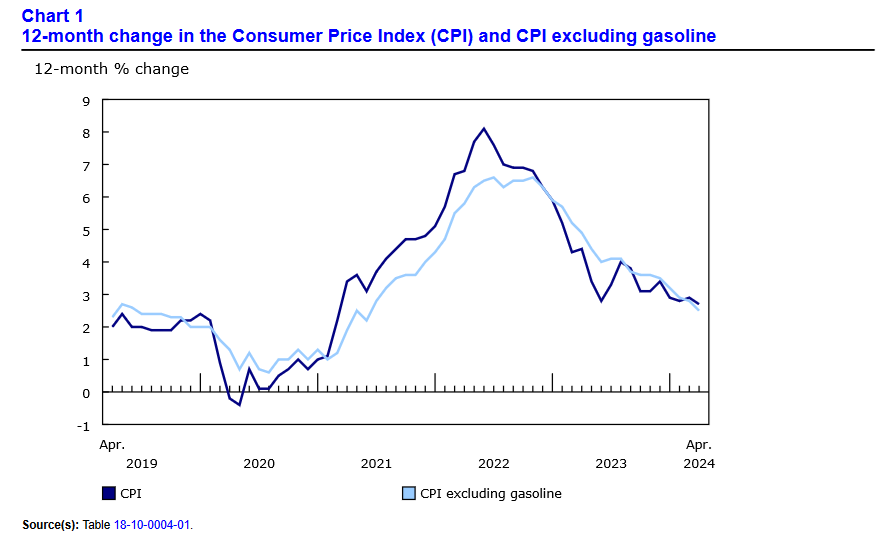

Canada’s consumer price index (CPI) rose by 2.7% year over year (Y-o-Y) in April, a drop from the 2.9% Y-o-Y recorded in March. Statistics Canada (StatsCan) published the data at 8:30 a.m. ET on May 21, 2024, via The Daily report. On a monthly basis, the CPI accelerated by 0.5% in April, a small retreat from March’s 0.6% reading. This month’s strength was largely driven by higher gasoline prices.

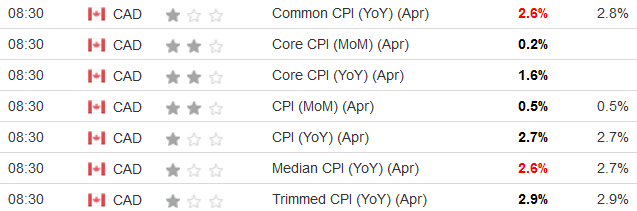

On a positive note, several CPI metrics either met expectations or came in below economists’ consensus estimates. For example, the table below is courtesy of Investing.com. The left column represents April’s figures, while the right column represents forecasters’ expectations. As you can see, the common and median CPIs (marked in red) were weaker than expected, while the rest of the figures (marked in black) were in line with expectations. As a result, the relatively mild data should provide more fuel for the rate-cut argument in the months ahead.

On May 2, Bank of Canada (BoC) Governor Tiff Macklem said, “We do see renewed downward momentum in underlying inflation. The message to Canadians is: we are getting closer [to rate cuts]. We are seeing what we need to see and we just need to be confident that it will be sustained.”

However, he cautioned that “Canadians should not be expecting a rapid decline in interest rates” and that any cuts would be gradual. Moreover, he added that “Interest rates are certainly not going to the emergency low levels we had during COVID. They’re unlikely to even get back to the pre-COVID levels.”

Thus, while April’s inflation slowdown supports a continuation of his dovish tone, it could be a while before interest rates decline substantially.

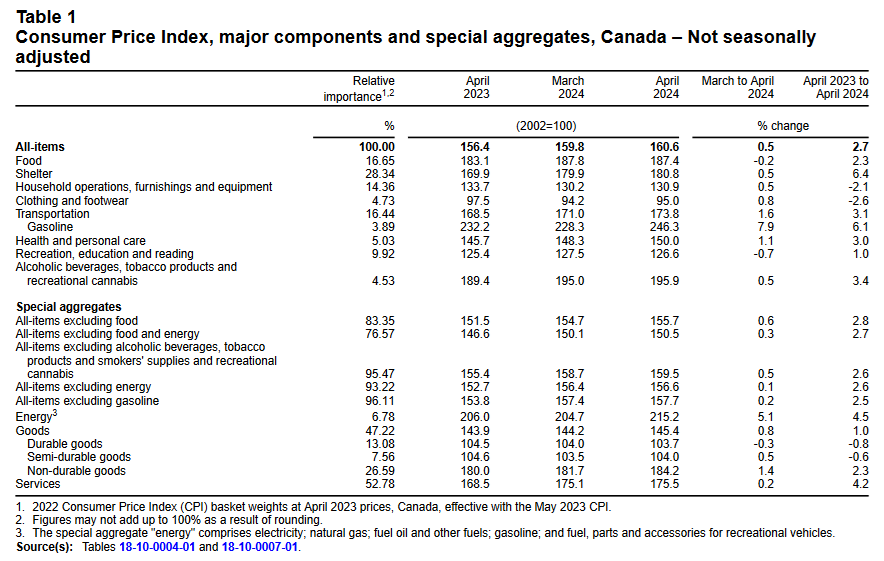

In April 2024, month-over-month inflation was largely driven by higher gasoline prices (+7.9%), transportation (+1.6%), non-durable goods (+1.4%), and recreation, education, and reading (+1.1%).

Source: Statistics Canada (Table 18-10-0004-01)

Core CPI Slows Again in April 2024

Core measures of the CPI in April 2024 fell across the board, with the CPI-common index falling to +2.6% (from +2.9%), the CPI-median falling to +2.6% (from +2.8%), and the CPI-trim falling to +2.9% (from +3.2%). These measures exclude the impacts of food and energy, and the BoC places heavy emphasis on core measures because they provide a smoothed distribution of overall inflation.

For example, food and energy prices are highly volatile and price spikes can occur for reasons outside of the BoC’s control. Plus, Macklem noted on May 2 that “Our key indicators of [core] inflation have all moved in the right direction,” so he should be satisfied with the continued deceleration.

Source: Statistics Canada (Table 18-10-0004-01)

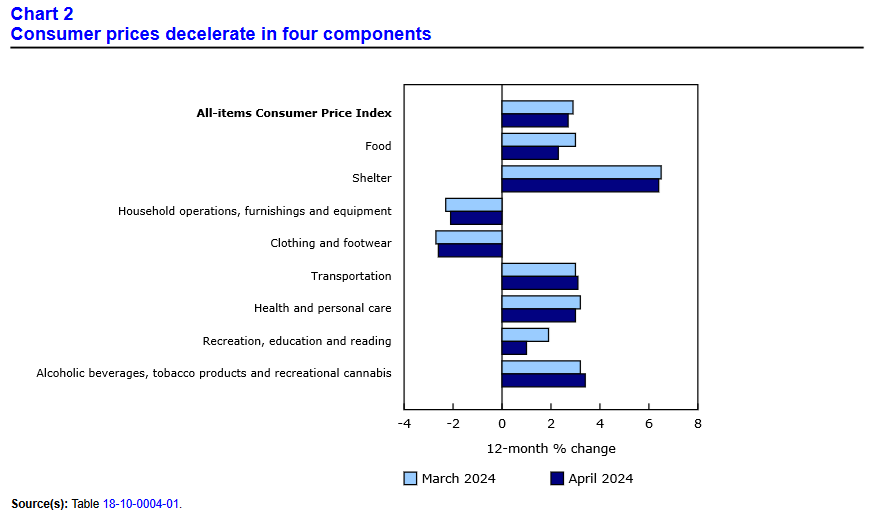

Inflation Slows Across 4 of 8 Major Sectors

On a Y-o-Y basis, slower pricing pressures were present in four of the eight major categories. These include food, shelter, household operations, furnishings and equipment, clothing and footwear, transportation, health and personal care items, recreation and education expenses, and alcohol and tobacco products.

Clothing and household products recorded outright deflation once again, while transportation prices, as well as alcohol, tobacco, and cannabis, accelerated. Shelter prices declined marginally.

Source: Statistics Canada (Table 18-10-0004-01)

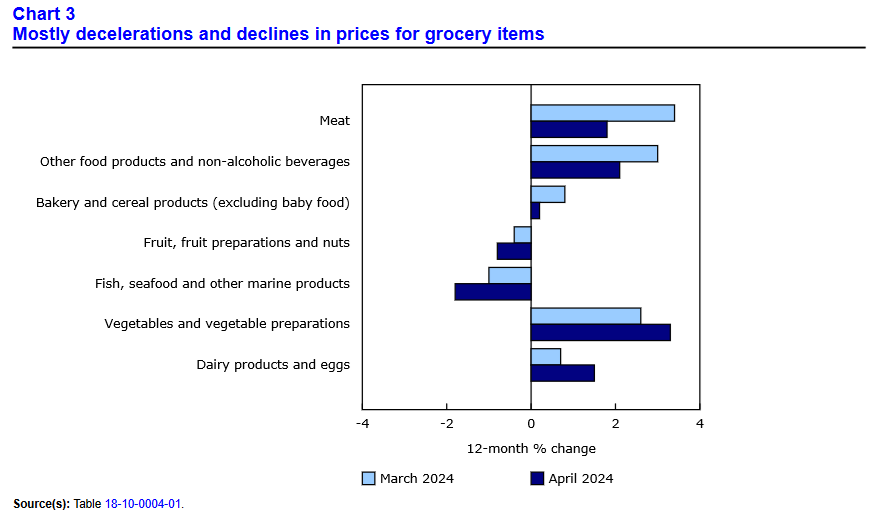

Grocery Inflation Continues Its Slowdown in April

Food inflation declined by 0.2% month-over-month in April, matching the decline witnessed in March. The drop was headlined by lower prices for fresh or frozen poultry (-6.9%), berries (-5.7%), roasted or ground coffee (-4.2%), fresh vegetables (-3.6%), and seafood (-3.3%).

Source: Statistics Canada (Table 18-10-0004-01)

A Rate Cut in June?

With inflation mostly aligning with the BoC’s 1% to 3% target range, economists are convinced that four or five rate cuts are on the table in 2024. Moreover, with Canadian job openings continuing their downtrend and real GDP growth struggling to meet the typical 2% target, there is a case for monetary easing.

However, with Macklem noting a few weeks back that any decline in rates will be gradual, it seems overly optimistic to expect four to five cuts over the next seven months.

Remember, month-over-month inflation came in at 0.6% and 0.5% in March and April. These figures annualize to nearly 7.5% and 6.2% Y-o-Y. Likewise, with the core CPI still at 0.3% month-over-month, that annualizes to nearly 3.7% Y-o-Y. As a result, a continuation of the recent monthly paces puts annual inflation well above the BoC’s 2% target, which makes the case for several rate cuts problematic.

To that point, Macklem highlighted on May 2 that cutting rates would negatively impact the loonie. “If we move lower than the Fed, that will tend to depreciate the Canadian dollar” versus the U.S. dollar, he said. Thus, with a weaker currency poised to increase import-driven inflation, several variables need to be considered.

So, while inflation and higher interest rates have hit low-income Canadians the hardest, it remains a balancing act for the BoC to determine the right solution at the right time.

As a proactive measure to protect your wealth from further deterioration, historically, precious metals assets such as gold and silver have held their value more reliably than stocks during periods of high inflation. In today’s economic environment, physical assets and commodities such as real estate and precious metals may provide a strategic hedge against inflation. Given gold and silver’s recent accelerations, several market participants have adopted a similar view.

Dedicating a small portion of one’s TFSA or RRSP portfolio to precious metals may help mitigate some of the negative effects of inflation. If you want to get started with investing in metals such as gold and silver, read our free guide to gold buying in Canada in 2024 today.