Driven logo. Credit: www.driven.ca

If you’re running a small or medium-sized business and need quick access to funding, even with an average or bad credit score, Driven.ca might be just what you’re looking for. Driven Financial is an alternative lender, just like Merchant Growth or Journey Capital, which means they don’t have the same strict rules as traditional banks. For businesses that don’t have a great credit score or are still in the early stages, Driven.ca offers a more flexible approach to financing. In this review, we’ll break down Driven.ca to help you determine if it’s the right choice for you…

Compare Rates From Top Alternative Lenders Now

| Lender | Loan Range | Speed | Best For | Action |

|---|---|---|---|---|

| Driven.ca | $5K – $300K | 1–3 business days | Quick, flexible loans for small businesses | Apply Now |

| Merchant Growth | $5K – $800K | 1–3 business days | Flexible repayments tied to revenue | Get Quote |

| Journey Capital | $10K – $2M+ | 1–3 business days | Personalized term loans & project financing | Learn More |

| Swoop Funding | $5K – $5M+ | Varies by lender | Marketplace for multiple loan offers | Compare Offers |

| Loans Canada | $500 – $500K+ | 1–3 business days | Aggregator for personal & business loans | Check Options |

💡 Tip: Compare Canada’s top 5 alternative business lenders side by side and find the one that best matches your startup’s needs.

Quick Overview of Driven Financial

- Name: Driven.ca, part of “Purpose Unlimited”. Under “Driven Financial Technologies Corporation”.

- URL: https://www.driven.ca/

- Phone: 1-866-889-9412

- Headquarters: 130 Adelaide St W, Suite 3100, Toronto, Ontario, Canada, M5H 3P5

- TrustPilot Score: 4.5/5 stars (860 reviews)

- Google Reviews: 4.6/5 stars (226 reviews)

- Certifications: CLA-certified.

Fun fact: Driven.ca is the new name for Thinking Capital, one of Canada’s original alternative business lenders. They rebranded after being acquired by Purpose Unlimited in 2022, but their mission to help small businesses access fast, flexible funding remains the same. (At higher rates, though!)

Driven’s Minimum Requirements

- 600+ FICO score

- 6 months in business

- $120,000 annual revenue (10k per month)

- Business bank account required

- Business is operating in Canada

What you need to apply

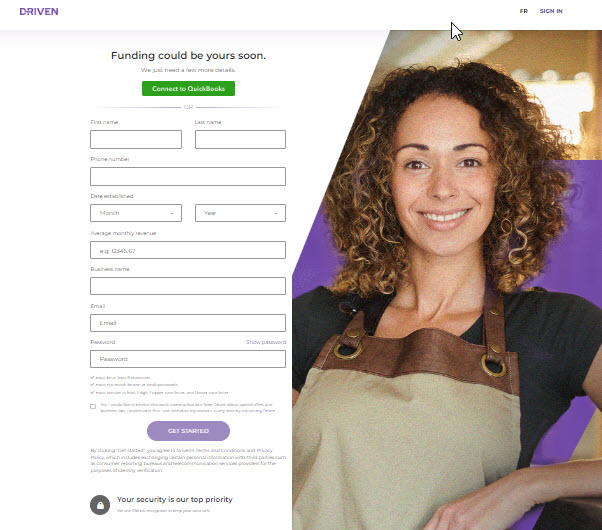

Driven Application Form. Credit: Driven.ca

- Basic details about you and your business

- Bank connection or bank statements for past 6 months

- Business is in good standing

Why You Might Like Driven.ca:

- Fast Funding: One of the best things about Driven.ca is how fast they can get you the money. If you’re in a pinch and need funding quickly for payroll, equipment, or other urgent business needs, Driven.ca can approve loans in a short time.

- No Early Repayment Fees: A huge plus is that there are no penalties for paying off the loan early. If you have a good few months and want to clear your debt faster, you won’t get hit with extra charges.

- Accessible for Small Businesses: With a requirement of just $5,000 in monthly revenue and a minimum of six months in operation, they cater to smaller businesses that might have trouble getting loans from traditional banks.

- Flexible Financing Options: Along with regular business loans, they also offer merchant cash advances, which can be helpful if your business relies on credit card transactions (like retail or restaurants).

Why You Might Be Cautious:

- Higher Interest Rates: Like many alternative lenders, Driven.ca’s loans come with higher interest rates compared to what you’d find at a traditional bank. This is especially true if you have a lower credit score, which means the cost of borrowing could add up fast.

- Shorter Loan Terms: They generally structure their loans for quicker repayment, often over a few months instead of years. While that might be good if you don’t want long-term debt, it also means higher payments over a shorter period.

- Loan Limits: The maximum loan amount is $300,000. If you’re a smaller business, this might be more than enough, but for larger ventures looking for significant expansion, this may not cover what you need.

Comparison of Driven.ca with Similar Lenders

Here’s a quick table comparing Driven.ca with other alternative lenders like Merchant Growth, Journey Capital, and SharpShooter Funding to help you see how they stack up:

| Lender | Loan Amounts | Approval Speed | Interest Rates | Repayment Terms | Requirements |

|---|---|---|---|---|---|

| Driven.ca | $5,000 – $300,000 | Fast (as little as 24 hrs) | Higher than banks | Short-term (months, up to 1-2 years) | $5K+ monthly revenue, 6+ months in business |

| Merchant Growth | $5,000 – $800,000 | Fast (within 24 hrs) | Higher than banks | 6 – 24 months | $10K+ monthly revenue, 6+ months in business |

| Journey Capital | $5,000 – $300,000 | Fast (24 hrs) | Higher than banks | Up to 24 months | $100K+ annual revenue, quick approval, no credit score impact |

| SharpShooter Funding | $10,000 – $250,000 | Fast (within 24 hrs) | Higher than banks | Short-term (months) | Business 100+ days old, $10K+ monthly revenue |

Breaking Down the Comparison:

- Driven.ca vs. Merchant Growth: Both offer fast funding, but Merchant Growth allows for larger loans, up to $800,000, which could be better for businesses needing more capital. However, Driven.ca has a lower entry point ($5,000), so smaller businesses might prefer it.

- Driven.ca vs. Journey Capital: The two are quite similar in terms of loan amounts and speed. Journey Capital also offers a flexible option where your application doesn’t impact your credit score, which can be a plus if you’re shopping around for the best loan terms.

- Driven.ca vs. SharpShooter Funding: SharpShooter requires your business to be a bit more established (at least 100 days old) and brings a bit more complexity into the process, but it’s still a solid option for quick funding with similar loan limits to Driven.ca.

Who Should Use Driven.ca?

- Those that don’t qualify with regular banks and credit unions (due to bad or no credit)

- Small businesses looking for fast, accessible funding

- Companies with lower monthly revenue or those who are newer and may not meet stricter bank criteria

- Businesses that may benefit from merchant cash advances, which Driven.ca offers, allowing repayment tied to sales volume

Who Should Look Elsewhere?

- Larger businesses needing more than $300,000 in funding

- Companies that aren’t in a hurry to get a loan and can wait for a traditional bank loan in order to secure lower interest rates

- Businesses that need longer repayment terms, as Driven.ca typically offers shorter repayment periods

Final Thoughts

Whether you’re in Ontario, BC, Alberta or anywhere else in Canada and need funding quickly, Driven.ca can be a solid option, especially if you’re a small business that needs accessible financing and are facing rejection from your bank or credit union. They’re fast, flexible, and won’t penalize you for paying off your loan early. They also have some great reviews and are CLA-certified.

However, if your credit score is decent and you can afford to wait, you might get better terms from a traditional bank. You can even consider other alternative lenders that offer longer repayment periods and potentially lower interest rates.

In short, Driven.ca (ex Thinking Capital) is a good choice if speed and flexibility are your top priorities, but you’ll want to weigh those benefits against potentially higher costs than traditional lenders like mainstream banks and credit unions.

Quick FAQ About Driven.ca

What is Driven.ca?

Driven.ca is a Canadian alternative lender offering fast, flexible business loans and merchant cash advances. They were known as Thinking Capital in the past.

Was Driven.ca formerly Thinking Capital?

✅ Yes! Driven.ca is the new name for Thinking Capital after rebranding under Purpose Unlimited.

How fast is funding?

Approval and funding can happen in as little as 24 hours.

What are the minimum requirements?

-

6+ months in business

-

$120K+ annual revenue (~$10K/month)

-

600+ personal credit score

-

Canadian business and bank account

Does applying hurt my credit?

No — pre-qualification only triggers a soft credit check.

How much can I borrow?

Between $5,000 and $300,000, depending on your business profile. Merchant Growth can do up to $800k if you’re looking for more. Swoop Funding can do higher than 1mm and can also do equipment loans.

Does Driven.ca offer merchant cash advances?

✅ Yes — repayment can be tied to your daily sales if you choose a merchant cash advance.

Are there early repayment penalties?

❌ No — you can repay early without extra fees.

How does it compare to banks?

-

Faster approvals (24–48 hours)

-

Higher rates than banks

-

Easier to qualify for

-

Shorter loan terms (typically under 2 years)

Lauren Brown

Lauren has over 13 years of experience in wealth management and financial planning. She is a CFA charterholder and holds a Bachelor's degree in Finance. Lauren has worked with several asset management firms, offering wealth advisory and portfolio management services to high-net-worth clients.