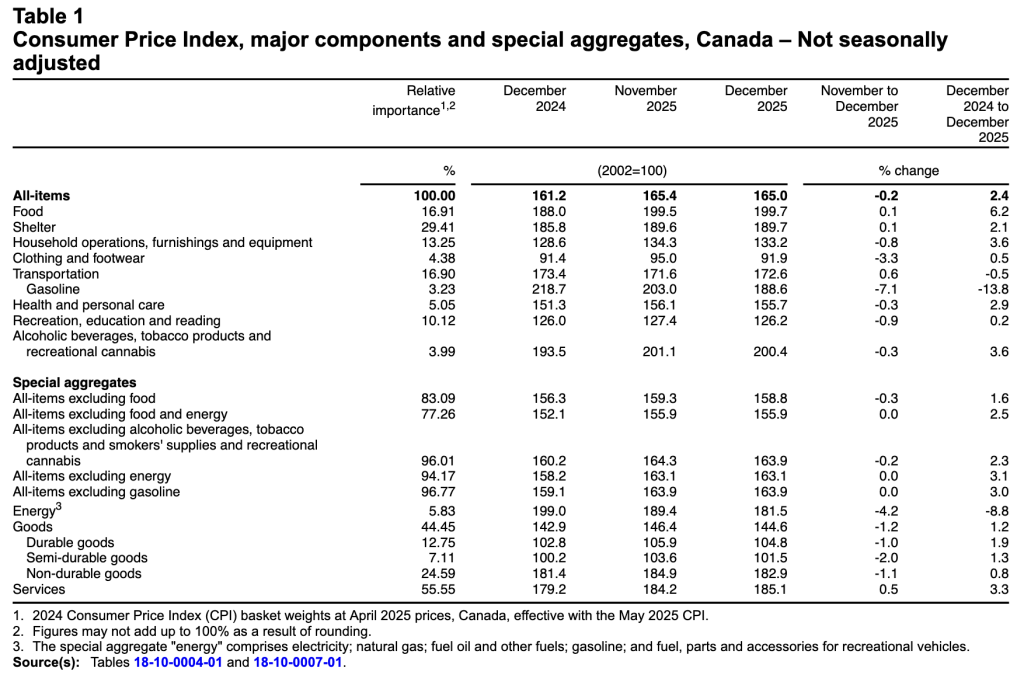

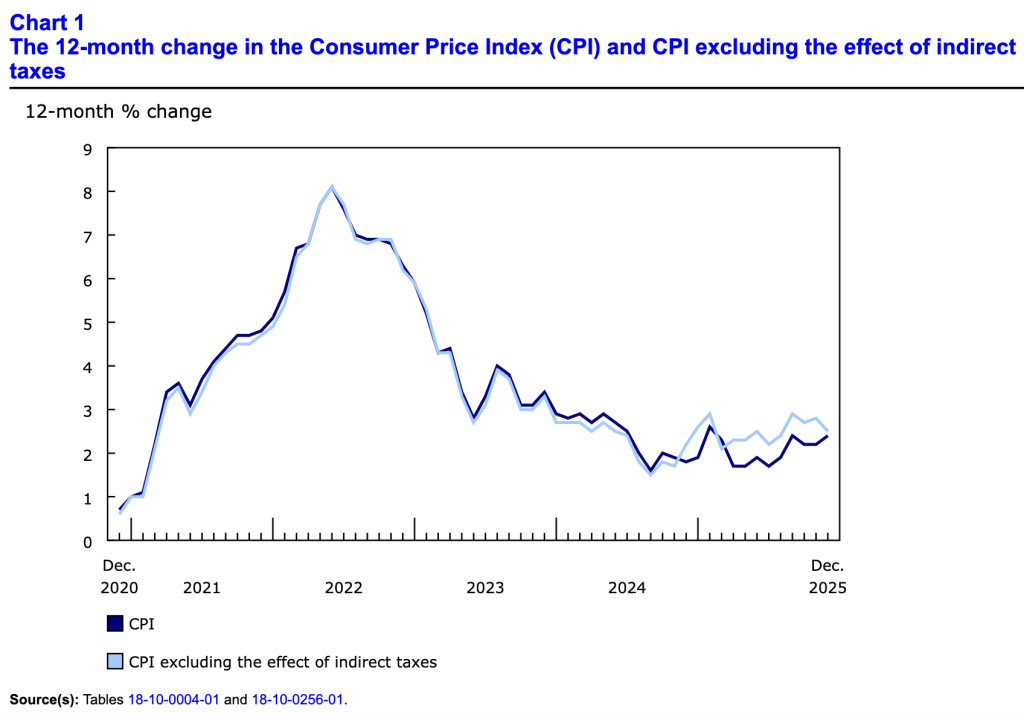

Canada’s consumer price index (CPI) increased by 2.4% year over year (Y-o-Y) in December, above the 2.2% Y-o-Y realized in November. Statistics Canada (StatsCan) published the data at 8:30 a.m. ET on January 19, 2026, via The Daily report. On a monthly basis, the CPI fell by 0.2%, and base effects from last year’s GST/HST holiday were the primary culprit for the monthly decline and annual increase.

Overall, the results were mixed relative to expectations. The table below is courtesy of Investing.com. The left column represents December’s figures, while the right column represents forecasters’ consensus estimates. As you can see, there were some positives and negatives.

To that point, the Bank of Canada (BoC) noted in its latest Summary of Governing Council Deliberations on Dec. 23 that “Members were encouraged by the job gains reported in the Labour Force Survey for November. Three months of solid employment growth had pushed the unemployment rate down to 6.5%….

However, “Members noted that, in the next few months, CPI inflation is likely to rise slightly. Year-over-year CPI inflation rates of some goods and services components would be higher because the prices had temporarily dropped during the GST/HST holiday a year ago. Looking through the near-term choppiness, Governing Council still expected soft demand and ongoing slack in the economy to roughly offset cost pressures associated with the reconfiguration of trade, keeping CPI inflation close to the 2% target.”

Add it all up, and resilient employment and potentially higher inflation over “the next few months” could keep the BoC on hold until both sides of its dual mandate show further weakness.

Declining Core CPI

Core measures of the CPI mostly weakened in December, with the CPI-common index holding at +2.8% (from +2.8%), while the CPI-median fell to +2.5% (from +2.8%), and the CPI-trim fell to +2.7% (from +2.9%). These measures exclude the impacts of food and energy, and the BoC places heavy emphasis on core measures because they provide a smoothed distribution of overall inflation.

Please note that food and energy prices are highly volatile and price spikes can occur for reasons outside of the BoC’s control. In contrast, core inflation is mainly driven by consumer demand and gives the BoC a better sense of how the Canadian economy is functioning.

Sector Results

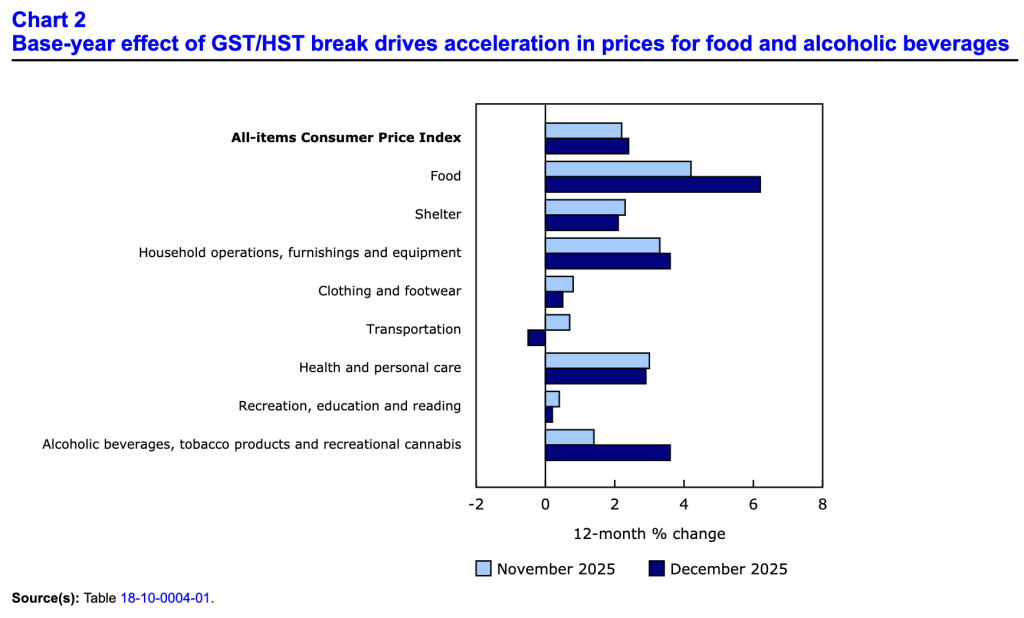

Sector performance was mixed in December, with food, alcohol, tobacco, and cannabis experiencing the highest Y-o-Y jumps due to the GST/HST impact.

For context, the eight sectors include food, shelter, household operations, furnishings and equipment, clothing and footwear, transportation, health and personal care items, recreation and education expenses, and alcohol and tobacco products.

Food Inflation Accelerates

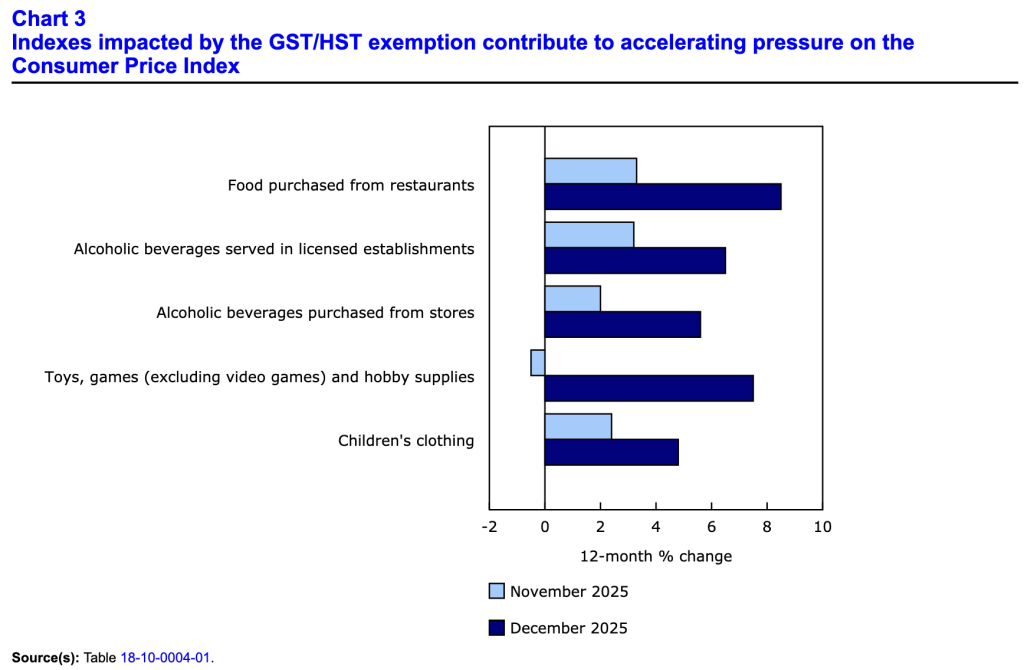

Food inflation rose by 6.2% Y-o-Y in December, as “higher restaurant prices were the largest contributor to faster growth in the all-items CPI. Prices for food purchased from restaurants rose 8.5% in December, compared with a 3.3% increase in November.”

On top of that, “Prices for alcoholic beverages served in licensed establishments (+6.5%) and alcoholic beverages purchased from stores (+5.6%) also grew at a faster pace in December.”

Consequently, base effects played a significant role this month, and the BoC expects that to continue over the near term.

Watching and Waiting

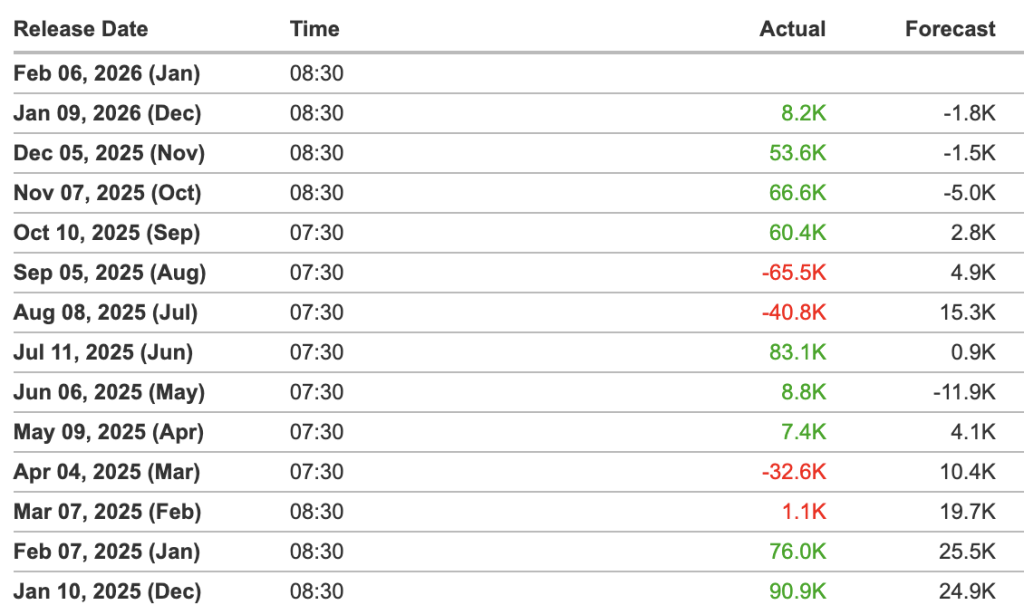

While the Boc highlighted the employment strength in November, the latest Labour Force Survey released on Jan. 9 didn’t upend that narrative.

For example, while the unemployment rate rose by 0.3% “as more people searched for work,” the Canadian economy added 8,200 net new jobs, the fourth straight month of positive data. Moreover, the table below from Investing.com shows how the labour market has stabilized after looking recessionary in August and September 2025 (the negative red figures). Thus, a continuation of the trend should allow the BoC to proceed patiently with future rate cuts.

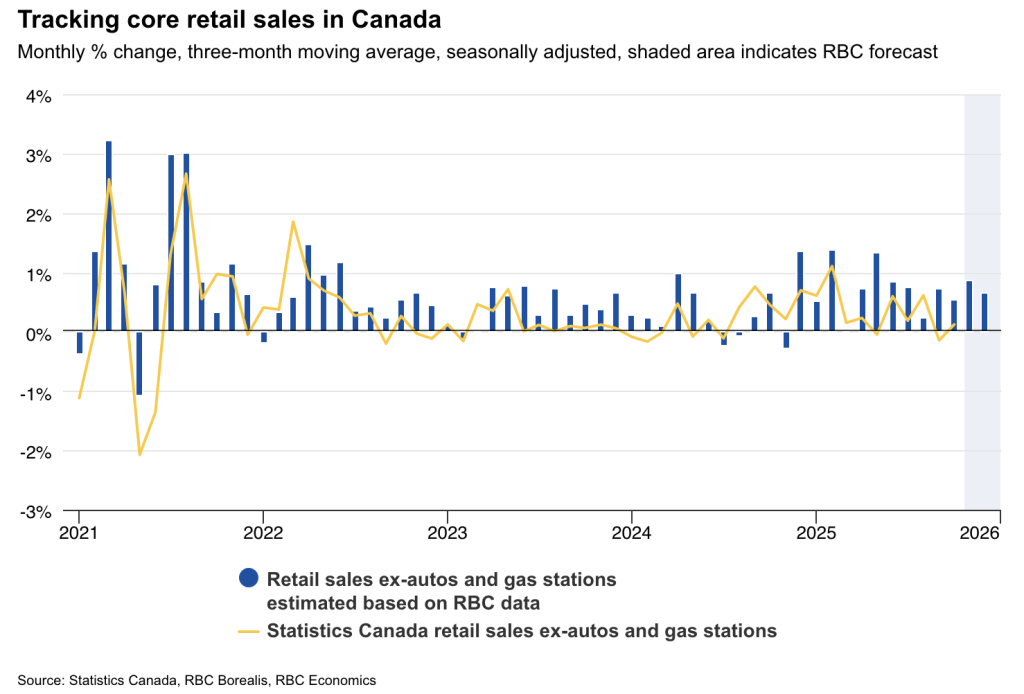

To that point, while Statistics Canada’s retail sales data has been mixed in recent months, RBC’s Consumer Spending Tracker has held firm. The latest release from Jan. 14 stated:

“Canadian cardholder spending remained resilient with RBC’s core retail sales rising 0.7% on a three-month average—down slightly from November—but still marking the 13th consecutive period of growth.

Spending over this critical holiday shopping period for retailers was driven by purchases of discretionary goods.”

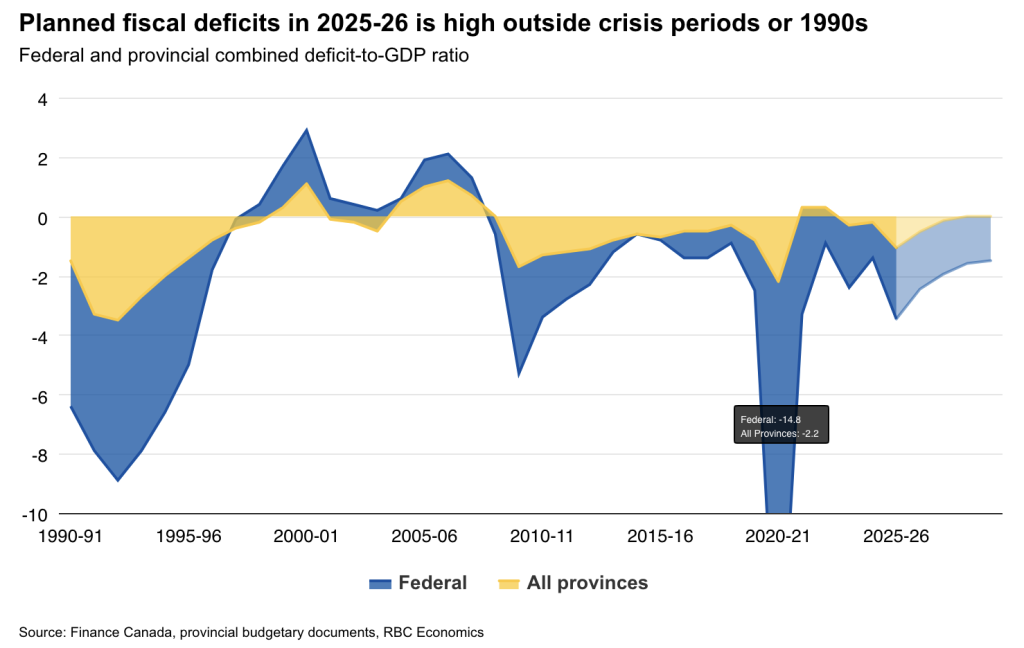

Likewise, RBC noted on Jan. 6 that deficit spending should help support economic growth and consumption over the next few years. An excerpt read:

“Federal and provincial fiscal impulse could be very high the next couple years, propelled by the recent federal budget. A high share of new funding is slated for defence and infrastructure, which typically produce more material impact on spending and growth within the three-year period. And, there’s still plenty of excess capacity in the economy in the near term to absorb fiscal stimulus. Our forecast adds 0.4 percentage points to GDP growth in 2025 and 2026. That’s decent stabilization coming from this type of policy.”

As such, RBC expects the federal government to stimulate the economy over the next several months, which may reduce the need for further BoC rate cuts.

On top of that, with deficit spending expected to rise south of the border in 2026 as well, gold should remain in fashion as fiat currencies underperform the yellow metal. Citigroup strategists led by Kenny Hu said on Jan. 13 that gold and silver should rise above $5,000 and $100, respectively, by the end of Q1 2026.

The team highlighted “heightened geopolitical risks, ongoing physical market shortages, and renewed uncertainty on Fed independence” as the primary drivers, while noting that these concerns could ease after Q1 and set up gold and silver for corrections.

Dedicating a small portion of one’s TFSA or RRSP portfolio to precious metals may help mitigate some of the geopolitical risks and negative effects of inflation. If you want to get started with investing in metals such as gold and silver, read our free guide to gold buying in Canada in 2025 today.

In addition, if financial obligations have become too stressful to manage on your own, Consolidated Credit Canada, the country’s largest non-profit, can negotiate with lenders on your behalf and educate you about the pros and cons of bankruptcy and consumer proposals. Plus, the initial consultation is free of charge, and the firm is accredited by the Canadian Association of Credit Counselling Services and has an A+ rating with the Better Business Bureau.

For business financing, capital resources are also available. Merchant Growth is great for companies that have been operational for 6+ months, have $10,000/month in sales, and a credit score of 550 or higher. Similarly, Journey Capital can help you obtain $5,000 to $500,000 if you have a credit score of 600 or higher.

For additional resources, please consult our list of reliable lenders to see the best products and services available in your area.