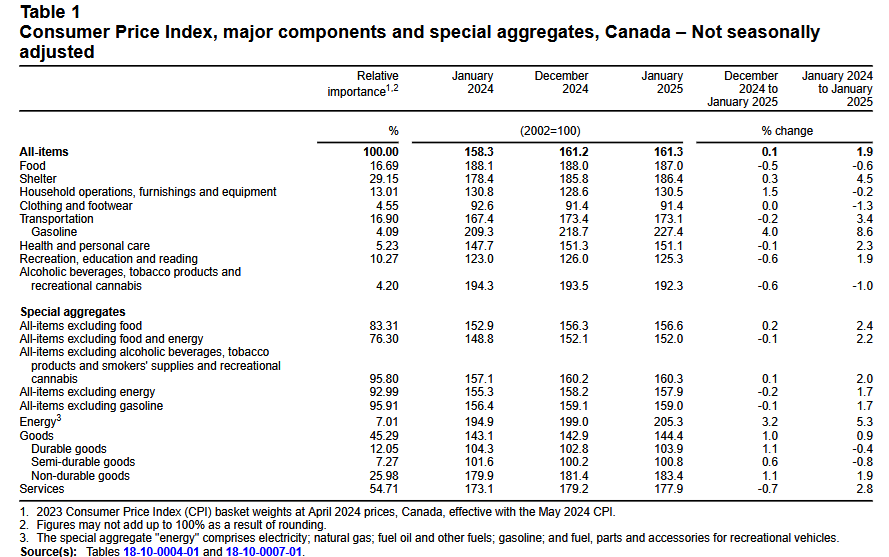

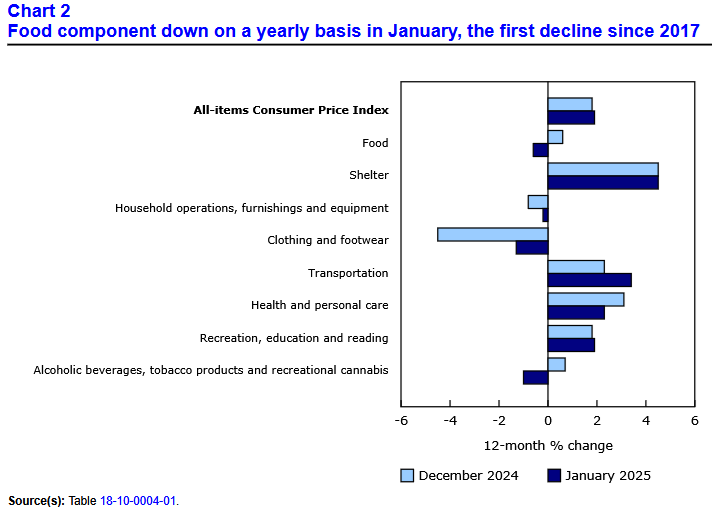

Canada’s consumer price index (CPI) increased by 1.9% year over year (Y-o-Y) in January, up from 1.8% Y-o-Y in December. Statistics Canada (StatsCan) published the data at 8:30 a.m. ET on February 18, 2025, via The Daily report. On a monthly basis, the CPI rose by 0.1%, moving back into positive territory after a negative December.

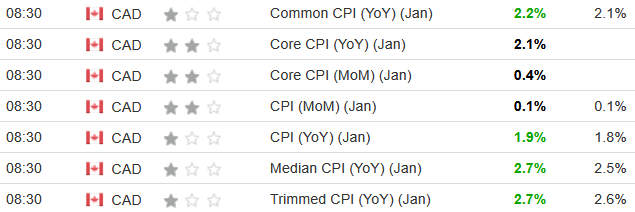

The core results were much hotter than the headline number, as the metrics surpassed economists’ consensus estimates by a decent margin. The table below is courtesy of Investing.com. The left column represents January’s figures, while the right column represents forecasters’ expectations. As you can see, there was plenty of green.

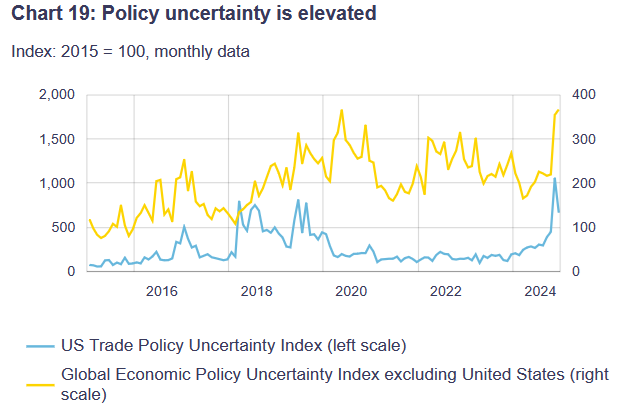

However, with the threat of U.S. tariffs still on the table, Bank of Canada (BoC) Governor Tiff Macklem said on Jan. 29:

“U.S. trade policy is a major source of uncertainty. There are many possible scenarios. We don’t know what new tariffs will be imposed, when or how long they will last. We don’t know the scope of retaliatory measures or what fiscal supports will be provided. And even when we know more about what is going to happen, it will still be difficult to be precise about the economic impacts because we have little experience with tariffs of the magnitude being proposed.”

In other words, while the hot inflation data would typically elicit a hawkish response, the BoC will likely remain accommodative until the tariff drama concludes.

In January 2025, the CPI acceleration was primarily driven by higher gasoline and natural gas prices, while household items and passenger vehicles also showcased strength.

Core CPI Rises in Janaury 2025

Core measures of the CPI jumped in January 2025, with the CPI-common index increasing to +2.2% (from + 2.0%), the CPI-median to +2.7% (from +2.6%), and the CPI-trim to +2.7% (from +2.5%). These measures exclude the impacts of food and energy, and the BoC places heavy emphasis on core measures because they provide a smoothed distribution of overall inflation.

Please note that food and energy prices are highly volatile and price spikes can occur for reasons outside of the BoC’s control. In contrast, core inflation is largely driven by consumer demand and gives the BoC a better sense of how the Canadian economy is functioning.

Sector Slowdown Continues

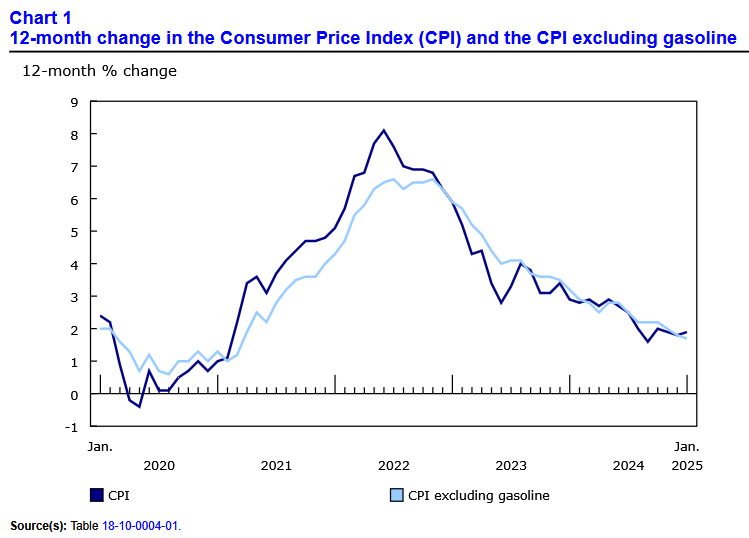

Most of the major sectors recorded Y-o-Y price decreases in January, led by alcohol, clothing, and food.

For context, the eight sectors include food, shelter, household operations, furnishings and equipment, clothing and footwear, transportation, health and personal care items, recreation and education expenses, and alcohol and tobacco products.

Grocery Deflation Arrives

Food inflation declined by 0.5% in January and recorded its first Y-o-Y drop since May 2017. The GST/HST holiday also helped usher in a record decline in restaurant inflation (-5.1%), which was more than triple the previous record of a 1.6% fall in December 2024.

The Waiting Is the Hardest Part

As the BoC attempts to balance a strengthening Canadian economy with the potential for more tariff uncertainty in March, there is likely little the Committee can do until policy clarity arrives.

Macklem noted these realities on Jan. 29:

“Unfortunately, tariffs mean economies simply work less efficiently,” he said. “Monetary policy cannot offset this. What we can do is help the economy adjust. With inflation back around the 2% target, we are better positioned to be a source of economic stability. However, with a single instrument — our policy interest rate — we can’t lean against weaker output and higher inflation at the same time.

“As we consider our monetary policy response, we will need to carefully assess the downward pressure on inflation from weakness in the economy, and weigh that against the upward pressure on inflation from higher input prices and supply chain disruptions.”

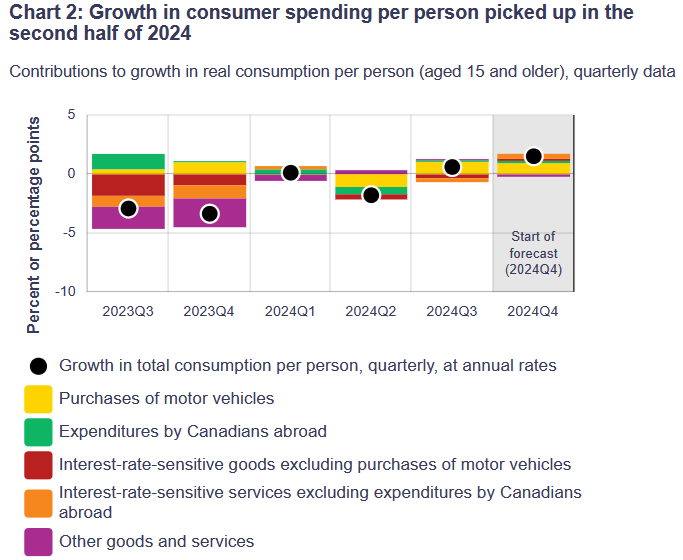

To that point, the BoC’s January 2025 Monetary Policy Report highlighted how “Growth in consumption per person turned positive in the third quarter of 2024, and it is estimated to have increased further to about 1.6% in the fourth quarter. This rise is supported by cuts made to the policy interest rate in 2024 and robust growth in disposable income per person.”

Conversely, “The threat of tariffs is creating uncertainty, which is already having a negative impact on the Canadian economy…. The longer this uncertainty persists, the more it would negatively impact investment. Businesses could also cut back on hiring, which would weigh on labour income and consumer confidence. Consequently, domestic demand would slow, exerting downward pressure on inflation.”

Add it all up, and the BoC should be in ‘wait-and-see mode’ over the next few months.

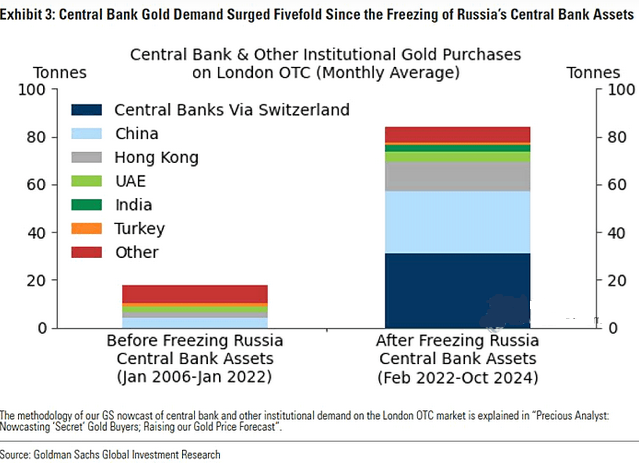

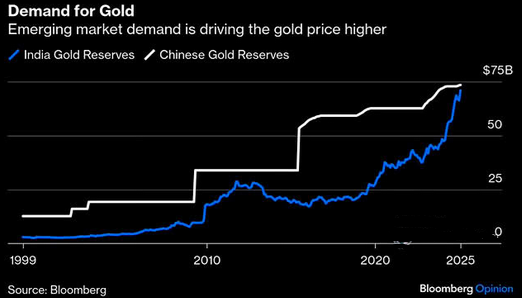

As for risk assets, with trade wars, geopolitical conflict, and accelerating inflation bullish for gold and silver, their outlooks continue to brighten. Citigroup and Goldman Sachs have increased their price targets, and global central banks continue to hoard the yellow metal.

The chart above highlights how global central banks have significantly increased their gold reserves in recent years, and a buying spree from the world’s largest customers could support higher prices in the months ahead.

Likewise, China and India have led the way and are showing no signs of slowing down.

On top of that, precious metals assets such as gold and silver have typically held their value more reliably than stocks during periods of high inflation and global uncertainty. In today’s polarised environment, physical assets and commodities such as real estate and precious metals may provide a strategic hedge.

Dedicating a small portion of one’s TFSA or RRSP portfolio to precious metals may help mitigate some of the negative effects of inflation. If you want to get started with investing in metals such as gold and silver, read our free guide to gold buying in Canada in 2025 today.