If you’re drowning in debt and unsure where to turn, you’re not alone. Many Canadians confront insolvency and wonder how mitigation will affect their family, assets, and long-term financial health. Moreover, most are unaware of the laws and regulations designed to help ease the burden.

As a step in the right direction, a consumer proposal is a legally binding process developed with the help of a Licensed Insolvency Trustee (LIT). A LIT draws up a repayment plan that’s a percentage of the total amount owed, and/or helps extend the repayment deadline. The goal is to reduce the immediate financial strain and help you to meet your periodic obligations.

But, is the strategy right for you?

Pros and Cons of a Consumer Proposal

Depending on your financial situation, the merits of a consumer proposal can vary. Please consult our list below for a short rundown.

Pros:

- Halts collections from unsecured creditors

- Interest no longer accrues on your debt balance

- You end up paying less than what you owe

- Monthly payments are fixed and won’t increase

- You receive budgeting and counseling services

- You can pay off the entire balance if you choose

- Creditors receive better terms vs. a bankruptcy

Cons:

- If the proposal is rejected, you may have to declare bankruptcy

- It can take 4-5 years to repay the debt, which is often longer than a bankruptcy process

- A consumer proposal remains on your credit profile and can severely hurt your credit score

- Creditors often view a consumer proposal as similar to a bankruptcy filing

- Your debts must be less than $250,000 (excluding the mortgage on your primary residence) to qualify

What Is a Consumer Proposal?

Expanding on the definition above, a consumer proposal is limited to unsecured debt (obligations not backed by collateral) and the repayment terms can’t exceed five years. The amount also can’t exceed $250,000 (excluding the mortgage on your primary residence). Examples of qualifying debt include:

- Credit card balances

- Personal loans, lines of credit, debt consolidation loans

- Payday and unsecured installment loans

- Student loans, assuming you were a student within the last seven years

- Income tax debt, including GST owing, and other forms of tax obligations.

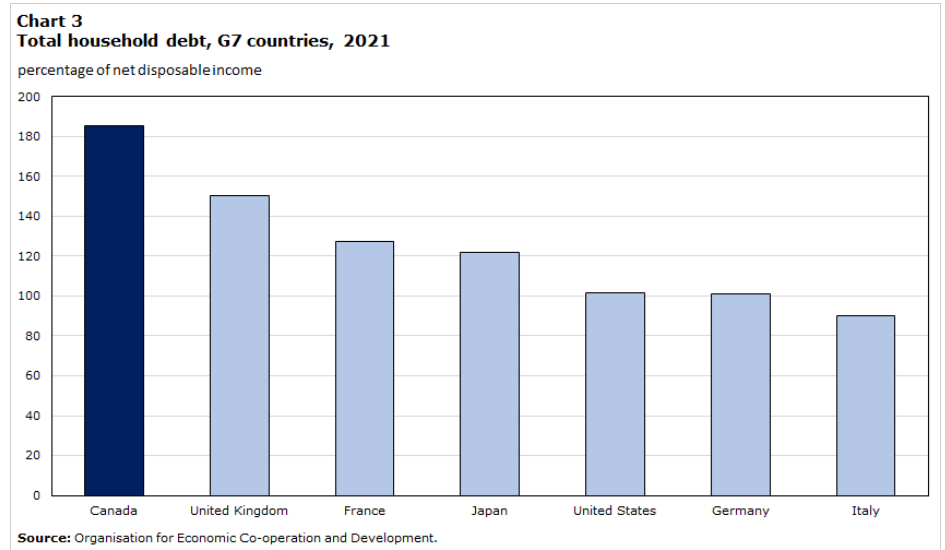

A February 2024 report from Statistics Canada said that “Based on the latest data across G7 countries, Canada has the highest level of household debt to disposable income, reaching over 180%, compared with about 100% in the United States and Germany.” As a result, many Canadians carry high debt balances.

How Does a Consumer Proposal Work?

Once you and your LIT have developed a debt-reduction strategy, it’s a three-step process to move forward with a consumer proposal:

- The LIT files the proposal with the Office of the Superintendent of Bankruptcy (OSB). Once the motion is in place, you stop repaying your unsecured creditors and they can no longer garnish your wages or file lawsuits against you.

- The LIT submits the documents to your unsecured creditors outlining the reasons for your financial difficulties.

- Your unsecured creditors have 45 days to accept or reject the proposal.

What Is a Meeting of Creditors?

If an unsecured creditor is owed 25% or more of the total debt balance, the entity can call a meeting to lobby on its behalf. The unsecured creditor can call this meeting within 45 days of your consumer proposal filing date, and the actual meeting must be held within 21 days of the call date. At the event, the group votes to accept or reject the consumer proposal. In addition, OSB may instruct the LIT to meet with the group at any point within this timeframe.

If no meeting is requested, the consumer proposal is automatically accepted, regardless of individual objections.

How Much Does a Consumer Proposal Cost?

According to MNP — a LIT licensed by the Government of Canada — the cost of a consumer proposal is in the area of $6,000 to $7,000. For starters, the disbursement is federally regulated and outlined in the insolvency legislation. Second, you don’t receive any bills during the process.

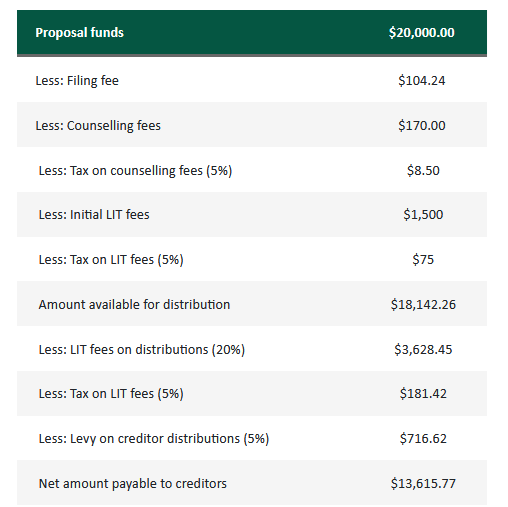

To explain, the MNP table below provides a nice summation:

As you can see, all costs associated with the consumer proposal are subtracted from the gross amount, with the creditors (if they accept) receiving the net amount. In other words, administration fees are deducted from the proposal.

Consumer Proposal vs. Bankruptcy

While consumer proposals and bankruptcy filings are used for debt relief, the main differences include:

- You keep more assets with a consumer proposal

- A consumer proposal has less impact on your credit score

- The filing stays on your credit report for three years versus six years for an initial bankruptcy

Another difference is a consumer proposal is a less severe form of debt mitigation. For example, you often surrender assets during a bankruptcy and your monthly payments can vary with your income. In contrast, consumer proposals help protect your assets and ensure fixed monthly payments.

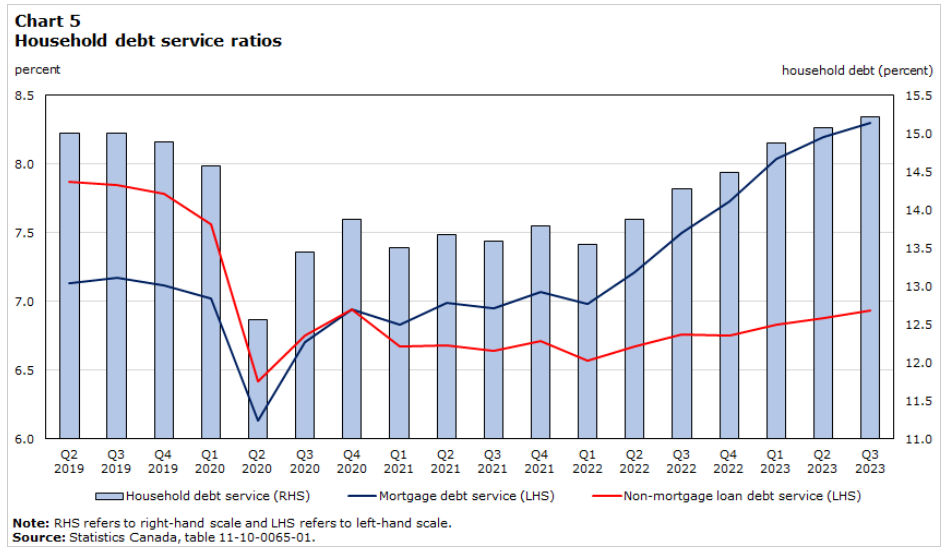

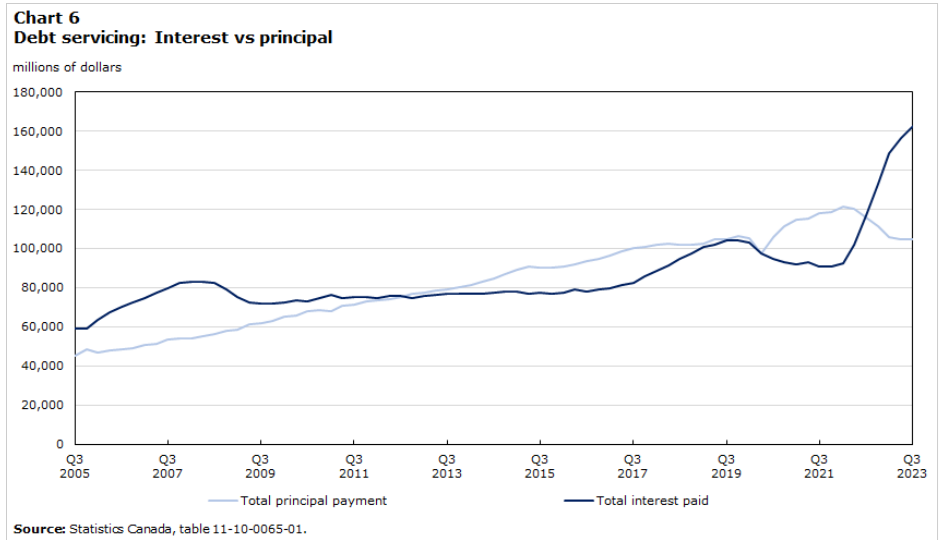

As a side note, Statistics Canada said that “variable rate mortgages represent around 30% of total outstanding mortgage debt.” Therefore, higher interest rates have increased bankruptcy risks for many Canadians.

Provincial Resources For Consumer Proposals

Obtaining local advice and consulting with an LIT in your area is a prudent way to get your finances back on track. Below, we outline reputable resources that may fit your needs, and our list focuses on businesses located in major metropolitan cities. Moreover, with higher interest rates increasing economic uncertainty, professional help has never been more valuable. For more information on how inflation is impacting your province, please see our Inflation Calculator CPI Tables.

Montreal, Quebec

Pierre Roy & Associés

- Phone Number: 1-514-375-1965

- Address: 3982 Wellington St Bureau 205, Verdun, Quebec H4G 1V3

- Website: https://pierreroy.com/en/

Toronto, Ontario

Hoyes, Michalos & Associates

- Phone Number: 1-416-815-7515

- Address: 8 King St E #800, Toronto, ON M5C 1B5

- Website: https://www.hoyes.com/

SPERGEL

- Phone Number: 1-416-778-8813

- Address: 307A Danforth Ave, Toronto, ON M4K 1N7

- Website: https://www.spergel.ca/

Morataya Corp

- Phone Number: 1-416-784-0904

- Address: 3200 Dufferin St Suite #307, Toronto, ON M6A 3B2

- Website: https://morataya.ca/

Fong & Partners Inc

- Phone Number: 1-416-260-3264

- Address: 2 Carlton St. #1007, Toronto, ON M5B 1J3

- Website: https://startingovertoronto.com/

Moncton, New Brunswick

Allan Marshall & Associates

- Phone Number: 1-506-384-7850

- Address: 505A St. George St, Moncton, NB E1C 1Y4

- Website: https://wecanhelp.ca/

MNP Debt

- Phone Number: 1-506-805-0174

- Address: 272 St. George St Suite 200, Moncton, NB E1C 1W6

- Website: https://mnpdebt.ca

Powell Associates Ltd.

- Phone Number: 1-506-870-8277

- Address: 500 St. George St, Moncton, NB E1C 1Y3

- Website: https://maritimetrustee.ca/

Halifax, Nova Scotia

Powell Associates Ltd.

- Phone Number: 1-902-403-3602

- Address: 2 Ralston Ave Suite 100, Dartmouth, NS B3B 1H7

- Website: https://maritimetrustee.ca/

MNP Debt

- Phone Number: 1-902-454-7934

- Address: 6080 Young St Suite 912, Halifax, NS B3K 5L2

- Website: https://mnpdebt.ca

Grant Thornton Limited

- Phone Number: 1-902-453-6600

- Address: 1675 Grafton St Suite 1000, Halifax, NS B3J 0E9

- Website: https://gtdebtsolutions.com/

Allan Marshall & Associates

- Phone Number: 1-902-425-7850

- Address: 362 Lacewood Dr #207, Halifax, NS B3S 1M7

- Website: https://wecanhelp.ca/

Charlottetown, Prince Edward Island

MNP Debt

- Phone Number: 1-902-892-2010

- Address: 230 Belvedere Ave, Charlottetown, PE C1A 6X8

- Website: https://mnpdebt.ca

Allan Marshall & Associates

- Phone Number: 1-902-894-7851

- Address: 410 Mt Edward Rd Unit#1, Charlottetown, PE C1E 2A1

- Website: https://wecanhelp.ca/

Grant Thornton Limited

- Phone Number: 1-902-566-4381

- Address: 98 Fitzroy St Suite 410, Charlottetown, PE C1A 7K4

- Website: https://gtdebtsolutions.com/

St. John’s, Newfoundland

Janes & Noseworthy Limited

- Phone Number: 1-709-364-8148

- Address: 516 Topsail Rd #201, St. John’s, NL A1E 2C5

- Website: https://janesnoseworthy.ca/

S.R. Stack & Company Ltd.

- Phone Number: 1-709-221-5500

- Address: 86 Elizabeth Ave, St. John’s, NL A1A 1W7

- Website: https://srstack.ca/

Winnipeg, Manitoba

MNP Debt

- Phone Number: 1-204-336-6167

- Address: 242 Hargrave St 12th Floor, Winnipeg, MB R3C 0T8

- Website: https://mnpdebt.ca

Grant Thornton Limited

- Phone Number: 1-204-594-7160

- Address: 200 Portage Ave Suite 500, Winnipeg, MB R3C 3X2

- Website: https://gtdebtsolutions.com/

Lazer Grant

- Phone Number: 1-204-977-3501

- Address: 309 McDermot Ave Suite 300, Winnipeg, MB R3A 1T3

- Website: https://insolvency.lazergrant.ca/

C. Buhler & Associates Ltd.

- Phone Number: 1-204-819-4141

- Address: 1460 Chevrier Blvd #200, Winnipeg, MB R3T 1Y6

- Website: https://debtfreenorth.com/

Saskatoon, Saskatchewan

MNP Debt

- Phone Number: 1-306-664-8334

- Address: 119 4th Ave S #800, Saskatoon, SK S7K 5X2

- Website: https://mnpdebt.ca

SPERGEL

- Phone Number: 1-306-341-1660

- Address: 2366 Ave C North Suite 260, Saskatoon, SK S7L 5X5

- Website: https://www.spergel.ca/

Calgary, Alberta

MNP Debt

- Phone Number: 1-403-538-3187

- Address: 112 4 Ave SW Suite 2000, Calgary, AB T2P 0H3

- Website: https://mnpdebt.ca

Bromwich+Smith

- Phone Number: 1-855-884-9243

- Address: 800 5 Ave SW #800, Calgary, AB T2P 3T6

- Website: https://www.bromwichandsmith.com/

Cameron Okolita

- Phone Number: 1-403-543-3100

- Address: 115 9a St NE, Calgary, AB T2E 9C5

- Website: https://cameronokolita.ca/

Hudson & Company

- Phone Number: 1-403-265-4357

- Address: 625 11 Ave SW Suite 200, Calgary, AB T2R 0E1

- Website: https://bankruptcycalgary.com/

Vancouver, British Columbia

Sands & Associates

- Phone Number: 1-604-684-3030

- Address: 1100 Melville St Suite 1370, Vancouver, BC V6E 4A6

- Website: https://www.sands-trustee.com/

MNP Debt

- Phone Number: 1-604-639-0001

- Address: 609 Granville St #1630, Vancouver, BC V7Y 1E7

- Website: https://mnpdebt.ca

Grant Thornton Limited

- Phone Number: 1-604-689-4255

- Address: 333 Seymour St Suite 1580, Vancouver, BC V6B 0A4

- Website: https://gtdebtsolutions.com/

D Thode & Associates Inc.

- Phone Number: 1-604-336-9533

- Address: 1055 W Hastings St #300, Vancouver, BC V6E 2E9

- Website: https://www.outofdebt.ca/

Yellowknife, Northwest Territories

C. Buhler & Associates Ltd.

- Phone Number: 1-855-352-3733

- Address: 5016 47 St, Yellowknife, NT X1A 1M1

- Website: https://debtfreenorth.com/

Iqaluit, Nunavut

C. Buhler & Associates Ltd.

- Phone Number: 1-855-352-3733

- Address: Not Listed

- Website: https://debtfreenorth.com/

Whitehorse, Yukon

MNP Debt

- Phone Number: 1-250-979-2580

- Address: 411 Main St, Whitehorse, YT Y1A 2B6

- Website: https://mnpdebt.ca

Consumer Proposal Frequently Asked Questions (FAQ)

How Long Does a Consumer Proposal Stay on My Credit Report?

It remains on your credit report for three years.

How Much Does a Consumer Proposal Cost?

It typically ranges from $6,000 to $7,000, but the funds are deducted from the proposal’s gross amount.

How Bad Is a Consumer Proposal?

Your credit score takes a major hit, so it’s not viewed positively. But, it’s a wise choice when you have no other option and don’t want to file for bankruptcy.

How Long After a Consumer Proposal Can I Get a Credit Card?

Due to the impact on your credit score, it could be a while. You need to demonstrate that your credit habits have changed, so you may have to settle for a prepaid or secured credit card at the beginning.

Conclusion

A consumer proposal is suitable for individuals with debt balances of less than $250,000 (excluding your home’s mortgage) who are on the verge of bankruptcy. Seeking professional help ensures you have the knowledge, coaching, and support needed to get your finances back on track.

Moreover, the process can help build the confidence you need to avoid similar struggles in the future.