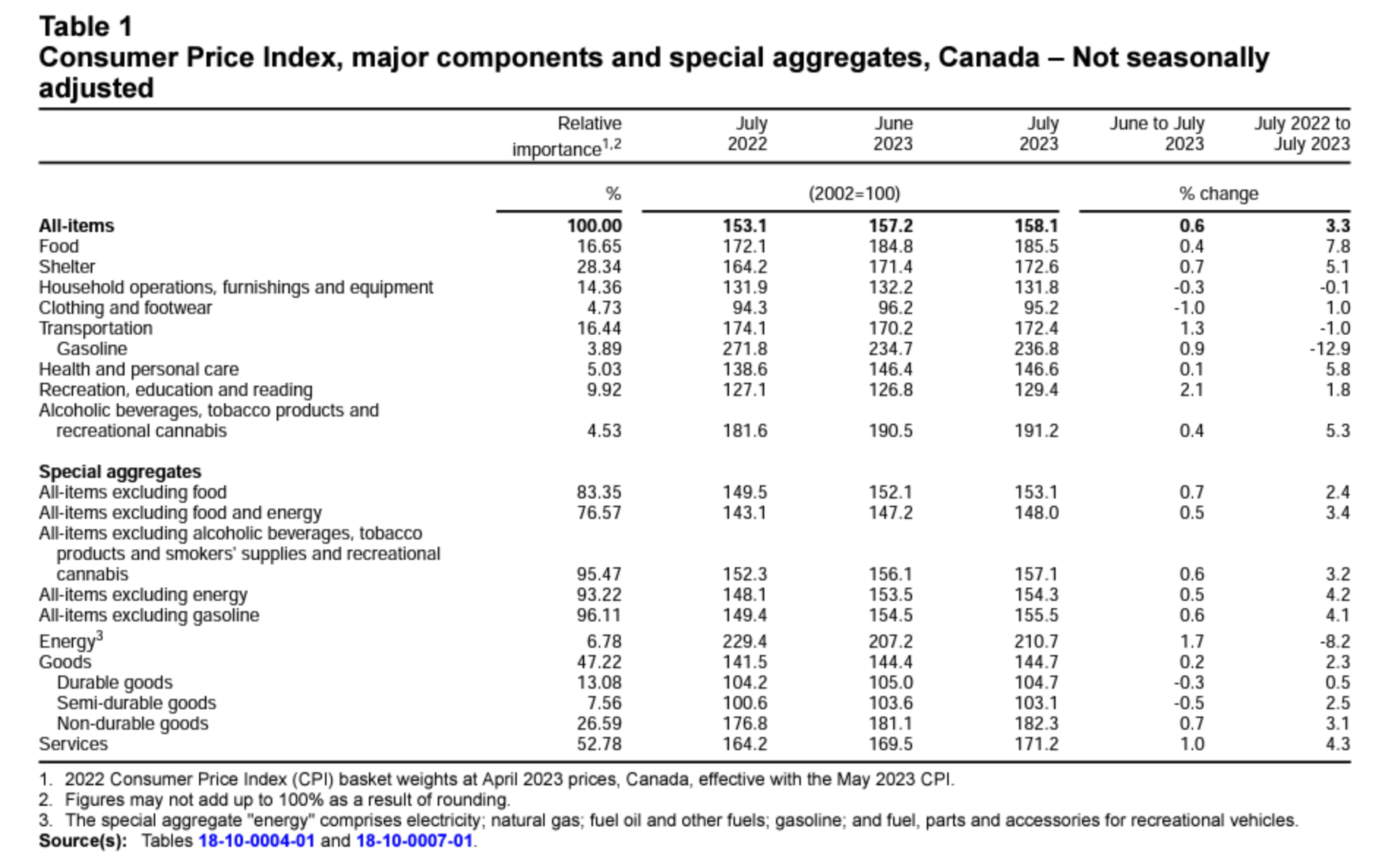

Canada’s consumer price index (CPI) increased by more than expected in July 2023, rising by 3.3% year over year (Y-o-Y), per today’s Statistics Canada (StatsCan) The Daily report published at 8:30 a.m. on August 15th, 2023. This marks a major acceleration from June’s 2.8% CPI reading posted the previous month.

Wednesday’s news came as a surprise to market watchers and economists who expected to see a headline CPI rate of 3.0%. As a result, the Bank of Canada’s upcoming interest rate decision in September is now in doubt, with more analysts now anticipating yet another 25 basis point hike next month. The central bank’s previous rate hike in July brought the overnight to 5% and the bank rate to 5.25%.

July’s CPI reading, which constitutes the first re-acceleration since April, is significant because it flies in the face of the Bank of Canada’s recent prediction that the inflation rate should remain around 3.0% for the remainder of the year. This month’s high inflation report suggests that perhaps the central bank’s interest rate policy has not gone far enough to keep inflation around target levels.

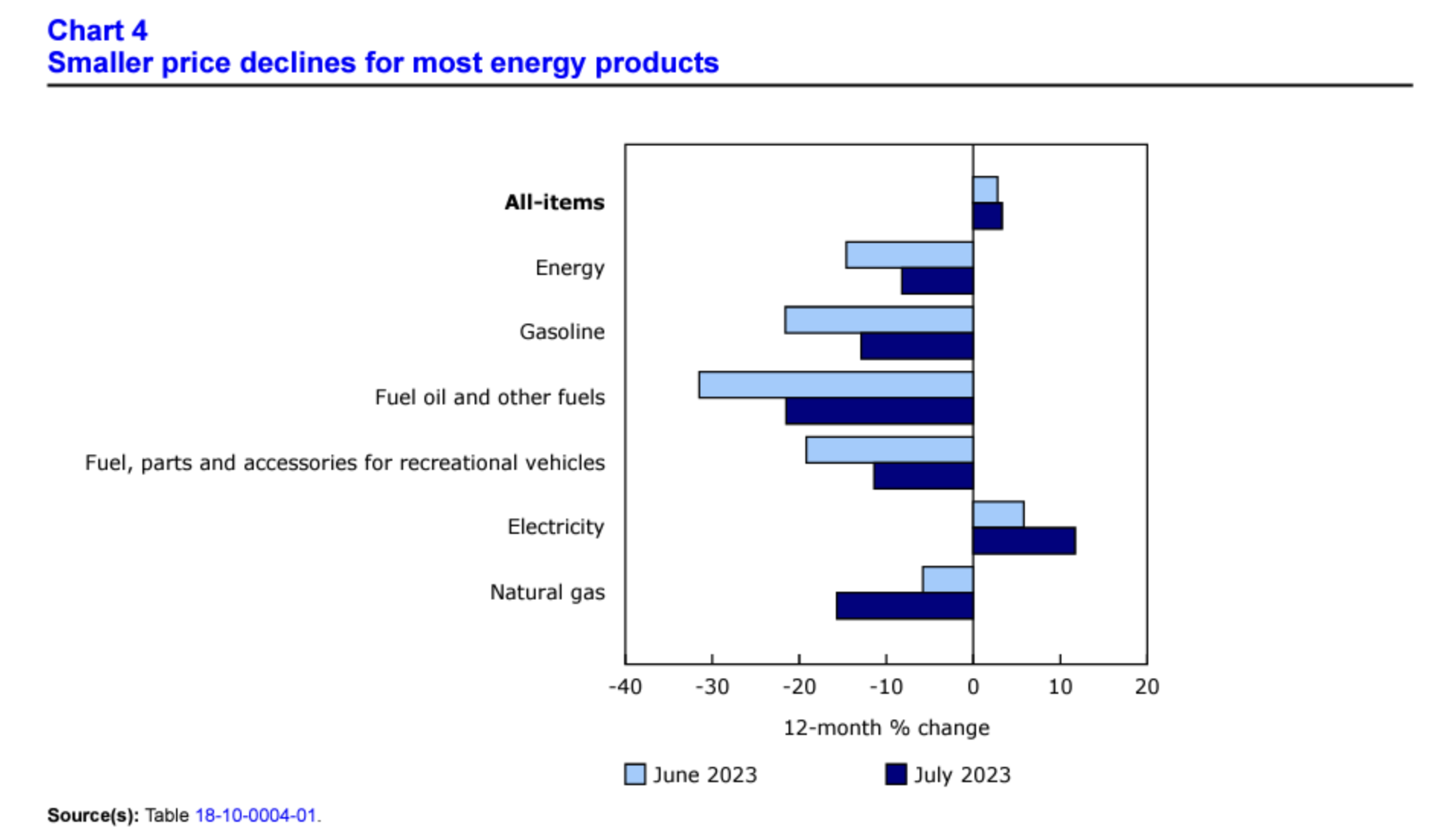

The main drivers of inflation in Canada’s July 2023 CPI report included energy prices, which fell by a lesser margin (-8.2%) compared to June (-14.6%). Notably, gasoline prices failed to drop by nearly as great a margin as the month prior (-12.9% versus -21.6% in June). However, rapidly rising mortgage index costs (+30.6%) were the single greatest factor in this month’s CPI reading—marking a record year-over-year gain in Canada. Similarly, electricity price increases accelerated in July compared to previous months, rising by 11.7% due, in large part, to high summertime demands on Albertan energy generation.

Lastly, a base year effect played a role in July 2023’s CPI report, as July 2022 was a time of particular concern among economists, many of whom foresaw a prolonged economic slowdown.

Source: Statistics Canada (Table 18-10-0004-01)

Core CPI Trends Downward Yet Again

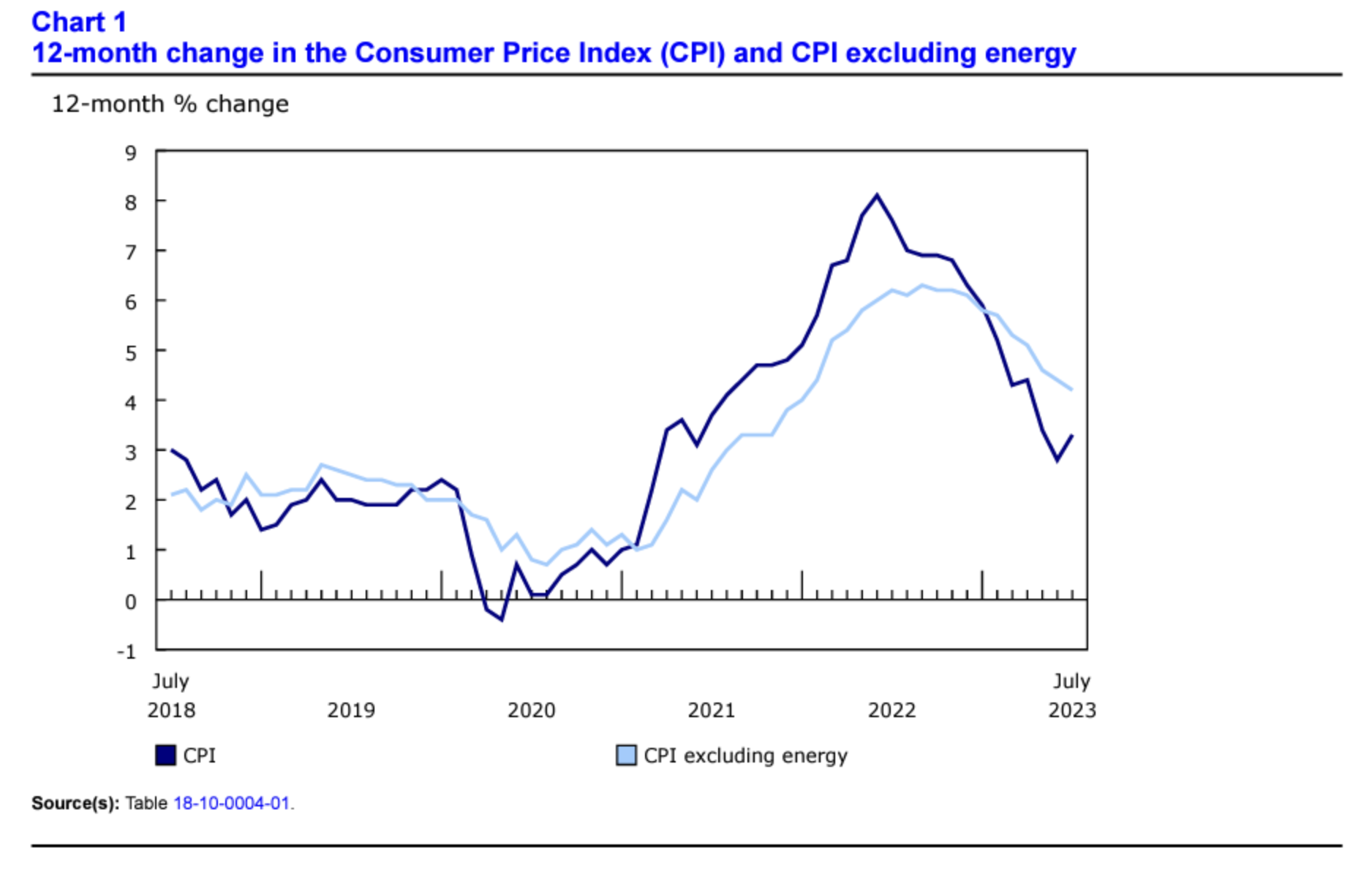

For the reference month of July 2023, the core CPI (i.e., CPI excluding food and energy prices) continued to its downward trajectory—a pattern recurring since late 2021. The annual measure of core inflation for July 2023 in Canada was 4.8%, down from 5.1% in June. This signifies that food and energy costs played a major role in July’s headline CPI report, whereas services and basic discretionary goods are likely to have stagnated or even declined in cost, albeit by a lesser margin than they declined in previous months (see the section below).

July 2023’s CPI report indicates that declining gasoline prices are contributing heavily to Canada’s declining inflation rate. By contrast, higher mortgage rates, rents, and grocery prices are contributing to net increases in the CPI.

Price Decelerations Slow Down Across the Board in July’s CPI Report

June 2023 saw far greater price decreases across virtually all line items in the headline CPI compared to July. The negative year-over-year changes in all items except natural gas were more pronounced in June, while electricity costs increased in July by nearly double the rate seen in the previous month.

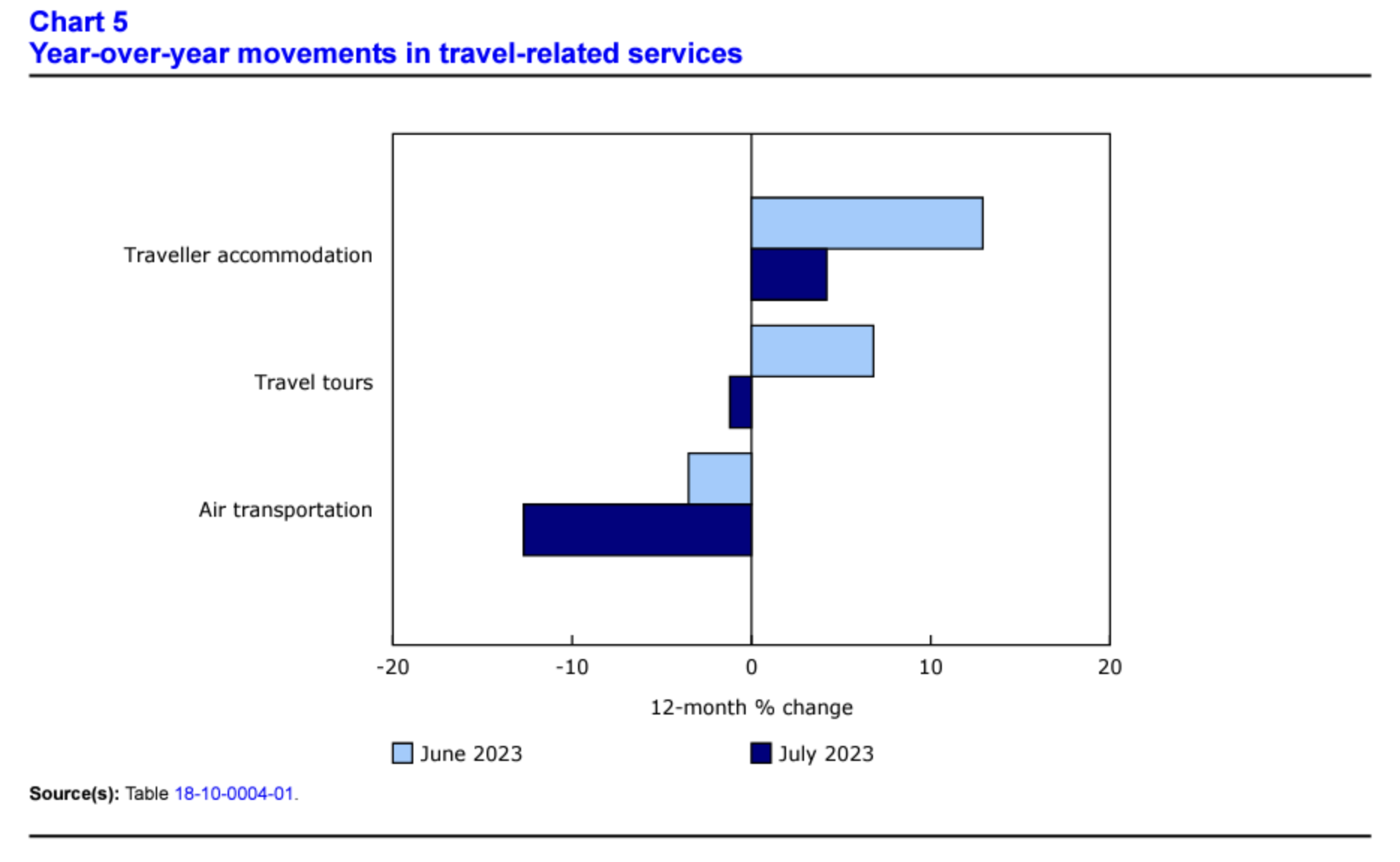

Good News for Travellers as Travel-Related Service Costs Decline

As seen in the chart below, travel-related service costs decelerated in July compared to the prior month. On a year-over-year basis, traveller accommodations increased by only 4.2% in July compared to June 2023’s significant 12.9% Y-o-Y gain. Airfare also marked a significant decline in prices, with average airfare prices in Canada down 12.7% since July 2022.

A recent Kiplinger report found that the international travel sector, after grinding to a near-halt in 2020, has fully rebounded to pre-pandemic levels and, in some cases, even surpassed levels seen in 2019. The abundance of international travellers originating from Canada has led to lower travel costs are more airlines are serving a greater number of airports compared to previous years.

Beat Inflation’s Summer Surge—Don’t Let Your Savings Melt Away

While many economists were taken aback by July’s CPI report, ordinary Canadians aren’t surprised. Over 80% of Canadians are alarmed by rising prices, whether it’s at the gas pump or the supermarket, and many now find life increasingly unaffordable. And with a probable rate hike looming on the horizon in September, mortgage and housing costs are only going to go up from here.

Naturally, many Canadians are wondering how they can protect their retirement savings this summer. With the value of the Canadian dollar diminishing faster than expected, it is crucial that Canadian families take precautions to safeguard their wealth from inflation and reduced purchasing power.

The good news is that there are options available for risk-conscious investors and retirement savers. Precious metals such as gold and silver have historically outperformed the stock market during times of high inflation or recessions. Hard assets such as real estate and precious metals can provide a strategic hedge against adverse market conditions such as those we’re seeing today.

Interested in getting started with precious metals? Browse our free guide to gold buying in Canada in 2023 to see how you can add gold or silver to your TFSA or RRSP today.

Report Cited: https://www150.statcan.gc.ca/n1/daily-quotidien/230815/dq230815a-eng.pdf