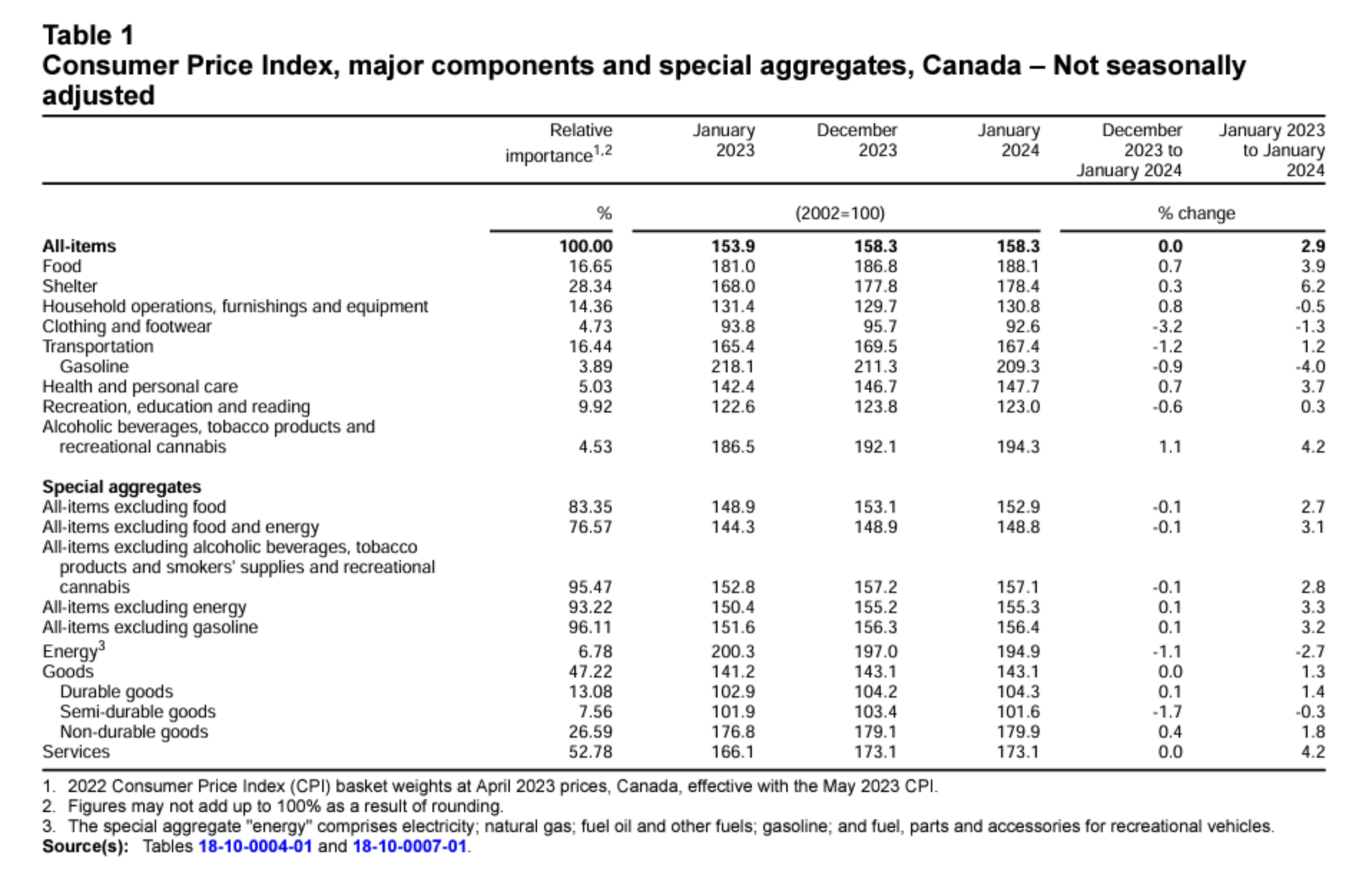

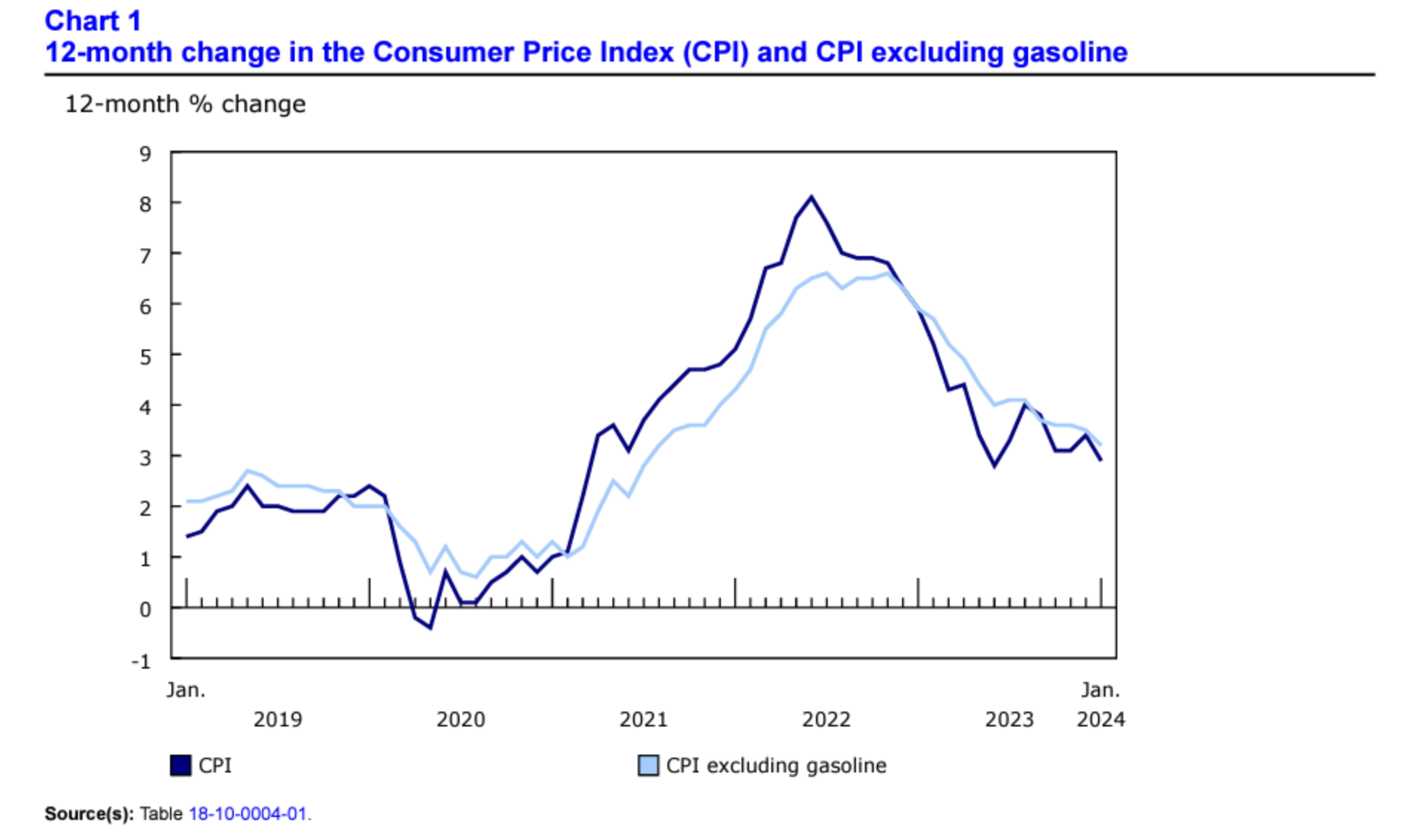

Canada’s consumer price index (CPI) rose by a sizable margin in January 2024, rising by 2.9% year over year (Y-o-Y) per today’s Statistics Canada (StatsCan) The Daily report published at 8:30 a.m. on February 20, 2024. On a monthly basis, the CPI decelerated by –0.3% in January, matching the level of price deceleration seen in December 2023 and a precipitous fall from November 2023’s rise of +0.1%.

The rise in this month’s CPI reading was softer than expected, with economists having forecasted a Y-o-Y rise of 3.3% in January per BNN Bloomberg. This month’s deceleration, therefore, constitutes a significant slowdown in Canadian inflation relative to expectations. Excluding mortgage and rent, which have seen massive immigration-driven price increases on the demand side, the Y-o-Y inflation rate adjusts to 1.5%.

This month’s figure is in line with the official Bank of Canada forecast of 3.0% or lower by the end of 2023—only, this target was reached one month later than they would have hoped.

Despite the Bank of Canada being tight-lipped about any firm timeline for initiating interest rate cuts, today’s positive CPI report indicates that rate cuts are very likely on the horizon in the first half of 2024. A precondition for interest rate cuts in Canada is several consecutive months of downward momentum in inflation. Therefore, positive inflation reports in March and April may set the stage for interest rate relief for Canadians.

In January 2024, inflation deceleration was largely driven by declining gasoline prices—excluding gasoline, the CPI clocked in higher, at +3.2% Y-o-Y. Meanwhile, food price inflation finally saw some price relief, seeing the lowest inflationary rise since March 2021 (+0.1%). Mortgages were the primary driver of upward price pressure per today’s report (+27.4%), while rents also saw significant Y-o-Y price increases (+7.9%).

Now, let’s take a closer look at Canada’s January 2024 CPI report to see exactly how and where prices are continuing to change in Canada.

Source: Statistics Canada (Table 18-10-0004-01)

Core CPI Falls in January 2024

Core measures of the CPI in January 2024 fell across the board, with the CPI-common index falling to +3.4% (from +3.9% in December), the CPI-median falling to +3.3% (from +3.5%), and the CPI-trim falling to +3.4% (from +3.7%). Per CBC, the headline core inflation rate steadied to +3.2% in January, which excludes gasoline prices and other sectors that see above-average volatility. This marks a continued trend since mid-2022 in which core, non-volatile market sectors have steadily declined in prices.

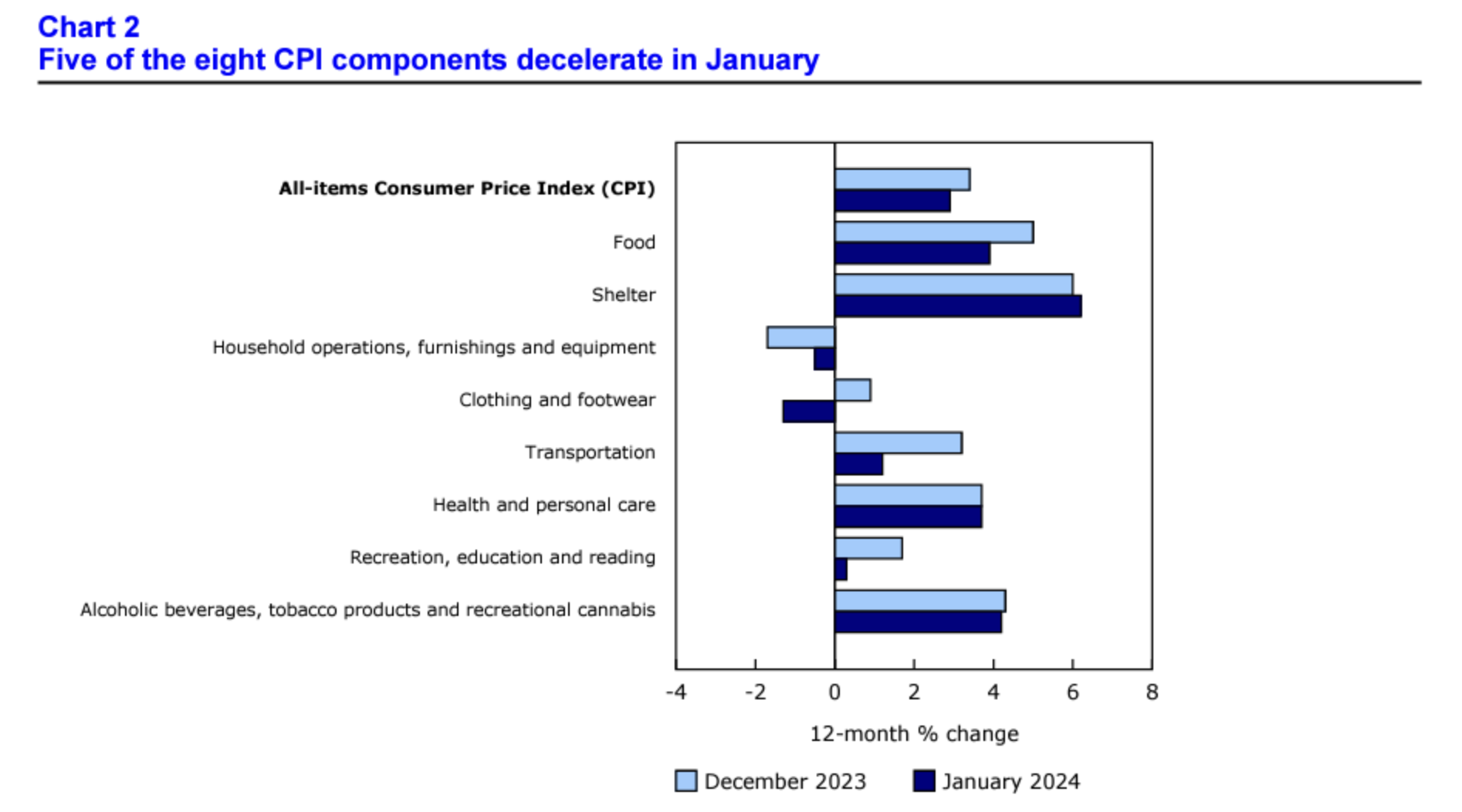

Broad Price Relief Across 5 of 8 Major Sectors

Over the past 12 months, Canadians have seen significant price deceleration in a majority of the eight dominant consumer spending categories, including food, clothing and footwear, transportation, health and personal care items, recreation and education expenses, and alcohol and tobacco products. Notably, two categories (clothing and household operations and furnishings) have seen price deflation on a Y-o-Y basis. As gasoline prices have now declined for a fifth-straight month (-0.9%), transportation and logistics costs have fallen across the board, precipitating cost reductions in various economic sectors.

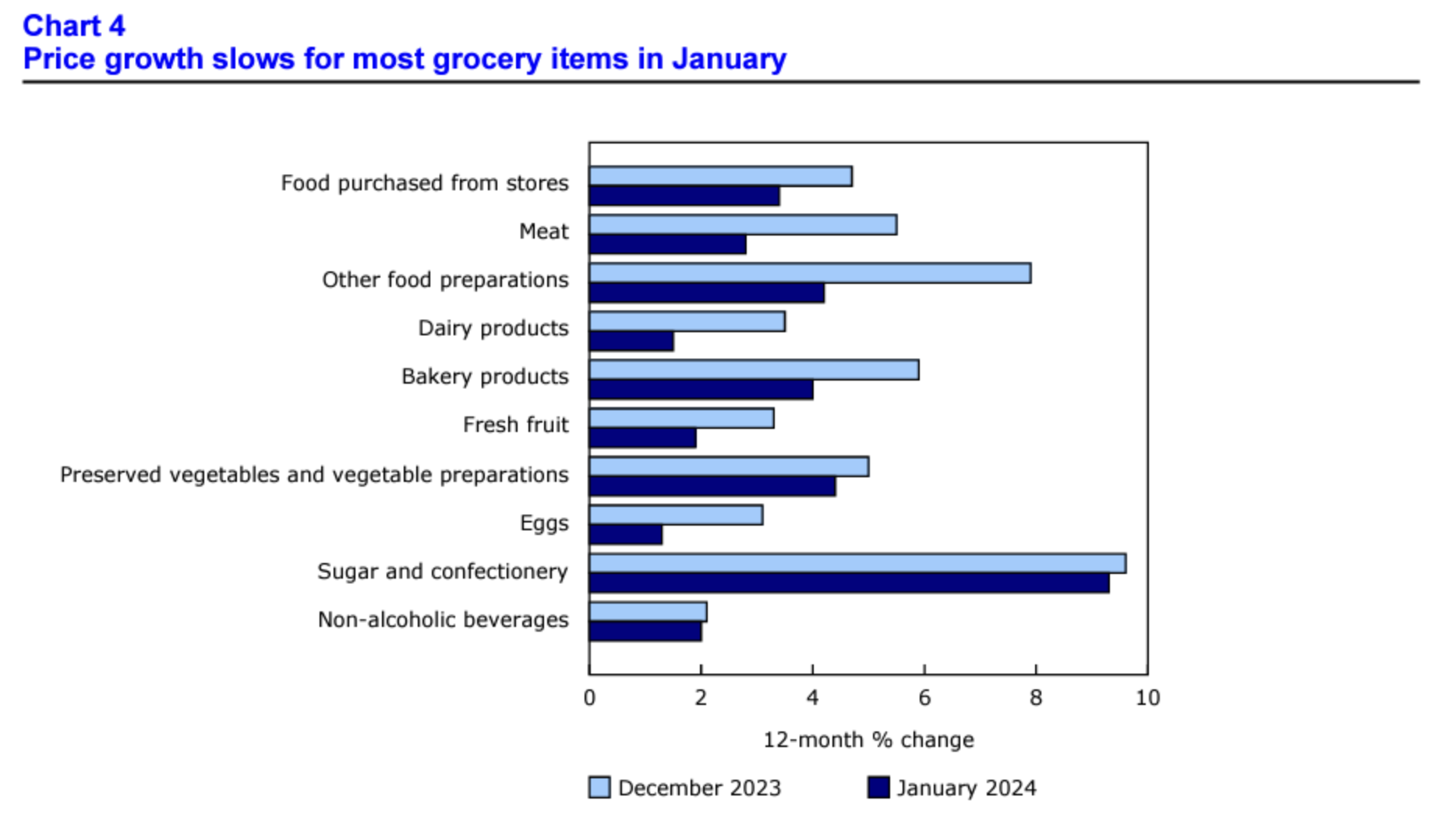

Widespread Price Relief on Grocery Items in January

Canadians have finally started to see some relief when it comes to sticker shock in the grocery aisles. On a Y-o-Y basis, the inflation rate for food goods at the supermarket fell in every category in January 2024, with the most significant deflationary effects seen in eggs and dairy products. On the whole, the grocery index slowed to +3.4% in January, down from +4.7% the previous month. Notably, some food items saw price declines this month, including soup (-2.1%), bacon (-8.4%), and shrimps and prawns (-3.4%).

With Cooling Inflation, Rate Cuts May Be On The Table for June

For the first time since last June, inflation is back within the Bank of Canada’s “control range” of 1 to 3 percent. Hopefully, this will speed up the conversation around interest rate cuts. BNN Bloomberg still anticipates between four and five rate cuts to come later this year, with the first potentially coming as early as June by 25 basis points. Given Canada’s success in reining in inflation so far this year, Canada’s central bank may beat the Federal Reserve to initiate a dovish pivot.

Despite this month’s positive inflation data, “last mile” inflation may be more stubborn than expected. There’s still a long road ahead to get to the Bank of Canada’s target inflation rate of two percent, and an expected 250 basis points’ worth of rate cuts in 2024 may interfere with Canada’s ability to hit this target.

Unfortunately, runaway deficit spending and poor macroeconomic management have likely made inflation a long-term reality for many Canadians—a population using food banks at never-before-seen rates. While inflation continues to take a heavy toll on Canadians’ bottom line, there are, fortunately, proactive measures you can take to protect your wealth from further deterioration.

Historically, precious metals assets such as gold and silver have held their value more reliably than stocks during periods of high inflation. In today’s economic environment, physical assets and commodities such as real estate and precious metals may provide a strategic hedge against inflation. Given that gold broke its all-time high in December (US$2,135 per troy ounce), current market dynamics indicate that gold is a resilient asset amid rapid price acceleration.

Dedicating a small portion of one’s TFSA or RRSP portfolio to precious metals may help mitigate some of the negative effects of inflation. If you want to get started with investing in metals such as gold and silver, read our free guide to gold buying in Canada in 2024 today.

Report Cited: https://www150.statcan.gc.ca/n1/en/daily-quotidien/240220/dq240220a-eng.pdf?st=cwRR_y_-