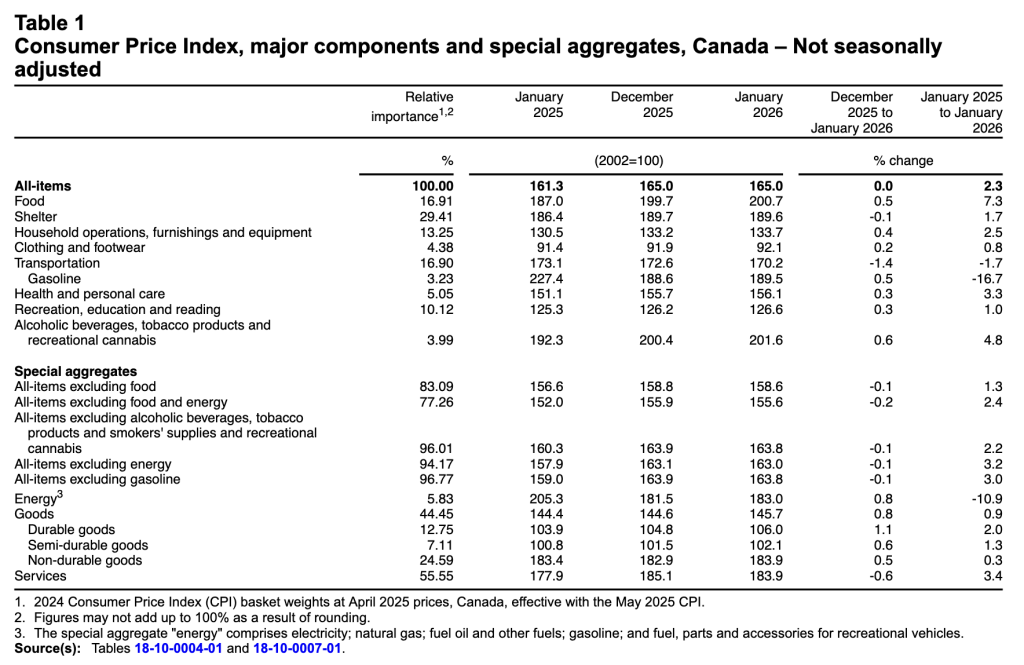

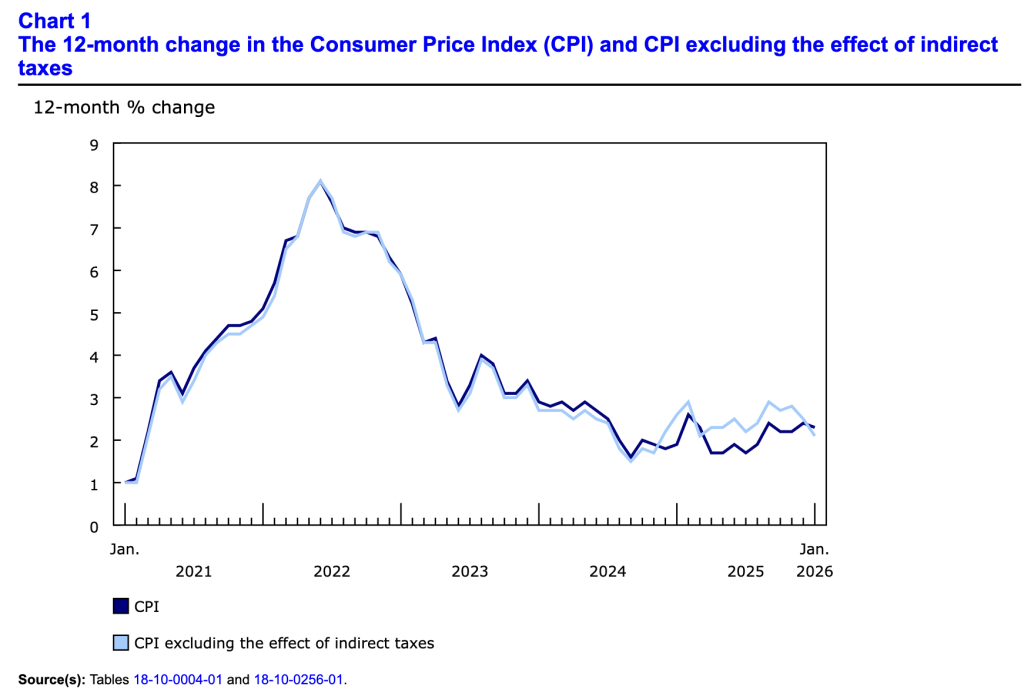

Canada’s consumer price index (CPI) increased by 2.3% year over year (Y-o-Y) in January, below the 2.4% Y-o-Y from December. Statistics Canada (StatsCan) published the data at 8:30 a.m. ET on February 17, 2026, via The Daily report. On a monthly basis, the CPI was flat, and despite the weakness, last year’s GST/HST holiday still provided some distortions that biased the annual metric higher.

Overall, the soft results largely missed expectations. The table below is courtesy of Investing.com. The left column represents January’s figures, while the right column represents forecasters’ consensus estimates. As you can see, the metrics were subdued.

Although, with the Bank of Canada (BoC) still in wait-and-see mode, Governor Tiff Macklem said on Jan. 28 that “Our forecast for economic growth and inflation in Canada has not changed significantly since our October projection. As the Canadian economy continues to adjust to U.S. trade restrictions, we expect GDP to grow modestly and inflation to stay close to the 2% target….

“Considering both our baseline forecast and the risks, Governing Council discussed the future path of monetary policy. While Council judges the current policy rate is appropriate based on our outlook, the consensus was that elevated uncertainty makes it difficult to predict the timing or direction of the next change in the policy rate.”

Thus, while economic data has weakened lately, the BoC will likely wait until a clear trend signals the need for more rate cuts.

Core CPI

Core measures of the CPI all weakened in January, with the CPI-common index falling to +2.7% (from +2.8%), the CPI-median falling to +2.5% (from +2.6%), and the CPI-trim falling to +2.4% (from +2.7%). These measures exclude the impacts of food and energy, and the BoC places heavy emphasis on core measures because they provide a smoothed distribution of overall inflation.

Please note that food and energy prices are highly volatile and price spikes can occur for reasons outside of the BoC’s control. In contrast, core inflation is mainly driven by consumer demand and gives the BoC a better sense of how the Canadian economy is functioning.

Sector Results

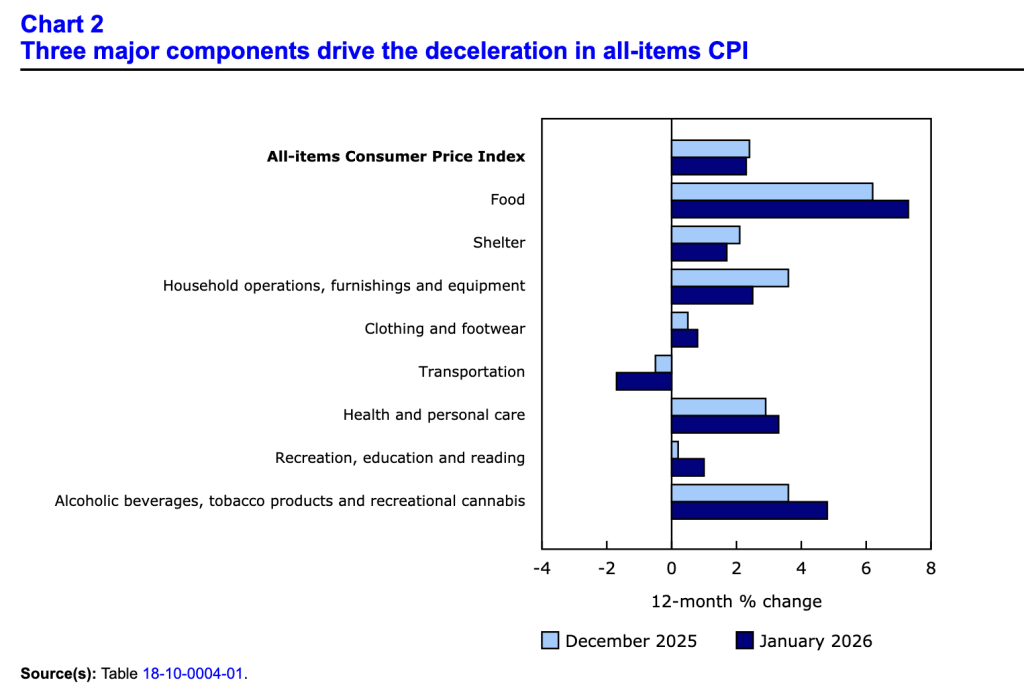

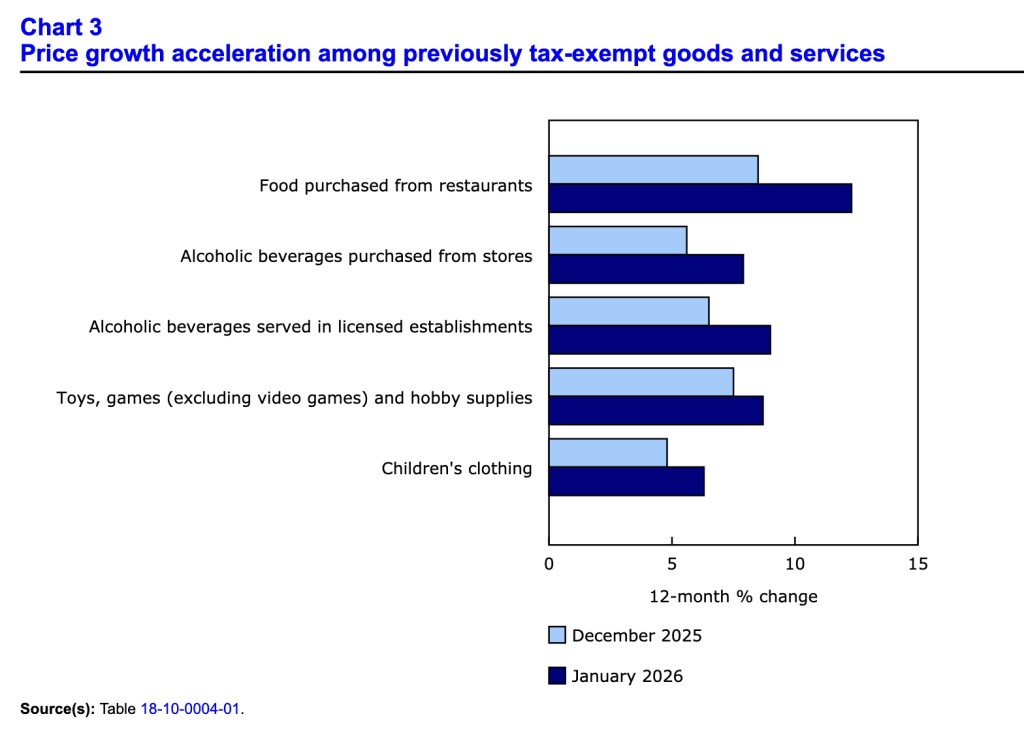

Sector performance was strong in January, with more than half of the categories outpacing December. However, base effects from the GST/HST holiday were meaningful. The report noted:

“Indexes with Y-o-Y movements impacted by the temporary GST/HST break in January 2025 continued to put upward pressure on the Y-o-Y all-items increase in January 2026. Of the affected indexes, the CPI continued to be most impacted by acceleration in prices for restaurant meals, and to a lesser degree, prices for alcoholic beverages, toys and children’s clothing.”

For context, the eight sectors include food, shelter, household operations, furnishings and equipment, clothing and footwear, transportation, health and personal care items, recreation and education expenses, and alcohol and tobacco products.

Food Inflation

Consolidated food inflation rose by 7.3% Y-o-Y in January, as items purchased from restaurants jumped by 12.3%, and alcoholic beverages purchased from stores increased by 7.9%.

Conversely, fresh fruit prices fell by 3.1% Y-o-Y and helped slow grocery store inflation to 4.8% (from 5.0% in December).

Elevated Uncertainty

While the BoC prefers to avoid preemptive rate cuts and wait until the economy shows signs of significant weakness, it’s a tough balancing act.

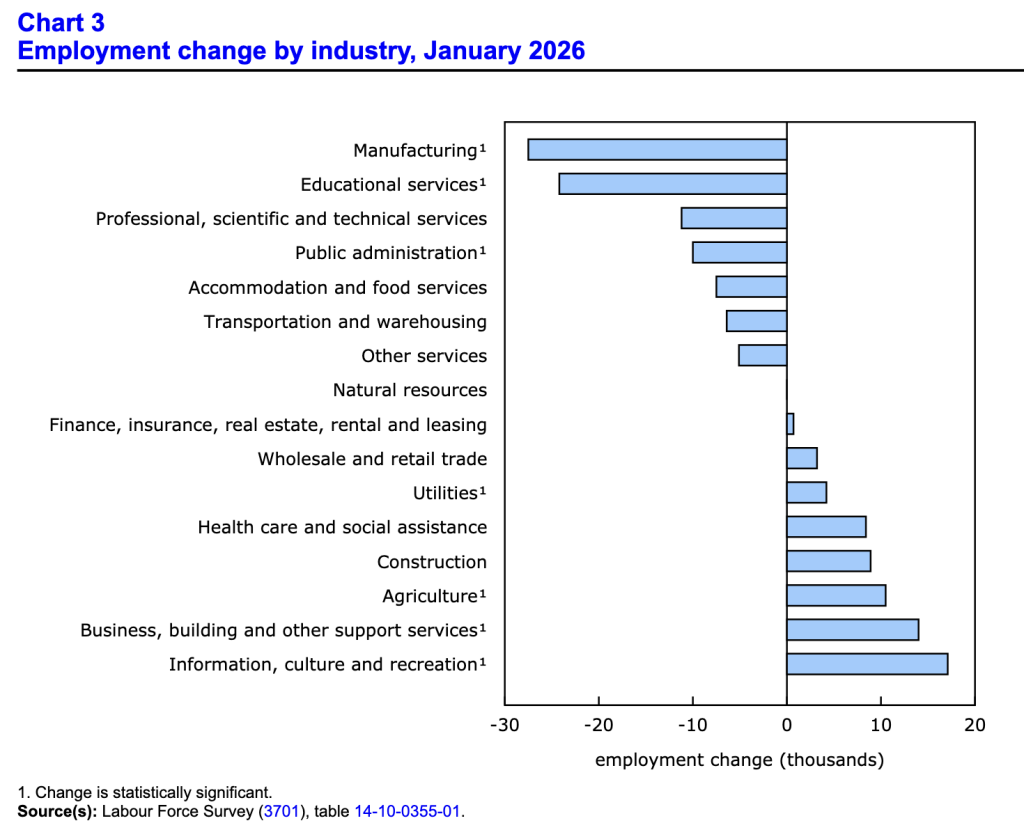

For example, Statistics Canada revealed on Feb. 6 that “Employment edged down in January (-25,000; -0.1%)” and “the unemployment rate fell by 0.3 percentage points to 6.5%, as fewer people searched for work.”

In a nutshell: while the economy shed 25,000 jobs in January, a decline in the participation rate (likely due to negative population growth) more than offset and reduced the unemployment rate. But, since it was the first negative print in the last five months, more weakness is necessary to cause concern.

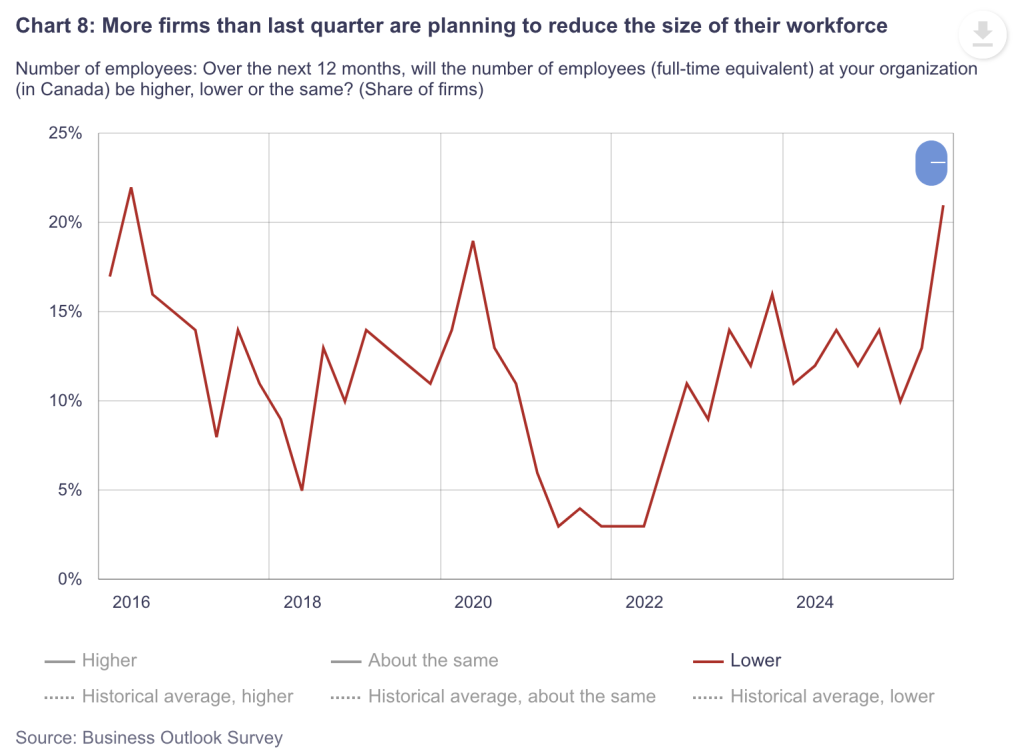

Speaking of which, a troubling data point came from the BoC’s latest Business Outlook Survey released on Jan. 28. The report highlighted how “Most businesses do not intend to increase the size of their workforce over the next 12 months, and the share planning outright staff reductions rose this quarter to its highest level since 2016.”

To explain, the red line above tracks the percentage of respondents who expect to lay off employees over the next 12 months. If you analyze the historical movement, you can see that the current reading surpasses the COVID-19 high and aligns near the 2016 recession high. As such, it could become an issue if these expectations turn into reality.

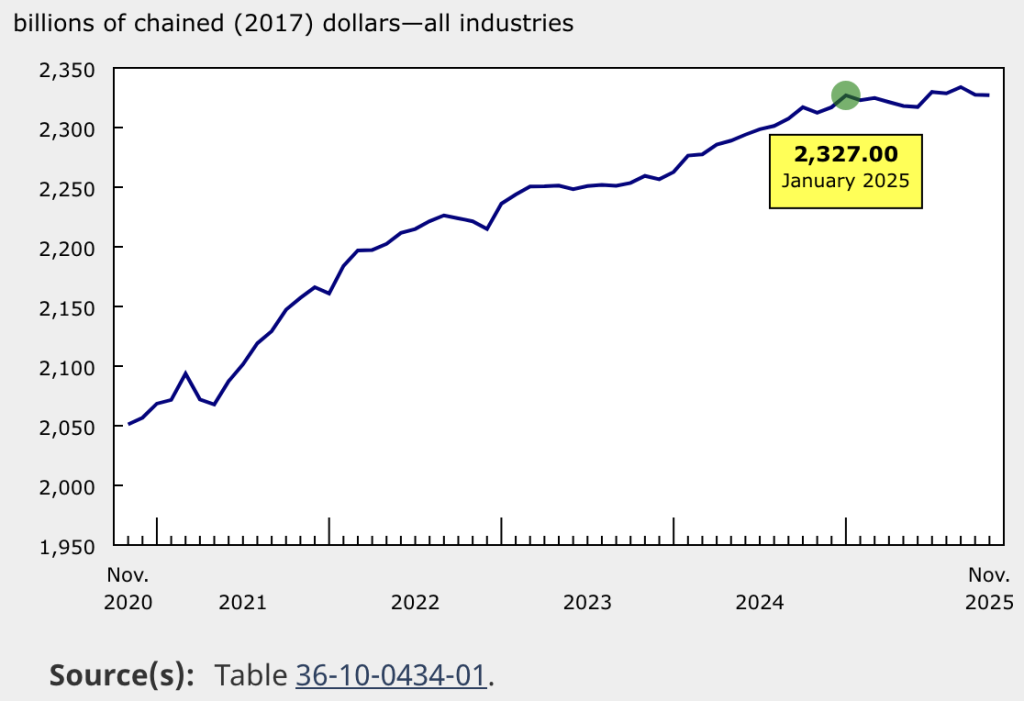

Finally, real GDP has flatlined. The latest November figure released on Jan. 28 has the metric at $2.327 trillion, matching the figure from January 2025. Consequently, if the no-growth environment doesn’t pick up soon, the layoff expectations cited above could further strain the labour market and force the BoC’s hand.

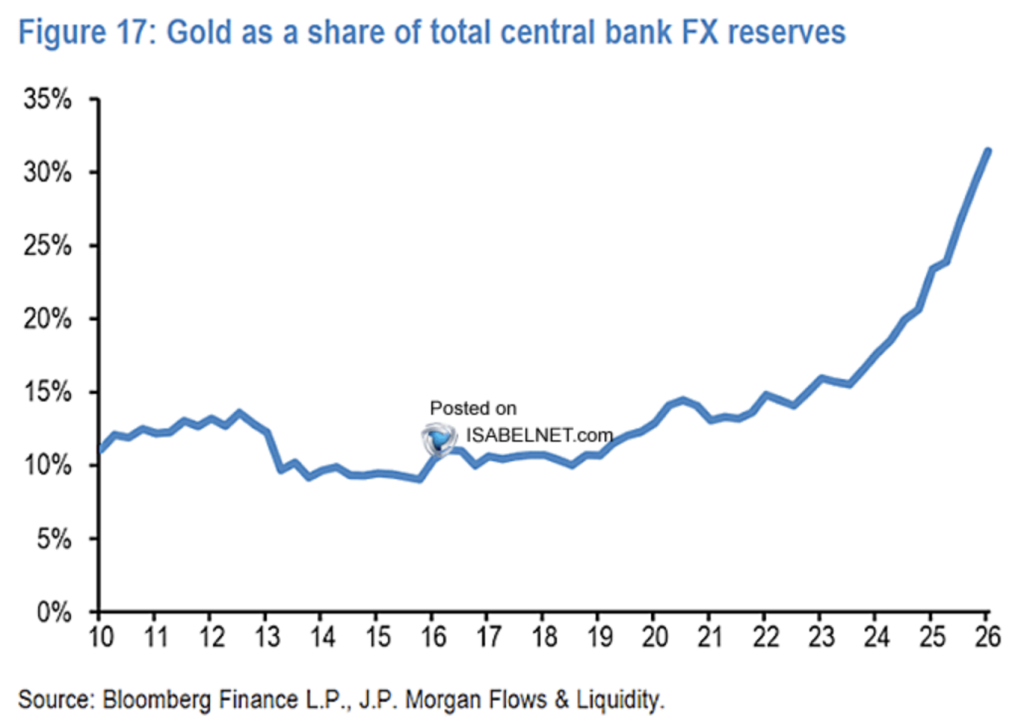

Turning to the financial markets, gold has been on a wild ride in recent weeks. And while the volatility may seem unsettling, the largest buyers in the market continue to stockpile bullion.

To explain, the blue line above tracks gold’s percentage of central bank reserves. As you can see, the buyers with unlimited firepower continue to shun fiat currencies and buy gold. As a result, a continuation of the trend should support precious metals’ prices over the long term.

Dedicating a small portion of one’s TFSA or RRSP portfolio to precious metals may help mitigate some of the geopolitical risks and negative effects of inflation. If you want to get started with investing in metals such as gold and silver, read our free guide to gold buying in Canada in 2026 today.

In addition, if financial obligations have become too stressful to manage on your own, Consolidated Credit Canada, the country’s largest non-profit, can negotiate with lenders on your behalf and educate you about the pros and cons of bankruptcy and consumer proposals. Plus, the initial consultation is free of charge, and the firm is accredited by the Canadian Association of Credit Counselling Services and has an A+ rating with the Better Business Bureau.

For business financing, capital resources are also available. Merchant Growth is great for companies that have been operational for 6+ months, have $10,000/month in sales, and a credit score of 550 or higher. Similarly, Journey Capital can help you obtain $5,000 to $500,000 if you have a credit score of 600 or higher.

For auto loans, several reputable firms make financing a breeze. The first is Prefera Finance. The team specializes in car, motorcycle, boat, trailer, and other vehicle financing, and is certified by the Canadian Lenders Association.

Second, Northlake Financial is another CLA-certified lender that’s a great option if you have bad credit. Interest rates are typically higher for riskier borrowers, but the lender may be a worthwhile option if you struggle to obtain financing elsewhere.

Third, Wippy is excellent if you prefer digital services and have a weak credit score that prevents you from obtaining a traditional loan. The only catch is that Wippy charges membership fees to be eligible for services, and you must use your car as collateral for the loan, which means it can be repossessed if you miss a payment.

For additional resources, please consult our list of reliable lenders to see a wide range of products and services available in your area.