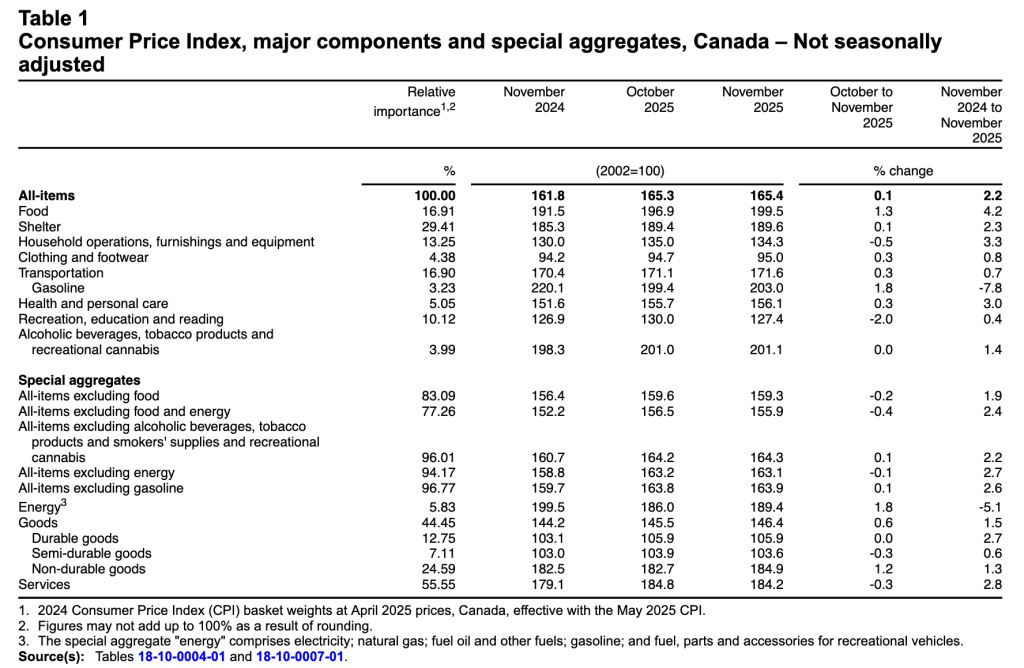

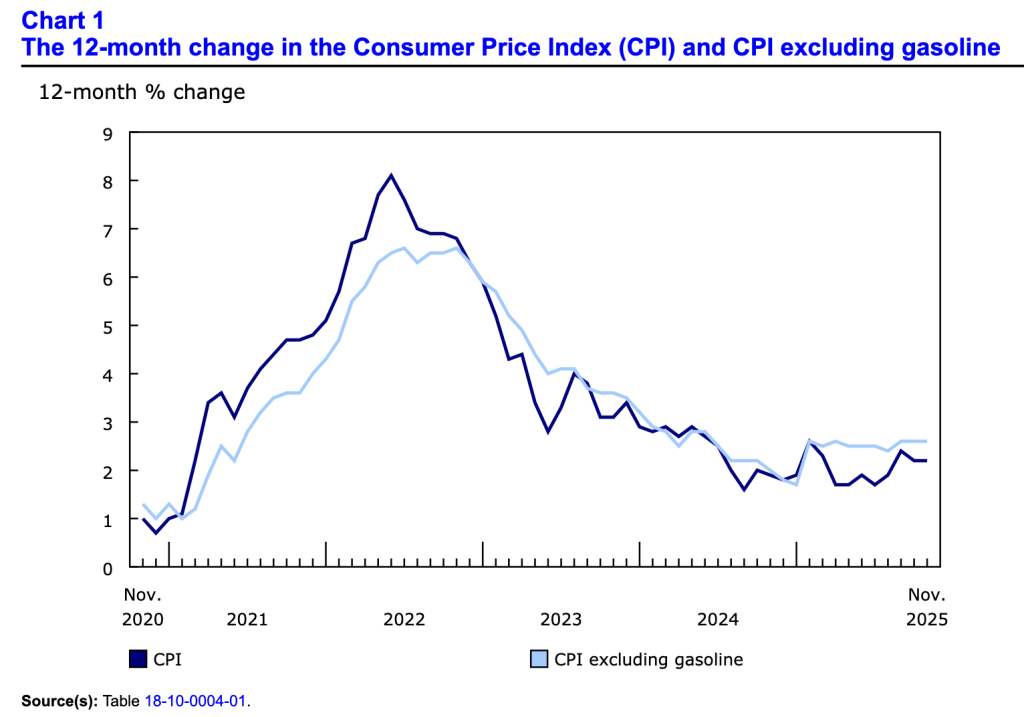

Canada’s consumer price index (CPI) increased by 2.2% year over year (Y-o-Y) in November, matching the 2.2% Y-o-Y rise in October. Statistics Canada (StatsCan) published the data at 8:30 a.m. ET on December 15, 2025, via The Daily report. On a monthly basis, the CPI rose by 0.1%, and the Bank of Canada (BoC) should be pleased that the pricing pressures remain until control.

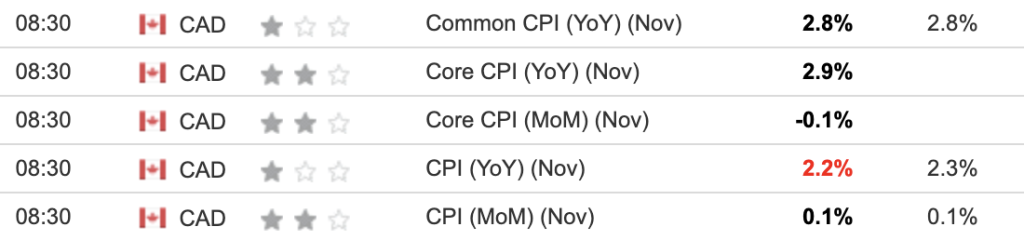

The table below is courtesy of Investing.com. The left column represents November’s figures, while the right column represents forecasters’ consensus estimates. As you can see, the data did little to reignite any inflation concerns.

Yet, with the BoC seeing interest rates in perfect balance with the overall economy, further easing isn’t necessary as long as the labour market stays in a healthy place. BoC Governor Tiff Macklem said at the latest Monetary Policy Meeting on Dec. 10:

The “Governing Council sees the current policy rate at about the right level to keep inflation close to 2% while helping the economy through this period of structural adjustment…. The labour market is showing some signs of improvement,” and “the recent federal budget includes increases in government spending, particularly in defence, and measures to increase public and private sector investment….

“If a new shock or an accumulation of evidence materially changes the outlook, we are prepared to respond.”

Thus, with no reason to waste rate cuts while the Canadian economy is in decent shape, a meeting-by-meeting approach is the most likely outcome in 2026.

Declining Core CPI

Core measures of the CPI mostly retreated in November, with the CPI-common index rising to +2.8% (from +2.7%), while the CPI-median fell to +2.8% (from +3.0%), and the CPI-trim fell to +2.8% (from +3.0%). These measures exclude the impacts of food and energy, and the BoC places heavy emphasis on core measures because they provide a smoothed distribution of overall inflation.

Please note that food and energy prices are highly volatile and price spikes can occur for reasons outside of the BoC’s control. In contrast, core inflation is mainly driven by consumer demand and gives the BoC a better sense of how the Canadian economy is functioning.

Sector Results

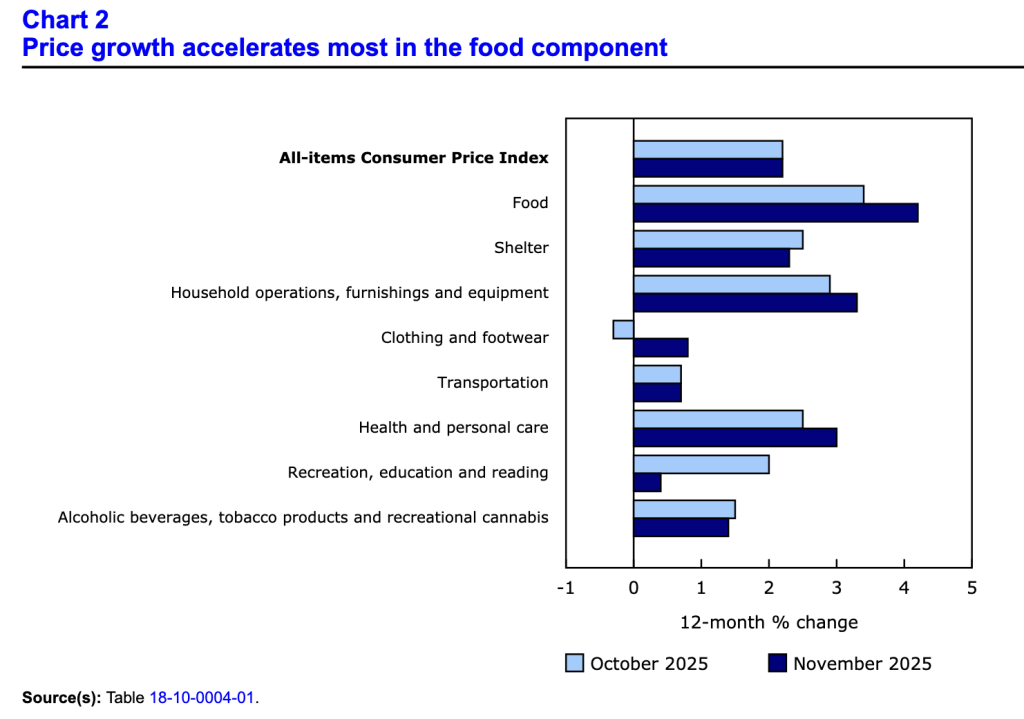

Sector performance was mixed in November, with food showcasing the highest Y-o-Y rate of change, while the shelter component moderated further.

For context, the eight sectors include food, shelter, household operations, furnishings and equipment, clothing and footwear, transportation, health and personal care items, recreation and education expenses, and alcohol and tobacco products.

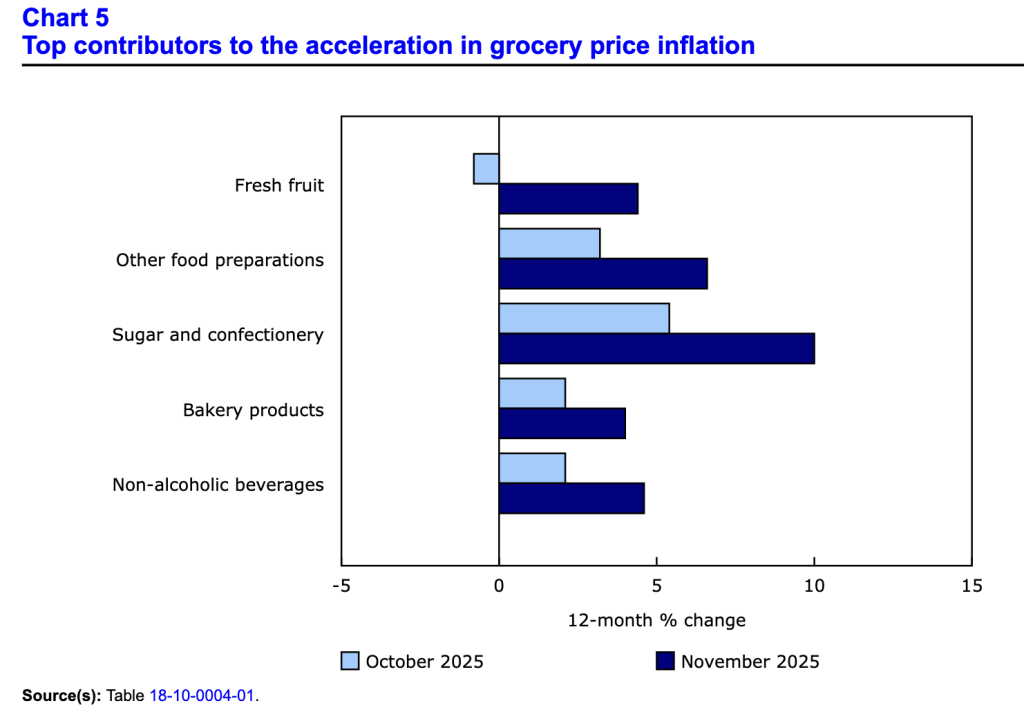

Food Inflation Accelerates

Food inflation rose by 4.7% Y-o-Y in November, a noticeable increase from the 3.4% jump in October. This month’s rise was the largest since December 2023, and the primary drivers were fresh fruit (+4.4%), led by higher prices for berries, and other food preparations (+6.6%).

In addition, fresh or frozen beef (+17.7%) and coffee (+27.8%) prices remained extremely elevated, as a North American cattle shortage continues to pressure meat prices.

The Recovery Gains Steam

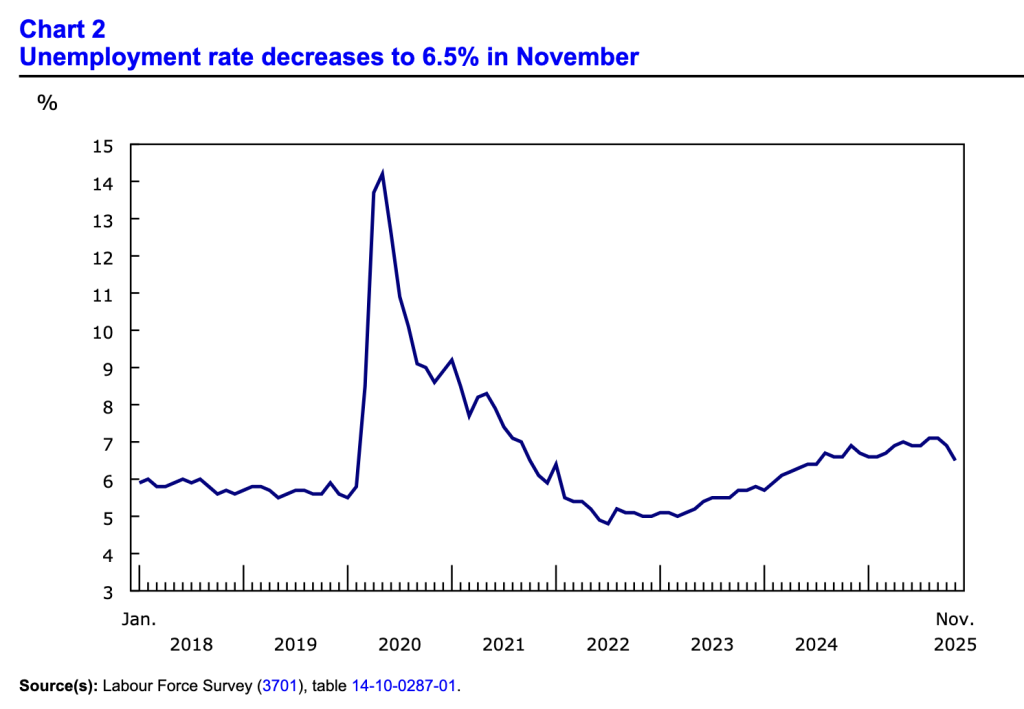

While leading economic data had been recovering for several weeks, the Labour Force Survey released on Dec. 5 highlighted the strength of the recent acceleration. The report stated:

“Employment rose by 54,000 (+0.3%) in November, the third consecutive monthly increase. Cumulative increases in September, October, and November (+181,000; +0.9%) followed a slow start to the year, with little net employment change from January to August.”

Likewise:

“The unemployment rate fell 0.4 percentage points to 6.5% in November, following a 0.2 percentage point decline in October. The unemployment rate had previously trended up through most of 2025, reaching 7.1% in September—the highest level since May 2016 (excluding 2020 and 2021 during the COVID-19 pandemic).”

It’s important to note that November’s job gains were driven by part-time employees, and full-time roles were negative for the month. So, while the material decrease in the unemployment rate is welcome news, it’s worth keeping an eye on in the months ahead.

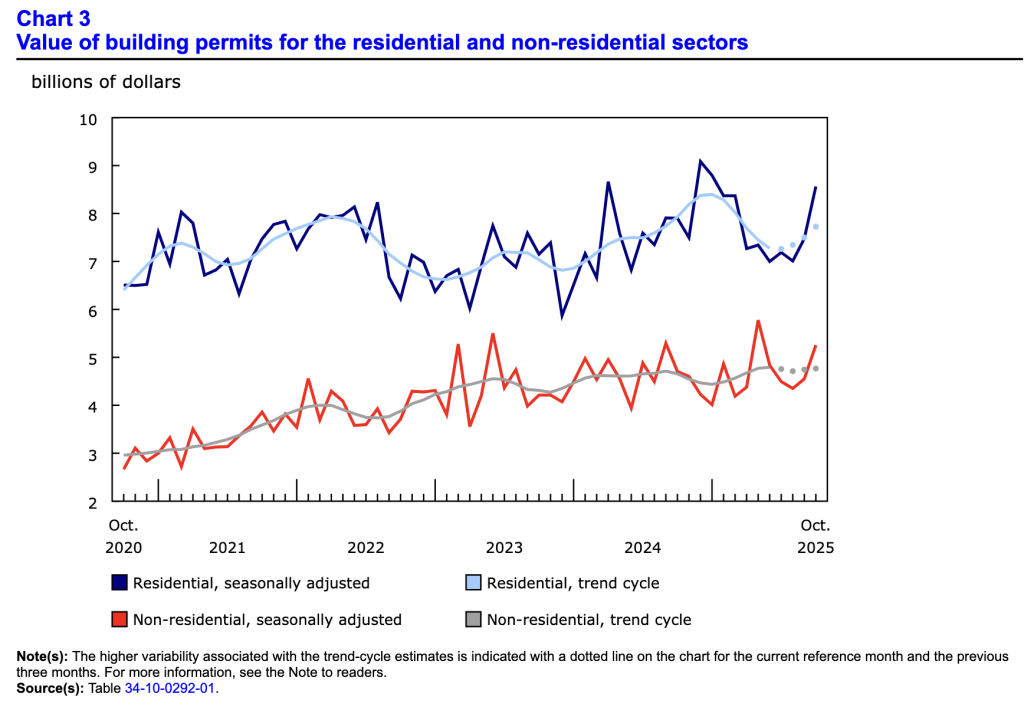

As another sign of optimism, housing market activity has accelerated recently, with building permits often a leading indicator for construction employment. Statistics Canada noted on Dec. 12:

“In October, the total value of building permits issued in Canada rose $1.8 billion (+14.9%) to $13.8 billion. The increase in construction intentions was led by the residential sector (+$1.1 billion). An increase was also observed in the non-residential sector (+$702.8 million)….

“Across Canada, a total of 24,300 multi-family dwellings and 4,100 single-family dwellings were authorized in October, marking a 13.6% increase from the previous month. Year-to-date, the average number of multi-family dwellings authorized is 21,500 per month, up from 19,100 during the same period in 2024.”

Consequently, with residential and non-residential developers planning to build more properties in 2026, the data highlights how investors remain bullish on the Canadian economy.

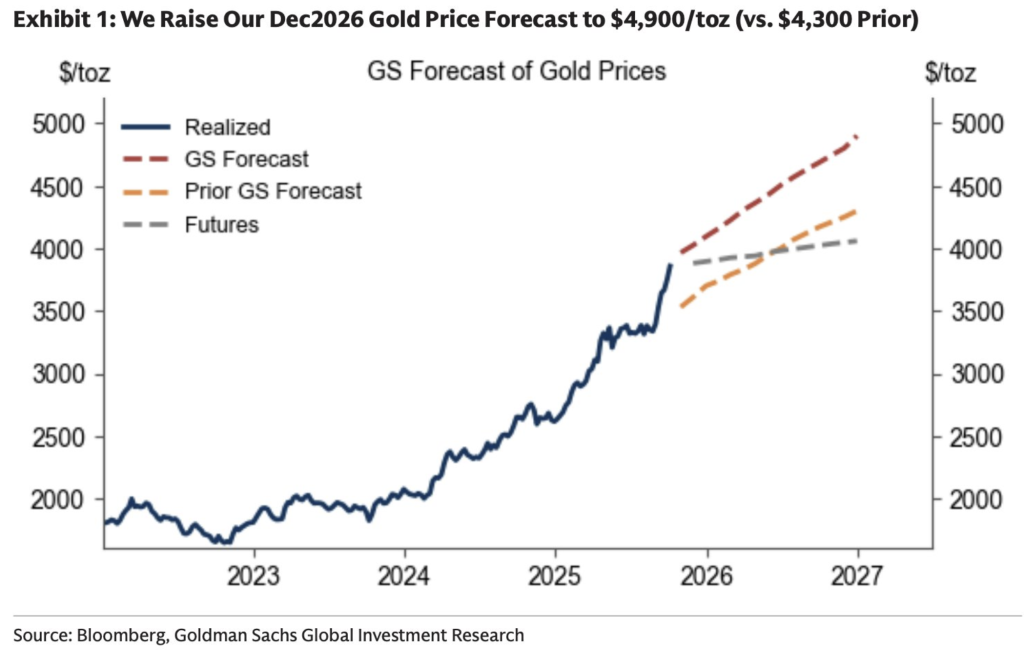

Speaking of bullish, Goldman Sachs told clients recently that gold should continue shining bright in 2026:

“We look for additional price upside by the end of 2026, with our forecast at $4,900 per troy ounce. Not as fast as this year – we were up almost 60% year-to-date – but the two drivers of the ‘25 rally, we think, will be repeated in ‘26…. We see our upgraded gold price forecast as still skewed to the upside on net, because private sector diversification into the relatively small gold market may boost ETF holdings above our rates-implied estimate.”

As such, the bullion bulls may have a lot more to celebrate about in the New Year.

Dedicating a small portion of one’s TFSA or RRSP portfolio to precious metals may help mitigate some of the geopolitical risks and negative effects of inflation. If you want to get started with investing in metals such as gold and silver, read our free guide to gold buying in Canada in 2025 today.

In addition, if a new car is in your plans for the New Year, there are several auto lenders offering affordable rates across the country. We compiled a list of the 10 best subprime lenders for bad or no credit, and Western Auto Group is an excellent dealership for drivers in Alberta. The company has a lot of positive reviews and options for buyers with no or poor credit. Similarly, Canada Drives is a CLA-certified lender that uses its vast partner network to help connect you with the right dealership and find the best loan terms. The online application is fast and easy, and most customers get pre-approval in minutes.

Furthermore, if your business needs capital for new products or to enter new markets, Merchant Growth is a solid resource for companies that have been operational for 6+ months, have $10,000/month in sales, and a credit score of 550 or higher. Also, Journey Capital can help you obtain $5,000 to $500,000 if you have a credit score of 600 or higher.

For additional resources, please consult our list of reputable lenders to see the best products and services available in your area.