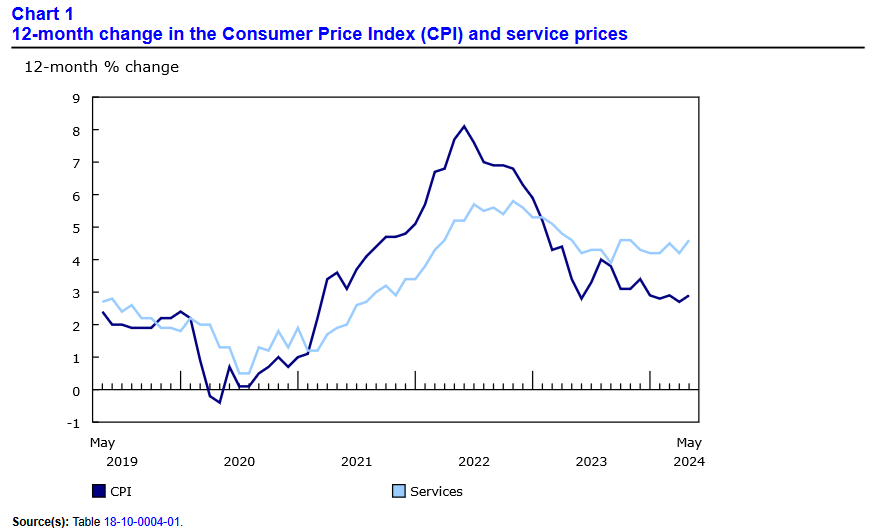

Canada’s consumer price index (CPI) rose by 2.9% year over year (Y-o-Y) in May, a jump from the 2.7% Y-o-Y recorded in April. Statistics Canada (StatsCan) published the data at 8:30 a.m. ET on June 25, 2024, via The Daily report. On a monthly basis, the CPI accelerated by 0.6% in May, a notch above April’s 0.5% reading. This month’s strength was largely driven by higher prices for travel tours.

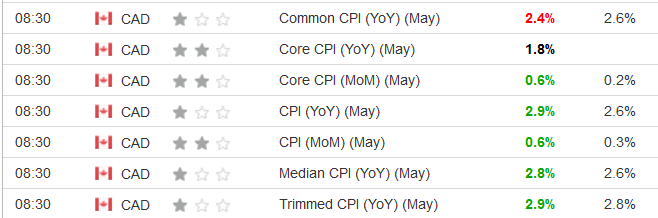

Outperformance was present across most metrics, as the CPI data came in above economists’ consensus estimates. For example, the table below is courtesy of Investing.com. The left column represents May’s figures, while the right column represents forecasters’ expectations. As you can see, only the common CPI (marked in red) was weaker than expected, while the rest of the figures (marked in green) were unexpectedly high. As a result, the monthly jump may keep the Bank of Canada (BoC) on hold until more sufficient inflation progress materializes.

On June 5, the BoC cut interest rates for the first time in several years. The committee noted how “Recent data has increased our confidence that inflation will continue to move towards the 2% target.”

However, “risks to the inflation outlook remain. Governing Council is closely watching the evolution of core inflation and remains particularly focused on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.”

Thus, with the core CPI increasing by 0.6% month-over-month (vs. 0.2% expected), the aforementioned risks were on full display, which may give the BoC cause for pause.

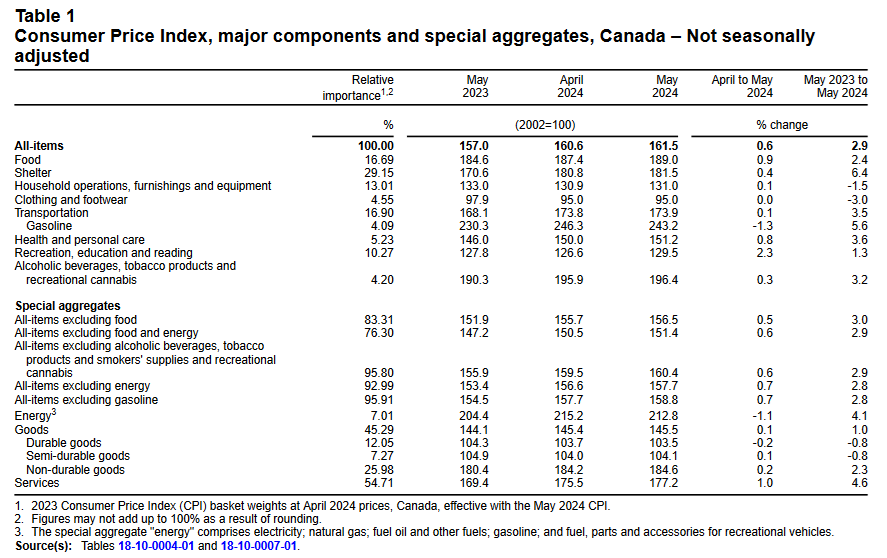

In May 2024, month-over-month headline inflation was largely driven by higher recreation, education, and reading costs (+2.3%), services (+1.0%), food (+0.9%), and health and personal care (+0.8%).

Core CPI Accelerates in May 2024

Core measures of the CPI in May 2024 were mixed, with the CPI-common index falling to +2.4% (from +2.6%). Conversely, the CPI-median rose to +2.8% (from +2.6%), and the CPI-trim hit +2.9% (from +2.8%). These measures exclude the impacts of food and energy, and the BoC places heavy emphasis on core measures because they provide a smoothed distribution of overall inflation.

Please note that food and energy prices are highly volatile and price spikes can occur for reasons outside of the BoC’s control. In contrast, core inflation is largely driven by consumer demand and gives the BoC a better sense of how the Canadian economy is functioning.

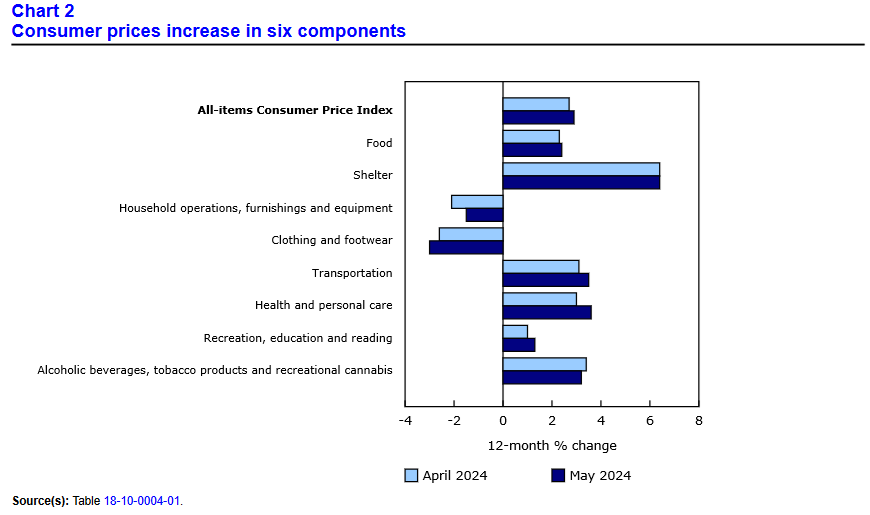

Inflation Rises Across 6 of 8 Major Sectors

On a Y-o-Y basis, stronger pricing pressures were present in five of the eight major categories. These include food, shelter, household operations, furnishings and equipment, clothing and footwear, transportation, health and personal care items, recreation and education expenses, and alcohol and tobacco products.

Clothing and household products recorded outright deflation once again, while transportation prices, food, health and personal care, as well as recreation, education, and reading accelerated. Shelter prices declined marginally.

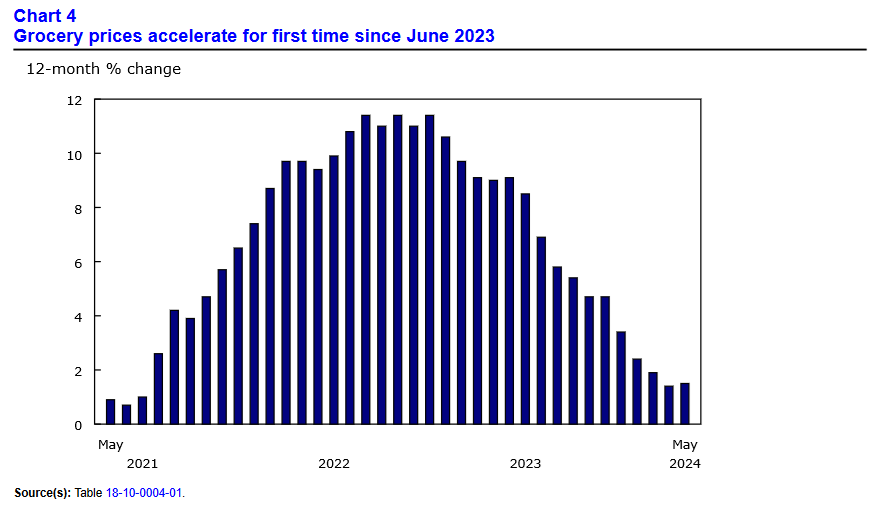

Grocery Inflation Rises in May

Food inflation rose by 1.1% month-over-month in May, a noticeable increase from the 0.2% decline in April. It was the largest monthly increase since January 2023. The strength was driven by higher prices for fresh vegetables (+3.5%), meat (+1.3%), fresh fruit (+2.2%) and non-alcoholic beverages (+2.4%). The monthly jump in meat prices was mostly driven by higher costs for fresh or frozen beef, as strong demand outweighed tight supply.

Bank of Canada On Hold in July?

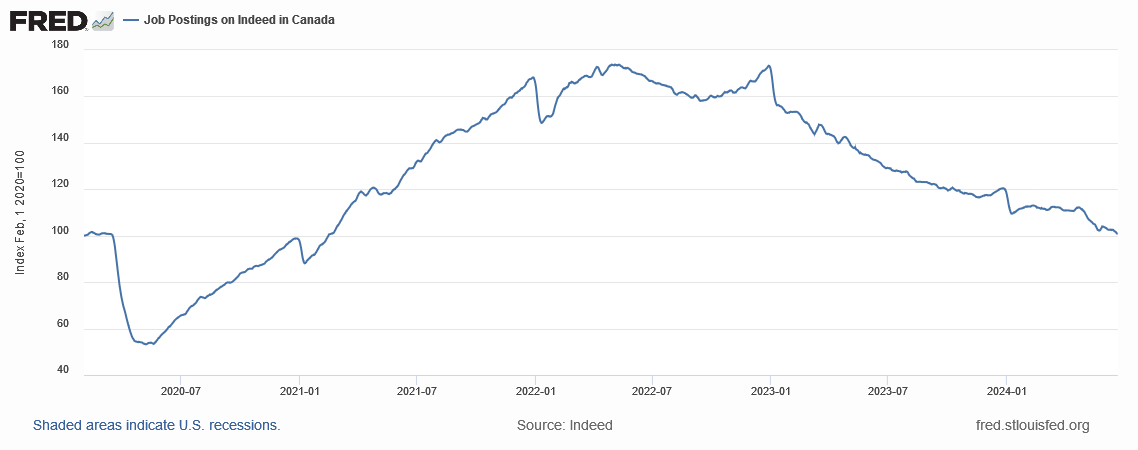

With inflation mostly aligning with the BoC’s 1% to 3% target range, economists are convinced that rate cuts will continue in 2024. Moreover, with Canadian job openings continuing their downtrend, Indeed reported on June 24 that employment opportunities are nearly back to their pre-pandemic baseline. In other words, the Canadian job market continues to slow.

On the flip side, month-over-month inflation came in at 0.6% in May, which annualizes to nearly 7.5%. Likewise, with the core CPI accelerating, a continuation of the recent monthly paces puts annual inflation well above the BoC’s 2% target, which makes the case for several rate cuts problematic.

To that point, BoC Governor Tiff Macklem said on June 5, “We don’t want monetary policy to be more restrictive than it needs to be to get inflation back to target. But, if we lower our policy interest rate too quickly, we could jeopardize the progress we’ve made. Further progress in bringing down inflation is likely to be uneven and risks remain. Inflation could be higher if global tensions escalate, if house prices in Canada rise faster than expected, or if wage growth remains high relative to productivity.”

Furthermore, oil has risen substantially in June, which typically translates to higher gasoline prices. Consequently, May’s 1.3% monthly decline in gasoline prices should reverse in June, making headline inflation more troublesome.

So, while higher interest rates have hit low-income Canadians the hardest, it remains a balancing act for the BoC to determine the right solutions at the right time.

As a proactive measure to protect your wealth from further deterioration, historically, precious metals assets such as gold and silver have held their value more reliably than stocks during periods of high inflation. In today’s economic environment, physical assets and commodities such as real estate and precious metals may provide a strategic hedge against inflation. Given gold and silver’s recent strength, several market participants have adopted a similar view.

Dedicating a small portion of one’s TFSA or RRSP portfolio to precious metals may help mitigate some of the negative effects of inflation. If you want to get started with investing in metals such as gold and silver, read our free guide to gold buying in Canada in 2024 today.