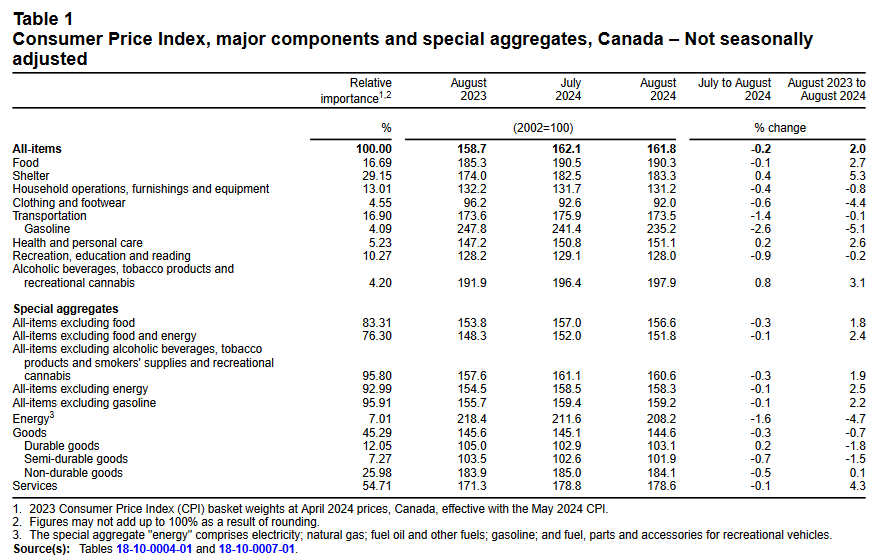

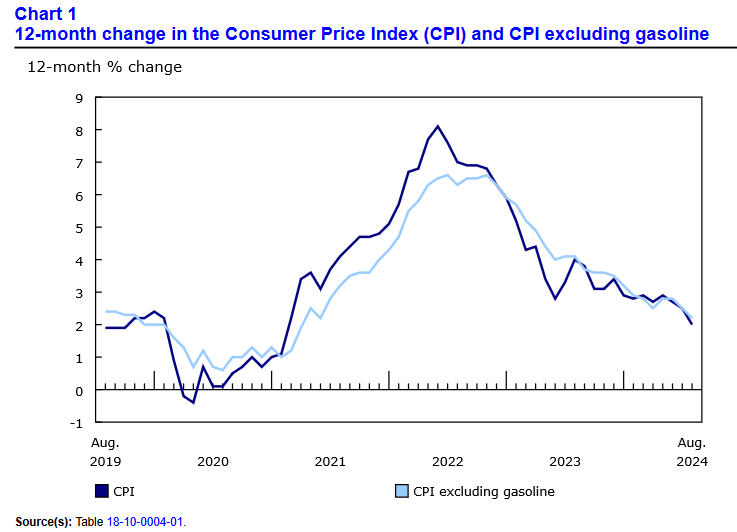

Canada’s consumer price index (CPI) rose by 2.0% year over year (Y-o-Y) in August, down from 2.5% Y-o-Y in July, and the slowest annual increase since February 2021. Statistics Canada (StatsCan) published the data at 8:30 a.m. ET on September 17, 2024, via The Daily report. On a monthly basis, the CPI declined by 0.2% in August and was primarily driven by lower gasoline prices and base-year effects.

The data was relatively weak compared to economists’ consensus estimates. For example, the table below is courtesy of Investing.com. The left column represents August’s figures, while the right column represents forecasters’ expectations. As you can see, only the median CPI (marked in green) was higher than expected, while three metrics (marked in red) missed expectations. Consequently, more rate cuts should be on the horizon as the Bank of Canada’s (BoC) price stability efforts are working.

Speaking of which, the BoC cut interest rates for a third time on Sep. 4. And Governor Tiff Macklem said during his press conference that “Inflation continues to reflect the push and pull of opposing forces. Overall weakness in the economy continues to pull inflation down…. If inflation continues to ease broadly in line with our July forecast, it is reasonable to expect further cuts in our policy rate.”

He added: “With the share of CPI components growing above 3% now around its historical norm, there is little evidence of broad-based price pressures…. With inflation getting closer to the target, we need to increasingly guard against the risk that the economy is too weak and inflation falls too much.”

Thus, while Macklem also highlighted the risks of an inflation comeback due to the stickiness of the shelter component, he should be pleased with August’s CPI results.

In August 2024, the drop in month-over-month headline inflation was supported by lower air transportation prices, gasoline, clothing and footwear, and travel tours. For context, gasoline prices fell 5.1% Y-o-Y in August following a 1.9% increase in July.

Core CPI Slows in August 2024

Core measures of the CPI in August 2024 continued their downtrends, with the CPI-common index falling to +2.0% (from +2.2%), the CPI-median falling to +2.3% (from +2.4%), and the CPI-trim dropping to +2.4% (from +2.7%). These measures exclude the impacts of food and energy, and the BoC places heavy emphasis on core measures because they provide a smoothed distribution of overall inflation.

Please note that food and energy prices are highly volatile and price spikes can occur for reasons outside of the BoC’s control. In contrast, core inflation is largely driven by consumer demand and gives the BoC a better sense of how the Canadian economy is functioning.

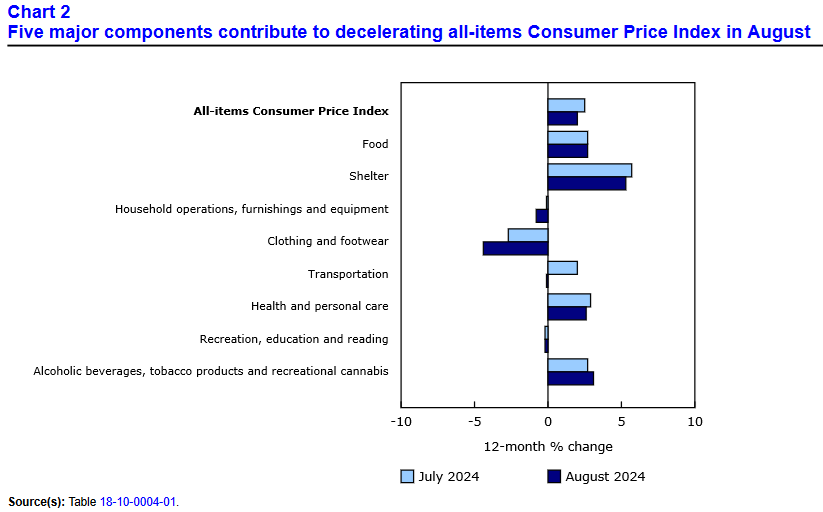

Inflation Slows Across 5 of 8 Major Sectors

On a Y-o-Y basis, weaker readings occurred across five of the eight prominent categories. These include food, shelter, household operations, furnishings and equipment, clothing and footwear, transportation, health and personal care items, recreation and education expenses, and alcohol and tobacco products.

Clothing and household products continued their deflationary trends, while recreation, education, reading, and transportation prices also dipped into negative Y-o-Y territory.

Grocery Inflation Still Rising Y-o-Y

Food inflation jumped by 2.4% Y-o-Y in August, up from 2.1% in July. Statistics Canada cited base-year effects as the primary culprit, “notably coming from prices for dairy products (+3.3%) and fresh fruit (+1.5%).” On a monthly basis, grocery prices fell by 0.2%, with fresh vegetables down by 2.8%.

Interest Rates Heading Below 4%?

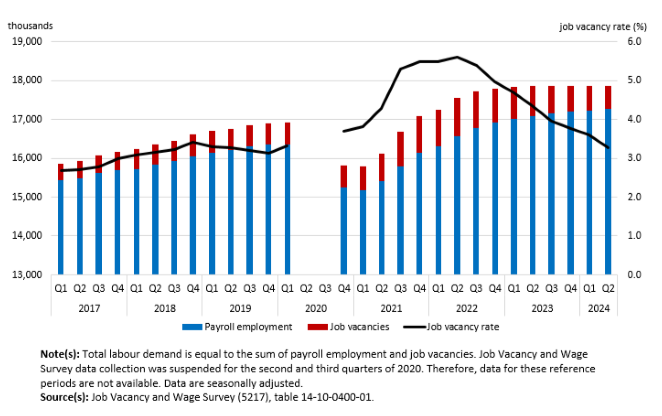

With the data continuing to support lower interest rates, the BoC’s overnight lending rate could be south of 4% in October. Macklem noted during his press conference that “The unemployment rate has risen over the last year to 6.4% in June and July. The rise is concentrated in youth and newcomers to Canada, who are finding it more difficult to get a job. Business layoffs remain moderate, but hiring has been weak. The slack in the labour market is expected to slow wage growth, which remains elevated relative to productivity.”

To that point, Statistics Canada reported on Sep. 17 that “Job vacancies fell by 59,000 (-9.2%) to 582,600 in the second quarter, marking the eighth consecutive quarterly decline from the record high of 983,600 reached in the second quarter of 2022. The drop in the second quarter of 2024 was approximately twice the decline observed in the previous quarter (-30,200; -4.5%)…. The job vacancy rate in the second quarter was at its lowest since the first quarter of 2020 (3.3%).”

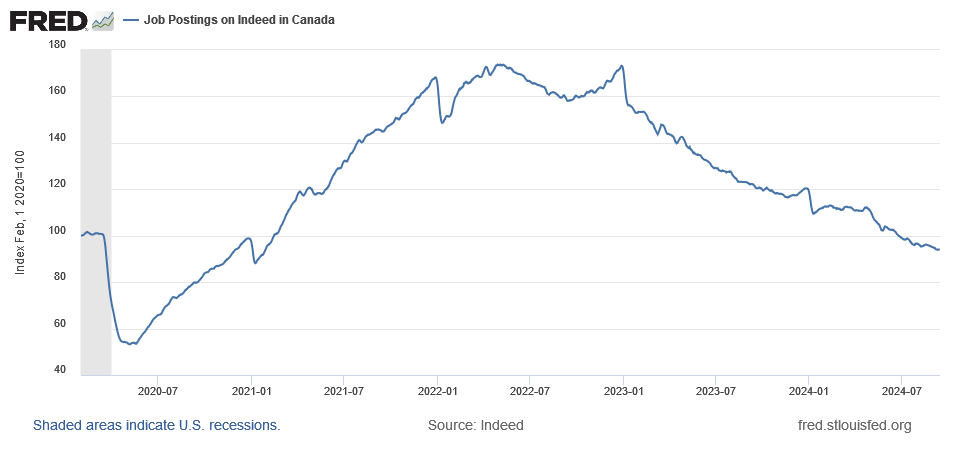

As further evidence, Indeed reported on Sep. 16 that Canadian job postings on its site continued their downtrend, which highlights how the balance of risks has shifted.

Thus, with inflation seemingly under control and the Canadian labour market wobbling, the argument for lower interest rates continues to grow.

Also helpful, oil and commodity prices have sold off in the financial markets recently, which helps reduce input costs for businesses and consumers. The developments could further reduce headline inflation, make the BoC’s job easier, and assisting low-income Canadians who have been hit the hardest by high interest rates.

Overall, more inflation progress was realized on Sep. 17, and the BoC is halfway to its historically elusive soft landing. With Macklem noting that “We care as much about inflation being below the target as we do above,” it’s important to remember that deflation is just as problematic as too-high inflation. Therefore, the BoC may need to shift to an accommodative stance if the Canadian economy weakens further.

To protect your wealth as the drama unfolds, precious metals assets such as gold and silver have typically held their value more reliably than stocks during periods of high inflation. In today’s economic environment, physical assets and commodities such as real estate and precious metals may provide a strategic hedge against inflation. Given how gold continues to hit new highs, several market participants have adopted a similar view.

Dedicating a small portion of one’s TFSA or RRSP portfolio to precious metals may help mitigate some of the negative effects of inflation. If you want to get started with investing in metals such as gold and silver, read our free guide to gold buying in Canada in 2024 today.