As a financial cushion, life insurance policies protect your family when tragedy strikes, allowing them to focus on what’s important. PolicyMe positions itself as a great choice for Canadians looking for life and critical illness insurance. Is it the right life insurance provider for you and your family? Hopefully, this review will help you decide…

Check If You Qualify With PolicyMe:Respond to these quick questionnaires to find out if you qualify and for how much: |

About the Company

- URL: https://www.policyme.com

- Phone: 1-866-999-7457

- Email: info@policyme.com

- Company HQ: Toronto, ON

- Google Reviews: 4.9/5 stars (160 reviews)

- Reviews.io Reviews: 4.8/5 stars (842 reviews)

- Glassdoor: 4.5/5 Stars (28 reviews)

- Money With Mark Review: 5/5 stars

PolicyMe Pros and Cons:

To help determine if PolicyMe fits your needs, please see our pros and cons list below:

Pros:

- Obtain a free, no-obligation quote

- Receive an answer in as little as five minutes

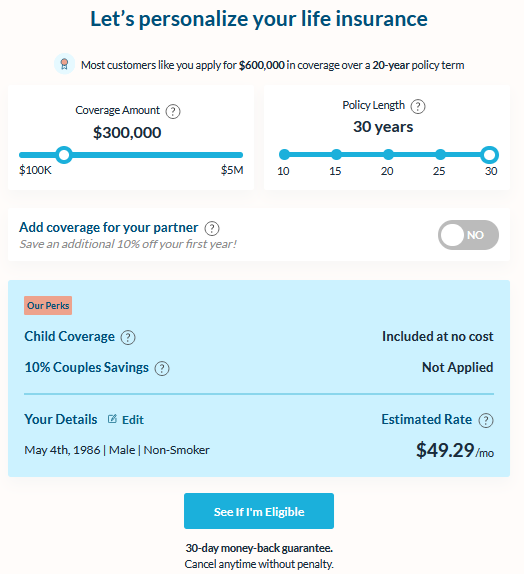

- Obtain coverage at 10% to 20% cheaper than comparable insurers

- Life insurance coverage ranges from $100,000 to $5,000,000

- Critical care insurance coverage ranges from $10,000 to $1,000,000

- Excellent customer service

- Highly rated by its clients on sites like Google Reviews, Reviews.io or Money With Mark.

- Most applicants don’t need a medical exam

Cons:

- There are no physical locations

- Policy Me is an insurance broker or comparison site, so it does not issue most policies

Who Is PolicyMe a Great Fit For?

- Busy parents looking for fast, affordable life insurance without medical exams.

- Self-employed Canadians needing critical illness coverage without the hassle.

- Young professionals who want a policy that grows with them financially.

- Anyone on a tight budget who still wants high-quality coverage and peace of mind.

No matter your situation, PolicyMe has a simple online form to show you what you qualify for. It takes 5 minutes or less.

How PolicyMe Compares to Other Insurers

| Feature | PolicyMe | Traditional Insurer |

|---|---|---|

| Application Time | 5-10 minutes online | 30+ minutes by phone or in person |

| Medical Exam Required | Rarely | Often |

| Starting Price | ~$20/month | ~$30–$40/month |

| Free Child Coverage | ✅ Up to $10,000 | ❌ Not included |

What Is PolicyMe?

PolicyMe is a Canadian life and critical care insurance broker. The fintech helps connect customers with insurers by providing a list of quotes from reputable providers. By encouraging competition, the site helps you find the best coverage at the best price.

In addition, PolicyMe partners with the Canadian Premier Life Insurance Company to provide direct insurance policies. The former generates quotes from the latter, and the process helps provide Canadians with more affordable options. Furthermore, the partnership increases efficiency, as acting as a broker requires the issuer to conduct its own risk assessment. However, by working with the Canadian Premier Life Insurance Company, they share those responsibilities, which enhances users’ experiences.

How Does Life and Critical Care Insurance Work?

When a loved one passes away, life insurance provides the beneficiary with a one-time, tax-free payment, called a death benefit. These funds help cover funeral expenses, childcare costs, and debts owed on behalf of the deceased.

Term life insurance pays a death benefit if the policyholder dies within a certain period. For example, terms typically range from 10, 15, 20, 25, and 30 years, and the individual must pass away within the chosen timeframe, or the policy expires and there is no payout. In addition, term policies don’t have cash values, so you can’t borrow against the policy or receive cash back if you cancel.

As you may expect, the lower the policy duration (10 vs. 30 years), the lower the monthly payment for the same individual.

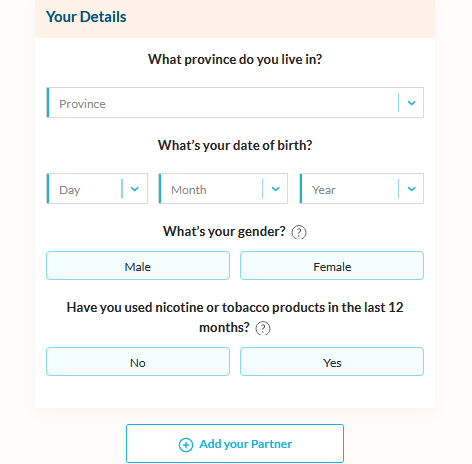

However, the cost of term life insurance depends heavily on your age, illness history, smoking history, and other factors.

Critical care insurance covers you for major ailments such as heart attacks, stroke, Alzheimer’s disease, and cancer. Some policies also cover early-stage conditions, which help with medical expenses and allow you to prioritize your recovery.

The Government of Canada notes that “Critical illness insurance usually covers a one-time lump-sum payment if you’re diagnosed with a critical illness. The payment may cover expenses such as daycare or renovations to make your home more accessible.”

How Can PolicyMe Help?

With inflation concerns morphing into recession concerns, our Inflation Calculator CPI tables highlight how Canadians confront several economic challenges. And with stretched budgets already under pressure, finding ways to save money is more important than ever.

Consequently, PolicyMe is a reputable and cost-effective conduit for life and critical care insurance, and you can obtain an affordable policy in as little as five minutes. The comparison site is known to offer options at 10% to 20% below comparable Canadian insurers, and it’s possible to attain $10,000 in free coverage for your children. Most applicants can skip the medical exam, and a yes-or-no decision can be obtained almost immediately.

Since PolicyMe is strictly an online insurance broker, it benefits from cost synergies that other insurers lack. For example, most insurance providers have physical locations, which require expenses for lodging, utilities, staff, merchandising, cleaning, etc. Conversely, PolicyMe bypasses these expenses by operating digitally and passes the savings on to applicants.

More importantly, a common theme among fintech firms is that pricing often comes at the expense of customer service. In a nutshell: the lack of human staffing can result in long wait times when technical glitches occur.

However, PolicyMe bucks the trend, as most applicants and policyholders rave about the company’s communication and willingness to educate about which terms and policies are right for them. As a result, you have nothing to lose by speaking with an agent and learning more about the options available.

🕒 Don’t Wait — Your Quote Takes Just 5 Minutes

You don’t need to speak to anyone. Get a no-pressure quote online and see what rates you qualify for based on your age and health.

What are the PolicyMe Specifics?

PolicyMe’s life insurance coverage ranges from $100,000 to $5,000,000, with terms extending from 10 to 30 years. Moreover, critical care insurance has the same terms, but payouts range from $10,000 to $1,000,000. In total, 44 conditions are covered — 27 critical illnesses and 17 early-stage ailments.

How Do Customers Rate PolicyMe?

It’s hard to find any negative PolicyMe reviews, as the overwhelming majority of customers seem satisfied with the service. Most cited an easy process, affordable pricing, and great customer service. A few of the testimonials stated:

- Highly recommend PolicyMe. The entire process of getting the insurance is very easy and quick, there is a very supportive team available to answer any questions one might have. Thanks to Natalie from the PolicyMe team who patiently helped me through my queries. Term insurance plans are very flexible, and critical illness has very extensive coverage.

- Great customer service experience. Great process. Love the application process, quick and simple to obtain life insurance. No pressure sales. Hassle-free. Will recommend. Thank you.

- Very straightforward process. Received multiple quotes from insurance companies – PolicyMe by far had the easier application/approval process. Ivana was very helpful and knowledgeable, and able to immediately answer my questions.

- Some of the best customer service I’ve ever had – so good that I actually looked up their job postings because it seemed like such a lovely place to work!

Thus, policyholders are quite satisfied with their coverage, and customer service agents spend the time to find the right coverage for you. As a result, we see little downside in obtaining a no-obligation quote to determine if PolicyMe fits your needs.

Is PolicyMe Really Worth It?

In our view, PolicyMe checks off all the boxes. The fintech offers affordable policies from reputable insurance providers and is there to help every step of the way.

Moreover, comparison sites are a great way to obtain the best quotes because platform companies compete for your business. Remember, most firms aim to sell consumers products at their reservation price — or, the highest price they’re willing to pay. But, when they know you’re receiving quotes from several competitors, they’re more likely to offer favourable terms to win your business. Essentially, competition helps drive down the price, and that’s what PolicyMe is all about.

Furthermore, we haven’t come across another Canadian insurer offering $10,000 in free coverage for your children. Thus, PolicyMe should be on your radar if you’re in the market for life or critical care insurance.