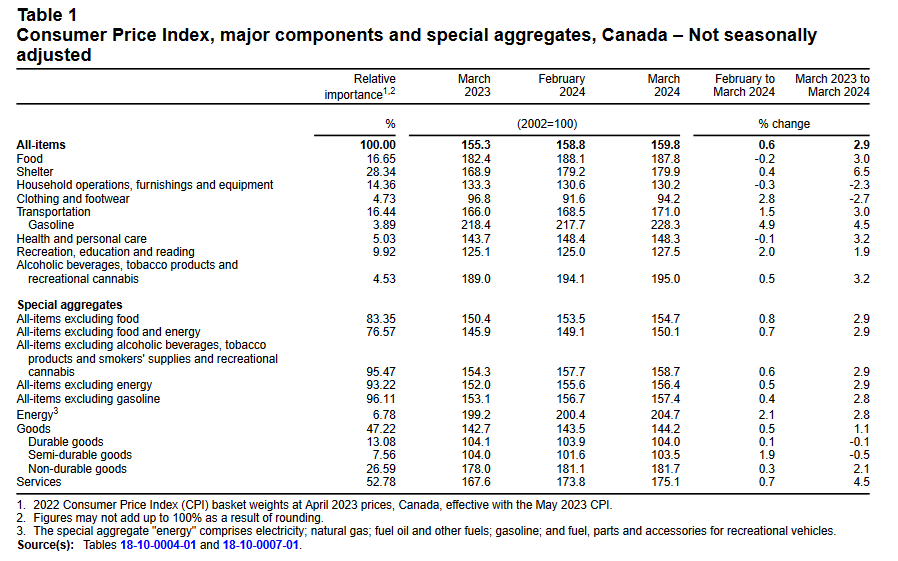

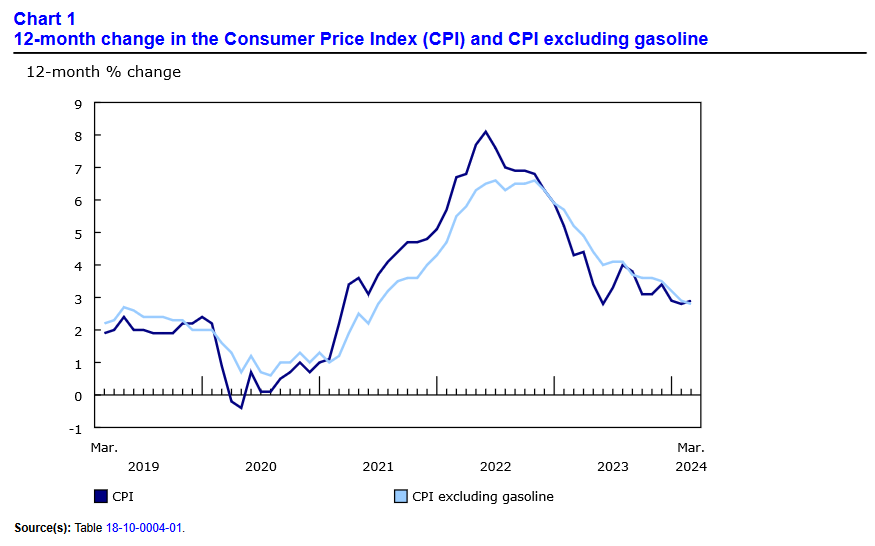

Canada’s consumer price index (CPI) rose by 2.9% year over year (Y-o-Y) in March, jumping above the 2.8% Y-o-Y witnessed in February. Statistics Canada (StatsCan) published the data at 8:30 a.m. ET on April 16, 2024, via The Daily report. On a monthly basis, the CPI accelerated by 0.6% in March, doubling the 0.3% reading from February. Statistics Canada labeled the monthly increase “broad-based,” as higher inflation was seen across many categories.

Still, Canadian economists anticipated a hot print due to the ascent of oil & gas prices. The consensus estimates were 0.7% month-over-month and 3.1% Y-o-Y. As a result, the data came in weaker than expected, and market strategists suggested the results continue to support rate cuts in the months ahead.

On April 10, the Bank of Canada (BoC) noted in its monetary policy statement that “While inflation is still too high and risks remain, CPI and core inflation have eased further in recent months. The Council will be looking for evidence that this downward momentum is sustained.”

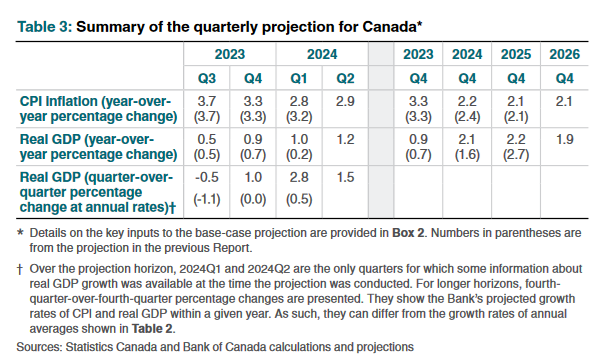

Moreover, the committee expects “CPI inflation to be close to 3% during the first half of this year, move below 2½% in the second half, and reach the 2% inflation target in 2025.”

In addition, the BoC’s latest Monetary Policy Report showed the committee still expects a soft landing. Y-o-Y real GDP growth is expected to hover near 2% from now until 2026, while Y-o-Y CPI inflation should decline from 3.3% to 2.1%. The table below reflects the BoC’s estimates from its April report.

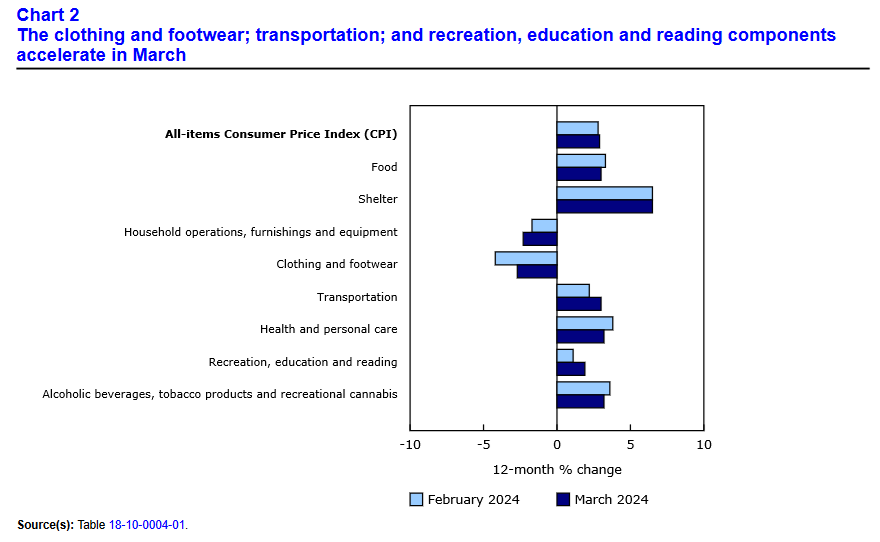

In March 2024, month-over-month inflation was largely driven by higher gasoline prices (+4.9%), Clothing and footwear (+2.8%), recreation, education and reading (+2.0%), and semi-durable goods (+1.9%).

Source: Statistics Canada (Table 18-10-0004-01)

Core CPI Retreats Again in March 2024

Core measures of the CPI in March 2024 fell across the board, with the CPI-common index falling to +2.9% (from +3.1%), the CPI-median falling to +2.8% (from +3.1%), and the CPI-trim falling to +3.2% (from +3.1%). These measures exclude the impacts of food and energy, and the BoC places heavy emphasis on core measures because they provide a smoothed distribution of overall inflation.

For example, food and energy prices are highly volatile and price spikes can occur for reasons outside of the BoC’s control. The rise in energy prices during the Russia-Ukraine war was an unexpected event that the BoC had to grapple with. Thus, core CPI measures are more useful for monetary policy decisions.

Source: Statistics Canada (Table 18-10-0004-01)

Inflation Decelerates Across 4 of 8 Major Sectors

On a Y-o-Y basis, slower pricing pressures were present in four of the eight major categories. These include food, shelter, household operations, furnishings and equipment, clothing and footwear, transportation, health and personal care items, recreation and education expenses, and alcohol and tobacco products.

Clothing and household products recorded outright deflation once again, while transportation prices accelerated. Shelter prices increased 6.5% Y-o-Y in March (matching February), while rents rose 8.5% Y-o-Y, a slight increase from the 8.2% uptick in February.

Source: Statistics Canada (Table 18-10-0004-01)

Grocery Inflation Slows in March

Food inflation declined by 0.2% month-over-month in March after a flat performance in February. The decline was headlined by lower prices for dry or fresh pasta (-7.3%), canned salmon (-5.0%), butter (-4.6%), and fresh fruit and vegetables (-4.1%).

Where Are Interest Rates Headed?

With inflation mostly aligning with the BoC’s 1% to 3% target range, economists are convinced that four or five rate cuts are on the table in 2024. Moreover, with Canadian job openings continuing their downtrend and real GDP growth struggling to meet the typical 2% target, the rate-cut case could be further emboldened if inflation remains under control for the next few months.

Conversely, the 0.6% month-over-month reading in March remains troubling because it annualizes to nearly 7.5% Y-o-Y. This means that if monthly inflation kept tracking at 0.6%, the annual inflation rate would get out of control.

BoC Governor Tiff Macklem said during his April 10 press conference that “We don’t want to leave monetary policy this restrictive longer than we need to. But if we lower our policy interest rate too early or cut too fast, we could jeopardize the progress we’ve made bringing inflation down.”

He concluded: “What do we need to see to be convinced it’s time to cut? The short answer is we are seeing what we need to see, but we need to see it for longer to be confident that progress toward price stability will be sustained. The further decline we’ve seen in core inflation is very recent. We need to be assured this is not just a temporary dip.”

Thus, with the BoC taking a conservative approach to monetary easing, Macklem remains concerned about repeating the “transitory” mistake from 2021. Back then, he was too slow to hike in the face of accelerating inflation. Now, he doesn’t want to repeat that process by cutting rates prematurely.

So, while inflation and higher interest rates have hit low-income Canadians the hardest, it remains a balancing act for the BoC to determine the right solution at the right time.

As a proactive measure to protect your wealth from further deterioration, historically, precious metals assets such as gold and silver have held their value more reliably than stocks during periods of high inflation. In today’s economic environment, physical assets and commodities such as real estate and precious metals may provide a strategic hedge against inflation. Given gold and silver’s recent accelerations, several market participants have adopted a similar view.

Dedicating a small portion of one’s TFSA or RRSP portfolio to precious metals may help mitigate some of the negative effects of inflation. If you want to get started with investing in metals such as gold and silver, read our free guide to gold buying in Canada in 2024 today.