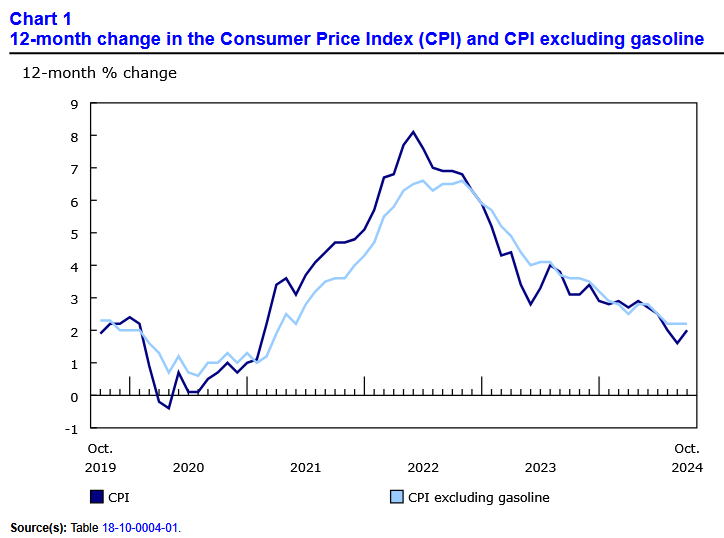

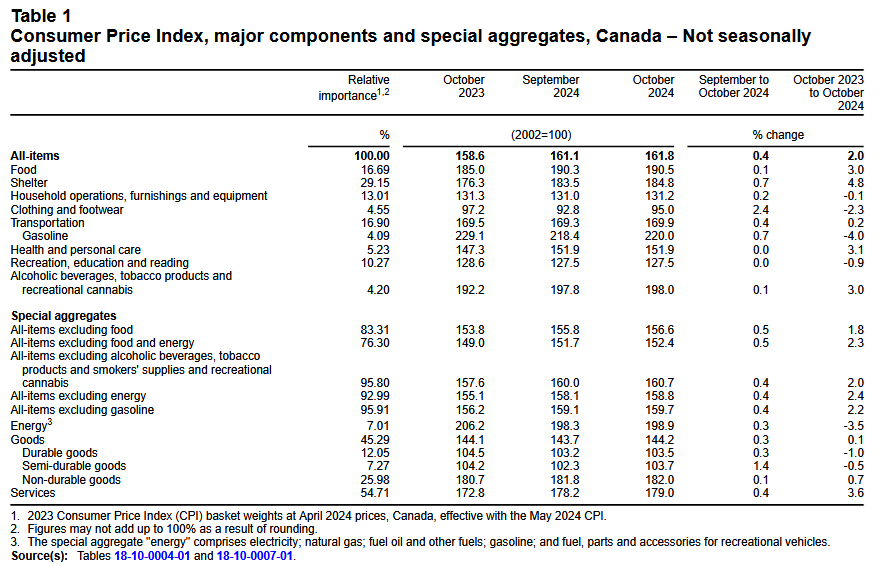

Canada’s consumer price index (CPI) rose by 2.0% year over year (Y-o-Y) in October, up from 1.6% Y-o-Y in September. Statistics Canada (StatsCan) published the data at 8:30 a.m. ET on November 19, 2024, via The Daily report. On a monthly basis, the CPI rose by 0.4% in October, a noticeable jump from the 0.4% decline in September. StatsCan noted how “gasoline prices fell to a lesser extent in October (-4.0%) compared with September (-10.7%).” As a result, the energy complex was less forgiving this month.

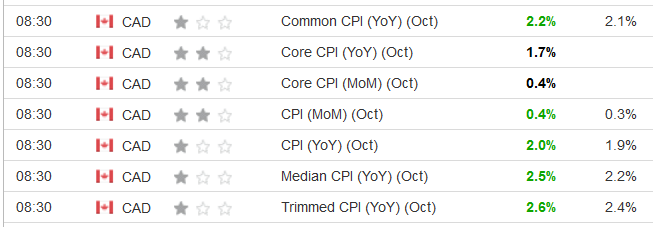

The CPI data outperformed across the board, with most metrics surpassing economists’ consensus estimates. The table below is courtesy of Investing.com. The left column represents October’s figures, while the right column represents forecasters’ expectations. As you can see, the sea of green highlights the ebbs and flows the Bank of Canada (BoC) may have to deal with in the months ahead.

To that point, while the BoC cut interest rates by 50 basis points on Oct. 23, Governor Tiff Macklem said, “Going forward, we can expect to continue to see some monthly fluctuations in inflation. But overall, inflation is expected to remain close to target over the projection horizon as upward pressure from shelter and other services gradually diminishes and excess supply in the economy is absorbed.”

Consequently, while the data came in hot, it remains well within the BoC’s acceptable range.

In October 2024, good prices rose by 0.1% Y-o-Y, while services slipped to 3.6%, the smallest increase since January 2022. As a reminder, prices for goods and services are up by 10.2% and 14.2%, respectively, over the last three years.

Core CPI Jumps in October 2024

Core measures of the CPI increased in October 2024, with the CPI-common index rising to +2.2% (from + 2.1%), the CPI-median to +2.5% (from +2.3%), and the CPI-trim to +2.6% (from +2.4%). These measures exclude the impacts of food and energy, and the BoC places heavy emphasis on core measures because they provide a smoothed distribution of overall inflation.

Please note that food and energy prices are highly volatile and price spikes can occur for reasons outside of the BoC’s control. In contrast, core inflation is largely driven by consumer demand and gives the BoC a better sense of how the Canadian economy is functioning.

Mixed Sector Performances

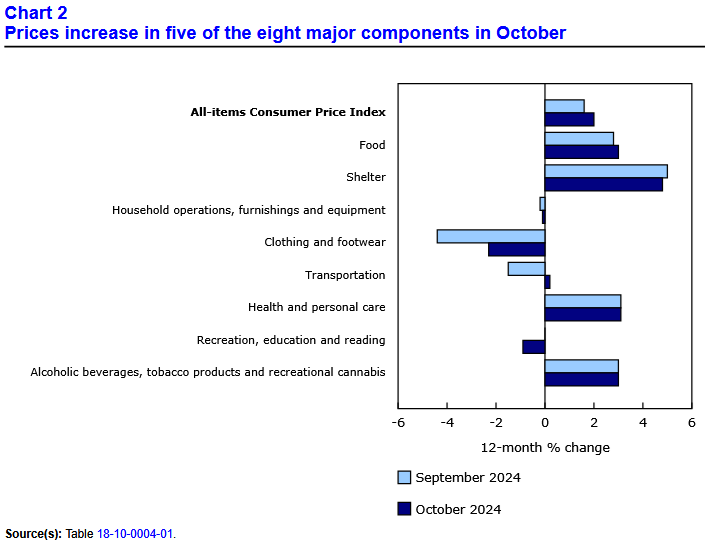

Food bounced, shelter slowed, clothing and household items realized less deflation, and transportation prices flipped from deflation to inflation. Add it all up, and five of the eight major sectors recorded October increases.

For context, the eight sectors include food, shelter, household operations, furnishings and equipment, clothing and footwear, transportation, health and personal care items, recreation and education expenses, and alcohol and tobacco products.

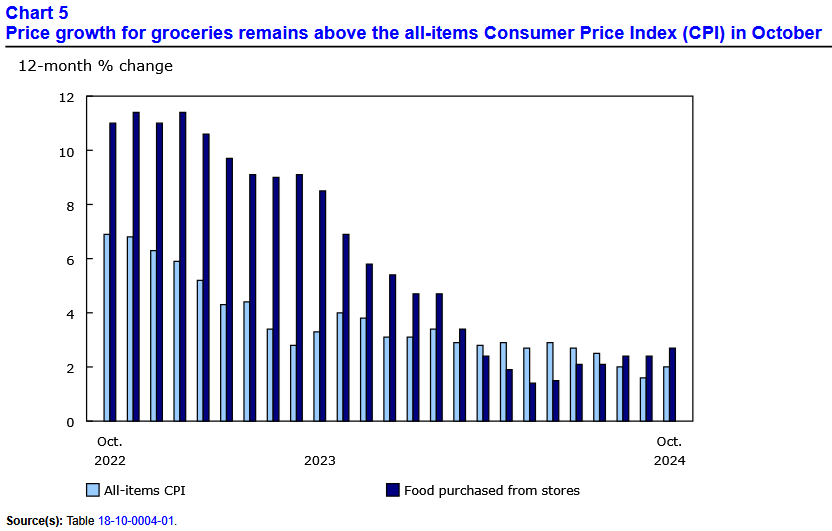

Grocery Inflation Surpasses September

Food inflation rose by 2.7% Y-o-Y in October, up from 2.4% in September. Fresh vegetables (+7.3%) and preserved fruit and fruit preparations (+7.6%) led the way, while a 7.0% rise in frozen beef (vs. +9.2% in September) helped mitigate the outperformance.

Path Unchanged?

While October’s inflation surprise has hawkish implications, the BoC will likely continue down its rate-cut path. Macklem has noted that monthly fits and starts should be expected, so he’s unlikely to overreact to one month’s data, regardless of the result.

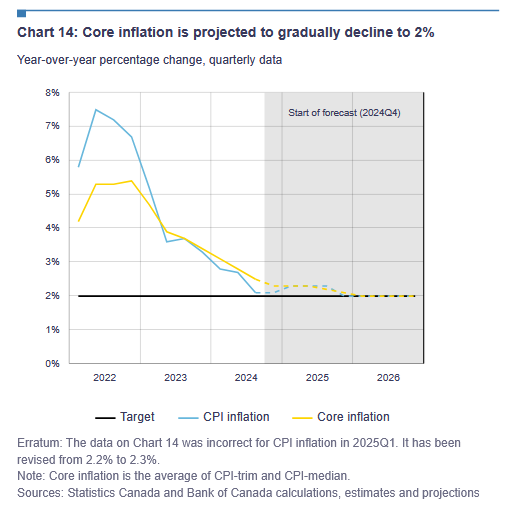

As evidence, the BoC’s latest Monetary Policy Report (released on Oct. 23), stated that “Inflation is now around 2% and is expected to remain near the middle of the Bank of Canada’s control range of 1% to 3% over the projection.”

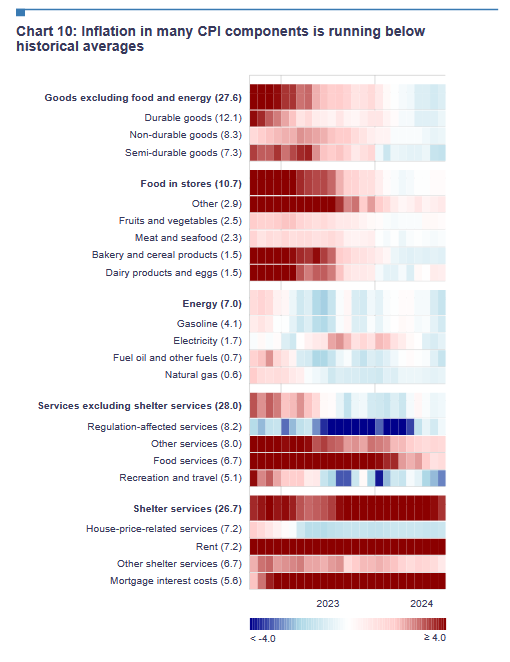

Moreover, while services remain problematic, “Inflation in many components of the CPI, particularly those for goods, is below historical averages.” The heat map below quantifies the data, and has become a source of optimism for the BoC.

Likewise, the BoC included the following shelter forecasts in its core CPI projection: “Inflation in shelter prices is expected to moderate gradually from elevated levels.

- Inflation in mortgage interest costs will ease from a high level, aided by the decline in interest rates.

- CPI rent inflation is projected to decrease slowly, reflecting a gradual adjustment to past increases in new rents.

- In contrast, CPI components related to house prices are projected to rise.”

The end result? According to the BoC, stable core inflation through 2026.

Overall, October’s CPI results likely did little to derail lower interest rates in the months ahead. And with looser monetary policy bullish for gold and silver, precious metals should benefit as geopolitical tailwinds also support their long-term outlooks.

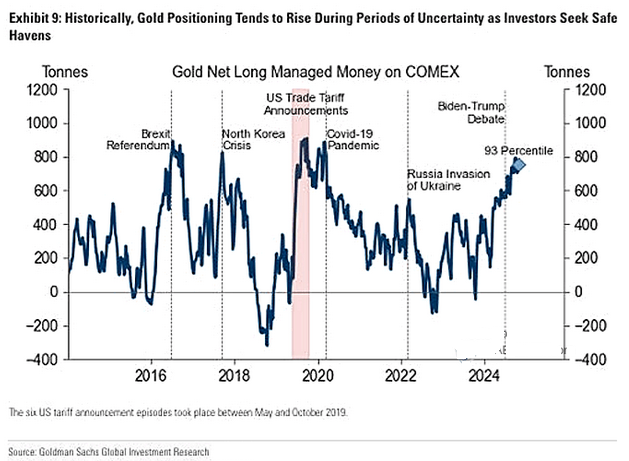

The chart below highlights how professional futures traders continue to buy gold and how the current backdrop aligns with similar periods of global conflict. As such, the PMs should remain attractive assets in 2025.

Furthermore, precious metals assets such as gold and silver have typically held their value more reliably than stocks during periods of high inflation and global uncertainty. In today’s polarised environment, physical assets and commodities such as real estate and precious metals may provide a strategic hedge.

Dedicating a small portion of one’s TFSA or RRSP portfolio to precious metals may help mitigate some of the negative effects of inflation. If you want to get started with investing in metals such as gold and silver, read our free guide to gold buying in Canada in 2024 today.