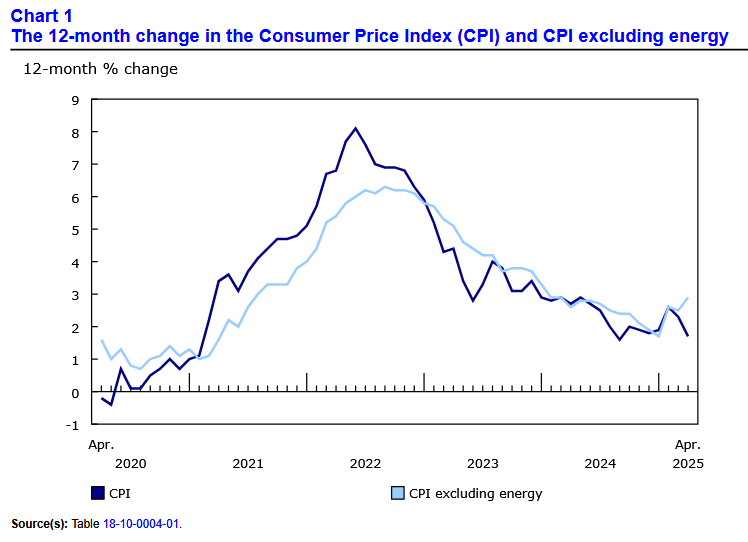

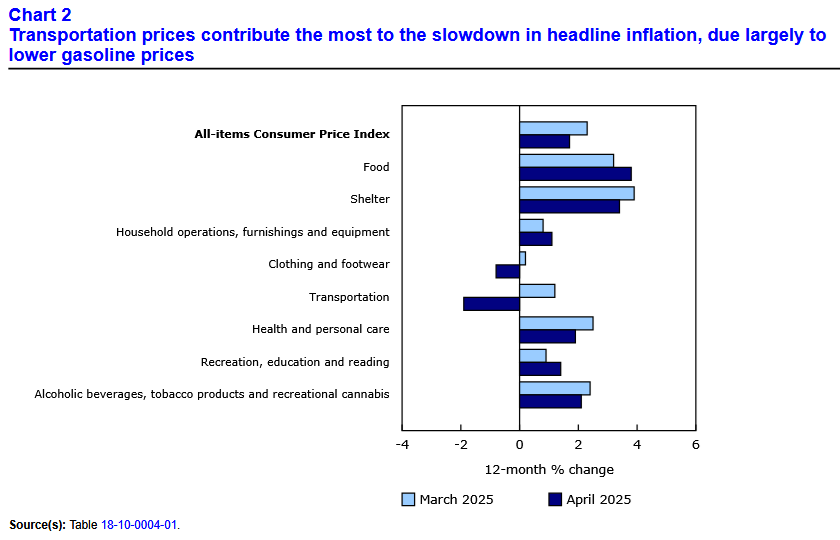

Canada’s consumer price index (CPI) increased by 1.7% year over year (Y-o-Y) in April, decelerating from 2.3% in March and 2.6% in February. Statistics Canada (StatsCan) published the data at 8:30 a.m. ET on May 20, 2025, via The Daily report. On a monthly basis, the CPI dropped by 0.1%, as energy prices sunk by 12.7% and drove the headline index lower. Conversely, travel tours (+6.7%) and food purchased from stores (+3.8%) were the main upside catalysts, and the former helped the core CPI measures outperform economists’ consensus estimates.

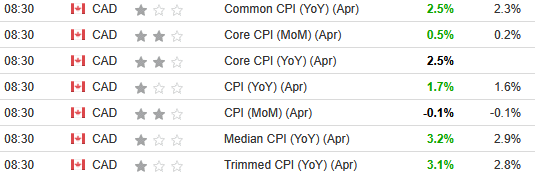

The table below is courtesy of Investing.com. The left column represents April’s figures, while the right column represents forecasters’ expectations. As you can see, today’s core data was relatively hot.

Consequently, the mixed results may keep the Bank of Canada (BoC) in wait-and-see mode. With tariff uncertainty still lingering, the inflation backdrop has become more challenging to predict. Yet, as I’ll cover later in the article, slowing economic growth may prove to be the dominant factor in the months ahead.

Core CPI Accelerates

Core measures of the CPI jumped in April, with the CPI-common index rising to +2.5% (from +2.3%), the CPI-median to +3.2% (from +2.8%), and the CPI-trim to +3.1% (from +2.9%). These measures exclude the impacts of food and energy, and the BoC places heavy emphasis on core measures because they provide a smoothed distribution of overall inflation.

Please note that food and energy prices are highly volatile and price spikes can occur for reasons outside of the BoC’s control. In contrast, core inflation is mainly driven by consumer demand and gives the BoC a better sense of how the Canadian economy is functioning.

Most Sectors Slow

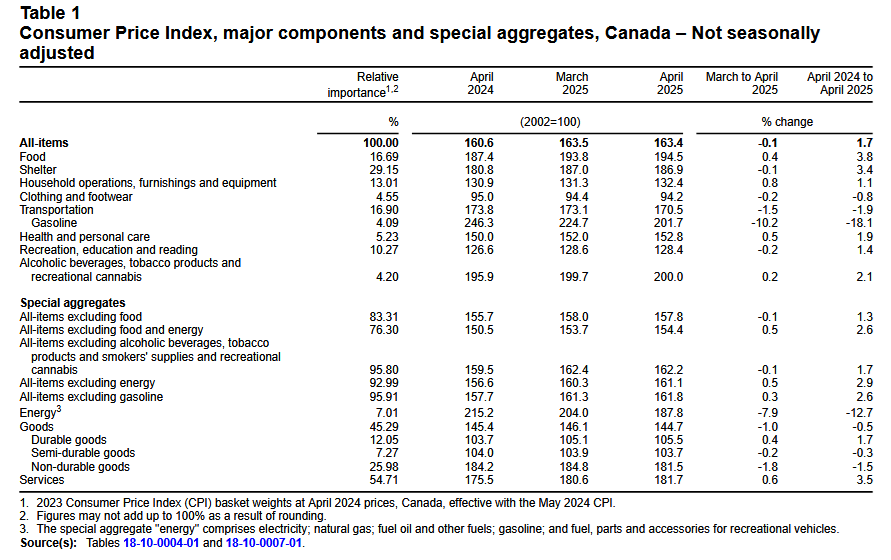

Five of the major sectors recorded Y-o-Y slowdowns in April, with transportation and clothing the noticeable outliers.

For context, the eight sectors include food, shelter, household operations, furnishings and equipment, clothing and footwear, transportation, health and personal care items, recreation and education expenses, and alcohol and tobacco products.

Grocery Comeback

After declining in January and recording its first Y-o-Y drop since May 2017, food inflation has now risen by 3.2% in March and 3.8% in April. The primary drivers this month were fresh vegetables (+3.7%), fresh or frozen beef (+16.2%), coffee and tea (+13.4%), sugar and confectionery (+8.6%), and other food preparations (+3.2%).

Likewise, restaurant inflation accelerated from 3.2% Y-o-Y in March to 3.6% Y-o-Y in April, as prices normalise following the tax holiday.

Patiently Waiting

As BoC Governor Tiff Macklem grapples with the uncertainty of rising inflation and a potential recession, reasons for dovish policy have emerged.

For starters, the U.S. announced trade deals with the U.K. and China, and Canada could be next in line for an agreement. The ratcheting down in tensions was welcome news and signals a shift in U.S. economic policy. As such, inflation concerns could take a back seat to economic growth in the months ahead.

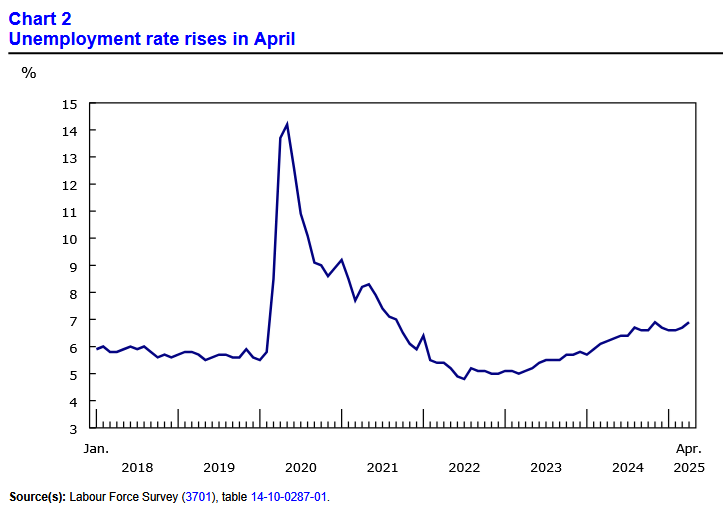

Speaking of which, April’s Labour Force Survey (released on May 9) showed the Canadian unemployment rate rose by 0.2% to 6.9%, the highest level since January 2017 (excluding the 2020/2021 COVID-19 pandemic). The release stated:

“The number of unemployed people—those looking for work or on temporary layoff—increased by 39,000 (+2.6%) in April and was up by 189,000 (+13.9%) on a year-over-year basis. People who were unemployed continued to face more difficulties finding work in April than a year earlier. Among those who were unemployed in March, 61.0% remained unemployed in April, higher than the corresponding proportion for the same months in 2024 (57.3%) (not seasonally adjusted).”

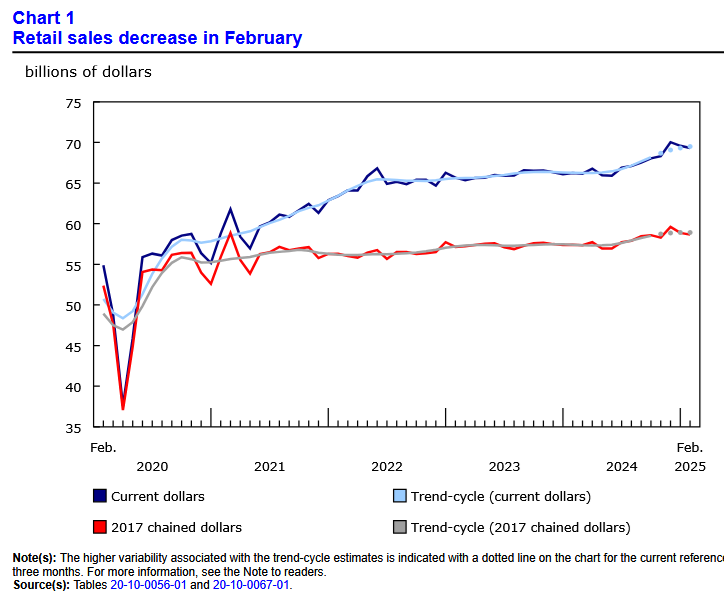

Similarly, the latest retail sales report was a mixed bag. While core purchases remained strong, the headline figure fell by 0.4% MoM, and consumer spending declined in seven provinces. Furthermore, both metrics have decelerated from their December 2024 highs, which could signal softer economic growth throughout 2025.

All in all, while trade tensions may dissipate throughout the summer, it remains to be seen how much economic scarring is left over. With labour markets and consumer spending cooling, corporations may confront limited pricing power, which helps alleviate future inflation. If so, it may provide the BoC with cover to loosen monetary policy further in the months ahead.

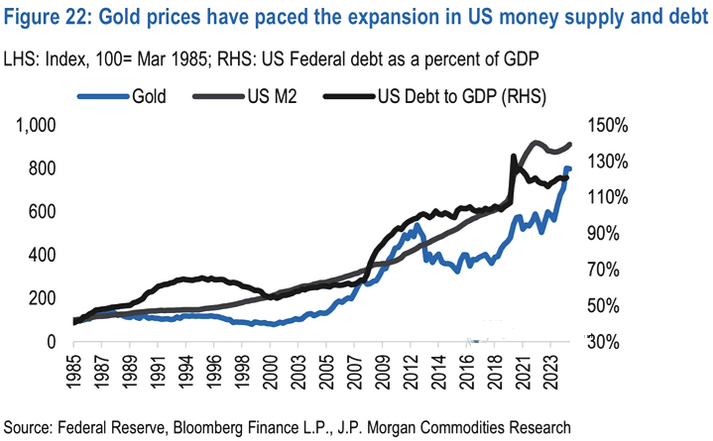

As for the financial markets, stocks have staged a furious comeback. Yet, with gold performing well during periods of panic and prosperity, higher highs should be on the horizon.

Remember, the yellow metal is highly correlated with U.S. debt levels and the money supply. And with the Trump Administration turning its attention to trade deals and tax cuts, the liquidity tailwind should continue to support gold.

To explain, the J.P. Morgan chart above highlights gold’s connection with U.S. stimulus. And as the old saying goes, ‘the trend is your friend’ when it comes to predicting where all three could go in 2025 and beyond.

On top of that, precious metals assets such as gold and silver have typically held their value more reliably than stocks during periods of high inflation and global uncertainty. In today’s polarised environment, physical assets and commodities such as real estate and precious metals may provide a strategic hedge.

Dedicating a small portion of one’s TFSA or RRSP portfolio to precious metals may help mitigate some of the negative effects of inflation. If you want to get started with investing in metals such as gold and silver, read our free guide to gold buying in Canada in 2024 today.

Finally, if the tariff clouds clear and the sun shines on the Canadian economy, your business may need capital to meet the demand shock on the other side. Driven Financial supports small and medium-sized companies by offering business loans and merchant cash advances for expenditures like payroll, equipment, and other urgent needs. Similarly, Greenbox Capital is an excellent option for startups, as they specialize in financing companies with little or no credit history. Whatever your preference, there are several reputable lenders available to help your business reach its potential.