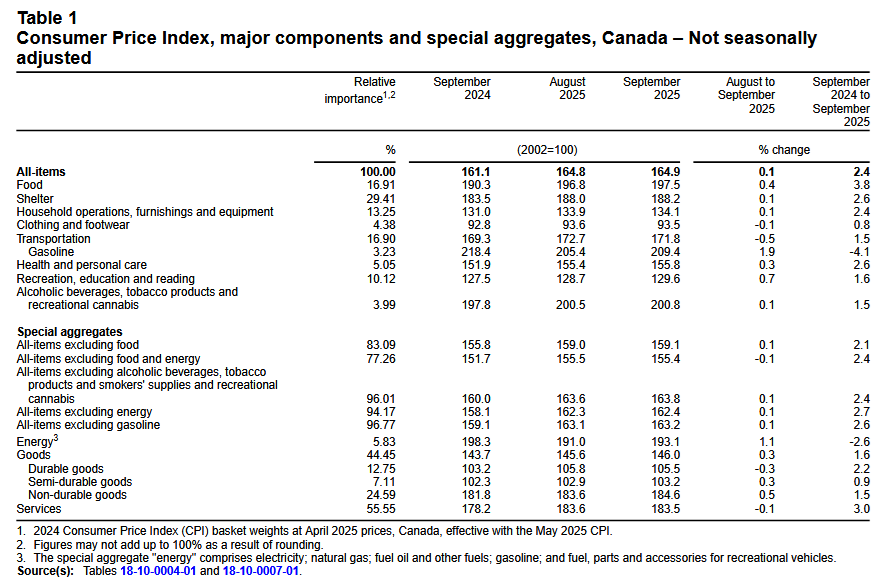

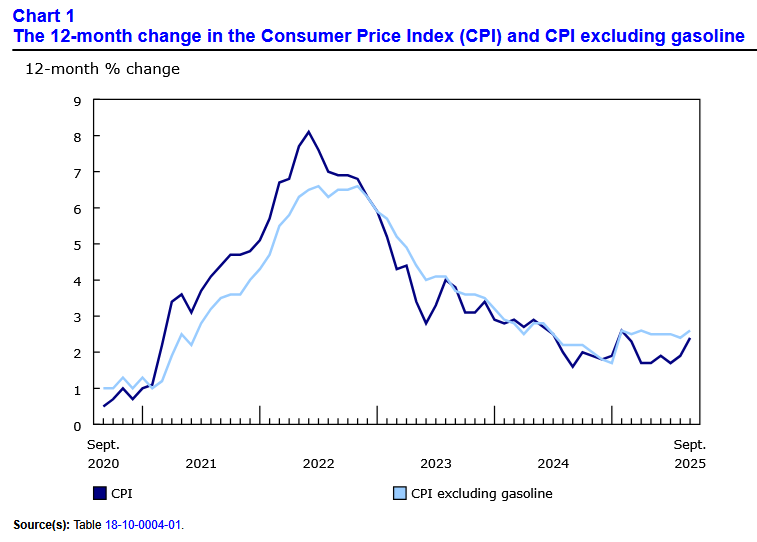

Canada’s consumer price index (CPI) increased by 2.4% year over year (Y-o-Y) in September, up from 1.9% Y-o-Y in August. Statistics Canada (StatsCan) published the data at 8:30 a.m. ET on October 21, 2025, via The Daily report. On a monthly basis, the CPI rose by 0.1%, and while the data was relatively tame, it still outperformed economists’ consensus estimates.

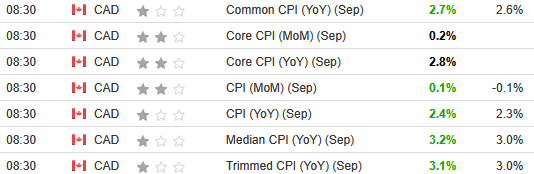

The table below is courtesy of Investing.com. The left column represents September’s figures, while the right column represents forecasters’ expectations. As you can see, the sea of green highlights how inflation was firmer than anticipated this month.

Yet, with ebbs and flows expected on the pathway to its long-term target, the Bank of Canada (BoC) will likely continue its rate-cut cycle over the next several months. BoC Governor Tiff Macklem said at the latest Monetary Policy Meeting on Sep. 17 that “there was clear consensus to lower our policy rate for the first time since March,” which may indicate an easing bias should inflation remain controlled into 2026.

Steady Core CPI

Core measures of the CPI remained stable in September, with the CPI-common index rising to +2.7% (from +2.5%), while the CPI-median held at +3.1% (from +3.1%), and the CPI-trim rose to +3.1% (from +3.0%). These measures exclude the impacts of food and energy, and the BoC places heavy emphasis on core measures because they provide a smoothed distribution of overall inflation.

Please note that food and energy prices are highly volatile and price spikes can occur for reasons outside of the BoC’s control. In contrast, core inflation is mainly driven by consumer demand and gives the BoC a better sense of how the Canadian economy is functioning.

Sector Results

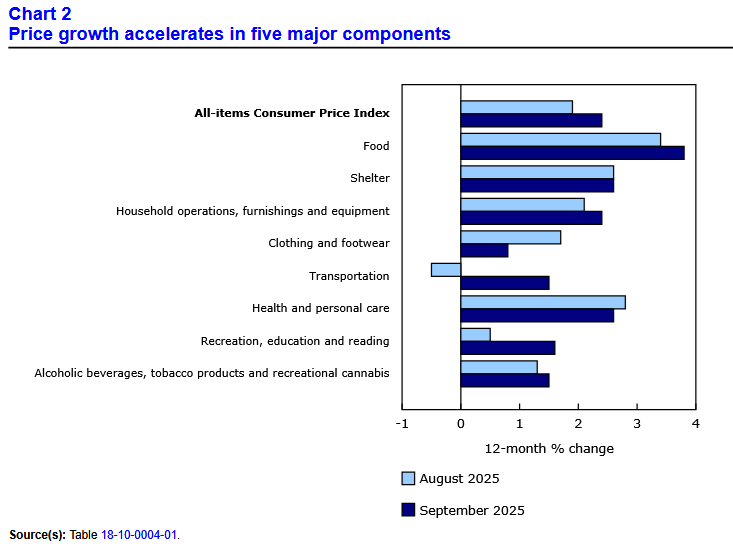

Five major sectors recorded Y-o-Y increases in September, with food rising considerably and transportation flipping from deflation to inflation.

For context, the eight sectors include food, shelter, household operations, furnishings and equipment, clothing and footwear, transportation, health and personal care items, recreation and education expenses, and alcohol and tobacco products.

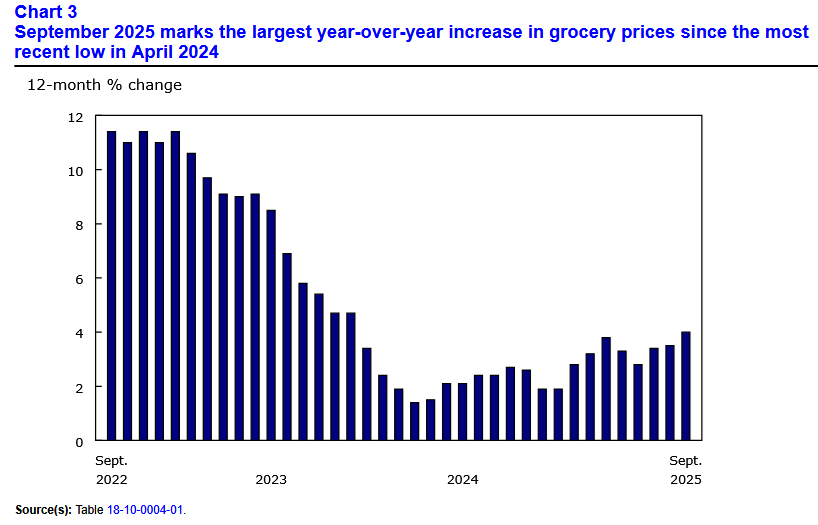

Grocery Inflation Accelerates

Grocery inflation jumped by 0.4% MoM in September and hit 3.8% Y-o-Y (not seasonally adjusted). Fresh vegetables (+1.9% in September vs. -2.0% in August) and sugar and confectionery (+9.2% in September vs. +5.8% in August) led the way, while frozen beef and coffee realized higher prices due to supply constraints.

Cuts to Continue?

After the BoC resumed its rate-cutting cycle on Sep. 17, the Governing Council highlighted “a weaker economy and less upside risk to inflation” as the primary drivers for easing monetary policy. And while the Canadian labour market has somewhat stabilized and GDP growth turned positive in July, businesses remain cautious on the medium-term outlook.

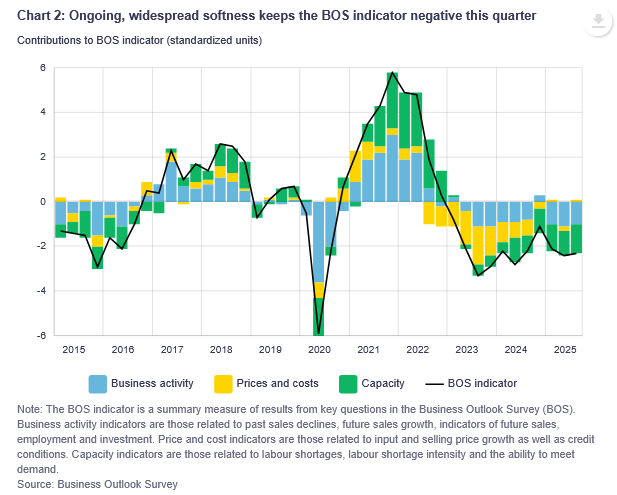

For example, the BoC released its latest Business Outlook Survey (BOS) on Oct. 20. The report noted how “expectations for growth in domestic and export sales remain soft due to concerns about the broad economic effects of trade tensions” and “most businesses do not expect to increase current staffing levels.”

Moreover, “the share of firms planning for a recession in Canada — for example, by tightening their budgets or pausing investments — has increased slightly, from 28% to 33%” and the BoC’s BOS Indicator remains stuck in negative territory.

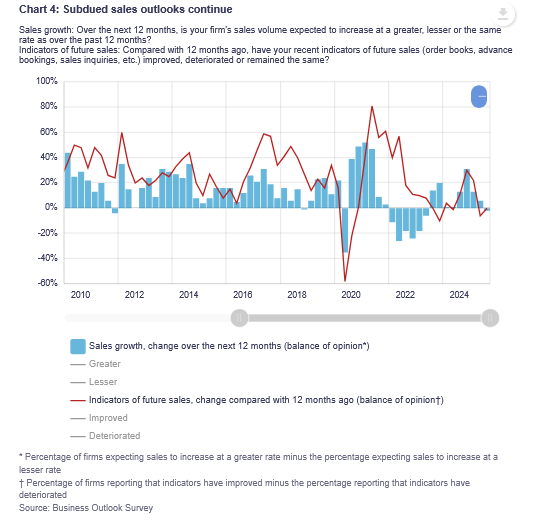

Likewise, while retail sales activity has improved marginally in recent weeks, “Businesses no longer expect sales growth to strengthen over the coming year as tariff-related impacts continue to hold back demand.” The pessimism was largely attributed to concerns over business and consumer spending, as well as uncertainty surrounding the housing market.

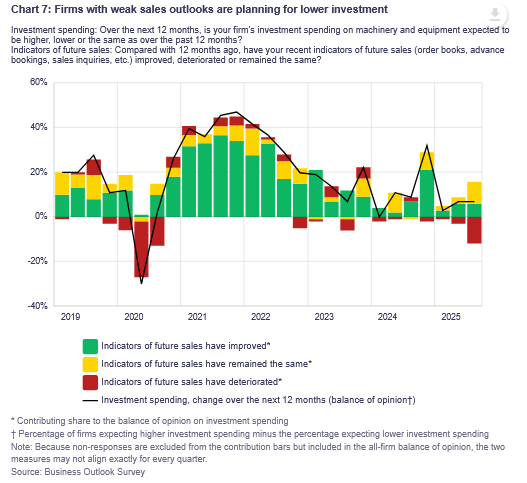

Finally, with more cons than pros confronting the Canadian economy, the report added that “Many businesses are scaling back their investment plans or putting new investments on hold because of soft demand and uncertainty related to trade tensions. More firms than usual continue to focus their investments on routine maintenance rather than expanding capacity.”

Thus, with capital expenditures and hiring intentions trending in the wrong direction, the BoC may need to ease policy further to help stimulate economic activity.

Yet, while inflation and recession uncertainty remain, the unsettling outlook has helped gold go parabolic. The yellow metal has soared in recent months, and JPMorgan CEO Jamie Dimon — who runs the largest bank in the U.S. — said on Oct. 15 that gold “could easily go to $5,000 or $10,000 in environments like this.”

And while he doesn’t own it himself, he added that “This is one of the few times in my life it’s semi-rational to have some in your portfolio.” As a result, the recent surge could have plenty of room to run.

Dedicating a small portion of one’s TFSA or RRSP portfolio to precious metals may help mitigate some of the geopolitical risks and negative effects of inflation. If you want to get started with investing in metals such as gold and silver, read our free guide to gold buying in Canada in 2024 today.

In addition, if financial concerns are keeping you up at night, Consolidated Credit Canada helps create debt management plans and negotiates with creditors on your behalf. The group is recognized by organizations like the Canadian Association of Credit Counselling Services and has an A+ rating with the Better Business Bureau. Moreover, the team can also assist with budgeting, housing counseling, student loan advice, and financial education.

Similarly, Fig Financial is an excellent resource for debt consolidation, as the firm provides unsecured personal loans from $2,000 to $35,000, terms from 24 to 84 months, and APRs from 8.99% to 29.49%.

Also noteworthy, KOHO has reduced the rates on its Credit Builder Plans, and they are excellent resources for Canadians looking to repair their credit scores before applying for a loan.

For DIY and large durable goods, LendCare is a trusted resource for financing auto, powersports, home improvement, healthcare (dental, vision, cosmetic), and general retail purchases. Loans commonly range from $500 to $15,000, and there are typically no prepayment penalties.

Finally, Merchant Growth is great for business owners looking to expand their operations or enter new markets. The company provides term loans, lines of credit, and merchant cash advances, and unsecured financing means you don’t have to post collateral and risk losing your asset. The only catch is that your company must be in business for at least six months with $10,000 per month or more in sales.

For additional resources, please consult our list of reputable lenders to see the best products and services available in your area.