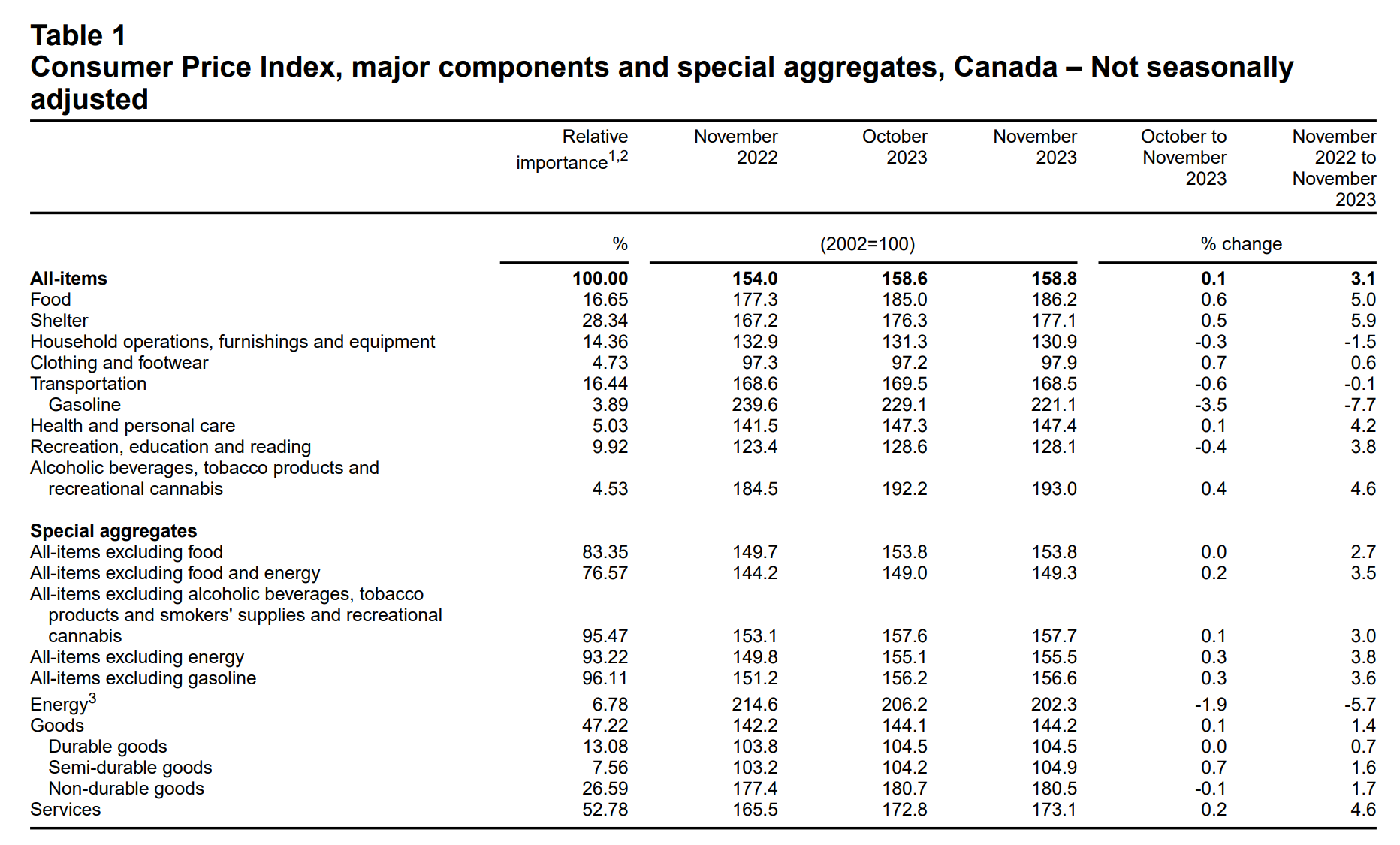

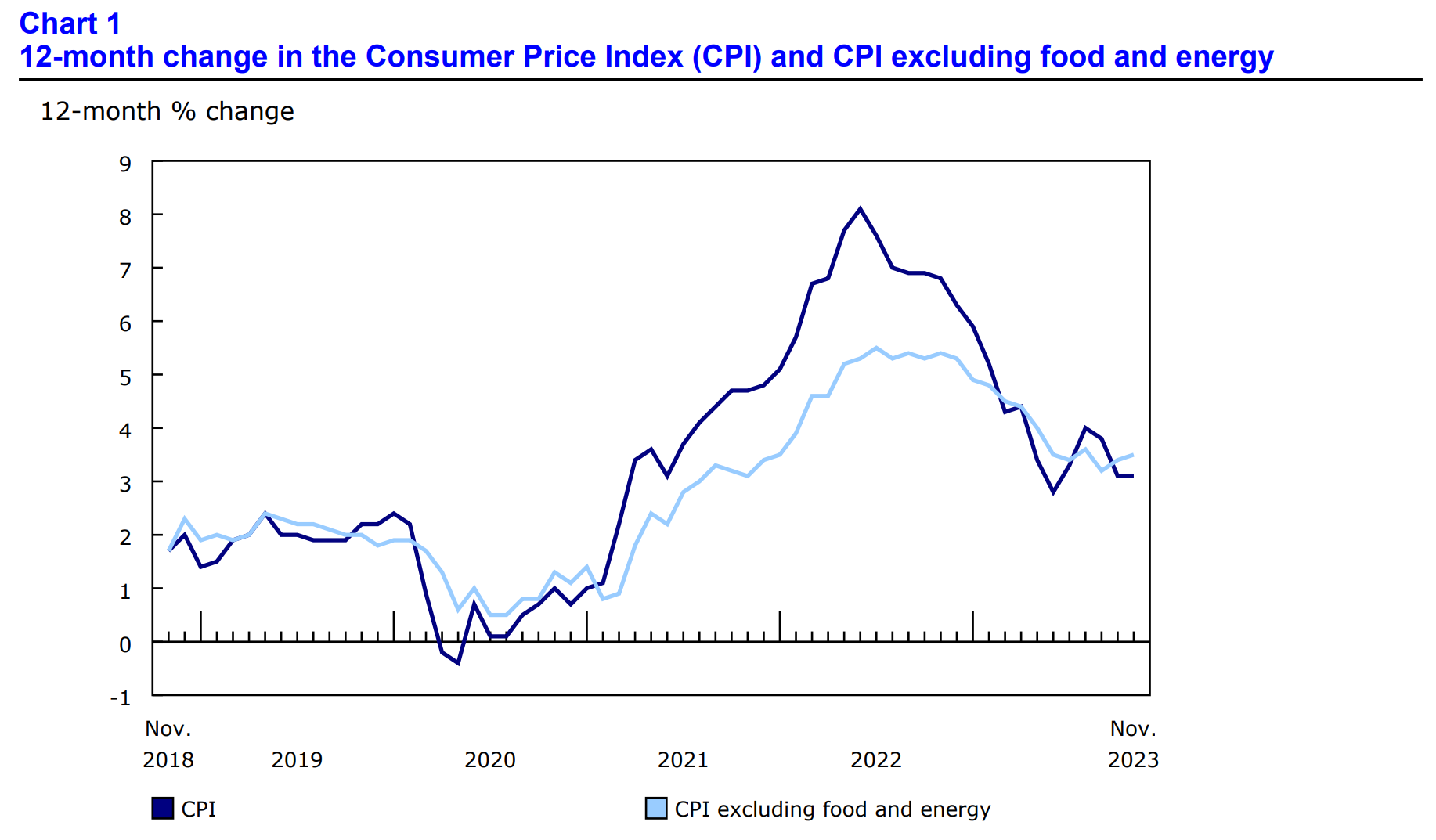

Canada’s consumer price index (CPI) remained unchanged in November 2023, rising by 3.1% year over year (Y-o-Y) per today’s Statistics Canada (StatsCan) The Daily report published at 8:30 a.m. on December 19, 2023. This matches the level of price acceleration seen in October 2023’s 3.1% CPI reading last month.

The financial media reported on Tuesday’s CPI reading with mixed reception, with the Financial Post citing that the 3.1% figure exceeded analysts’ expectations, as well as those of the Bank of Canada. A Reuters poll indicated that inflation was forecasted to fall to 2.9% from 3.1% on a yearly basis, while marking a 0.1% decline on a month-over-month basis. These price decelerations, however, did not come to fruition.

Despite November’s disappointing inflation news, experts still forecast that the Bank of Canada will cut interest rates in 2024 and reverse the hawkish monetary policy campaign that they have maintained throughout 2023. A precondition for interest rate cuts in Canada would be several consecutive months of downward momentum in inflation. Therefore, today’s inflation reading may have delayed next year’s interest rate cuts. This month’s inflation report also comes in higher than the Bank of Canada’s predicted 3.0% inflation rate which the central bank set as a benchmark for the second half of 2023.

Inflation in November 2023 was largely driven by basic staple expenses such as rent (+7.4%), food purchased from stores (+4.7%), and mortgage interest costs (+29.8%). However, downward price pressure was also seen in the report due to lower cellular service prices and lower fuel oil prices. Below, we’ll take a closer look at Canada’s October 2023 CPI report to see how and where prices are changing in Canada.

Source: Statistics Canada (Table 18-10-0004-01)

Core CPI Spikes in November

In November, the CPI excluding gasoline changed course and rose by 0.1% relative to October. The core CPI (including both “CPI-trim” and “CPI-median”) both decelerated in October, continuing a longstanding downward trend since 2022. The CPI-trim index was 3.5 in September, remaining unchanged from October, as well as the CPI-median which was 3.5% in both October and November. The “CPI-trim” metric tracks the core CPI reading in Canada, minus the outlying extremes on the tail ends of the price distribution.

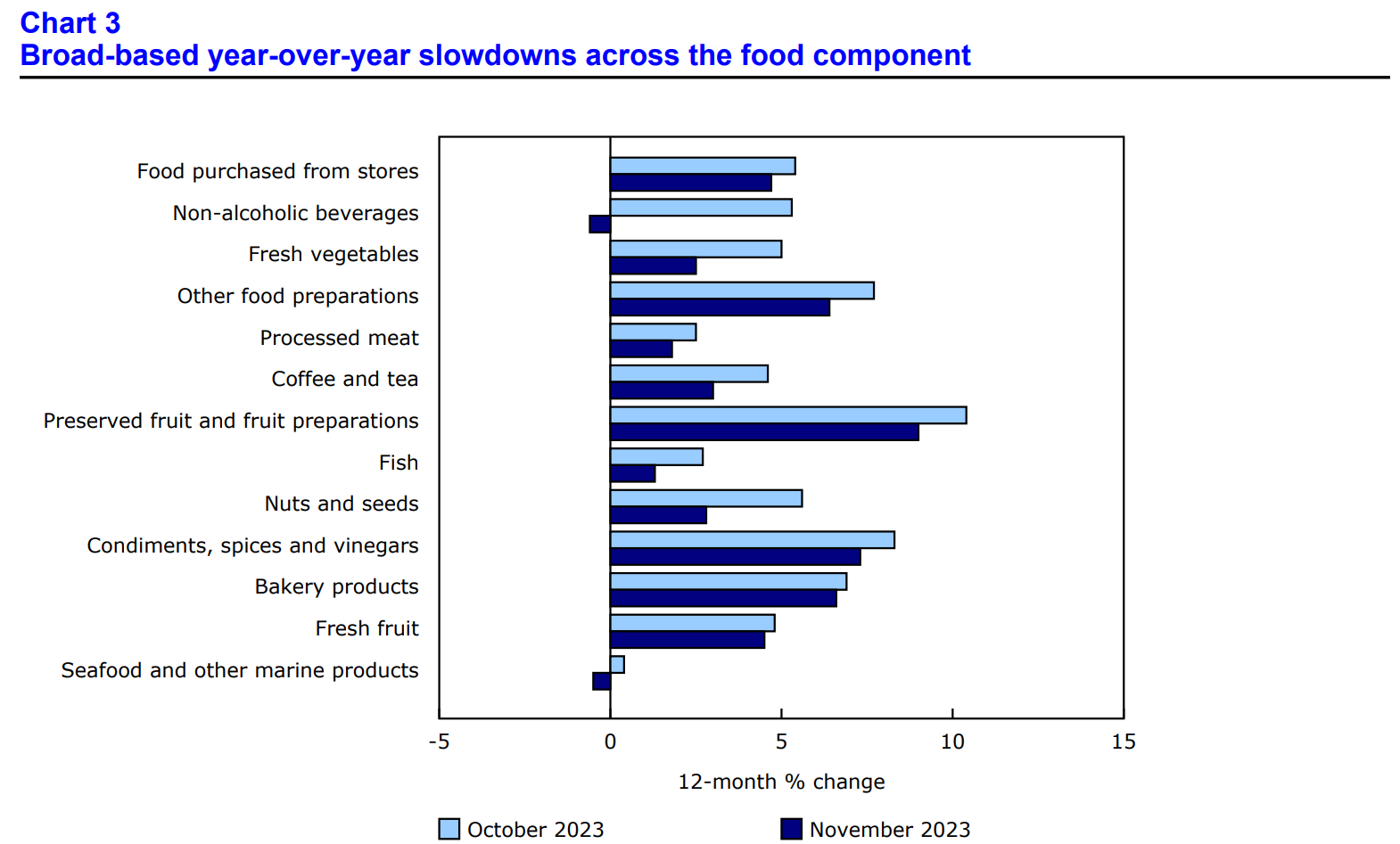

Broad Consumer Price Relief for Food Items in November

November saw many food components decelerate in price, including non-alcoholic beverages, fresh vegetables, processed meat, fish, fruit, and bakery products. Although food purchased from stores rose in price by 4.7%, this marks a substantial deceleration from October’s 5.4% price growth. Prices have been decelerating in Canadian supermarkets for five consecutive months. On the other hand, certain food categories such as meat (+5.0%) and preserved vegetables (+5.8%) accelerated in price.

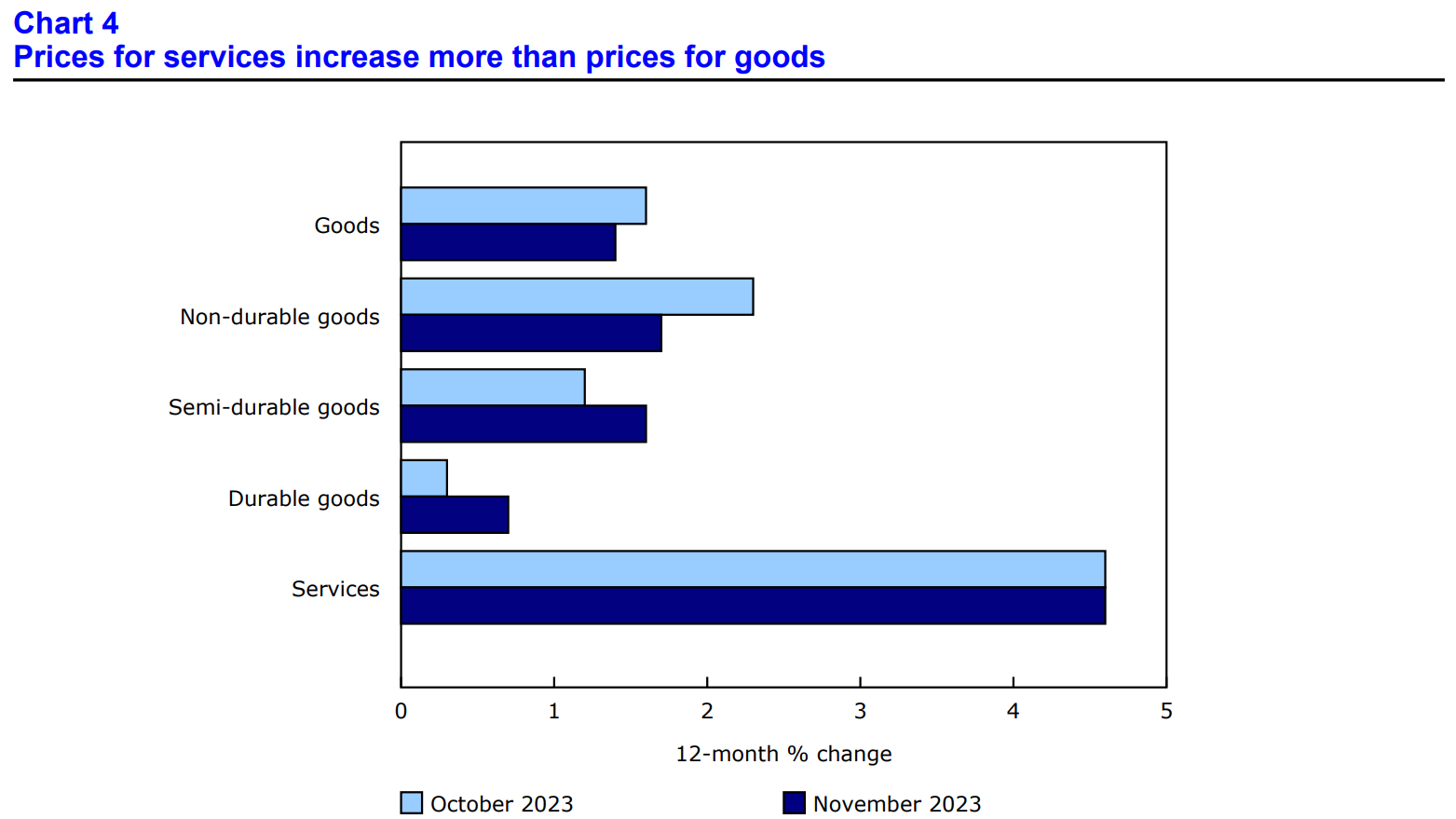

Goods Fall, Services Stagnate in November’s CPI Report

Most CPI inclusion categories decelerated on a 12-month basis in November, with the notable exception of services. The services index remained unchanged from October (+4.6%). There were some noteworthy items that accelerated by a large margin in November on a year-over-year basis, such as prices for travel tours (+26.1%). However, cellular service prices in Canada fell by 22.6% in November due, at least in part, to promotional Black Friday pricing.

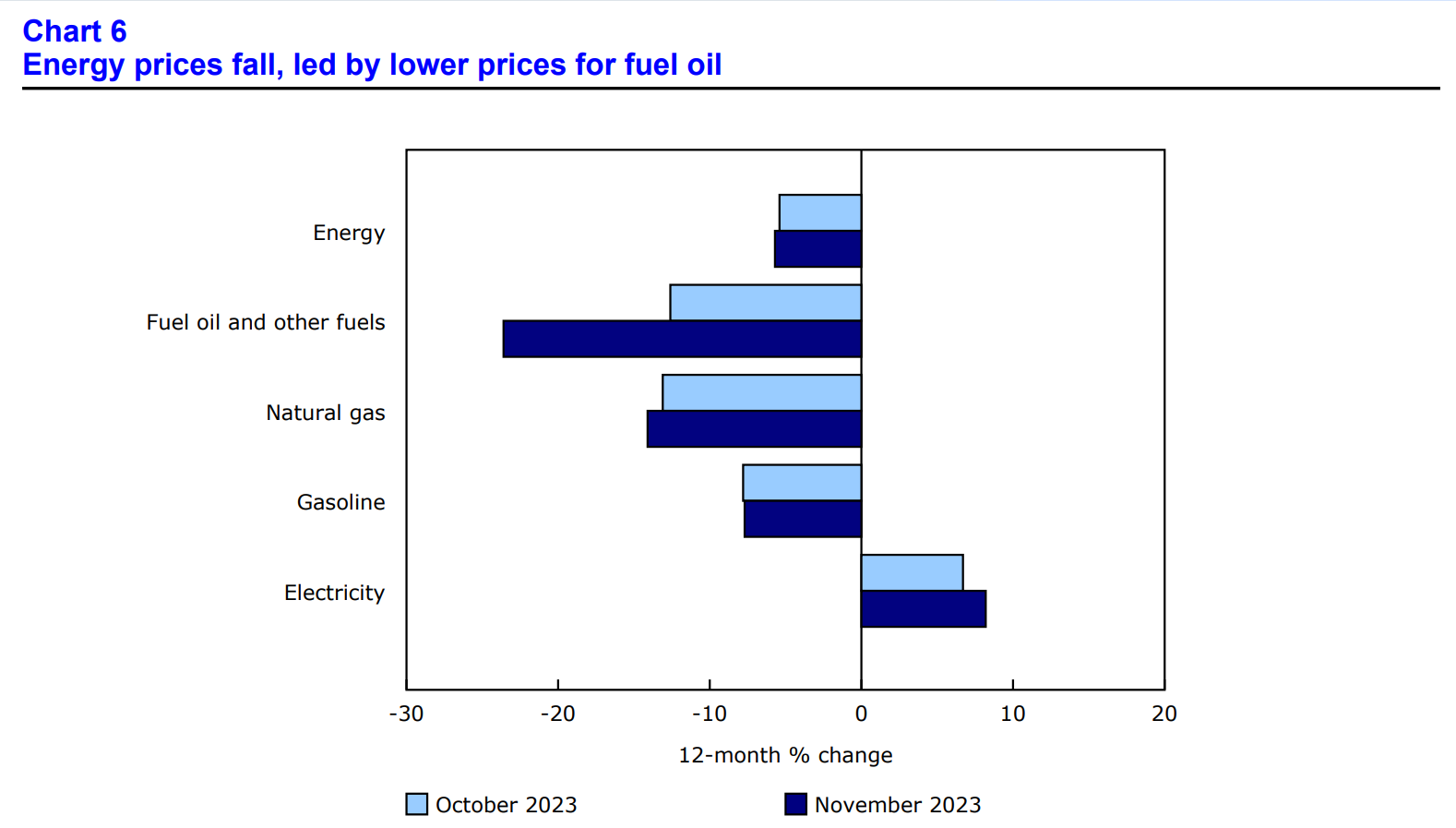

Energy Prices Continue to Fall, Electricity Slightly Spikes

Following a summer in which gasoline prices hovered around 1.70 CAD per litre, many Canadians have finally found relief at the gas pump. Across the board, several energy prices have fallen in recently months. Each of the five principal energy categories continued to fall in November, building on October’s decleration, with the notable exception of electricity which rose by 8.2% in November. On the whole, the energy index in Canada fell by 5.7% in November, a steeper deceleration than in October (-5.4%).

Inflation Got You Down This Holiday Season? Diversify With Trusted Assets

It feels like inflation just won’t quit on Canadians. Despite a target inflation rate of 3.0 percent or lower set by Canadian central banks for H2 2023, we still haven’t seen a single month hit that mark. Unfortunately, runaway deficit spending and poor macroeconomic management have made inflation a long-term reality for many Canadians who simply want to put food on the table and gifts under the tree this holiday season.

The pain of high inflation doesn’t appear to be going anywhere soon, but, fortunately, there are proactive measures you can take to safeguard your wealth before it gets any worse.

Precious metals such as gold and silver have historically held their value more reliably than stocks during inflationary periods. Physical assets and commodities such as real estate and precious metals may provide a strategic hedge against adverse market conditions such as inflation, recessions, and more. Dedicating a small portion of one’s TFSA or RRSP portfolio to precious metals may help mitigate some of the deleterious effects of inflation.

Want to get started with investing in metals such as gold and silver? Browse our free guide to gold buying in Canada in 2023 and 2024 to learn how to add physical metals to your investment accounts.

Report Cited: https://www150.statcan.gc.ca/n1/daily-quotidien/231219/dq231219a-eng.htm