Canada’s consumer price index (CPI) increased by 1.8% year over year (Y-o-Y) in December, slipping from 1.9% Y-o-Y in November. Statistics Canada (StatsCan) published the … Read More

9 Equipment Loans For Startup Businesses in Canada (2025)

If you’re an up-and-coming manufacturer, or a business in need capital to build out your assembly line, equipment loans are practical pathways to increasing your … Read More

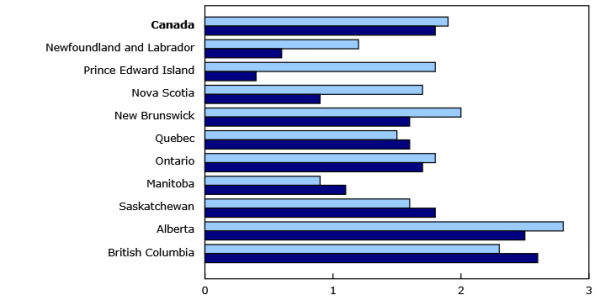

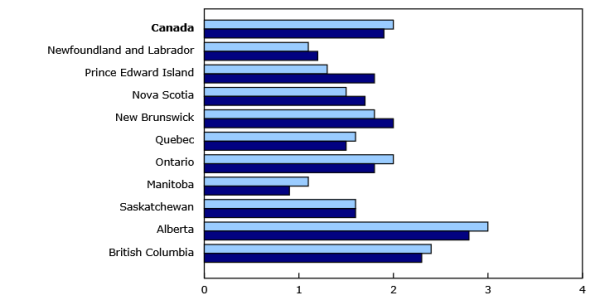

The Consumer Price Index Stalls (+0.0%) in November 2024, Hits 1.9% Y-O-Y

Canada’s consumer price index (CPI) rose by 1.9% year over year (Y-o-Y) in November, down from 2.0% Y-o-Y in October. Statistics Canada (StatsCan) published the … Read More

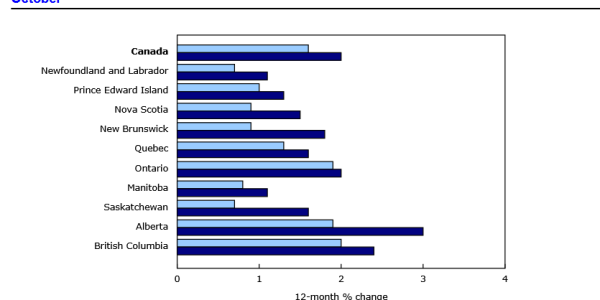

The Consumer Price Index Jumps (+0.4%) in October 2024, Hits 2.0% Y-O-Y

Canada’s consumer price index (CPI) rose by 2.0% year over year (Y-o-Y) in October, up from 1.6% Y-o-Y in September. Statistics Canada (StatsCan) published the … Read More

6 Logging & Forestry Equipment Loans in Canada (2025)

As in any business, specialized equipment is essential in the logging and forestry industry. Whether you are looking to expand operations, replace aging machinery, or … Read More

Farm Equipment Financing For Bad Or No Credit: 8 Places To Go

Do you work in agriculture? If so, you already know how demanding the business is, so deciding how to finance farming equipment should not add … Read More

Gym Equipment Financing: 7 Ways to Get a Loan Without Breaking the Bank (2025)

Do you have a business in the fitness industry? Is the company new or undergoing expansion? If so, purchasing gym equipment can require a sizable … Read More

Dump Truck Financing in Canada: 5 Loans You Can Apply For.

If you’re looking to finance a dump truck in Canada, there are a variety of loans tailored to fit your needs, whether you’re an established … Read More

LoansCanada – Legit Loan Broker? (2024 Review)

Loans Canada (www.LoansCanada.ca) is one of Canada’s largest loan brokers. They offer a free search engine that allows loan seekers to connect with 50+ lenders … Read More

Quantifi Lending Inc. – Should You Choose This Auto Loan Provider? (2024 Review)

When searching for auto financing options in Canada, the vast range of lenders can make the process feel overwhelming. Each auto loan provider promises several … Read More