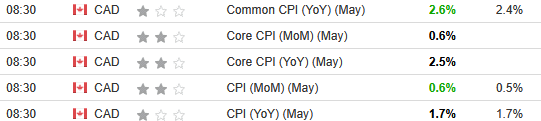

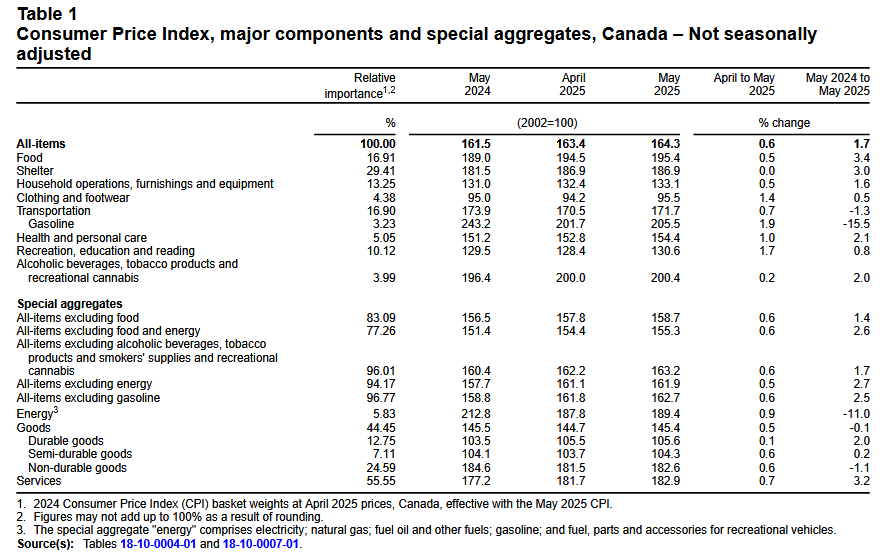

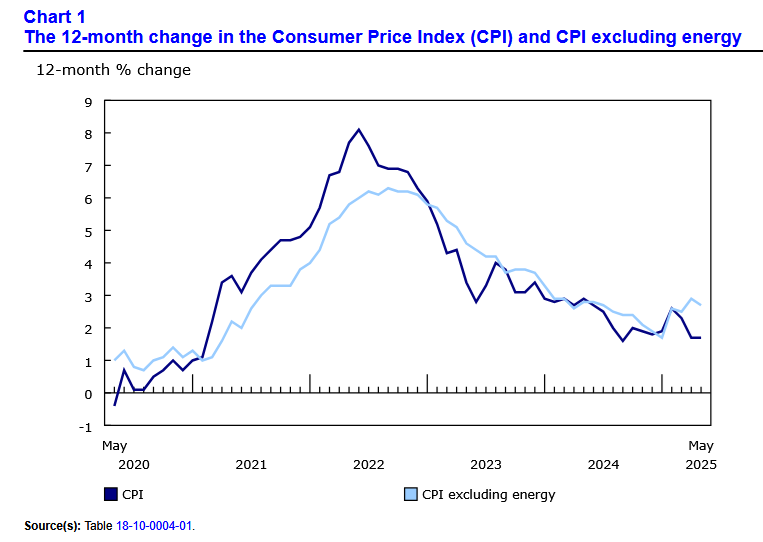

Canada’s consumer price index (CPI) increased by 1.7% year over year (Y-o-Y) in May, matching April’s print, and declining from 2.3% in March and 2.6% in February. Statistics Canada (StatsCan) published the data at 8:30 a.m. ET on May 20, 2025, via The Daily report. On a monthly basis, the CPI jumped by 0.6%, as gasoline prices rose by 1.9%, helping the metric outperform economists’ consensus estimate.

The table below is courtesy of Investing.com. The left column represents May’s figures, while the right column represents forecasters’ expectations. As you can see, the mixed results were somewhat skewed to the upside.

Overall, the Bank of Canada (BoC) should be pleased with the results. Annual inflation metrics mostly remain within its 2% long-term target, and given the labour market challenges, the Canadian economy faces plenty of uncertainty. Governor Tiff Macklem said during the June monetary policy meeting that “we are being less forward-looking than usual.” And with the Israel-Iran conflict pushing oil prices higher and further complicating the inflation outlook, the BoC has to be nimble in its assessment of when to lower interest rates and when to hold firm.

Mixed Core CPI

Core measures of the CPI were well behaved in May, with the CPI-common index rising to +2.6% (from +2.5%), while the CPI-median fell to +3.0% (from +3.1%), and the CPI-trim fell to +3.0% (from +3.1%). These measures exclude the impacts of food and energy, and the BoC places heavy emphasis on core measures because they provide a smoothed distribution of overall inflation.

Please note that food and energy prices are highly volatile and price spikes can occur for reasons outside of the BoC’s control. In contrast, core inflation is mainly driven by consumer demand and gives the BoC a better sense of how the Canadian economy is functioning.

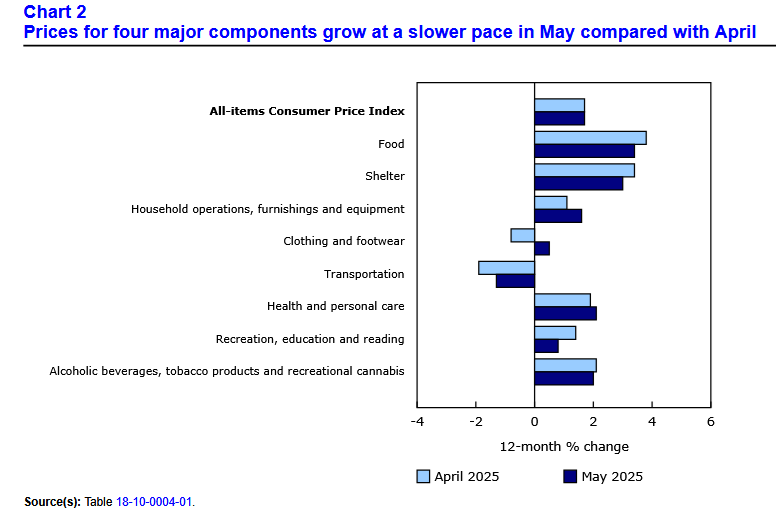

Four Sectors Slow

Four of the major sectors recorded Y-o-Y slowdowns in May, with transportation the noticeable outlier. In contrast, clothing and footwear moved from deflation to inflation, rising by 1.4% MoM.

For context, the eight sectors include food, shelter, household operations, furnishings and equipment, clothing and footwear, transportation, health and personal care items, recreation and education expenses, and alcohol and tobacco products.

Grocery Inflation Stays Firm

Grocery inflation slowed in May but still rose by 3.4% Y-o-Y. Similarly, restaurant inflation increased by 3.3% Y-o-Y, and both metrics remain well above the headline figure of 1.7% Y-o-Y.

More Uncertainty For the BoC

While the BoC was already dealing with economic and tariff challenges, the latest geopolitical conflict between Israel and Iran has made monetary policy even more difficult.

The clash induced a spike in global oil prices, and Western Canada Select (WCS) has added more than $7 a barrel in less than a month. The jump should increase headline inflation over the next couple of prints, and a sustained rise could hurt consumer spending as Canadians allocate more of their incomes to gasoline and fuel costs. However, global oil prices sold off on Jun. 23, so it remains to be seen whether upside or downside volatility will dominate in the weeks ahead.

On the flip side, Canada produces the fourth-most oil in the world, and a sustainably higher WCS price should support exports, growth, and employment, especially in Alberta. As such, it could be a juggling act for the BoC to determine which variable deserves the most attention as the drama unfolds.

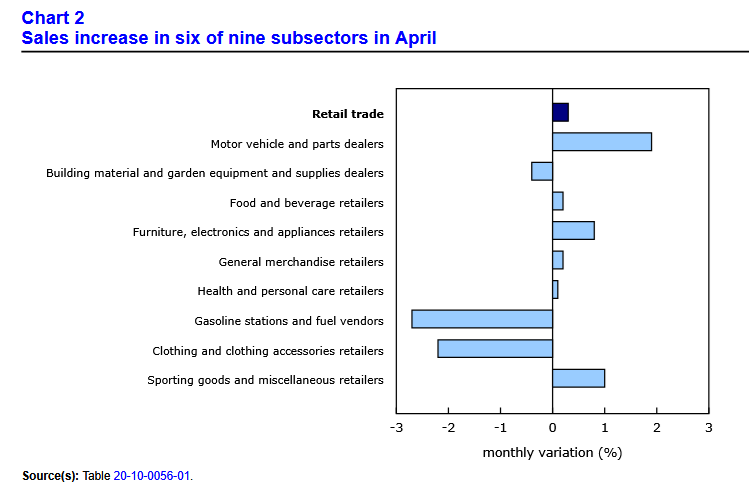

As for the domestic data, a resilient retail sales print hit the wire on Jun. 20. Headline consumption increased by 0.3% MoM, while core (which excludes energy and motor vehicle parts) rose by 0.1%. Although, the report noted:

“36% of retail businesses were impacted by the trade tensions in April. The most common impacts were price increases, change in demand for products, and supply chain disruptions. Despite six of nine subsectors posting monthly gains in retail sales, all nine subsectors saw a negative impact on sales.”

Thus, while the realised data was solid, the negative anecdotes highlight how conflicting sentiment makes forecasting extremely difficult in this environment.

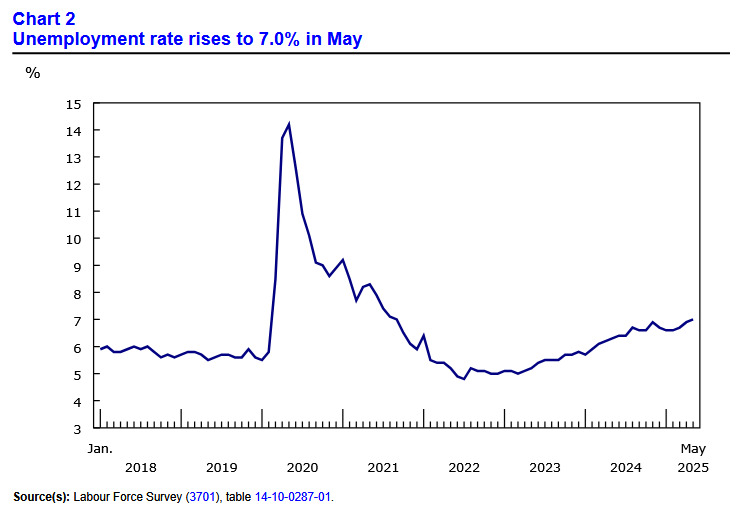

To that point, the Canadian labour market continues to slow. And with ominous evidence piling up, the BoC should be on alert. For example, while the economy added 8,800 jobs in May, the Labour Force Survey stated:

“The unemployment rate increased 0.1 percentage points to 7.0% in May, the highest rate since September 2016 (excluding 2020 and 2021, during the pandemic). The uptick in May was the third consecutive monthly increase; since February, the unemployment rate has risen by a combined total of 0.4 percentage points.”

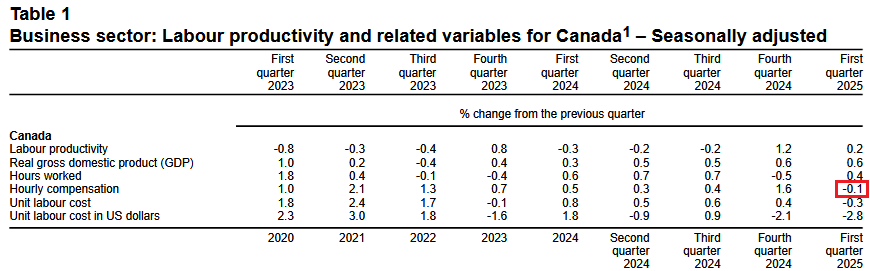

Even more concerning, the latest wage growth data signals a challenging consumer environment. The table below highlights how Canadians’ hourly compensation fell by 0.1% in Q1 2025 — the first quarterly decline in at least eight quarters. As a result, the BoC should understand that it’s difficult for Canadians to stoke inflation when their hourly wages are declining.

All in all, while the recent oil spike is troubling, the inflationary impact should be temporary. If so, it may provide the BoC with cover to loosen monetary policy during the summer months.

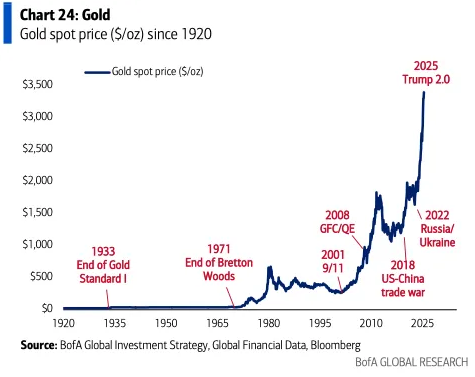

As for the financial markets, the Israel-Iran conflict is another catalyst supporting higher gold prices. The yellow metal is a safe-haven asset and often outperforms during periods of economic and geopolitical turmoil.

To explain, the Bank of America chart above highlights how major historical events often increase investors’ appetite for gold. And with the global landscape becoming more precarious, gold should continue to act as a strategic hedge against the evolving uncertainty.

Dedicating a small portion of one’s TFSA or RRSP portfolio to precious metals may help mitigate some of the geopolitical risks and negative effects of inflation. If you want to get started with investing in metals such as gold and silver, read our free guide to gold buying in Canada in 2024 today.

Finally, if you’re experiencing economic challenges and need financing up to $50,000, Fairstone provides personal loans and secured lending products to Canadians with credit scores of 580 and higher. For emergencies, you may want to consider iCASH. The fintech provides payday loans up to $1,500, and the product is best for applicants with poor or bad credit. However, the financing fees are high, so please consult our list of reputable lenders first to see if you qualify for a more affordable option.