The Consumer Price Index grew by 1.4% on a monthly basis in May, following a 0.6% rise seen in April, reported Statistics Canada. This marks “, the fastest pace since the introduction of the series in 1992”.

“Canadians continued to feel the impact of rising prices in May as consumer inflation rose 7.7% year over year. This was the largest yearly increase since January 1983 and up from a 6.8% gain in April.

Excluding gasoline, the CPI rose 6.3% year over year in May, after a 5.8% increase in April. Price pressures continued to be broad-based, pinching the pocketbooks of Canadians and in some cases affecting their ability to meet day-to-day expenses.

The acceleration in May was largely due to higher prices for gasoline, which rose 12.0% compared with April 2022 (-0.7%). Higher prices for services, such as hotels and restaurants, also contributed to the increase. Food prices and shelter costs remained elevated in May as price growth was unchanged on a year-over-year basis,” explained Stats Can in its monthly report.

In addition, Statistics Canada also discussed wages in its May report.

“Wage data from the Labour Force Survey found that average hourly wages rose 3.9% year over year in May, meaning that, on average, prices rose faster than wages in the previous 12 months. However, understanding the dynamics of wage changes—and their relationship to rising consumer prices—requires a range of indicators above and beyond average hourly wages. For more information on a range of wage indicators, see the release “Disaggregating wage growth: Trends and considerations.”

(Source: Statistics Canada)

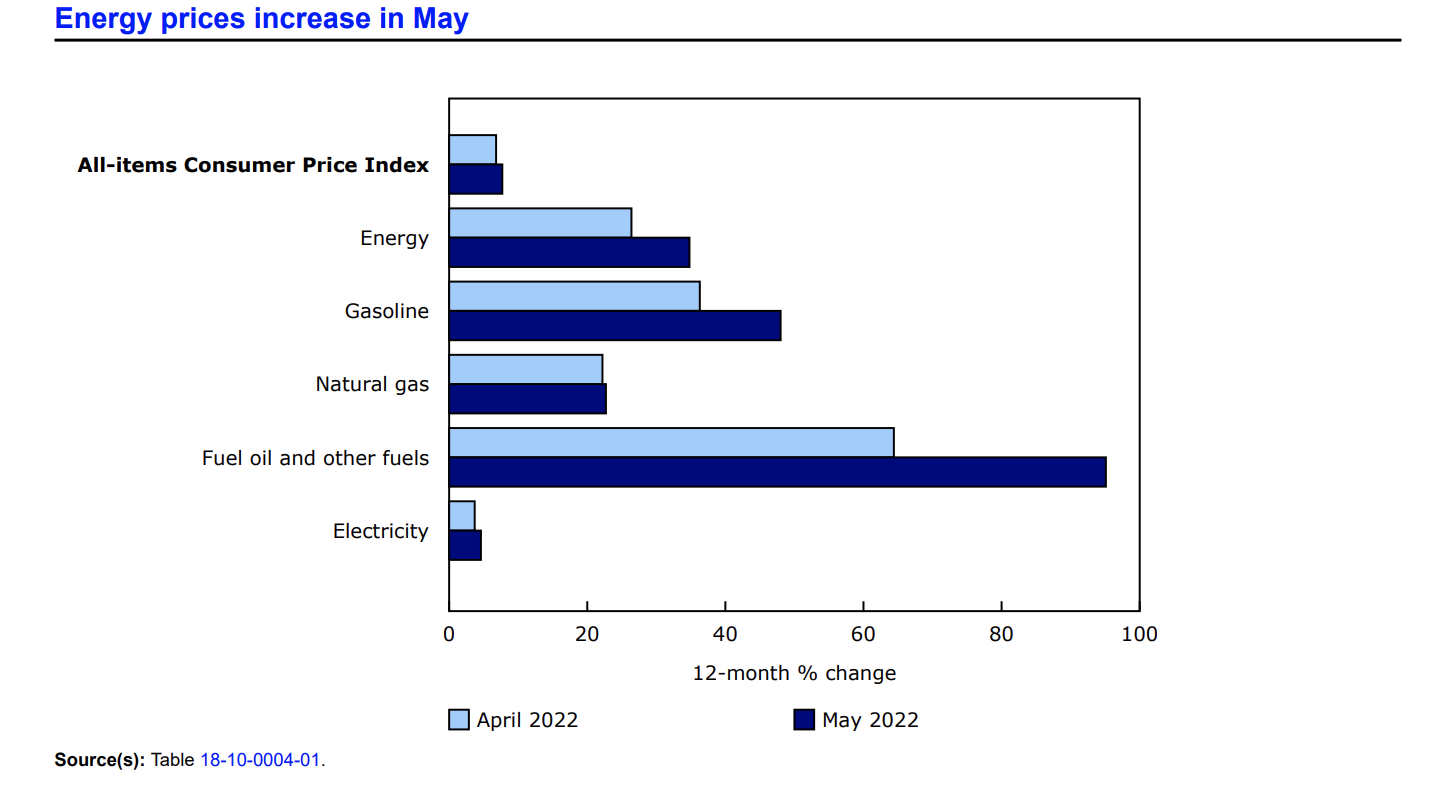

Energy

In May, the energy index soared 34.8% on a year-over-year basis, “driven primarily by the largest one-month price increase since January 2003”.

“Compared with May 2021, consumers paid 48% more for gasoline in May, stemming from high crude oil prices, which also resulted in higher prices for fuel oil and other fuels (+95.1%).

On a month-over-month basis, gasoline prices increased 12.0% in May, after a 0.7% decline in April. This was the largest monthly increase since May 2020, when oil prices began to recover following major price declines in the early stages of the COVID-19 pandemic in March and April 2020.

Crude oil prices rose in May as a result of supply uncertainty amid Russia’s invasion of Ukraine, as well as higher demand as travel continued to grow in response to eased COVID-19 restrictions,” explained the agency.

(Source: Statistics Canada)

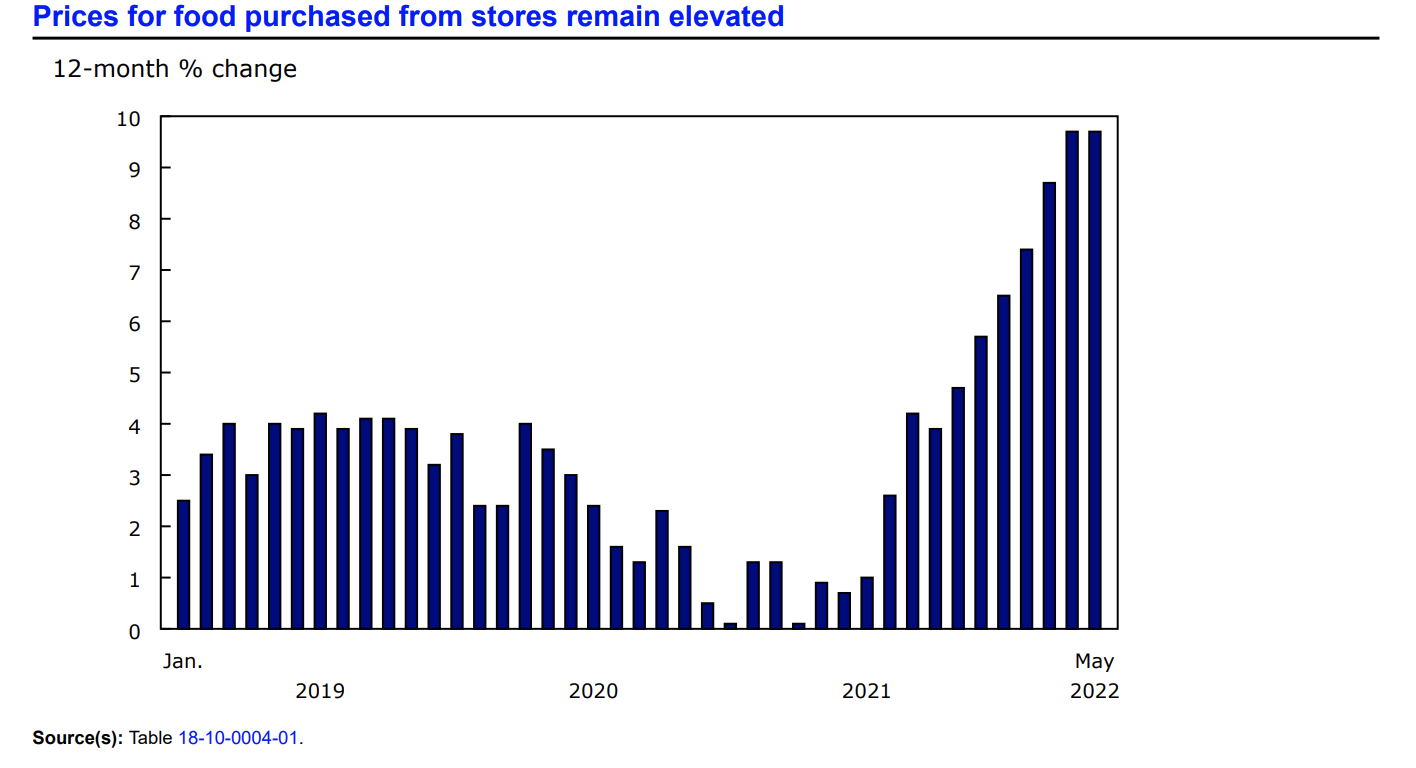

Food

In May, Canadian consumers paid more for groceries as the food index increased once again.

“Grocery prices remained elevated in May as prices for food purchased from stores rose 9.7%, matching the gain in April. With price increases across nearly all food products, Canadians reported food as the area in which they were most affected by rising prices. Supply chain disruptions, as well as higher transportation and input costs, continued to put upward pressure on prices.

Edible fats and oils (+30%) recorded its largest increase on record, mainly driven by higher prices for cooking oils. Fresh vegetable prices increased 10.3% in May, following an 8.2% gain in April. Prices for other fresh vegetables, including onions, peppers and carrots, contributed the most, rising 10.2% on a year-over-year basis.

Prices for fresh or frozen fish rose 11.7% year over year in May. Increased input costs and the recent introduction of tariffs amid Russia’s invasion of Ukraine pushed prices higher. Meat prices increased at a slower pace in May (+9%) compared with April (+10.1%), moderating the food purchased from stores index,” stated Statistics Canada.

Statistics Canada released a statement regarding a basket update.

“The basket of goods and services used in the calculation of the CPI has been updated with the release of the May 2022 data. The new basket weights, available in table 18-10-0007-01, are based on 2021 expenditure data, which include information on pandemic impacts with some recovery and the emergence of new consumption patterns, ensuring the relevance of the CPI as a reflection of the most recent consumer expenditure data available.

The new basket weight reference period is 2021, based on the most recent Household Final Consumption Expenditure (HFCE) data, and supplemented by data from the Survey of Household Spending (SHS). Additional data sources were used to better inform expenditure weights for specific aggregates, or where HFCE or SHS data were unavailable.

The base period, in which the all-items CPI is set to equal 100, remains 2002.

The headline CPI for May 2022 would have been the same using the 2020 basket weights.

For more detailed information, consult the document entitled “An Analysis of the 2022 Consumer Price Index Basket Update, Based on 2021 Expenditures” in the Prices Analytical Series (62F0014M).”

Source cited: https://www150.statcan.gc.ca/n1/en/daily-quotidien/220622/dq220622a-eng.pdf?st=qR3ZapF3