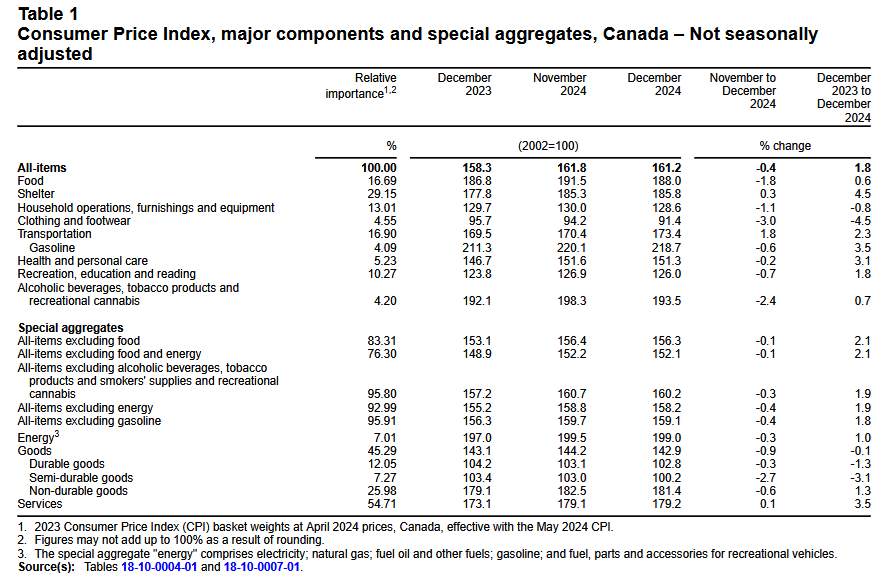

Canada’s consumer price index (CPI) increased by 1.8% year over year (Y-o-Y) in December, slipping from 1.9% Y-o-Y in November. Statistics Canada (StatsCan) published the data at 8:30 a.m. ET on January 21, 2025, via The Daily report. On a monthly basis, the CPI declined by 0.4%, although it rose by 0.2% on a seasonally-adjusted basis.

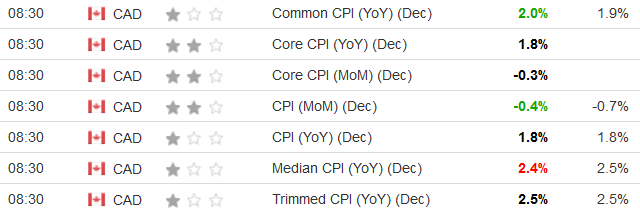

The overall results were mixed, as two metrics outperformed, one missed, and the others matched economists’ consensus estimates. The table below is courtesy of Investing.com. The left column represents December’s figures, while the right column represents forecasters’ expectations.

While the Bank of Canada (BoC) had been on a relatively clear path, U.S. President Donald Trump clouded the outlook on Jan. 20 when he said, “We’re thinking in terms of 25 per cent [tariffs] on Mexico and Canada. I think Feb. 1.… I think we’ll do it Feb. 1. On each.” Consequently, more macro uncertainty should reign for the next few weeks.

In December 2024, the GST/HST holiday had a material impact. Restaurant prices fell by 1.6% Y-o-Y in December, with its largest periodic decline of 4.5% during the GST/HST break. Alcoholic beverage prices also sunk by 4.1% during the holiday, a new record, and nearly triple the December 2005 reading of -1.4%.

Muted Core CPI in December 2024

Core measures of the CPI were well behaved in December 2024, with the CPI-common index holding at +2.0% (from + 2.0%), while the CPI-median fell to +2.4% (from +2.6%), and the CPI-trim to +2.5% (from +2.6%). These measures exclude the impacts of food and energy, and the BoC places heavy emphasis on core measures because they provide a smoothed distribution of overall inflation.

Please note that food and energy prices are highly volatile and price spikes can occur for reasons outside of the BoC’s control. In contrast, core inflation is largely driven by consumer demand and gives the BoC a better sense of how the Canadian economy is functioning.

Sector Slowdowns

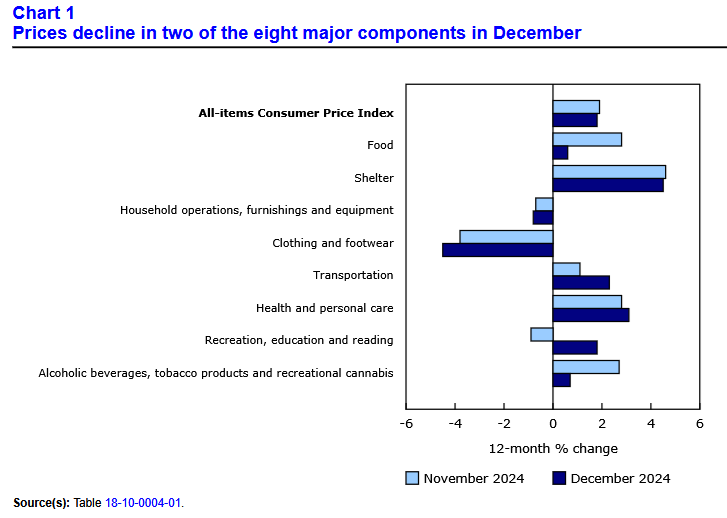

Transportation, health, and recreation prices outperformed in December, while all other sectors came in below November’s readings.

For context, the eight sectors include food, shelter, household operations, furnishings and equipment, clothing and footwear, transportation, health and personal care items, recreation and education expenses, and alcohol and tobacco products.

Grocery Inflation Falls

Food inflation declined by 1.8% in December, as the segment was one of the “major components impacted by the tax break.”

Subtle Strength in Canada?

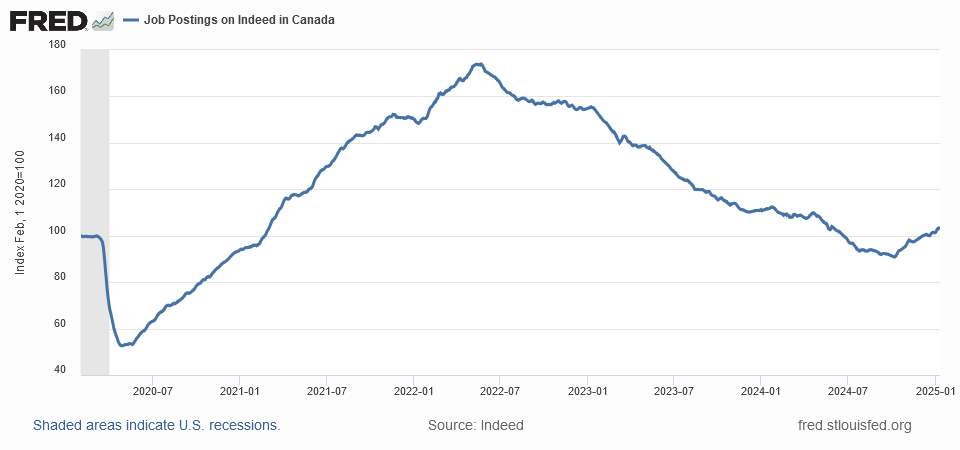

While Trump’s tariff threats garner all of the attention, the Canadian economy has quietly rebounded in recent months. For example, Indeed revealed on Jan. 15 that its Canada job postings index rose to 103.82, which is a noticeable jump from the October 2024 low of 90.83.

Likewise, Indeed’s Jan. 13 report noted:

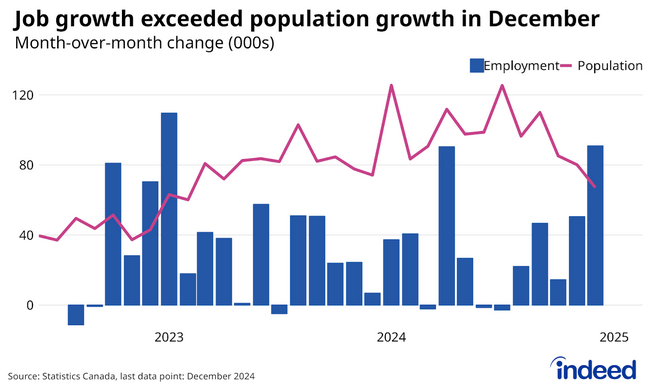

“At last, a meaningfully positive surprise from the Canadian job numbers to end 2024. For the first time in nearly two years, the number of people working rose by more than the size of the population (91,000 vs. 67,000). Hours worked also posted solid gains after flatlining for much of the second half of the year. Meanwhile, the unemployment rate partially reversed its November pop, coming in at 6.7%.”

Finally, the BoC released its latest Business Outlook Survey on Jan. 20. The report stated:

“After a period of weak demand, firms expect their sales growth to improve over the coming year. This expectation is largely driven by recent interest rate reductions and the anticipation of further cuts ahead….

“With lower financing costs and improving demand outlooks, intentions to increase investment have become more widespread among firms. Part of this is a resumption of previous plans that were postponed.”

As such, while tariffs will be the talk of the town for the foreseeable future, Canadian economic data is trending in the right direction.

Overall, December’s CPI results aligned with the BoC’s long-term outlook. And with the U.S. Fed likely to follow suit (trade wars are bad for all economies), looser monetary policy is bullish for gold and silver, and precious metals should also benefit from ongoing geopolitical conflicts.

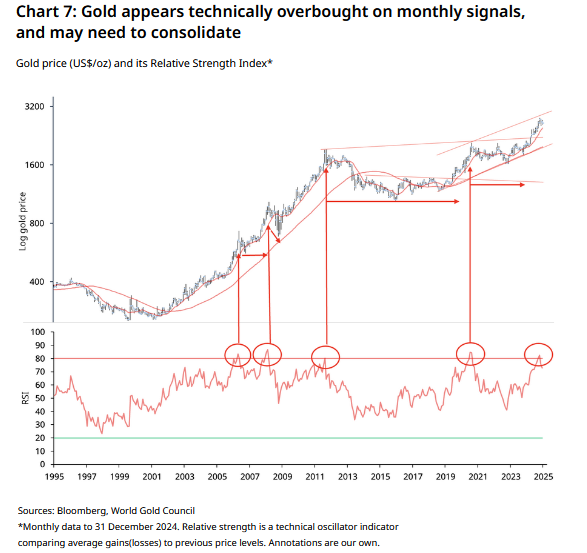

To that point, while the World Gold Council noted on Jan. 8 that overbought technicals could facilitate a short-term pullback, “the core uptrend looks well cemented and any near-term weakness could be viewed as an opportunity for investors to re-engage in gold at more attractive levels.”

Furthermore, precious metals assets such as gold and silver have typically held their value more reliably than stocks during periods of high inflation and global uncertainty. In today’s polarised environment, physical assets and commodities such as real estate and precious metals may provide a strategic hedge.

Dedicating a small portion of one’s TFSA or RRSP portfolio to precious metals may help mitigate some of the negative effects of inflation. If you want to get started with investing in metals such as gold and silver, read our free guide to gold buying in Canada in 2024 today.