If you’re searching for a Merchant Growth review because a bank said “no” (or you just need money fast), you’re not alone. A lot of Canadian small businesses hit cash-flow crunches that banks move too slowly to solve: inventory orders, payroll weeks, equipment repairs, seasonal slowdowns, tax remittances, you name it. In this review, we’ll break down what Merchant Growth offers, who it’s actually a fit for, what to watch out for (daily/weekly repayments and pricing), and how it compares to other Canadian funding options.

Need fast business funding in Canada?

If your business is established and bringing in revenue, checking eligibility is a quick way to see potential amounts and repayment structure before you waste time.

Tip: Always compare at least 2–3 offers so you understand pricing and repayment options.

Quick verdict

- Best for: Canadian businesses that need speed and can handle shorter terms and frequent payments.

- Not ideal for: startups, thin cash-flow, or anyone who needs long repayment terms.

- Bottom line: Legit option to compare when banks are too slow or too strict. Just be very clear on total cost and repayment cadence.

Merchant Growth overview

| Company | Merchant Growth Ltd. |

| Head office | Suite 200 – 171 Water St, Vancouver, BC |

| Website | www.merchantgrowthcapital.com |

| Common loan sizes | Typically smaller working-capital to mid-size growth financing (amounts vary by business profile) |

| Products you’ll see most | Term financing, lines of credit, and cash-flow-based options (your offer depends on revenue + statements) |

| Where they lend | Canada-wide (all provinces and territories) |

| Trustpilot | ⭐⭐⭐⭐⭐ 4.8/5 (650+ reviews) |

| BBB | A+ rating (note: BBB customer review score can differ from the letter rating) |

Pros & cons of Merchant Growth

👍 Pros

- Fast decisions and funding compared to banks.

- Built for real-world cash flow (retail, restaurants, trades, services).

- Options beyond a basic term loan if you need flexibility.

- Online-friendly process with straightforward document requests.

- Canada-wide availability, not limited to one province.

👎 Cons

- Total cost can be high versus banks and some credit unions.

- Frequent repayments (daily/weekly) can squeeze tight months.

- Shorter terms mean bigger payments, even if the rate looks “okay”.

- Not ideal for brand-new startups with limited history.

Who Merchant Growth is a good fit for

- Established businesses (usually 6+ months) with consistent deposits and card sales.

- Owners who need money fast for inventory, equipment repairs, marketing, staffing, or expansion.

- Businesses that can comfortably handle weekly or daily payments without starving operations.

When you should probably skip it

- You need long-term financing (multi-year) to spread payments out.

- Your cash flow is already fragile and a daily/weekly withdrawal would create NSF fees.

- You qualify for a bank or credit union loan at a meaningfully lower total cost.

What they offer

Merchant Growth is generally positioned as an alternative lender for Canadian SMEs. In practice, your offer depends on revenue, statements, and the overall health of the business.

- Term financing: Lump sum, fixed repayment schedule. Best when you know exactly what the money is for.

- Line of credit: Flexibility to draw what you need. Better for uneven months and seasonal businesses.

- Revenue-based / card-sales-based options: Often used when card volume is strong and speed matters.

If you’re not sure what type you need, start with a simple rule: short-term working capital (inventory, payroll, repairs) can make sense with shorter terms, but long-term projects often need longer amortization so payments don’t crush cash flow.

Typical requirements (what most businesses need)

- Canadian business operating in any province/territory.

- Time in business: commonly 6+ months.

- Revenue: many approvals are easier at ~$10,000+/month in consistent deposits (lower may still be considered depending on the file).

- Documents: business bank statements, ID, and basic business details; additional docs depending on product.

If you want a broader overview of approval criteria across Canada, see our guide on how to qualify for a small business loan in Canada.

Want to see real terms for your business?

Eligibility checks can clarify potential loan size, repayment frequency, and whether the numbers make sense before you commit.

Pro tip: Ask for a clear breakdown of total repayment and whether there are prepayment terms.

How the application usually works

- Apply online with basic business info.

- Share statements (and card processing info if relevant).

- Review the offer carefully: payment frequency, total repayment, term length, and any fees.

- Funding once documents are finalized.

Local relevance: major Canadian cities they commonly serve

Because Merchant Growth lends Canada-wide, you’ll see clients across the country. We most often hear from business owners in places like Vancouver, Calgary, Edmonton, Winnipeg, Toronto, Ottawa, Montréal, and Halifax, especially in retail, hospitality, trades, logistics, and professional services.

Merchant Growth vs. other Canadian funding options

If you’re comparing lenders, here’s a quick and practical overview. The “best” choice usually comes down to speed vs. total cost and how well the repayment schedule fits your cash flow.

| Option | Best for | Tradeoffs |

|---|---|---|

| Big banks / credit unions | Lowest cost when you qualify | Slower, stricter underwriting, more paperwork |

| BDC | Growth-focused financing and longer-term projects | Can still be slower than alternative lenders |

| Merchant Growth | Fast funding for established SMEs | Higher cost vs banks, frequent repayments |

| Journey Capital | Alternative lending with quick turnaround | Pricing depends heavily on profile and term length |

| Driven | Fast access to capital for qualifying businesses | Rates/terms vary; compare total repayment |

| Swoop | Comparing multiple funding routes in one place | You’ll still need to review offers lender-by-lender |

If you’re trying to qualify with weaker credit, you may also want to read our guide to bad credit business loans in Canada and our explainer on asset-backed financing (useful when you have equipment, vehicles, or receivables).

What to ask before you sign anything

- What’s the total payback? (Not just the rate.)

- How often are payments pulled? Daily, weekly, or monthly?

- Is there a prepayment option? If you repay early, do you save money?

- Any origination or admin fees? Get them in writing.

- What happens if revenue dips for a month? Ask how they handle temporary slow periods.

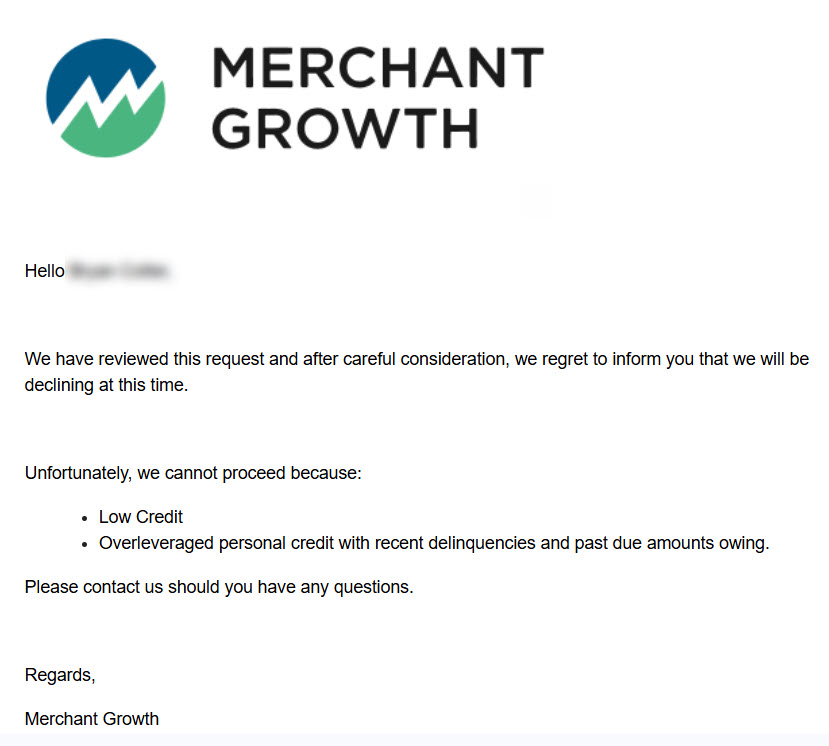

Does Merchant Growth accept everyone?

No. They’re more flexible than most banks, but they still look for a minimum level of stability in the business and cash flow. If your application doesn’t fit their criteria, you may receive a decline notice similar to the example below.

Final thoughts: should you trust Merchant Growth?

Merchant Growth is a legitimate Canadian alternative lender to compare when speed matters or the bank route is moving too slowly. Where people get burned with any short-term financing is not the lender’s existence, it’s signing an offer that doesn’t match cash flow. If your revenue is consistent and you understand the repayment cadence and total cost, it can be a practical tool.

If you’re close to qualifying for a traditional loan, consider improving your profile first. Our Canadian guide on improving your credit score can help you move into better pricing over time.

Ready to compare numbers?

If Merchant Growth is on your shortlist, start with an eligibility check and then compare it to at least one bank/credit union quote so you can make a clean decision.

Get Started With Merchant Growth

Disclosure: We may receive a referral commission if you apply through this link.