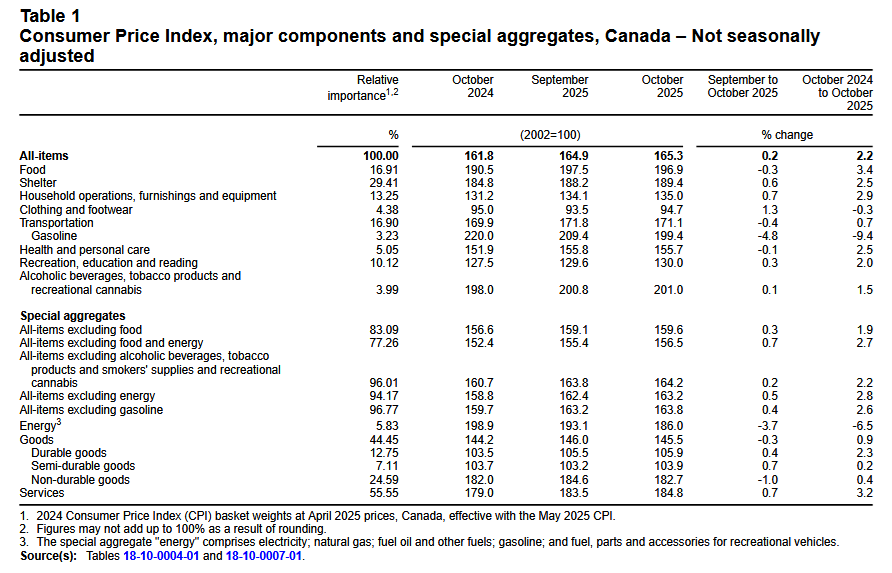

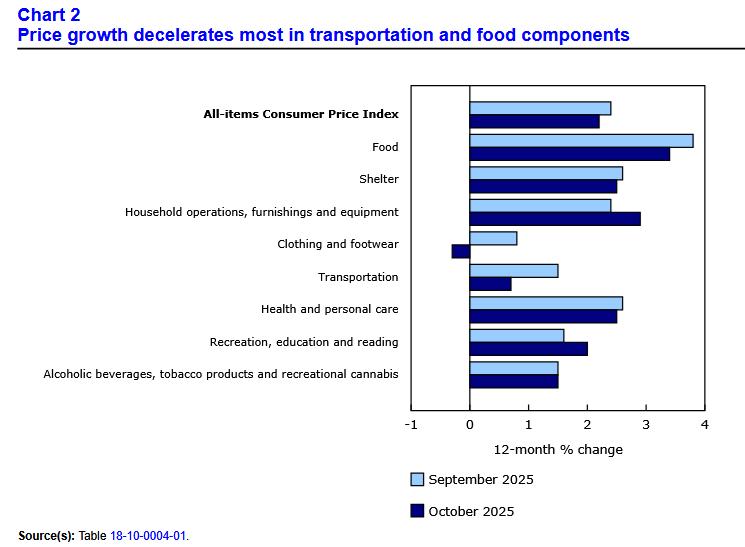

Canada’s consumer price index (CPI) increased by 2.2% year over year (Y-o-Y) in October, down from 2.4% Y-o-Y in September. Statistics Canada (StatsCan) published the data at 8:30 a.m. ET on November 17, 2025, via The Daily report. On a monthly basis, the CPI rose by 0.2%, and the relatively mild metrics reinforced the disinflationary trends that have occurred over the last few years.

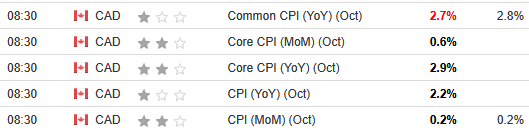

The table below is courtesy of Investing.com. The left column represents October’s figures, while the right column represents forecasters’ consensus estimates. As you can see, the common CPI missed expectations, while the monthly headline CPI aligned with expectations.

Yet, with gyrating economic activity clouding the outlook, the Bank of Canada (BoC) will likely take a meeting-by-meeting approach to rate cuts over the next several months. BoC Governor Tiff Macklem said at the latest Monetary Policy Meeting on Oct. 29 that “In the second half of this year, GDP growth is expected to resume, but remain weak, averaging about ¾%…. Even as growth recovers, the entire path for GDP is lower than it was before the shift in US trade policy. By the end of 2026, the level of GDP is about 1½% lower than forecast in January.”

Although, “If the economy evolves roughly in line with the outlook in our MPR, Governing Council sees the current policy rate at about the right level to keep inflation close to 2% while helping the economy through this period of structural adjustment.”

Translation? Worsening trends and another downward revision to the BoC’s GDP estimates may be required for more rate cuts.

Declining Core CPI

Core measures of the CPI retreated in October, with the CPI-common index holding at +2.7% (from +2.7%), while the CPI-median fell to +2.9% (from +3.1%), and the CPI-trim fell to +3.0% (from +3.1%). These measures exclude the impacts of food and energy, and the BoC places heavy emphasis on core measures because they provide a smoothed distribution of overall inflation.

Please note that food and energy prices are highly volatile and price spikes can occur for reasons outside of the BoC’s control. In contrast, core inflation is mainly driven by consumer demand and gives the BoC a better sense of how the Canadian economy is functioning.

Sector Results

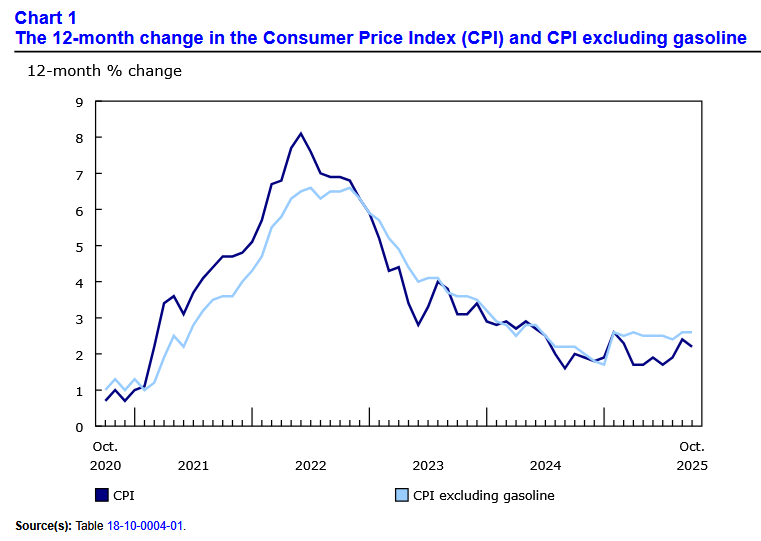

Five major sectors recorded Y-o-Y declines in October, with food and transportation showcasing the largest pullbacks, while clothing and footwear flipped from inflation to deflation.

For context, the eight sectors include food, shelter, household operations, furnishings and equipment, clothing and footwear, transportation, health and personal care items, recreation and education expenses, and alcohol and tobacco products.

Food Inflation Moderates

Food inflation declined by 0.3% MoM in October, pushing the Y-o-Y (not seasonally adjusted) metric down to 3.4%. Other food preparations (+3.2%), which is mostly processed foods, and fresh vegetables (-1.4%) were the primary laggards, while fresh or frozen chicken (+6.2%) outperformed the 1.5% increase in September.

Still, grocery inflation has surpassed the overall inflation rate for the last nine months.

Will the Comeback Last?

While GDP growth has slowed considerably in 2025, the Canadian economy has shown some recent signs of life as rate cuts help boost sentiment and consumption.

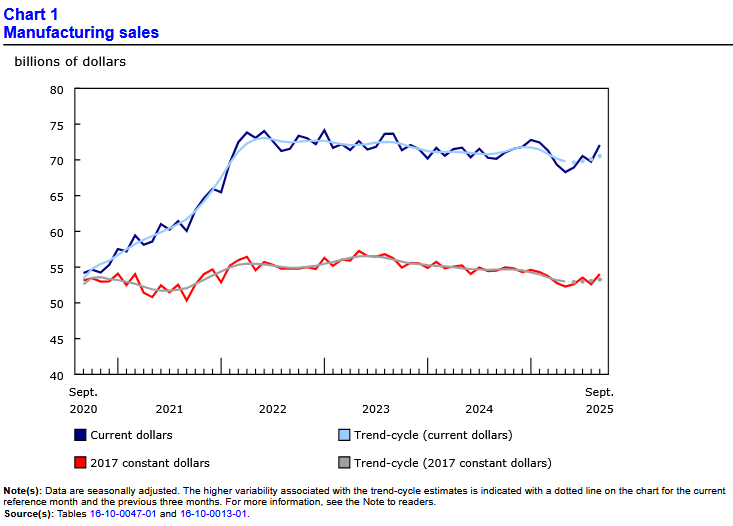

For example, Statistics Canada noted on Nov. 14 that the manufacturing sector recorded a bump in activity in September, with capacity utilization (a gauge of how close the economy is behaving relative to its potential) also climbing. The report stated:

“Manufacturing sales reached their highest level since February 2025, rising 3.3% month over month to $72.1 billion in September. Sales rose in 14 of the 21 subsectors, led by the transportation equipment (+9.2%) and petroleum and coal (+5.3%) subsectors….

“The manufacturing sector’s capacity utilization rate (not seasonally adjusted) rose from 78.2% in August to 80.7% in September.”

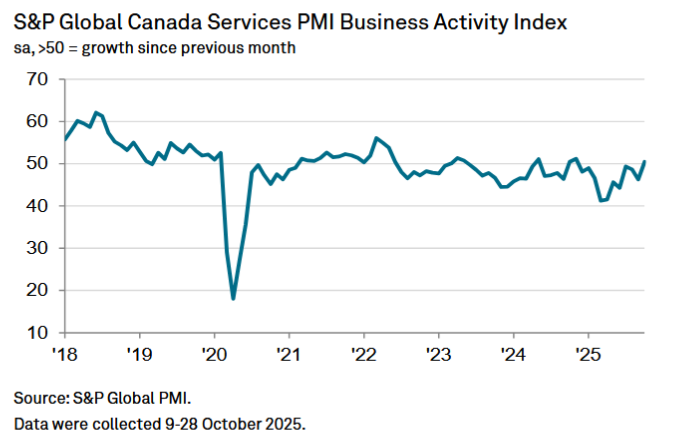

Likewise, S&P Global revealed on Nov. 5 that Canada’s service sector has also rebounded from the recent lows. An excerpt read:

“Canada’s service sector expanded in October for the first time in 2025…. The Business Activity Index moved above the critical 50.0 no-change mark for the first time since November 2024. At 50.5, the index was notably higher than September’s 46.3 and well above readings seen during the spring.”

Thus, while employment declined and business confidence remained weak, the data highlight how some positive developments have occurred in recent weeks.

Finally, Indeed revealed on Nov. 4 that Canadian job postings on its site rallied back above the 100 index level and have shown some strength after bottoming near 95 in early September. As a result, while the metric still remains in a downtrend, the recent jump provides some hope that a labour market recovery is on the horizon.

So, while the BoC believes that interest rates are low enough to help revive the economy, monitoring indicators like these will help determine if/when the easing cycle will continue.

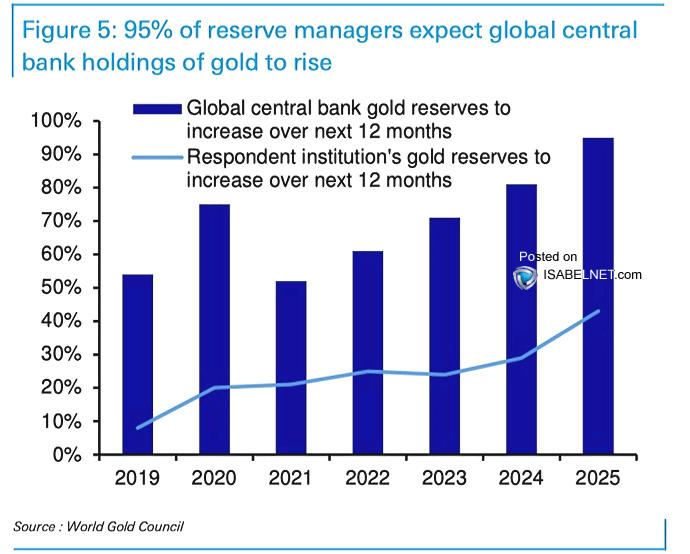

To that point, because very few trends unfold in a straight line, gold is an excellent example of how short-term corrections should be expected along the way. The yellow metal endured a sharp pullback recently, but given the rapid rise in 2025, the damage wasn’t too severe.

And with a comeback already underway as gold climbs once again, the fundamentals that helped drive the upswing remain quite healthy. For example, with inflation, geopolitical conflict, and rising sovereign debt levels increasing gold’s appeal, 95% of global central bank allocation managers said they plan to increase their gold holdings over the next 12 months. Consequently, the continued demand should help support prices for the foreseeable future.

Dedicating a small portion of one’s TFSA or RRSP portfolio to precious metals may help mitigate some of the geopolitical risks and negative effects of inflation. If you want to get started with investing in metals such as gold and silver, read our free guide to gold buying in Canada in 2025 today.

In addition, if a new car is in your plans for the New Year, there are several auto lenders offering affordable rates across the country. We compiled a list of the 10 best subprime lenders for bad or no credit, and Western Auto Group is an excellent dealership for drivers in Alberta. The company has a lot of positive reviews and options for buyers with no or poor credit. Similarly, Canada Drives is a CLA-certified lender that uses its vast partner network to help connect you with the right dealership and find the best loan terms. The online application is fast and easy, and most customers get pre-approval in minutes.

Finally, if your business needs capital for new products or to enter new markets, Merchant Growth is a solid resource if your company has been operational for 6+ months, with $10,000/month in sales, and a credit score of 550 or higher.

For additional resources, please consult our list of reputable lenders to see the best products and services available in your area.