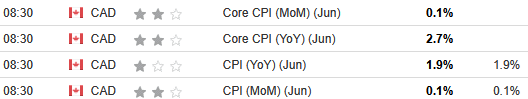

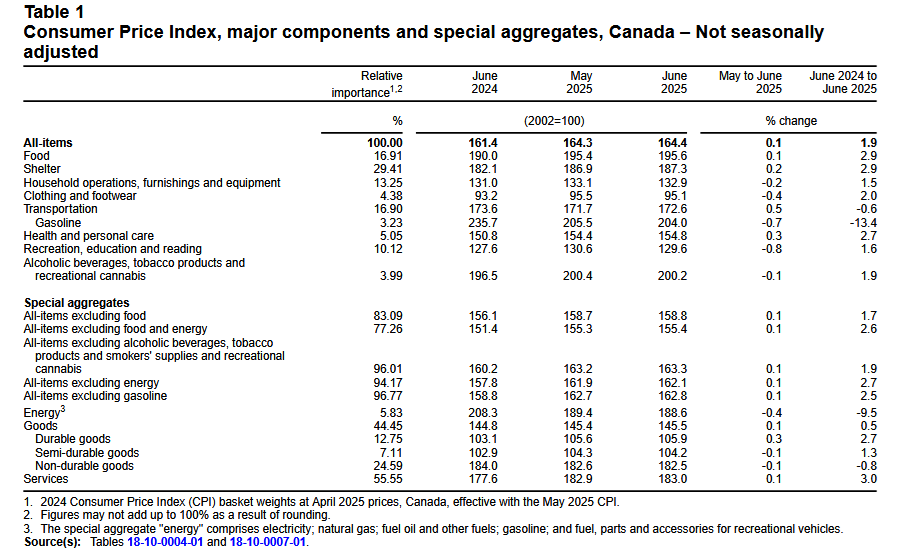

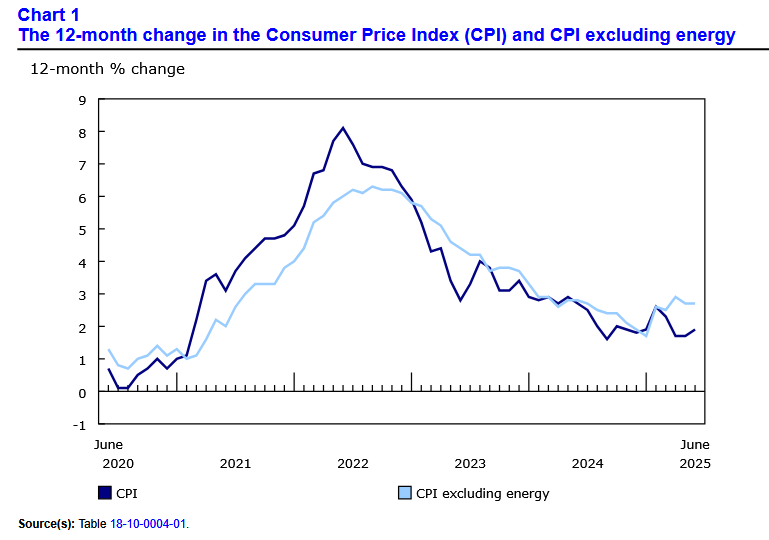

Canada’s consumer price index (CPI) increased by 1.9% year over year (Y-o-Y) in June, up from 1.7% Y-o-Y in May and April. Statistics Canada (StatsCan) published the data at 8:30 a.m. ET on July 15, 2025, via The Daily report. On a monthly basis, the CPI rose by 0.1%, and the data aligned with economists’ consensus estimates.

The table below is courtesy of Investing.com. The left column represents June’s figures, while the right column represents forecasters’ expectations. As you can see, June’s headline and core CPI’s were relatively calm.

Overall, the Bank of Canada (BoC) should be pleased with the results. Annual inflation metrics remain anchored near its 2% long-term target, and given the labour market challenges, the Canadian economy faces plenty of uncertainty. Governor Tiff Macklem said recently that “My colleagues on Governing Council and I agreed there could be a need for a further reduction in the policy interest rate if the effects of U.S. tariffs and uncertainty continued to spread through the economy and cost pressures on inflation were contained.”

Thus, while the realised data continues to cooperate, the BoC may need more time to be certain inflation is not re-accelerating.

Mixed Core CPI

Core measures of the CPI were well behaved again in June, with the CPI-common index holding at +2.6% (from +2.6%), while the CPI-median rose to +3.1% (from +3.0%), and the CPI-trim held at +3.0% (from +3.0%). These measures exclude the impacts of food and energy, and the BoC places heavy emphasis on core measures because they provide a smoothed distribution of overall inflation.

Please note that food and energy prices are highly volatile and price spikes can occur for reasons outside of the BoC’s control. In contrast, core inflation is mainly driven by consumer demand and gives the BoC a better sense of how the Canadian economy is functioning.

Sector Results

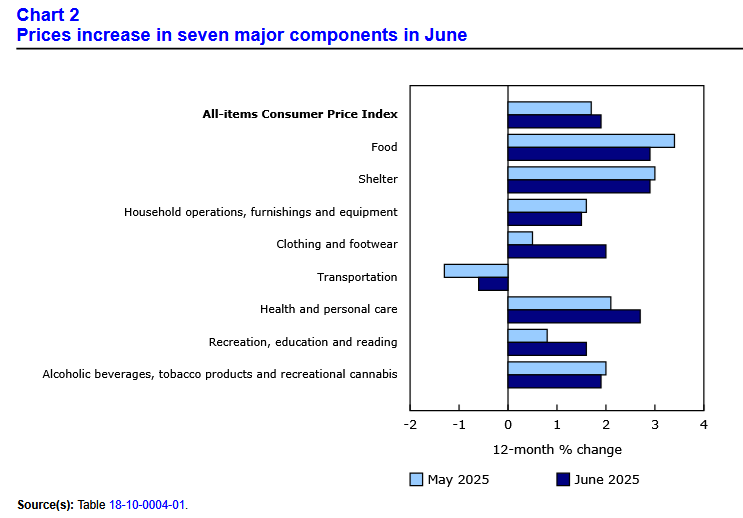

Seven major sectors recorded Y-o-Y increases in June, as clothing and footwear accelerated by 2.0%, and durable goods jumped by 2.7%. However, shelter slowed to 2.9%.

For context, the eight sectors include food, shelter, household operations, furnishings and equipment, clothing and footwear, transportation, health and personal care items, recreation and education expenses, and alcohol and tobacco products.

Grocery Inflation Slows

Grocery inflation pulled back in June, rising by 2.8% Y-o-Y following a 3.3% increase in May. The slowdown was largely driven by a 3.1% decline in vegetable prices, which fell for the first time since October 2021. Moreover, lower prices for onions (-10.3%) and cucumbers (-18.3%) had the largest impacts.

Back to Square One

With the Trump Administration unveiling a fresh set of tariffs last week, uncertainty around inflation and growth should continue to plague the BoC. While the new 35% levy excludes items already covered in the USMCA (the bulk of cross-border trade) and doesn’t come into effect until Aug. 1, the threat could complicate the BoC’s interest rate outlook.

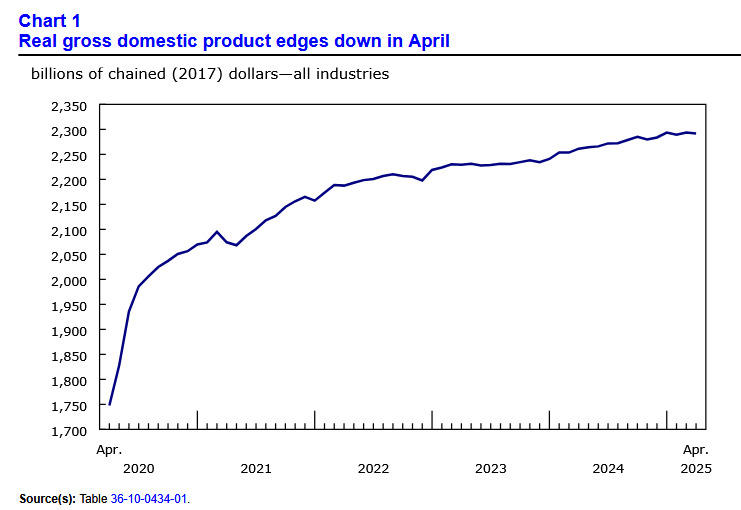

For one, real GDP growth has largely stagnated in recent months, as output hit $2.94 trillion in January 2025 and fell to $2.92 trillion in April 2025. And with a quarter of basically zero inflation-adjusted growth, the Canadian economy was treading water before the recent tariff escalation. The Jun. 27 release stated:

“The manufacturing sector was down 1.9% in April, the largest drop since April 2021, reflecting broad-based declines across both durable and non-durable goods manufacturing aggregates.

“In April, durable goods manufacturing (-2.2%) was down for the first time in four months as 8 of 10 subsectors contracted. The transportation equipment manufacturing subsector (-3.7%) was the largest contributor to the decline, registering its largest monthly contraction since September 2021 when prolonged global supply chain disruptions and semiconductor shortages hit motor vehicle manufacturing.”

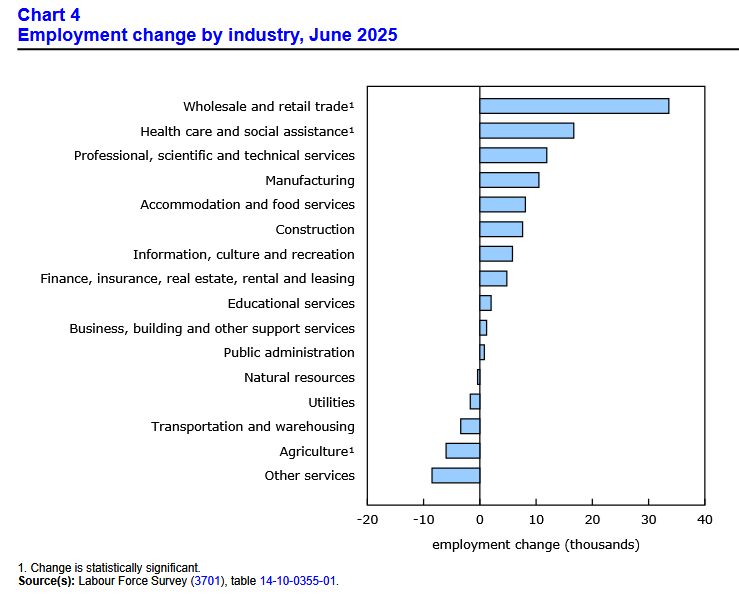

Conversely, the latest Labour Force Survey showed the Canadian economy added 83,000 jobs in June and the unemployment rate fell to 6.9%. However, part-time employees accounted for 70,000 of the 83,000 total, and seasonal hires are typical during the summer months, especially in retail trade, which accounted for the bulk of the additions. Consequently, the BoC will have to parse the data to determine whether a potential inflation surge could unfold alongside new tariffs, or whether slowing growth is the greater medium-term concern.

All in all, a summer lull seems likely in the months ahead. Since the economic data doesn’t scream recession, the BoC will likely continue its patient approach. Moreover, with tariff uncertainty creating upside risks to inflation, doing nothing may be the best approach until more clarity emerges in the fall.

As for the financial markets, the TSX Composite has soared to new highs. And although many of the tariff threats that helped create the April crash remain, investors seem less worried about the potential fallout.

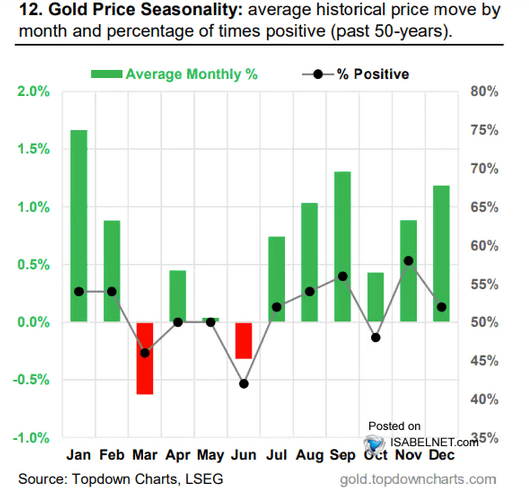

Yet, with gold often rallying during periods of uncertainty and prosperity, the yellow metal remains one of the best-performing assets in 2025, and seasonality favours higher prices in the months ahead.

To explain, the green and red bars above track gold’s average monthly performance over the last 50 years. If you analyse the September and August periods, you can see they foster the second and fourth-best average monthly gains after January (first) and December (third). Therefore, strong fundamentals and bullish seasonality should help gold continue its robust performance into year-end.

Dedicating a small portion of one’s TFSA or RRSP portfolio to precious metals may help mitigate some of the geopolitical risks and negative effects of inflation. If you want to get started with investing in metals such as gold and silver, read our free guide to gold buying in Canada in 2024 today.

Finally, if you’re drowning in debt and want to reduce the strain of higher interest rates, Consolidated Credit Canada helps create debt management plans and negotiates with creditors on your behalf. The group is recognized by organizations like the Canadian Association of Credit Counselling Services and has an A+ rating with the Better Business Bureau. Moreover, the team can also assist with budgeting, housing counseling, student loan advice, and financial education.

Similarly, Borowell is an excellent credit repair service that you can access for free. The company provides free weekly credit scores and report monitoring, and its education services include personalized tips, articles, and tools to become more credit savvy.

For more information, please consult our list of reputable lenders to see the best products and services available in your area.