When lenders extend financing to you, their primary objective is to have the funds returned safe and sound. Beyond interest and a sufficient rate of return, protecting their principal is essential to survival. In other words, a few bad loans can severely impact a lender’s aspirations and have their operations being scrutinized by a Licensed Insolvency Trustee (LIT) sooner rather than later…

Enter the world of asset-backed loans or asset-backed lending…

Because collateral is king, recourse products allow issuers to seize assets if borrowers default. But, since the risk is a two-way street, is asset-backed lending right for you?

What Is the Difference Between Secured and Unsecured Financing?

To understand the ins and outs of asset-backed financing, you must understand the concept of collateral. When a business takes out a mortgage, a bank, credit union, or fintech firm lends against the value of the property, knowing it can foreclose and seize it if a default occurs. Using ‘recourse loans’ protects lenders when economic challenges arise.

In contrast, traditional credit card loans are a form of unsecured borrowing. When you swipe your card online, or at a retail shop or restaurant, the amount owed is ‘non-recourse,’ meaning the lender can’t seize your assets if you can’t repay the debt.

What Should I Consider Before Applying For An Asset-Backed Loan?

Before using your valuable assets as collateral, you may want to pursue an alternative path. If you have a poor credit score, providing surety may be the only way to obtain financing. However, the interest rate and terms may still be unfavourable, as lenders typically have little incentive to offer bad credit loans.

As a result, a prudent path is to work on your credit score and postpone your credit aspirations until you’ve improved your financial health. It doesn’t happen overnight, but our guide on How to Improve Your Canadian Credit Score includes 10 helpful tips that can put you on a path to a better financial reputation. The Government of Canada notes that “it takes 30 to 90 days for information to be updated in your credit report,” so it’s possible to build momentum in short order.

Consequently, we believe working to fix the issue is better than masking the problem with collateral.

What is Asset-Backed Financing or Lending and How Does It Work?

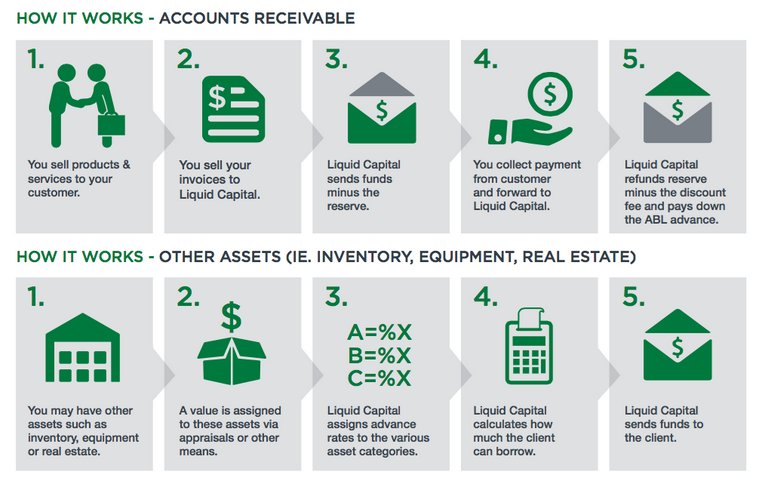

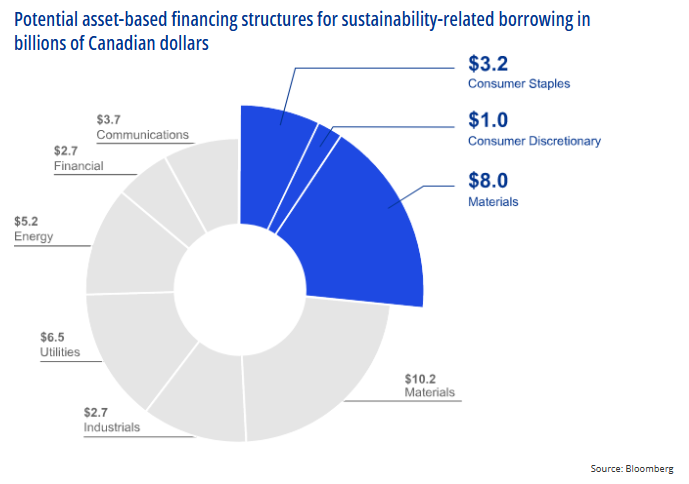

Businesses are the main clients in the asset-backed lending market, and they use the funds to alleviate cash flow concerns. If a struggling business does not meet the requirements for a traditional line of credit, a secured vehicle is used to provide the lender additional protections.

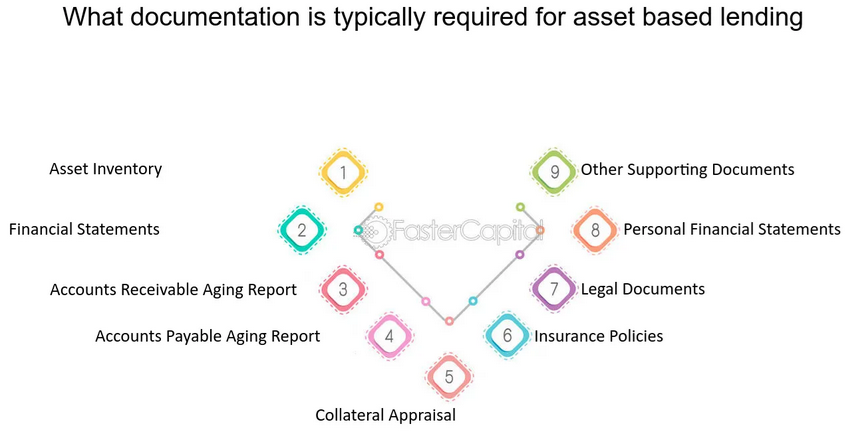

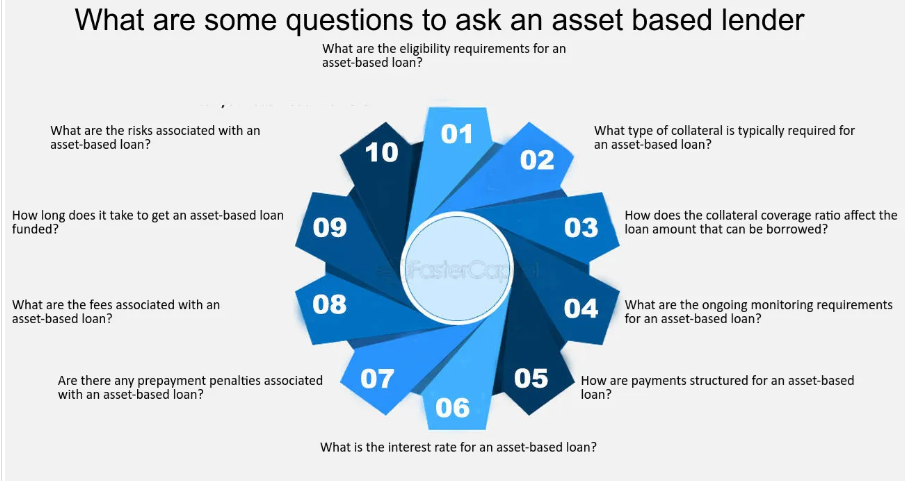

Asset-based loans can be secured against accounts receivable, equipment, inventory, property owned by the business or its founder, and other assets. They typically include ‘covenants,’ which means the business must maintain minimum financial metrics or limit other borrowings below a specific figure. These clauses are used to further protect the lender’s principal.

The amount offered is usually 60% of the asset’s forced liquidation value (FLV), which means the lender will loan you 60% of what the asset is worth in the open market. The low threshold is used in case a lender needs to seize the asset and sell it quickly to recoup its principal.

How Much Does Asset-Backed Lending Cost?

The interest rate on asset-backed loans can vary widely and can depend on the applicant’s industry, cash flow, credit history, length of time in business, and other factors. As a result, you may encounter financing rates of 10% to 15% or more.

Asset-Backed Lending Example

For illustrative purposes, the FLV has an outsized impact on the loan amount. As an example, imagine you need $100,000 to modernize your retail space. If your business owns $100,000 of Canadian federal bonds or publicly listed stocks, the lender may increase the FLV to 80% of the value, which means you receive $80,000 in loan proceeds backed by $100,000 of collateral.

In this case, the higher FLV is a function of liquidity. Because these assets trade several times per day, it’s easy to obtain real-time prices and liquidate them in short order. Therefore, the less risky collateral allows for a higher FLV.

In contrast, if equipment, inventory, or property are used as collateral, the FLV could be 60% or less to account for the increased liquidation risk. Because these assets don’t trade frequently. it’s more difficult to find buyers in the event of default. In turn, lenders may only receive lowball offers, which puts them at greater risk of principal loss.

What Are the Risks of Asset-Backed Loans?

The primary risk is losing your collateral. If you secure a valuable property for 60% of its market value and default, it’s akin to selling that property for much less than it’s worth.

On top of that, it can be difficult to keep up with the high interest charges and maintain operational efficiency at the same time. The struggles can increase your chances of default and dig an even deeper hole for your business.

Where Are the Best Places to Find Asset-backed Loans In Canada?

If you have a good credit score, you should begin your search for asset-based lending at traditional banks (the big five). You can also explore alternative lenders and compare their rates with the banks, if you want to make sure you are getting the best possible loan. If you have a bad credit score, your first goal should be on improving it, as any bank or alternative lender will likely give you unfavourable terms for your asset-based loan. Here are some places in Canada where you should start you search for an asset-based loan:

Royal Bank of Canada

As an industry leader, the Royal Bank of Canada (RBC) has been active in the Canadian asset-backed lending market since 1999 and offers loan solutions to companies of all sizes. Moreover, with more than 35 experienced representatives across the country, you can obtain revolving lines of credit with the following benefits:

- Loans of up to 90% for accounts receivable and appraised inventory values

- Term loans based on fixed assets’ appraised values

- Customer invoices can be purchased for up to 100% of their face value

- FX solutions to obtain financing in Canadian, U.S., and other currencies

Canadian Imperial Bank of Commerce

The Canadian Imperial Bank of Commerce (CIBC) is another of Canada’s Big 5 banks that can meet all your asset-backed financing needs. You can obtain customized loans backed by accounts receivable, inventory, and fixed assets, with limited or no financial covenants.

The only downside is that CIBC caters to medium and large-sized businesses, so scale is an important factor in whether or not you obtain financing.

Business Development Corporation

The Business Development Corporation (BDC) offers a wide range of financing solutions to assist entrepreneurs and small businesses. Whether it’s equipment loans, purchase order financing, working capital loans, or start-up financing, several options may fit your needs.

Moreover, the BDC doesn’t specify collateral as a requirement, so you may be able to obtain a loan without risking your assets.

We also recommend that you check out our provincial pages to find Asset-Backed Financing options based on your specific province:

We’ll be adding more options for other provinces shortly…

Conclusion

While asset-based financing is a worthwhile solution for Canadian businesses in need of emergency capital, it’s often wise to apply for unsecured options first. If you have a strong personal credit score, it could look more favorable on your business loan application, as potential lenders may value your reputation for responsible money habits.

In addition, managing higher interest charges can be difficult if your business is already struggling. As such, you should run the numbers to ensure you can meet the monthly cash outflows and still achieve your business goals.