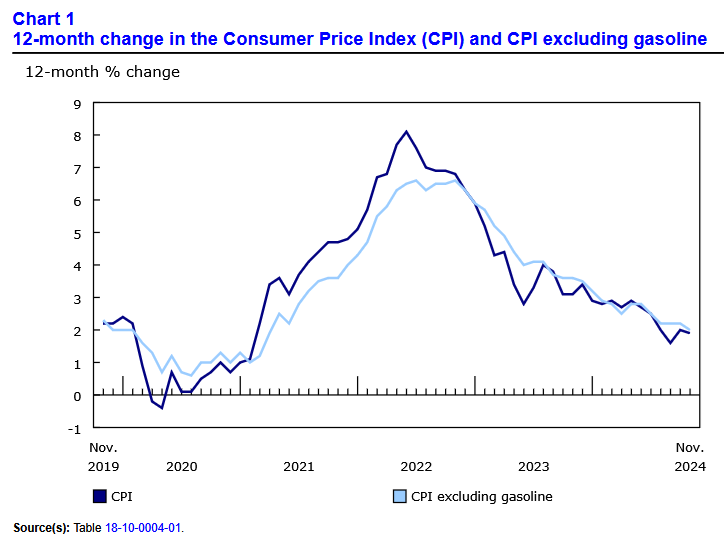

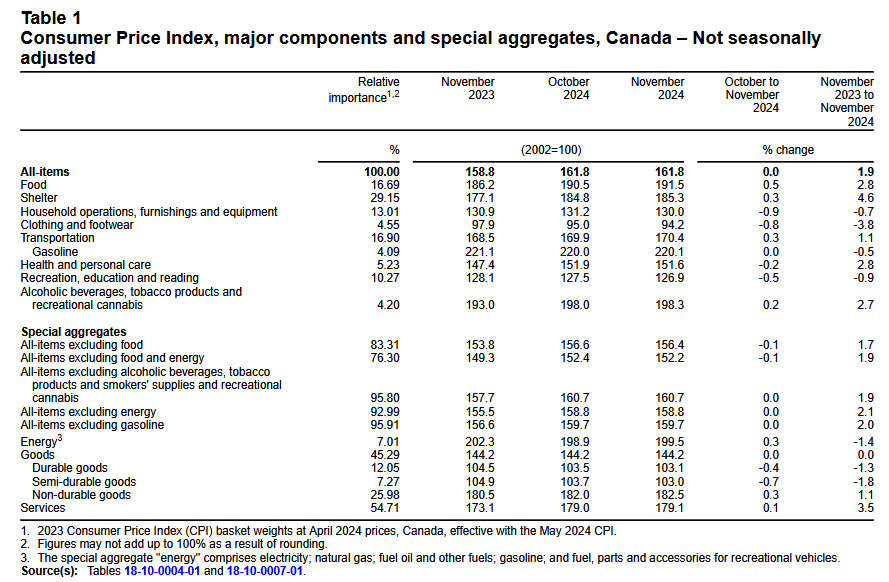

Canada’s consumer price index (CPI) rose by 1.9% year over year (Y-o-Y) in November, down from 2.0% Y-o-Y in October. Statistics Canada (StatsCan) published the data at 8:30 a.m. ET on December 17, 2024, via The Daily report. On a monthly basis, the CPI was flat in November, as subdued demand weighed on prices.

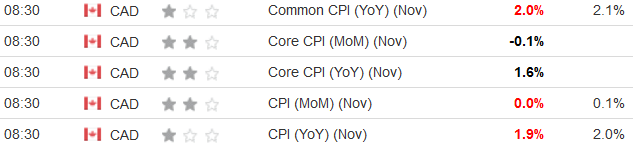

The CPI data came in slightly weaker than expectations, with most metrics missing economists’ consensus estimates. The table below is courtesy of Investing.com. The left column represents November’s figures, while the right column represents forecasters’ expectations. As you can see, the red figures should help the Bank of Canada (BoC) feel more confident in its dovish policy actions.

To that point, the BoC cut interest rates by another 50 basis points on Dec. 11. The press release stated:

“In Canada, the economy grew by 1% in the third quarter, somewhat below the Bank’s October projection, and the fourth quarter also looks weaker than projected….

“Reductions in targeted immigration levels suggest GDP growth next year will be below the Bank’s October forecast…. In addition, the possibility the incoming U.S. administration will impose new tariffs on Canadian exports to the United States has increased uncertainty and clouded the economic outlook.”

Thus, with demand pressures, demographics, and potential trade disruptions on the docket for 2025, the BoC may believe a more accommodative approach is prudent in the months ahead.

In November 2024, shelter and grocery inflation slowed to 4.6% and 2.6% Y-o-Y, respectively. However, both are up by 18.9% and 19.6% versus November 2021. Furthermore, rents accelerated to +7.7% Y-o-Y in November (versus +7.3% in October), with Ontario (+7.4%), Manitoba (+7.9%), and Nova Scotia (+6.4%) leading the way.

Core CPI Muted in November 2024

Core measures of the CPI were muted in November 2024, with the CPI-common index falling to +2.0% (from + 2.2%), while the CPI-median was flat at +2.6% (from +2.6%), as was the CPI-trim at +2.7% (from +2.7%). These measures exclude the impacts of food and energy, and the BoC places heavy emphasis on core measures because they provide a smoothed distribution of overall inflation.

Please note that food and energy prices are highly volatile and price spikes can occur for reasons outside of the BoC’s control. In contrast, core inflation is largely driven by consumer demand and gives the BoC a better sense of how the Canadian economy is functioning.

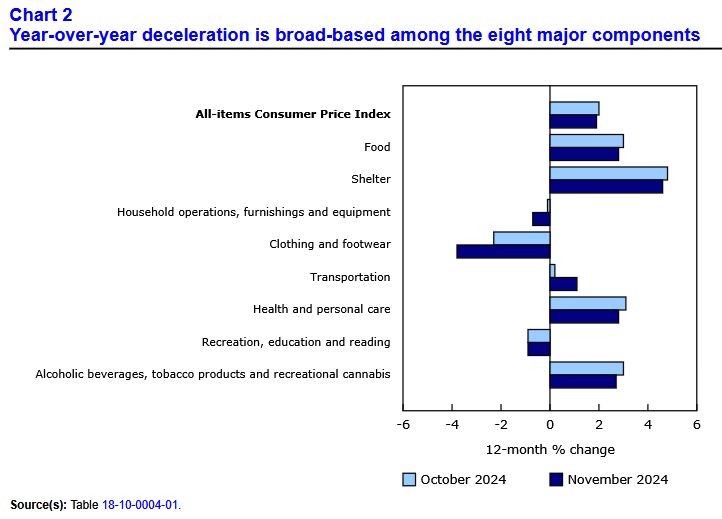

Sector Slowdown

Outside of transportation prices, disinflation was present across all the major sectors, with clothing, recreation, and household items realizing outright deflation.

For context, the eight sectors include food, shelter, household operations, furnishings and equipment, clothing and footwear, transportation, health and personal care items, recreation and education expenses, and alcohol and tobacco products.

Grocery Inflation Pulls Back

Grocery inflation rose by 2.6% Y-o-Y in November, down from 2.7% in October. The overall index (which includes food away from home) was up by 2.8%, rising by 0.5% on a monthly basis.

Look Out For the Loonie?

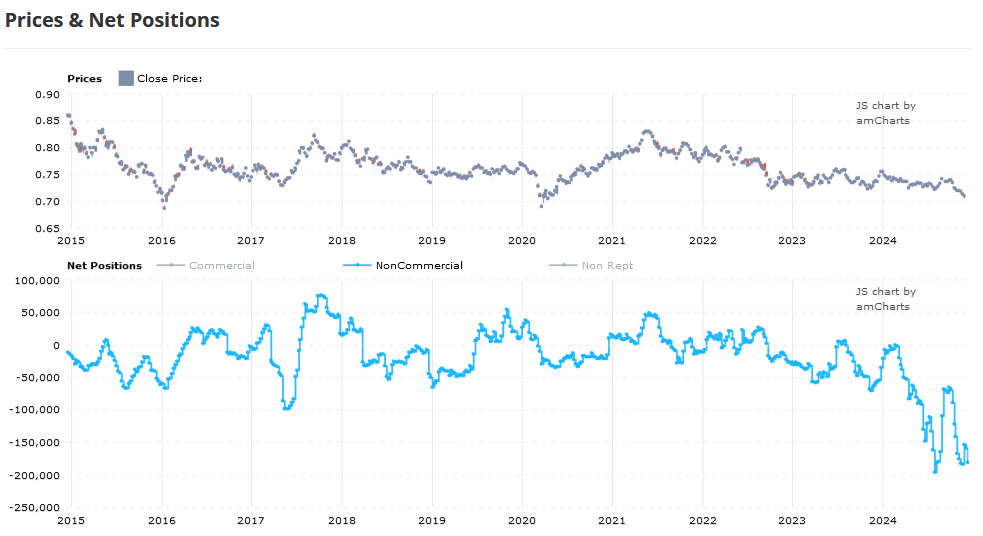

While the BoC’s dovish disposition may aid the housing market and borrowers with variable-rate debt, the Canadian dollar has suffered versus the USD.

To explain, the BoC’s relative easing has pushed Canadian interest rates well below U.S. interest rates. And with financial market speculators pouncing on the momentum, the Loonie is in a precarious position.

The gray line at the top half of the chart below tracks the CAD/USD exchange rate. As you can see, the pair is near the multi-year lows set in 2016 and 2020.

What’s more, the blue line at the bottom half tracks the net positions of speculative futures traders. The sharp drop on the right highlights how speculators have built up record CAD short positions — meaning they expect the Loonie to weaken further.

Yet, BoC Governor Tiff Macklem said during his Dec. 11 press conference, “Going forward, we will be evaluating the need for further reductions in the policy rate one decision at a time. In other words, with the policy rate now substantially lower, we anticipate a more gradual approach to monetary policy if the economy evolves broadly as expected.”

Consequently, the Loonie’s plight could play an important role in shaping the BoC’s 2025 policy decisions.

Overall, November’s CPI results aligned with the BoC’s long-term outlook. And with the U.S. Fed likely to follow suit, looser monetary policy is bullish for gold and silver, and precious metals should also benefit from ongoing geopolitical conflicts.

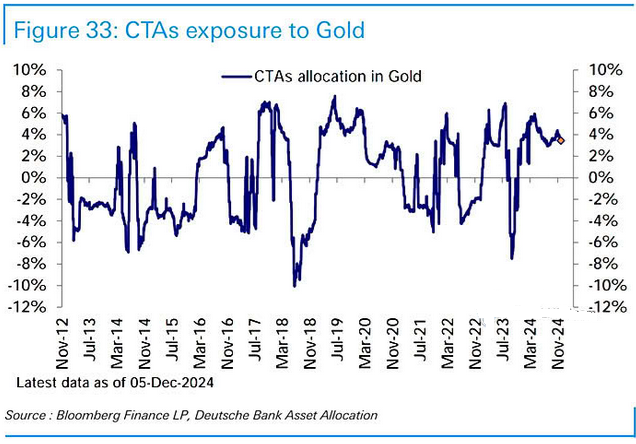

As it stands, the algorithms remain fans of gold, as the chart below highlights how CTA investment funds still have positive allocations to the yellow metal. Therefore, the favourable momentum should continue in 2025.

On top of that, precious metals assets such as gold and silver have typically held their value more reliably than stocks during periods of high inflation and global uncertainty. In today’s polarised environment, physical assets and commodities such as real estate and precious metals may provide a strategic hedge.

Dedicating a small portion of one’s TFSA or RRSP portfolio to precious metals may help mitigate some of the negative effects of inflation. If you want to get started with investing in metals such as gold and silver, read our free guide to gold buying in Canada in 2024 today.