While financial metrics like revenue, profit, and cash flow often dominate the thought process of Canadian business owners, insuring against issues like water damage, fires, security breaches, lawsuits, employee injuries, and professional mistakes is absolutely essential, and is where Zensurance comes in. In this post, we’ll review this new business insurance provider for Canadian businesses of all sizes…

About the Company

- URL: https://www.zensurance.com/

- Phone: 1-888-654 6030

- Email: support@zensurance.com

- Company HQ: Toronto, ON.

- Google Reviews: 4.8/5 stars (3,847 reviews)

- Trustpilot Reviews: 4.9/5 stars (905 reviews)

Zensurance Pros and Cons:

For a quick rundown of Zensurance’s strengths and weaknesses, please see our list below:

Pros:

- Reduces business insurance costs by up to 35% versus its competitors

- You can obtain commercial insurance for as little as $19 per month

- Zensurance partners with over 50 insurance providers and has more than 250 employees nationwide

- Excellent customer service

- Highly rated by applicants and policyholders

- Selected top business insurance provider by Amazon Canada

Cons:

- Zensurance is a broker and does not offer direct insurance policies

- Some may find the breadth of coverage options and add-ons confusing.

What Is Zensurance?

Zensurance is a Toronto-based fintech firm aiming to disrupt the business insurance landscape and be the go-to source for small business insurance in Canada. Their simplified userfriendly platform is designed to give business owners and entrepreneurs the ability to sign up for business insurance online in minutes, without needing to speak to a representative.

The company has accumulated almost 4,000 great reviews on their Google Business Profile at the time of writing this article. This makes it one of the highest-rated business insurance providers in the country. The company was also recently selected a preferred provider of business insurance by Amazon Canada.

The company more than 250 employees across the country and partners with over 50 insurance providers to help you obtain the best quotes. Its digital-first footprint helps Canadian small businesses reduce their insurance costs by up to 35%, which means more money to invest back into your company. Furthermore, most applications are completed within 24 hours.

To learn more about the merits of small business insurance, The Government of Canada highlights the benefits of protecting your business from adverse events.

How Does Zensurance Work?

Whether you own a retail business, sell on Amazon, rent Airbnbs, or run a restaurant, Zensurance can fulfill your commercial insurance needs for as little as $19 per month.

As a comparison site, the company does not offer direct insurance. Instead, it acts as a broker and partners with insurers to help you find the best coverage at the lowest rates. Customer service is available 24/7, and its team provides the guidance needed to help customers file claims.

Zensurance also makes it easy to switch insurance providers. If you’re unsatisfied with your coverage or curious about what other options are available, you can show the company your policy, and the team will work to help you find more coverage at a better rate.

Unfortunately, the cost of insurance varies depending on your business, assets, number of employees, location, etc. In other words, the infinite number of variables makes it impossible to provide generic quotes. As a result, you’ll have to apply through Zensurance to determine the costs of different plans.

Who Can Obtain Coverage At Zensurance?

With a well-rounded assortment of plans and additional coverage choices, Zensurance offers 13 solutions for several types of businesses. The following options are available:

- Builder’s Risk Insurance

- Errors & Omissions Insurance

- Commercial Auto Insurance

- Commercial General Liability Insurance

- Commercial Property Insurance

- Cyber Liability Insurance

- Directors & Officers Liability Insurance

- Event Liability Insurance

- Legal Expense Insurance

- Liability Insurance

- Malpractice Insurance

- Product Liability Insurance

- Professional Liability Insurance

How Do I Apply For Coverage Through Zensurance?

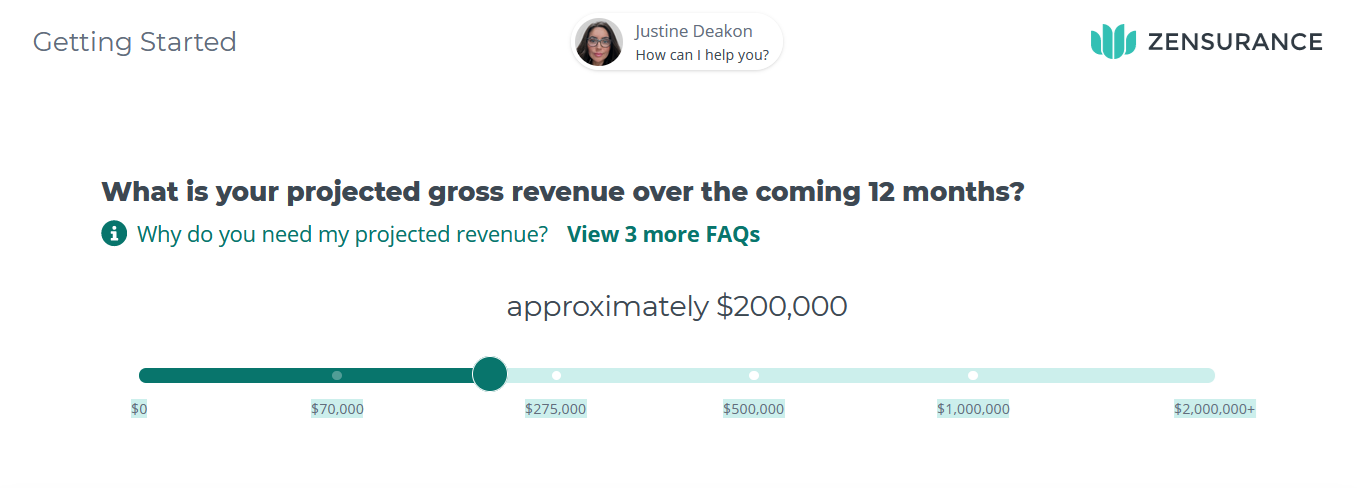

To inquire about pricing, simply visit Zensurance’s homepage and click “Get a Free Quote.” For this example, we chose a restaurant company. You’ll be asked about the nature of your business and your projected gross revenue over the following 12 months.

Next, you’re asked about alcohol sales, side businesses, the company’s years of operation, and how many years of experience you and your partners have.

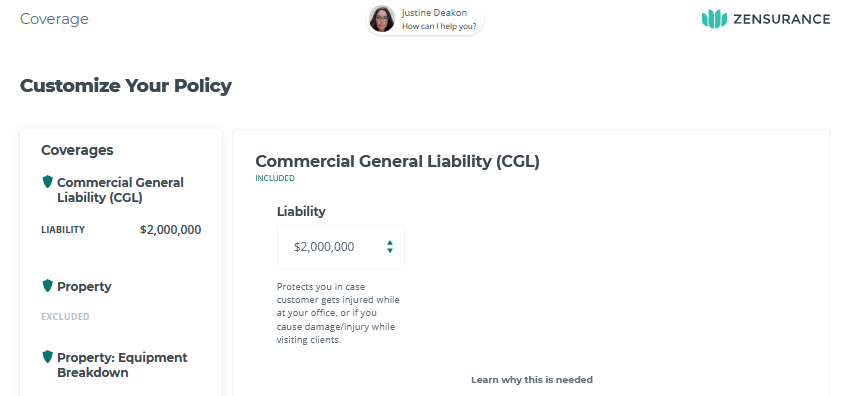

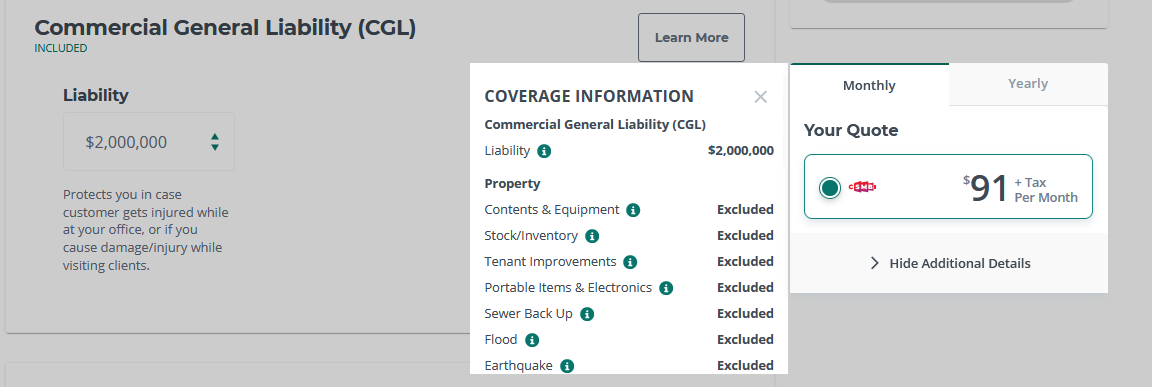

Next, Zensurance asks about the different attractions at your venue to get a better sense of the potential risks and liabilities. After a few more questions, you’re asked to enter the business location and customize your policy. You can also add additional protections if you want.

Finally, you’re granted a quote after answering all the questions and you can expand the section to see what’s covered in your policy. The application process was simple and takes minimal effort to view the options available.

Does Zensurance Offer Individual Coverage?

Because Zensurance prioritizes commercial insurance, it doesn’t offer individual plans. However, to obtain personal insurance, you may want to consider PolicyMe. The fintech firm is a Canadian life and critical care insurance broker, and like Zensurance, it partners with reputable insurers to help you obtain the best coverage and rates.

In addition, PolicyMe provides direct policies through its collaboration with the Canadian Premier Life Insurance Company. The former generates quotes from the latter, and the two work together to determine the most affordable plans.

The main attraction is that you can obtain life and critical care insurance for 10% to 20% less than comparable Canadian insurers, and you can also qualify for $10,000 in free coverage for your children. Life insurance coverage ranges from $100,000 to $5,000,000, with terms extending from 10 to 30 years, while critical care insurance has the same terms, but payouts range from $10,000 to $1,000,000.

On top of that, the company’s reviews are highly positive, and satisfied applicants cited excellent customer service as one of the traits that set PolicyMe apart from the competition. To learn more about whether the company is right for you, please see our PolicyMe Review.

How Do Customers Feel About Zensurance?

Zensurance boasts exceptional ratings on Google and Trustpilot. The majority of the reviews cited affordability, excellent customer service, and help choosing the right policy. Some of the testimonials stated:

- In gaining the required insurance for my profession, I had the pleasure of dealing with Brandon Bowie. He was extremely knowledgeable, very kind, and made the whole process extremely easy and stress-free! Brandon was on top of everything and ensured I was agreeable along every step of the process. Would highly recommend Zensurance.

- The quote that was given to me was based on what I needed and was given purchase options which enabled me to keep the cost down. There were no pressure tactics used to have me purchase my policy with them. Once discussing the terms of my policy with Alexandria Anthony and seeing that she was extremely personable, professional, helpful and knew every aspect of the job. I didn’t look any further.

- Zensurance is such a pleasure to deal with. They try to keep the insurance file as uncomplicated as possible, while still retaining professionalism and protecting the client from their own shortcomings. Reminders and guidance procedures are built into their customer relations protocols. Zensurance keeps things in good order if the client meets them halfway. Zensurance personnel are terrific.

Thus, with customer reviews often the best indicator of a company’s merits, plenty of policyholders believe Zensurance is legit.

How Do We View Zensurance?

There is a lot to like about Zensurance, as cheaper policies mean less out-of-pocket costs for your business. Moreover, fintech’s digital-only business models often include less human staff, which results in poor customer service. However, Zensurance bucks the trend, and the plethora of positive reviews highlights Canadians’ belief in the service.

As a result, you have little to lose by answering a few questions and obtaining a free, no-obligation quote.

If you want to sign up or learn more, visit: https://www.zensurance.com/