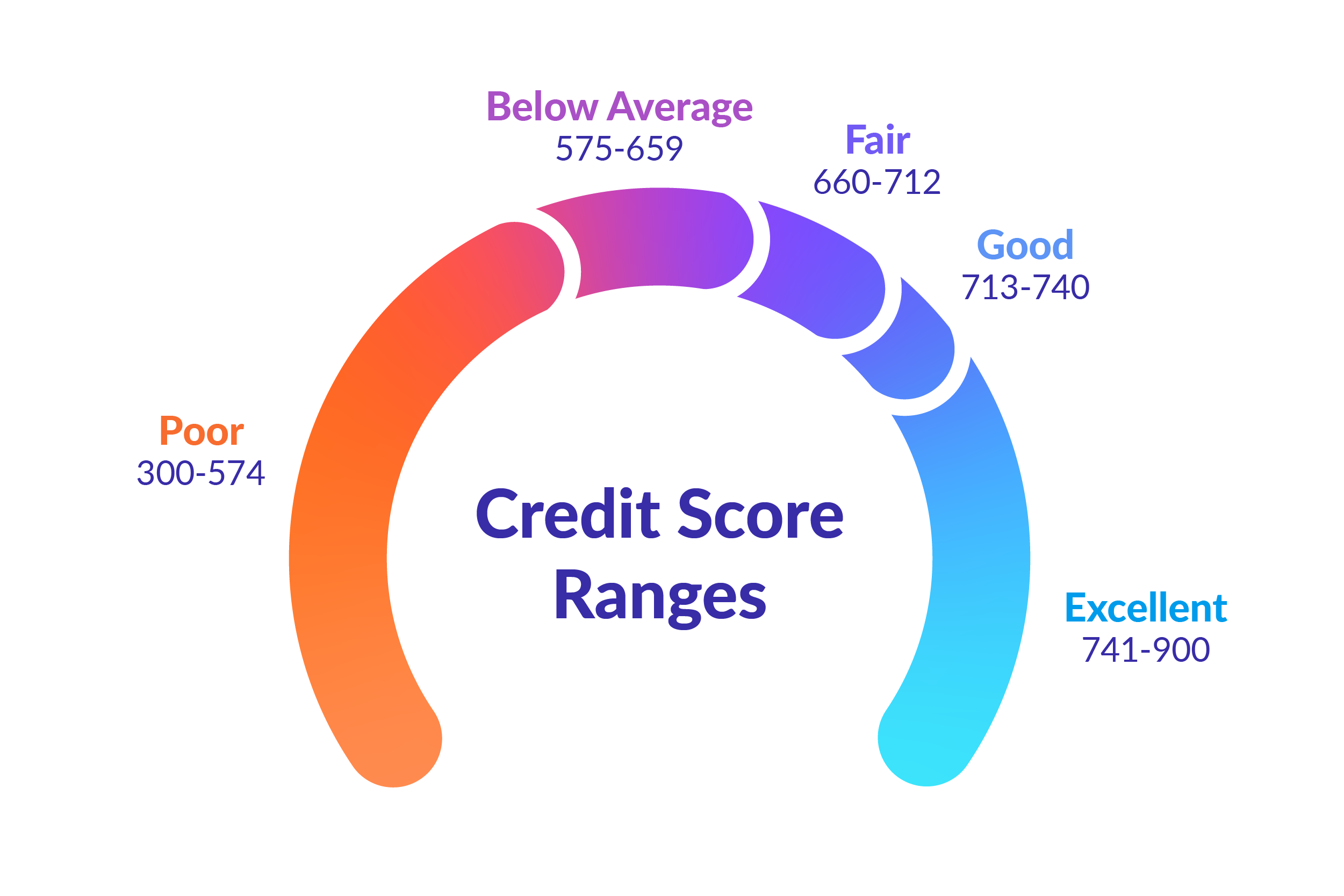

Canadian credit scores range from 300 to 900, and lenders place applicants in one of the following brackets:

Credit score brackets in Canada:

- Excellent: 760–900

- Good: 725–759

- Fair: 660–724

- Poor: 560–659

- Very Poor: Below 560

You’re not alone — millions of Canadians are struggling to keep up with payments. The good news? Help is available.

See if you qualify for debt relief from Consolidated Credit Canada

. It’s free to check and could change your financial future.

Furthermore, with Canada’s housing crunch creating headaches for aspiring homeowners, the Federal Government took measures in March to ensure “Millennials and Gen Z, who are most likely to rent, get a level playing field in the rental market” and can build their credit scores at the same time. The release stated:

“Renters deserve credit for the money they put toward rent over the years, especially when it comes time to apply for a mortgage for their first home. We’re going to amend the Canadian Mortgage Charter and call on landlords, banks, credit bureaus, and fintech companies to make sure that rental history is taken into account in your credit score.”

So, while building your credit score may not seem like a priority right now, failing to do so could negatively impact your financial aspirations down the line.

Why Is My Credit Score So Important?

In the financial world of algorithms and risk management, lenders use standardized metrics to determine whether to approve or deny credit applications. Unfortunately, while there may be good reasons for why adverse events occurred, lenders prioritize mathematics, and that’s why Borrowell’s credit score tips are so valuable.

The five components of your credit score include:

- Payment History (35% Weight)

- Credit Utilization (30% Weight)

- Credit History (15% Weight)

- Credit Mix (10% Weight)

- Credit Inquiries (10% Weight)

As you can see, your payment history (at 35%) is the most important factor impacting your credit score. As a result, credit card bills, utility bills, car payments, and other recurring obligations play important roles in determining how lenders perceive you. Moreover, missed or late payments can stay on your credit report for up to six years and negatively influence your access to credit.

Next up is credit utilization (at 30%). It’s prudent to keep your credit card or line of credit borrowings below 30% of the limit. For example, if your credit card has a $2,000 balance, you should aim to keep your spending on that card at or below $600 per month. Have a large percentage of exisiting debt that is overwhelming? Reach out to Consolidated Credit Canada for debt relief.

After that, your credit history (at 15%) determines the length of your borrowing record. The longer you’ve had products like a mortgage, credit card, line of credit, etc. in good standing, the better it looks to potential lenders. As such, it’s wise to keep old accounts open rather than closing them even if they’re idle. That way, your credit history will go back as far as possible.

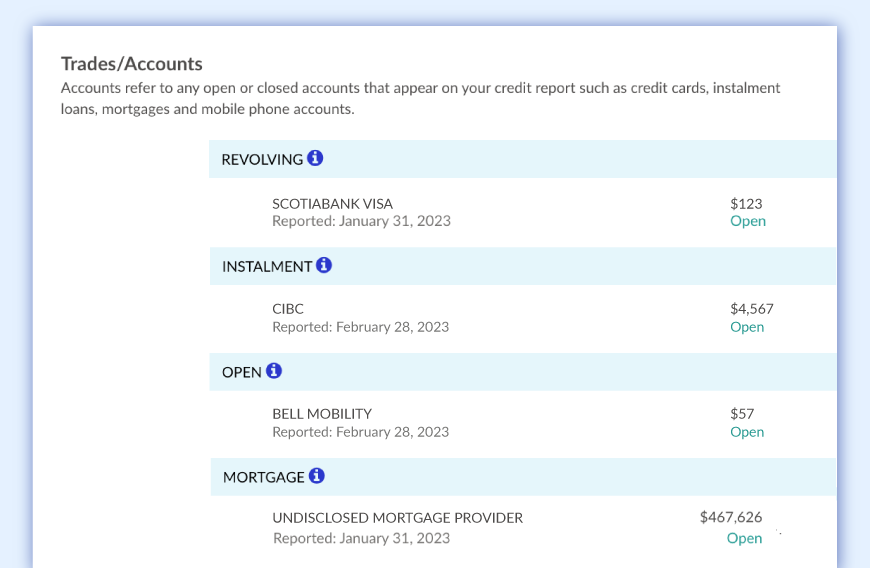

Fourth on the list, your credit mix (at 10%) is also meaningful. Typical categories include revolving (credit cards and lines of credit), installment (loans), mortgages, and open (cell phone plans, utility bills, etc.). The more items on the list in good standing, the more attractive you look to lenders.

Finally, credit inquiries (at 10%) represent the number of times a lender requests to view your profile. Inquiries made over the past three years will show up on Borrowell’s credit report dashboard, so it’s advisable to limit the number of pulls over a short period. In a nutshell: if several institutions are viewing your credit profile, it may seem like you’re in a bad financial situation.

How Can Borrowell Canada Help Me?

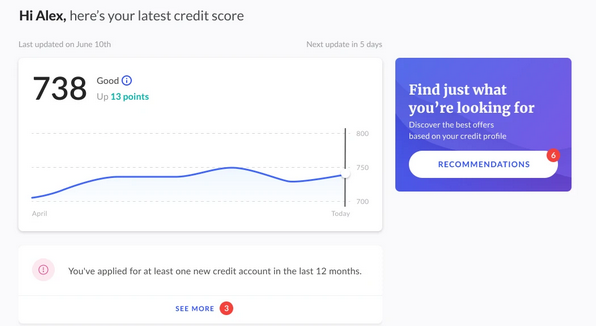

The primary advantage of being a Borrowell member is that you can view your credit report and score for free. In addition, monitoring the data won’t impact your credit score, and you can also access tools to help understand, manage, and master your credit.

Moreover, signing up takes less than three minutes, Borrowell won’t ask for a credit card, and your Equifax credit report can be viewed immediately. Plus, Borrwell provides weekly updates outlining how your credit score has evolved, including tips for building a better financial future.

The three advantages of Borrowell Canada include:

- Monitor & Track

- Understand & improve

- Find the Right Product

The first pillar surrounds accessing your credit report. The goal is to help you track your success, flag errors, and spot fraudulent activity. You can also cancel at any time.

Second, Borrowell introduces you to Molly, Canada’s first AI-powered Credit Coach, who provides personalized tips, articles, and tools to become more credit savvy.

Finally, Borrowell Canada curates a list of financial products from over 75+ partners that fit your unique profile, and it only takes a few clicks to see the likelihood of approval.

How Do Users Rate Borrowell?

Highly regarded at the Apple App Store and Google Play, Borrowell has ratings of 4.8 and 4.4 out of 5, with thousands of positive reviews. Moreover, it’s rated 4.0 out of 5 on Trustpilot, and a few of the testimonials read:

- The app does everything it says it would. Help build my credit score. Great customer service. Very fast prompt friendly. I would recommend them to anybody.

- Borrowell’s great customer service helped me get back into my Credit Account when an error locked me out. I tried everything to get back in and even called Equifax who would not even help me get back in and just wanted to sell me a monthly membership to get me a new Credit Account with them. I would recommend Borrowell to everyone.

- The service offered is fantastic. It’s great to have access to your credit score so you can determine your own financial destiny. Customer support was easy to deal with and able to help resolve my issue quickly and effectively. I would definitely recommend this service to anyone interested in monitoring their credit score free of charge.

Thus, Borrowell has helped millions of people increase their credit literacy, and several users vouched for the company’s excellent customer service.

Borrowell can help you understand and track your credit, but if you’re buried in debt and unsure where to turn,

check if you’re eligible for free debt relief through Consolidated Credit Canada

. You might qualify for a custom plan that reduces your interest, lowers your payments, and helps you breathe again.

Are We Bullish on Borrowell Canada?

We believe Borrowell can be a useful resource for Canadians looking to improve their credit scores. It’s easy to sign up and you gain free access to your Equifax credit report. Moreover, you don’t need a credit card, there are no fees, and you can cancel without penalty.

The only catch is that Borrowell will market its partners’ credit products, which you may or may not find useful and rather aggressive in their advertising. The company must make its money somehow, right? Remember, if it’s “free”, YOU are the product, and Borrowell is marketing YOU to their affiliate partners. Either way, there is no obligation to purchase anything, so you can enjoy the free benefits for as long as you desire.

Plus, accessing Borrowell’s Credit Coach, Molly, is valuable in itself. If you struggle with budgeting or have encountered credit missteps throughout your life, the wisdom can help move things in the right direction.

If you want to sign up or learn more, visit: https://borrowell.com/

☝REMEMBER:

➔ If you’re unable to pay existing debt, Consolidated Credit Canada can help. Reach out as you may qualify for up to 70% debt relief.