Payday loans in Canada can (sometimes) be a lifesaver when you’re in a financial pinch and have an emergency expense coming up. They’re generally quick to get, easy to apply for (can be 100% online), and don’t usually require a credit check. So if you’re struggling with bad credit (or no credit), you might see them as your only option. But let me tell you, they come with some pretty hefty downsides that are worth considering. In this review, I’ll break down what you need to watch out for, and some potential better alternatives you should consider…

Are They Worth It?

Honestly, in most cases, payday loans are NOT worth it. Here’s why:

- Insanely High Costs: While they might look like a small, quick fix, the fees can be shockingly high. Payday loans typically charge you about $15 to $19 for every $100 you borrow, and that’s a limit set forth by the Government. That might not sound too bad at first glance, but when you look at it as an annual percentage rate (APR), it can go well over 300-400%. Compare that to a credit card or a personal loan, and it’s clear payday loans are a seriously expensive way to borrow money.

- Short Repayment Terms: Most payday loans need to be paid back within two weeks or by your next payday, which is where the name comes from. If you’re already struggling to make ends meet, two weeks might not be enough time to get back on your feet. And when you can’t pay it back, things get ugly fast. You might end up in a cycle of taking out new loans to pay off the old ones, creating a debt spiral that’s hard to escape.

- Debt Trap Risk: Speaking of that cycle, many people find themselves trapped. The short terms and high fees lead many borrowers to roll over their loans, meaning they take out a new loan to cover the old one. Before you know it, you’re paying way more in fees than what you originally borrowed, and it can take months or even years to dig out of that hole. Many people go bankrupt because of this debt trap. Debt consolidation is your best bet if you are already dealing with high debt.

The Costs Involved

In Canada, the Federal Government has laid out some rules when it comes to the maximum that lenders can charge (see this article).

Now, payday loans are also heavily regulated at the provincial level, and each province sets its own maximum allowable costs and fees.

Despite federal and provincial government regulations, the fees for these types of loans are still extremely high! It’s important that you understand why fees are high: Payday loans are designed to provide short-term, small-dollar loans, typically for emergency purposes. The loans must be repaid quickly, usually within two weeks to one month, or upon your next paycheck. And the costs for borrowing can be incredibly high when calculated as an annual percentage rate (APR).

Here’s a breakdown of the typical costs, fees, and terms associated with payday loans across Canada:

- Flat Borrowing Fee: This is usually a set amount per $100 borrowed, instead of interest. For example, in most provinces, you’ll see something like $15 per $100 borrowed.

- Repayment Term: Payday loans are typically due on the borrower’s next payday, hence the name. This means you often have between 14 to 30 days to repay the loan in full.

- Rollovers/Extensions: Many provinces do not allow lenders to roll over payday loans (extending the loan period by taking out a new loan to cover the old one), as this can trap borrowers in a cycle of debt. If you are dealing with heavy debt, consider speaking to a debt counselling non-profit like Consolidated Credit or the Credit Counselling Society.

- Interest Rate Cap: Canada caps the criminal interest rate at 60% APR for all forms of credit, but payday loans are exempt because they structure fees per $100 borrowed instead of using traditional interest rates.

Example of Payday Loan Costs:

If you borrow $300 for two weeks in a province with a $15 fee per $100 borrowed, like Ontario, your fee would be:

- $15 x 3 = $45 in fees.

- Total repayment: $300 (principal) + $45 (fees) = $345.

The APR for this example, when annualized, would be around 390%. Although the loan is only short-term, this demonstrates the steep cost of borrowing.

Payday Loan Regulations and Costs by Province:

Each province has specific regulations governing payday loan costs. Here’s a comparison table summarizing the maximum costs per $100 borrowed in different provinces across Canada:

| Province | Max Cost per $100 Borrowed | Max APR (Approx.) | Max Loan Term | Rollover Allowed? |

|---|---|---|---|---|

| Ontario | $15 | ~390% | 62 days | No |

| British Columbia | $15 | ~390% | 14-62 days | No |

| Alberta | $15 | ~390% | 14-62 days | No |

| Manitoba | $17 | ~443% | 62 days | No |

| Saskatchewan | $17 | ~443% | 14-62 days | No |

| Nova Scotia | $17 | ~495% | 62 days | No |

| Newfoundland & Labrador | $14 | ~546% | 14-62 days | No |

| Prince Edward Island | $15 | ~390% | 62 days | No |

| Quebec | Payday loans effectively banned (Max 35% APR) | N/A | N/A | N/A |

| New Brunswick | $15 | ~390% | 62 days | No |

Explanation of Key Terms:

- Max Cost per $100 Borrowed: This is the flat fee you pay for every $100 you borrow. For instance, in Nova Scotia, you’ll pay $17 for every $100 borrowed.

- Max APR (Approx.): The APR is calculated based on how much the loan costs when annualized. Although payday loans are short-term, regulators calculate the APR to highlight how expensive these loans can be.

- Max Loan Term: This is the maximum time you have to repay the loan. In most provinces, it’s between 14 to 62 days.

- Rollover Allowed?: This indicates whether you can extend the loan period by taking out a new loan to cover the old one. Most provinces in Canada do not allow rollovers to prevent debt traps.

Understanding the Real Costs:

Even though payday loans seem manageable when you’re borrowing small amounts, the fees can quickly add up, making it very expensive if you don’t repay the loan on time. The cost structure means that if you’re not careful, you could end up taking out additional loans just to cover the costs of your first payday loan, which can lead to a cycle of debt.

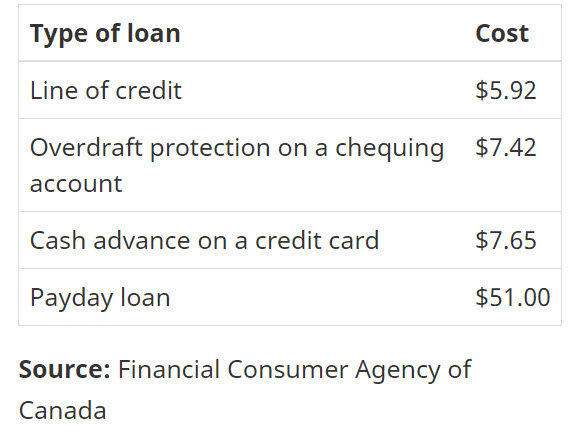

Are There Better Alternatives?

The good news is yes, there are better options, even if you have bad credit or need money fast.

- 0% Cash Advance Services: Canada has services like Bree or Nyble that can allow you to access up to $350 at 0% interest. These services can also help you rebuild your credit which will help you acquire loans from your bank at competitive rates.

- Credit Unions: Many credit unions offer small-dollar loans with much more reasonable interest rates than payday lenders. You don’t have to be a high-income earner or have great credit to qualify, and they’re often willing to work with you if you have a history with them.

- Installment Loans: Some lenders offer installment loans, where you borrow a set amount and pay it back in regular payments over a longer period of time. These loans usually have lower interest rates and give you a lot more flexibility in paying it off, which is key if you’re dealing with tight finances.

- Personal Line of Credit: If you’re able to get one, a personal line of credit is way better than a payday loan. You only pay interest on the amount you use, and rates are typically much lower than payday loans.

- Borrowing from Friends/Family: It’s not always easy to ask, but if you have someone in your life who could help you out, borrowing from a friend or family member might be a better way to get through a rough patch. Just make sure to keep things clear and agree on how you’ll pay them back to avoid any tension.

- Government Assistance: If your situation involves employment or housing issues, you might qualify for government support or assistance programs that help with emergency expenses.

- Non-Profit Credit Counseling: If you’re constantly in debt or struggling with managing your finances, getting in touch with a non-profit credit counselor can help you sort things out. They can guide you to better financial strategies and even help negotiate with creditors on your behalf.

Final Thoughts – Thread Carefully!

Payday loans might seem like a quick fix, but in most cases, they end up creating more problems than they solve. With sky-high fees and super-short repayment terms, it’s easy to get caught in a cycle of debt that’s tough to break free from. The alternatives—like credit unions, installment loans, or even borrowing from friends—can offer a much better solution. If you’re considering a payday loan, take a step back, and explore these other options first. You’ll appreciate this decision in the future!

Lauren Brown

Lauren has over 13 years of experience in wealth management and financial planning. She is a CFA charterholder and holds a Bachelor's degree in Finance. Lauren has worked with several asset management firms, offering wealth advisory and portfolio management services to high-net-worth clients.