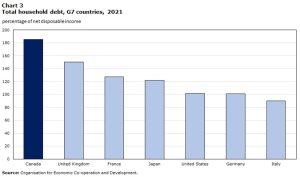

Debt is a reality many Canadians live with. The household debt-to-income ratios have continued to soar. The household debt-to-income ratio reached 184.5% in early 2023, meaning Canadians owed $1.85 for every dollar of disposable income.

If you are feeling buried under financial obligations, two common solutions for you are debt consolidation and a consumer proposal. But how do you know which one is the best fit for you?

In this article, we will explore both options, weighing their benefits and drawbacks and how they can shape your financial future.

What Is Debt Consolidation?

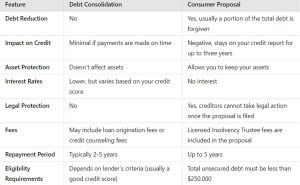

Debt consolidation means combining several debts into one loan or payment plan. The idea is to make your payments easier to manage and possibly lower the amount of interest you pay.

There are two main types of debt consolidation options.

Debt consolidation entails borrowing a new loan to repay your other expensive debts in an attempt to reduce the interest rates. The primary benefit of this option is that it makes repayment more manageable, eliminating several debts into one, and usually with a lower interest rate. This route can help you save money if the new loan has a better rate than what you’re currently paying on your other debts. This is most suitable for people with good credit ratings because the lenders will offer the best rates to such clients.

In contrast, a debt management program is not a loan. However, it is a formalized plan that is supervised by a credit counselling agency. This agency is able to discuss with your creditors and reduce the interest rates and fees that come with the debts. You make one monthly payment to the agency, and they pay your creditors in return. DMPs are especially beneficial if you experience financial difficulties because the negotiators can lower your monthly payment responsibilities considerably. Furthermore, when you apply for a DMP, all of your credit accounts are usually frozen to make sure that you are not able to borrow more money.

Pros of Debt Consolidation

- It’s easier to handle just one monthly payment.

- If you qualify, you could save money with a lower interest rate.

- This option doesn’t require you to use your property, like a house or car, as collateral.

- Making regular payments can help improve your credit score.

Cons of Debt Consolidation

- You usually need a decent credit score to reduce the interest rate.

- It would not reduce the principal amount you owe.

- Some loans come with extra costs, like origination fees.

What Is a Consumer Proposal?

A consumer proposal is a legal agreement to settle your debt, arranged by a Licensed Insolvency Trustee (LIT). The LIT negotiates with your creditors to reduce the amount you owe on unsecured debt. Payments are spread out over up to five years, making it easier to manage if you’re struggling with debt.

Pros of a Consumer Proposal

- You only have to repay a portion of your total debt, which can significantly ease your financial burden.

- Once you file, creditors can’t take legal action, garnish your wages, or harass you for payments.

- Unlike bankruptcy, you don’t have to give up any of your property.

- Payments stay the same throughout the agreement, making it easier to budget.

Cons of a Consumer Proposal

- It stays on your credit report for three years after completion, making it harder to get loans or credit.

- The process can take up to five years, which might be longer than expected.

- You must have less than $250,000 in unsecured debt, not including the mortgage on your primary residence.

Statistics on Debt Relief in Canada

In 2023, a total of 128,043 insolvencies were filed with the Office of the Superintendent of Bankruptcy, a 23.6% increase from 2022. Out of these, 123,233 were consumer insolvencies. The number of consumer proposals filed in 2023 stood at 96,987 (78.7% of total consumer insolvencies). These numbers illustrate that more Canadians are choosing consumer proposals as a preferred debt relief option. The growing preference for consumer proposals indicates that individuals favor the flexibility and creditor protection they provide.

Which Option Is Right for You?

So, which option will suit you the best? Let’s find out:

Debt Consolidation Can be Better For You If:

- You have a good credit score and can qualify for a low-interest loan.

- You can afford to repay the full amount of your debt but want to simplify your payments.

- You prefer to avoid a significant impact on your credit score.

Consumer Proposal Can be Better For You If:

- You are having trouble making minimum payments and can’t pay off your full debt.

- You need legal protection from creditors.

- You want to keep your assets, like your home or car.

Final Words

If you want to pay off an overwhelming amount of debt, both debt consolidation and a consumer proposal are options to consider. Debt consolidation can simplify payments and may reduce the interest rate, whereas a consumer proposal protects you from creditors and could reduce part of your debt.

Not sure which option is right for you? It is best to contact a financial advisor to choose an option that aligns with your financial goals.