Should you consider Nyble (www.nyble.com) instead of a traditional loan? I think you should. Especially if you need a small loan (up to $250) and want to pay 0% interest. Nyble also offers credit building tools. In this review, we’ll dive into Nyble and its pros and cons….

About the Company

- URL: https://www.nyble.com/

- Phone: Not Available

- Email: support@nyble.com

- Company HQ: Toronto, ON

- Trustpilot Reviews: 4.8/5 stars (5,610 reviews)

- Apple Store Reviews: 4.8/5 stars (1,357 reviews)

☝IMPORTANT 2025 TIP:

➔ Lost control of your existing debt? Need help? Reach out to Consolidated Credit Canada as you may qualify for 50%-70% debt relief. Don’t take another loan if you’re already struggling with your existing debt load.

Nyble Pros and Cons:

Before downloading the Nyble app, please see our list outlining the company’s strengths and weaknesses.

Pros of Nyble:

- You can obtain a line of credit ranging from $30 to $250 (not a traditional loan)

- There are no credit checks, interest, or fees

- Free members receive the funds in 0-3 business days

- On-time repayments can increase your credit score

- Highly rated by users

- Great customer service

Cons of Nyble:

- There is a $0.99 monthly fee to link your bank account

- You must have employment or recurring government income

- It usually takes time to obtain the full $250 credit limit

What Is Nyble Canada?

When your paycheck is days away and bills are piling up, where can you turn? Personal loans? Payday loans? A cash advance on your credit card? The options may seem prudent under the right circumstances, but they typically have longer wait times and/or more out-of-pocket costs. This is where Nyble’s no-fee credit line might come in handy…

In contrast to all the above options, a no-fee line of credit can provide peace of mind when you need it most. But, with plenty of players in the short-term lending space, should Nyble Canada be near the top of your list?

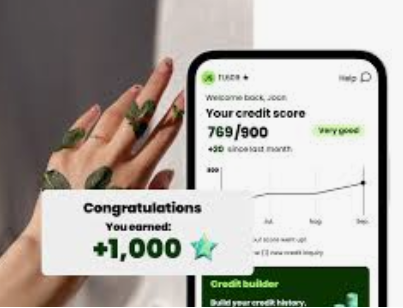

Nyble is a fintech firm that helps you build credit with confidence. Designed to help Canadians restore their credit scores, Nyble provides interest-free lines of credit that rival cash advances. Each time you make a payment, Nyble reports the activity to credit bureaus like Equifax and TransUnion. Over time, diligent repayment can improve your credit score and help you obtain cheaper financing in the future. The strategy is especially beneficial if you hope to obtain a mortgage or auto loan with the best rates and lowest fees.

Does Nyble Offer Loans?

Technically, Nyble does NOT offer loans in the traditional sense.

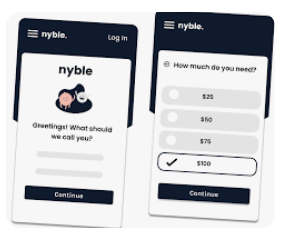

Instead, they offer small interest-free cash advances through a line of credit: usually between $30 and $250.

- ✅ No interest charges

- ✅ No credit check

- ✅ No traditional loan application

- ❌ Not a lump-sum loan like you would get from a bank or lender.

In other words: If you need a few hundred dollars to cover bills until your next paycheck, Nyble’s line of credit works more like a short-term cash buffer — not a full personal loan like Alterfina, Spring Financial, Journey Capital or others can get you.

From a credit-building perspective, Borrowell is another reputable service that can help improve your credit score. It’s free to use, and the main advantages of Borrowell Canada include:

- Monitor & Track

- Understand & improve

- Find the Right Product

At the outset, the initial goal is to track your success, flag errors, and spot fraudulent activity. The second is to offer personalized tips, articles, and tools to become more credit savvy. The third is to provide a curated list of products from 75+ partners that may fit your needs. To learn whether Borrowell is a better fit for you, please see our Borrowell Credit Report Review.

How Is My Credit Score Calculated?

The five components of your credit score include:

- Payment History (35% Weight)

- Credit Utilization (30% Weight)

- Credit History (15% Weight)

- Credit Mix (10% Weight)

- Credit Inquiries (10% Weight)

As you can see, the most important factors impacting your credit score are repaying your debts on time and borrowing less than your limit. For example, you shouldn’t exceed more than 30% of your debt maximum, meaning if your credit card limit is $1,000, you should keep your monthly charges to $300 or less. Credit bureaus view this behavior as responsible and following these rules can help improve your credit score over time.

If you have exisiting debts and are struggling to pay them, avoid applying for more credit. Instead, consider working with a debt relief organization like Consolidated Credit Canada.

How Does Nyble Work?

To qualify for a Nyble Canada line of credit, you must meet the following requirements:

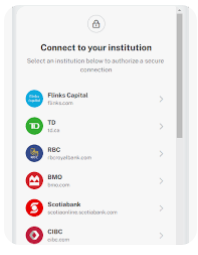

- Have a Canadian bank account to verify your identity

- Receive employment or government income monthly, or have a history of recurring deposits

Upon approval, you can apply for an interest-free line of credit ranging from $30 to $250. On the repayment date, Nyble deducts the amount owing from your bank account on file and reports the repayment history to credit bureaus.

If you miss a payment, a second charge is automatically scheduled for the following day or until the debt is repaid. Please note that missed payments are reported to credit bureaus and will negatively impact your credit score.

Free Nyble members receive their funds in zero to three business days, while paying members receive credit in 30 minutes or less. A premium subscription costs $11.99 per month, but it includes additional perks like access to your credit file and identity theft protection. In our opinion, the free option is the best choice if you can wait 0-3 business days for the funds to arrive.

What Are Nyble’s Downsides?

Instead of charging interest, Nyble relies on tips to generate profits. Gratuity isn’t mandatory, but you can choose to tip as a way to show appreciation for the service.

As for expenses, there is a $0.99 monthly fee to cover the cost of linking your bank account to your Nyble account. It’s akin to a subscription fee, but it’s still less than what competitors charge.

Finally, the main drawback of Nyble is the credit limit. Typically, fintechs like to build relationships with customers before they offer a maximum loan. And Nyble is no different. You likely won’t qualify for $250 immediately, but as you make on-time repayments, your limit should increase.

For those with exisiting debts, consider reaching out to Consolidated Credit Canada for debt relief options.

What About Similar Apps Like Bree?

Nyble and Bree have similar products that are great alternatives to payday loans. Remember, the latter have annual percentage rates (APRs) north of 100% and often leave Canadians stuck in a vicious debt cycle. Furthermore, the Government of Canada notes how overdraft fees can reach upwards of $50, and most financial institutions charge $5 per month to obtain overdraft protection. As a result, Nyble and Bree are great ways to keep more of your hard-earned money. For a complete breakdown of Bree’s strengths and weaknesses, see our Bree Loans Review.

What are the main differences between apps like Nyble and Bree? Both offer up to $250. Both have no credit checks, interest, or fees, and you need recurring employment or government income to qualify. However, Bree charges a $2.99 per month platform fee, while Nyble only costs $0.99 per month to link your bank account. So, while both are great for avoiding overdraft fees, Nyble is the cheaper option.

Are Customers Happy With Nyble?

Users are big believers in Nyble Canada, and note how its borrowing and credit-building services have improved their financial health. The company has a rating of 4.8 out of 5 on both the Apple App Store and Trustpilot, and some of the testimonials stated:

- Was very easy to apply and very fast approval and money was in my account quickly. Not a huge amount to begin with but love the service and convenience.

- My experience was amazing right from the start. Help is available without feeling bad about income, credit, or other life challenges.

- It was easy to find out how much I qualified for and money was sent! You have to build up credit to get higher loans but perfect when in a jam.

- I’m grateful that a program to access money when in a jam is available. No credit check. No issues. If I could get this in a pinch fast money, anyone can. Thanks, you saved me a few times since hearing about this website.

Thus, users have high praise for Nyble and find the app helpful when cash shortfalls emerge.

Are We Fans of Nyble?

With no interest, fees, or subscription costs, we think Nyble is one of the best short-term lenders in Canada. The $0.99 per month bank connection charge is relatively small considering Bree charges $2.99 per month to receive cash advances and Big Banks typically charge $5 per month for overdraft protection. Therefore, Nyble should be on your radar if cash shortfalls are a recurring theme in your life.

In addition, free members can see their credit scores, and weekly updates help you monitor your progress over time. As a result, you have nothing to lose by giving Nyble a try.

If you want to sign up or learn more, visit: https://www.nyble.com/

☝IMPORTANT 2025 TIPS:

➔ Lost control of your existing debt? Need help? Reach out to Consolidated Credit Canada as you may qualify for 50% debt relief.