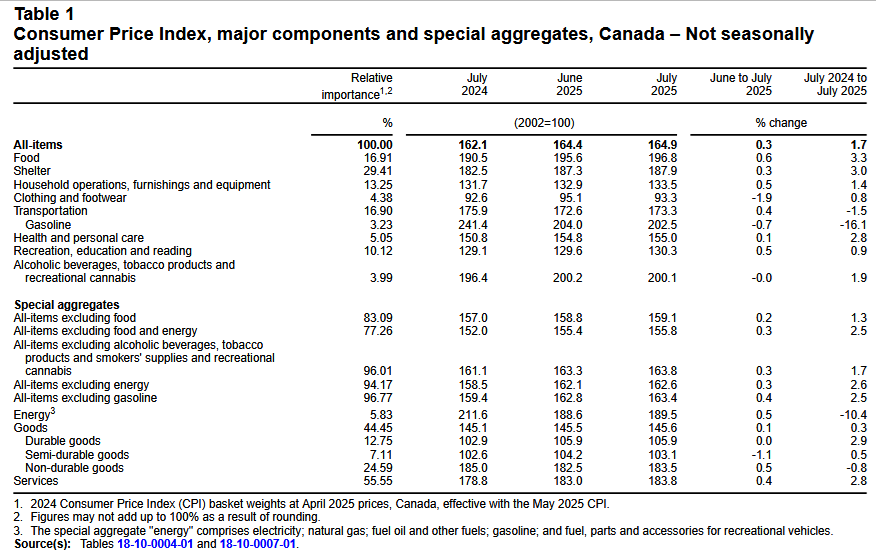

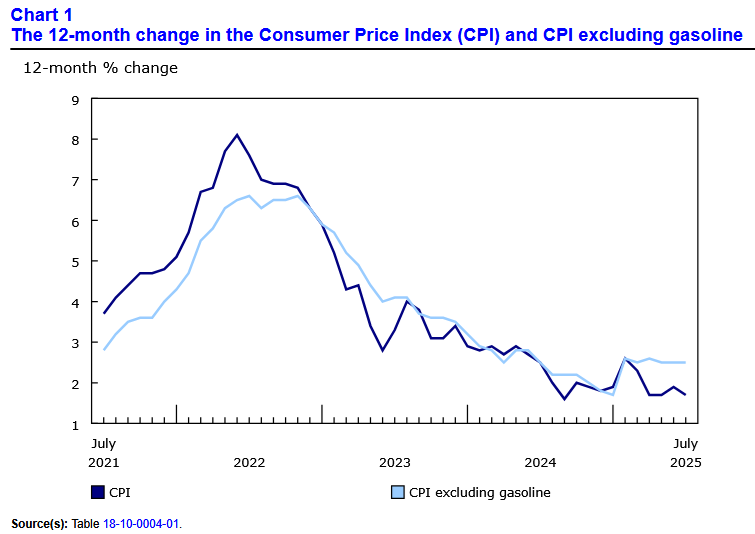

Canada’s consumer price index (CPI) increased by 1.7% year over year (Y-o-Y) in July, down from 1.9% Y-o-Y in June. Statistics Canada (StatsCan) published the data at 8:30 a.m. ET on August 19, 2025, via The Daily report. On a monthly basis, the CPI rose by 0.3%, and most metrics aligned with economists’ consensus estimates.

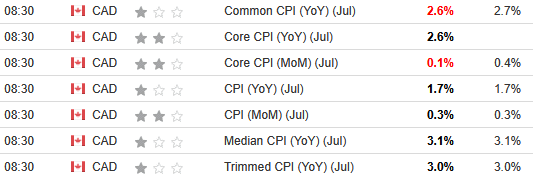

The table below is courtesy of Investing.com. The left column represents July’s figures, while the right column represents forecasters’ expectations. As you can see, the core CPI was noticeably weak MoM, while the Y-o-Y Common CPI came in slightly weaker than expected.

Overall, the Bank of Canada (BoC) should applaud the results. The Governing Council held interest rates steady at that Jul. 30 monetary policy meeting, and Governor Tiff Macklem said during his press conference that “So far, the global economic consequences of U.S. trade policy have been less severe than feared.”

He added:

“There are reasons to think that the recent increase in underlying inflation will gradually unwind. The Canadian dollar has appreciated, which reduces import costs. Growth in unit labour costs has moderated, and the economy is in excess supply. At the same time, tariffs impose new direct costs, which will be gradually passed through to consumers. In the current tariff scenario, upside and downside pressures roughly balance out, so inflation remains close to 2%.”

Thus, today’s muted data may increase Macklem’s confidence that inflation hovers near the BoC’s 2% target for the foreseeable future.

Steady Core CPI

Core measures of the CPI were well behaved again in July, with the CPI-common index holding at +2.6% (from +2.6%), while the CPI-median rose to +3.1% (from +3.0%), and the CPI-trim held at +3.0% (from +3.0%). These measures exclude the impacts of food and energy, and the BoC places heavy emphasis on core measures because they provide a smoothed distribution of overall inflation.

Please note that food and energy prices are highly volatile and price spikes can occur for reasons outside of the BoC’s control. In contrast, core inflation is mainly driven by consumer demand and gives the BoC a better sense of how the Canadian economy is functioning.

Sector Results

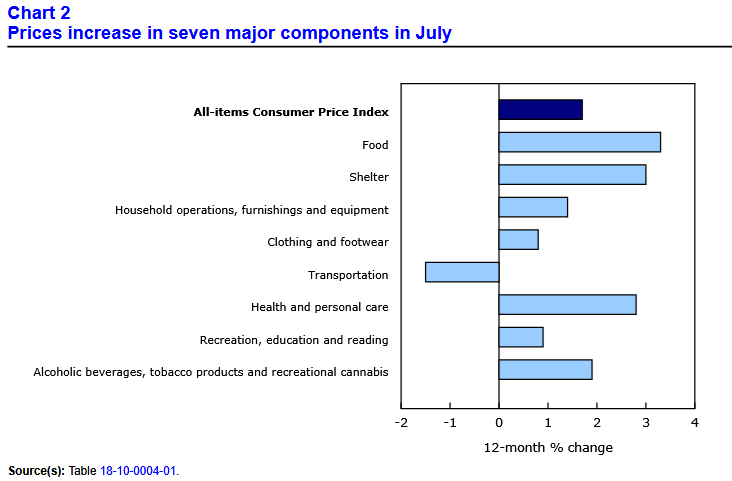

Seven major sectors recorded Y-o-Y increases in July, with food and shelter outperforming, while transportation remains in deflation.

For context, the eight sectors include food, shelter, household operations, furnishings and equipment, clothing and footwear, transportation, health and personal care items, recreation and education expenses, and alcohol and tobacco products.

Grocery Inflation Accelerates

Grocery inflation jumped in July, rising by 3.4% Y-o-Y compared to 2.8% Y-o-Y in June. Weather disruptions in source regions for cocoa

and coffee beans pushed confectionery (+11.8%) and coffee (+28.6%) prices higher, while fresh fruit rose by 3.9% Y-o-Y as grapes surged by 29.7%.

Add it all up, and total grocery inflation has increased by 27.1% since July 2020.

Deconstructing the Dual Mandate

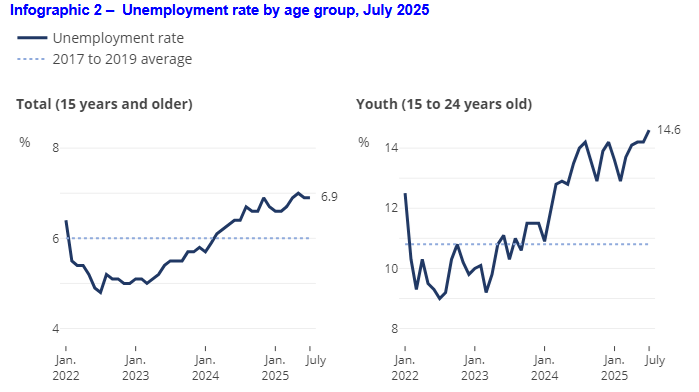

Like the FOMC in the United States, the BoC has a dual mandate to maintain price stability and maximum employment. And while inflation uncertainty remains problematic, slack in the labour market makes the situation even more difficult.

For example, Statistics Canada released another sluggish Labour Force Survey on Aug. 8. An excerpt read:

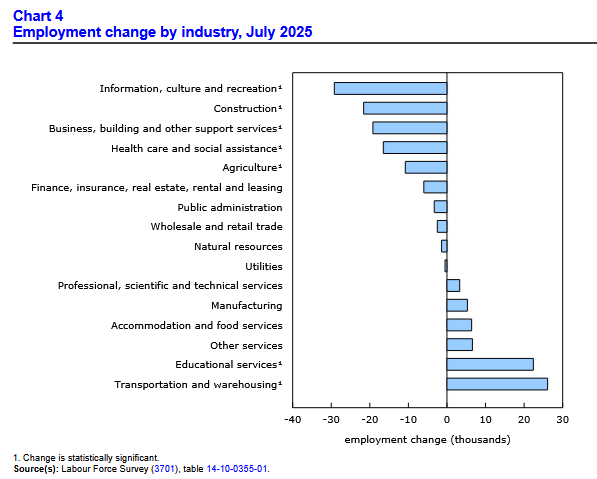

“Employment fell by 41,000 (-0.2%) in July, partly offsetting the increase in June (+83,000; +0.4%). The decline in July was concentrated in full-time work (-51,000; -0.3%). Overall, there has been little net employment growth since the beginning of the year.”

Moreover, the report added:

“The youth unemployment rate [aged 15 to 24] edged up to 14.6% in July, the highest rate since September 2010 (excluding 2020 and 2021). The youth unemployment rate has trended up over the past two years and in July 2025 was up 4.3 percentage points compared with July 2023.”

Thus, while the overall unemployment rate held steady at 6.9%, seven months of roughly zero net employment growth should be a prime concern for the BoC.

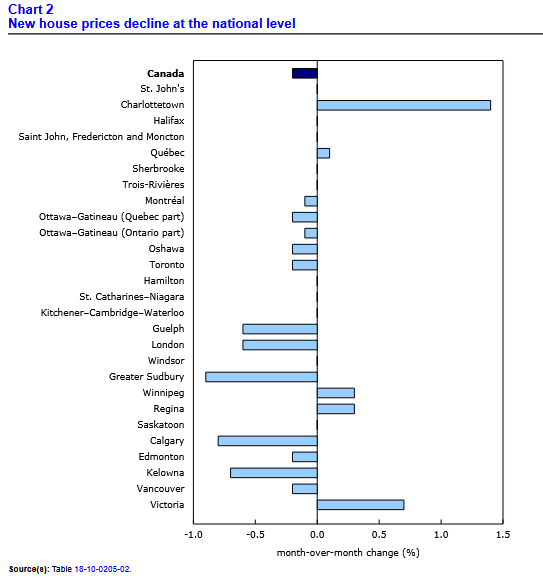

To that point, the Canadian housing market is highly sensitive to monetary policy, especially the performance of long-term bonds that affect mortgage rates. And with the housing market showing signs of slippage, the weakness could impact construction employment and slow rent inflation.

Statistics Canada revealed on July 23:

The New Housing Price Index (NHPI) “declined on a month-over-month basis in June (-0.2%), down for the third consecutive month.”

Furthermore, the June index level of 123.4 was the lowest reading since February 2022. Therefore, if employment continues to stagnate alongside slowing real GDP growth, the BoC may confront several fundamental issues that are at odds with its inflation dilemma.

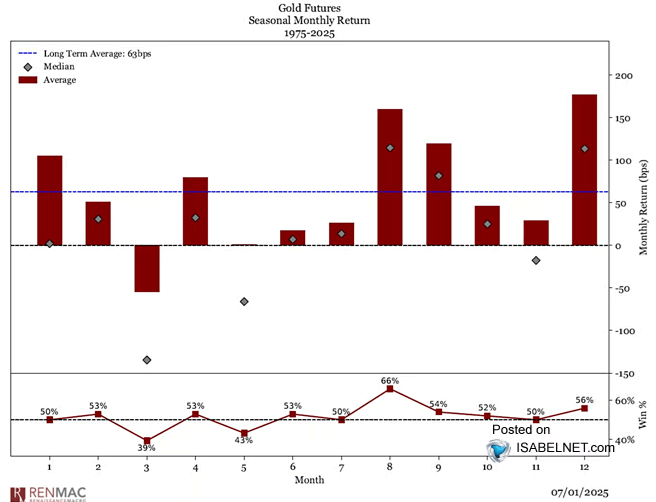

In the meantime, though, gold should benefit as the stagflationary backdrop percolates. Plus, with bullish seasonality another factor boosting the yellow metal’s appeal, the wind is at its back for the next several months.

The chart above from Renaissance Macro Research shows how gold’s best-performing months often occur in August, September, December, and January. Consequently, the calendar supports more upside in the fall and winter.

Dedicating a small portion of one’s TFSA or RRSP portfolio to precious metals may help mitigate some of the geopolitical risks and negative effects of inflation. If you want to get started with investing in metals such as gold and silver, read our free guide to gold buying in Canada in 2024 today.

In addition, if financial concerns are keeping you up at night, Consolidated Credit Canada helps create debt management plans and negotiates with creditors on your behalf. The group is recognized by organizations like the Canadian Association of Credit Counselling Services and has an A+ rating with the Better Business Bureau. Moreover, the team can also assist with budgeting, housing counseling, student loan advice, and financial education.

Similarly, Borowell is an excellent credit repair service that you can access for free. The company provides free weekly credit scores and report monitoring, and its education services include personalized tips, articles, and tools to become more credit savvy.

Finally, if you’re on the move this fall or want to lock in some savings by switching, Square One Insurance is an excellent option for Canadians living in British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, and Quebec. Whether it’s homeowner, tenant, or condo insurance, Square One provides affordable solutions for as low as $12 per month.

For more information, please consult our list of reputable lenders to see the best products and services available in your area.