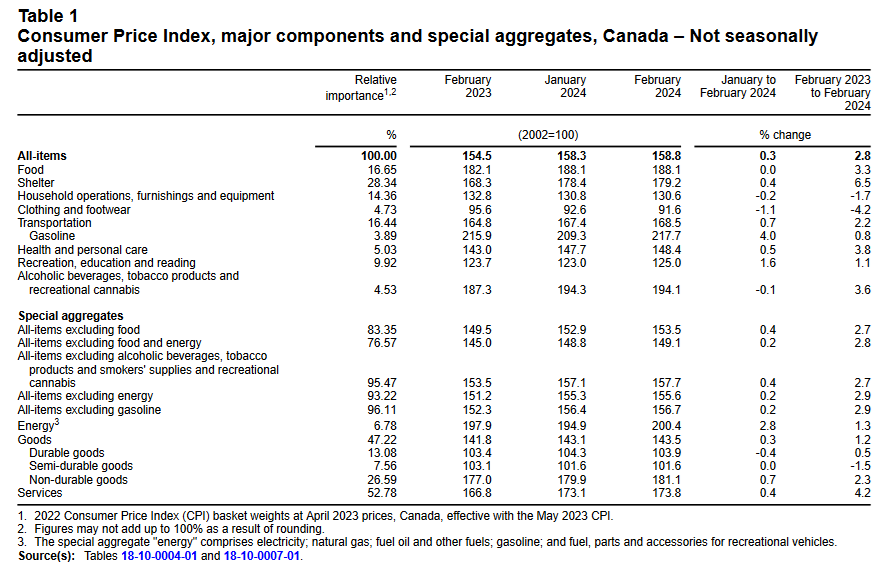

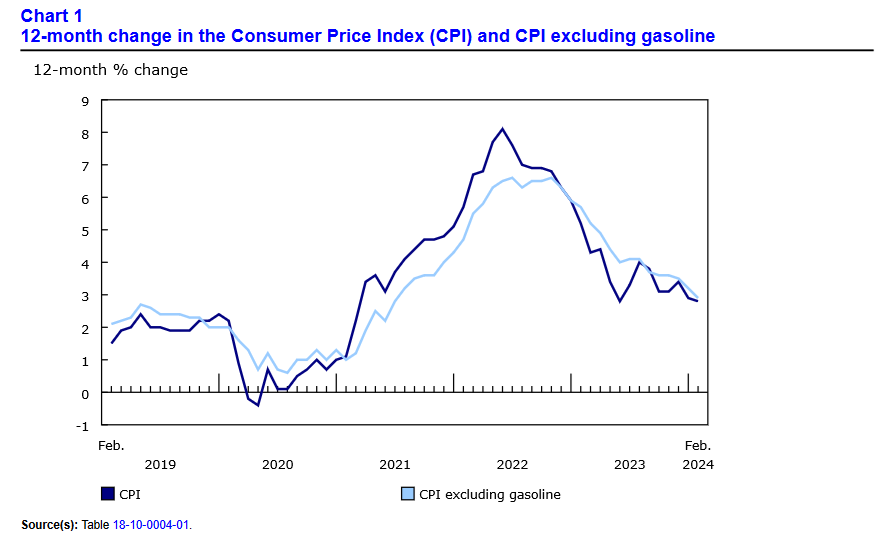

Canada’s consumer price index (CPI) rose by 2.8% year over year (Y-o-Y) in February, down from 2.9% Y-o-Y in January. Statistics Canada (StatsCan) published the data at 8:30 a.m. ET on March 19, 2024, via The Daily report. On a monthly basis, the CPI increased by 0.3% in February, a noticeable acceleration from the muted results in January.

Despite that, the data came in weaker than expected according to BNN, as Canadian economists predicted the Y-o-Y figure would remain at 2.9%. The results were a welcome sign for the Bank of Canada (BoC), as the monetary body continues to grapple with sluggish economic growth.

Moreover, while BoC Governor Tiff Macklem remains conscious of supporting growth at the expense of reigniting inflation, he also has to contend with a weaker loonie that could materialize if the BoC cuts rates. Given the Fed’s hawkish stance in the U.S. weakening the Canadian dollar versus the U.S. dollar would increase the cost of future imports and potentially enhance inflation.

However, the BoC said on March 6 that it “continues to expect inflation to remain close to 3% during the first half of this year before gradually easing.” As a result, the February print should further the committee’s belief in its projections, even though “the Council is still concerned about risks to the outlook for inflation, particularly the persistence in underlying inflation.”

In February 2024, month-over-month inflation was largely driven by higher gasoline prices (+4.0%), recreation, education, and reading (+1.6%), transportation (+0.7%), and non-durable goods (+0.7%).

Source: Statistics Canada (Table 18-10-0004-01)

Core CPI Falls in February 2024

Core measures of the CPI in February 2024 fell across the board, with the CPI-common index falling to +3.1% (from +3.3%), the CPI-median falling to +3.1% (from +3.3%), and the CPI-trim falling to +3.2% (from +3.4%). These measures exclude the impacts of food and energy, and the BoC noted how “the share of [core] CPI components growing above 3% declined but is still above the historical average” and it “wants to see further and sustained easing in core inflation.”

Thus, February’s results should provide further indication that inflation is trending in the right direction.

Source: Statistics Canada (Table 18-10-0004-01)

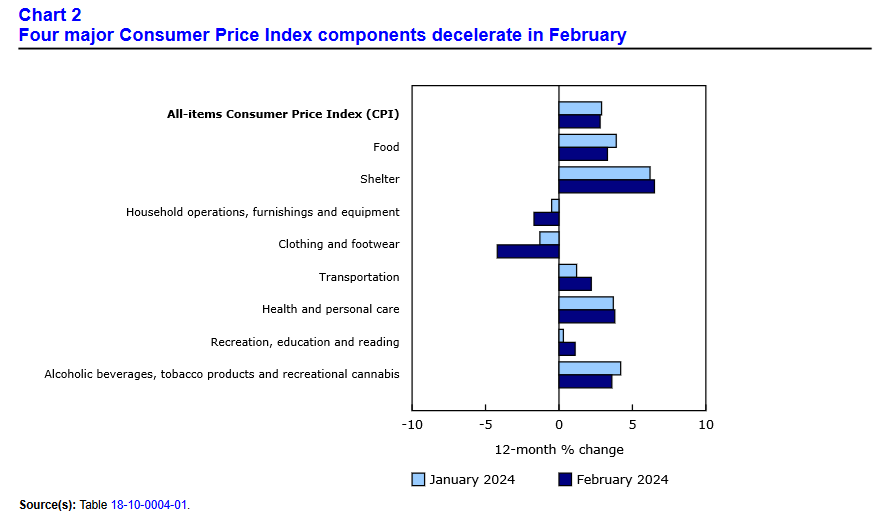

Price Relief Across 4 of 8 Major Sectors

On a Y-o-Y basis, slower pricing pressures were present in four of the eight major categories. These include food, shelter, household operations, furnishings and equipment, clothing and footwear, transportation, health and personal care items, recreation and education expenses, and alcohol and tobacco products.

Clothing and household products recorded outright deflation in February, while shelter remained problematic and transportation prices showed a noticeable increase.

Source: Statistics Canada (Table 18-10-0004-01)

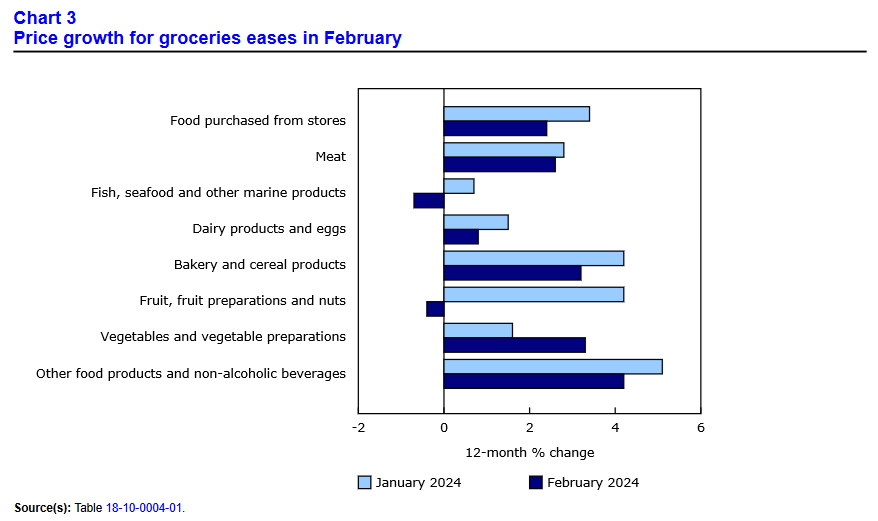

Grocery Inflation Slows in February

Y-o-Y food inflation was less problematic this month. The decline was headlined by lower prices for fresh fruit (-2.6%), processed meat (-0.6%), and fish (-1.3%), while other food preparations (+1.4%), preserved fruit and fruit preparations(+4.0%), cereal products (+1.7%) and dairy products (+0.6%) showcased lower increases relative to their January figures.

Notably, February was the first month since October 2021 that grocery inflation was weaker than the headline figure, although, base effects played a key role.

In addition, the cumulative effect is palpable. From February 2021 to February 2024, grocery inflation has risen by 21.6%.

Source: Statistics Canada (Table 18-10-0004-01)

Will They or Won’t They: The Rate-Cut Dilemma

With inflation hovering near the BoC’s 1% to 3% target range, economists are convinced that four or five rate cuts are on the table in 2024. Moreover, with Canadian job openings falling toward their pre-pandemic baseline and real GDP growth below trend in recent months, the case for lower rates has become more justified.

However, with the Teranet–National Bank House Price Index showcasing strength, home price appreciation makes the BoC concerned about cutting rates. The committee noted how a hot housing market could increase shelter costs and reignite an upward trend for inflation.

“If the housing sector rebounds in the spring, shelter price inflation could be pushed up, delaying the return of CPI inflation to the (two per cent) target,” the BoC said. “If inflation proves more persistent than expected, monetary policy would likely need to remain restrictive for longer.”

Thus, while inflation and higher interest rates have hit low-income Canadians the hardest, it remains a balancing act for the BoC to determine the right solution at the right time.

As a proactive measure to protect your wealth from further deterioration, historically, precious metals assets such as gold and silver have held their value more reliably than stocks during periods of high inflation. In today’s economic environment, physical assets and commodities such as real estate and precious metals may provide a strategic hedge against inflation. Given gold and silver’s recent accelerations, several market participants have adopted a similar view.

Dedicating a small portion of one’s TFSA or RRSP portfolio to precious metals may help mitigate some of the negative effects of inflation. If you want to get started with investing in metals such as gold and silver, read our free guide to gold buying in Canada in 2024 today.