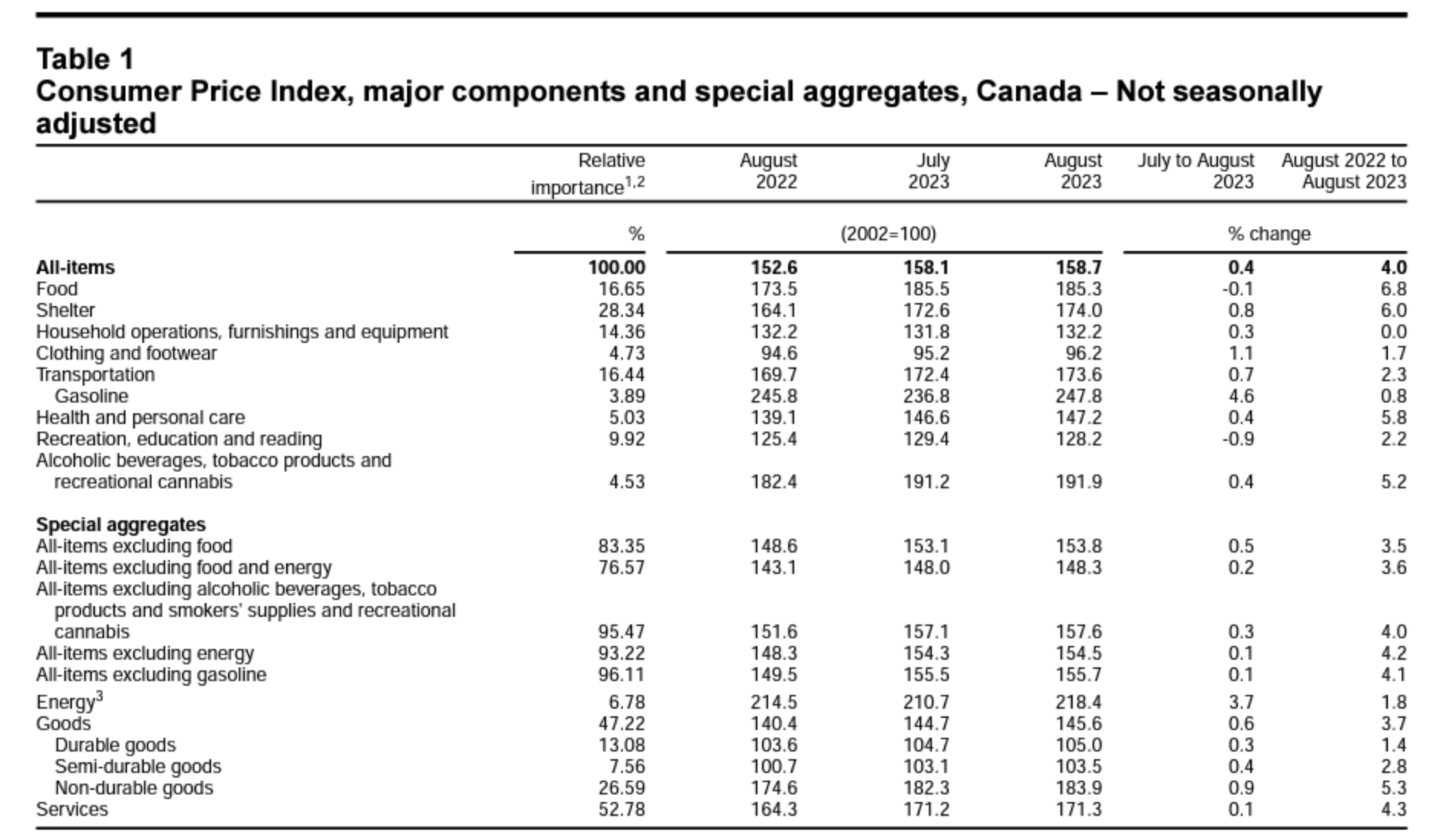

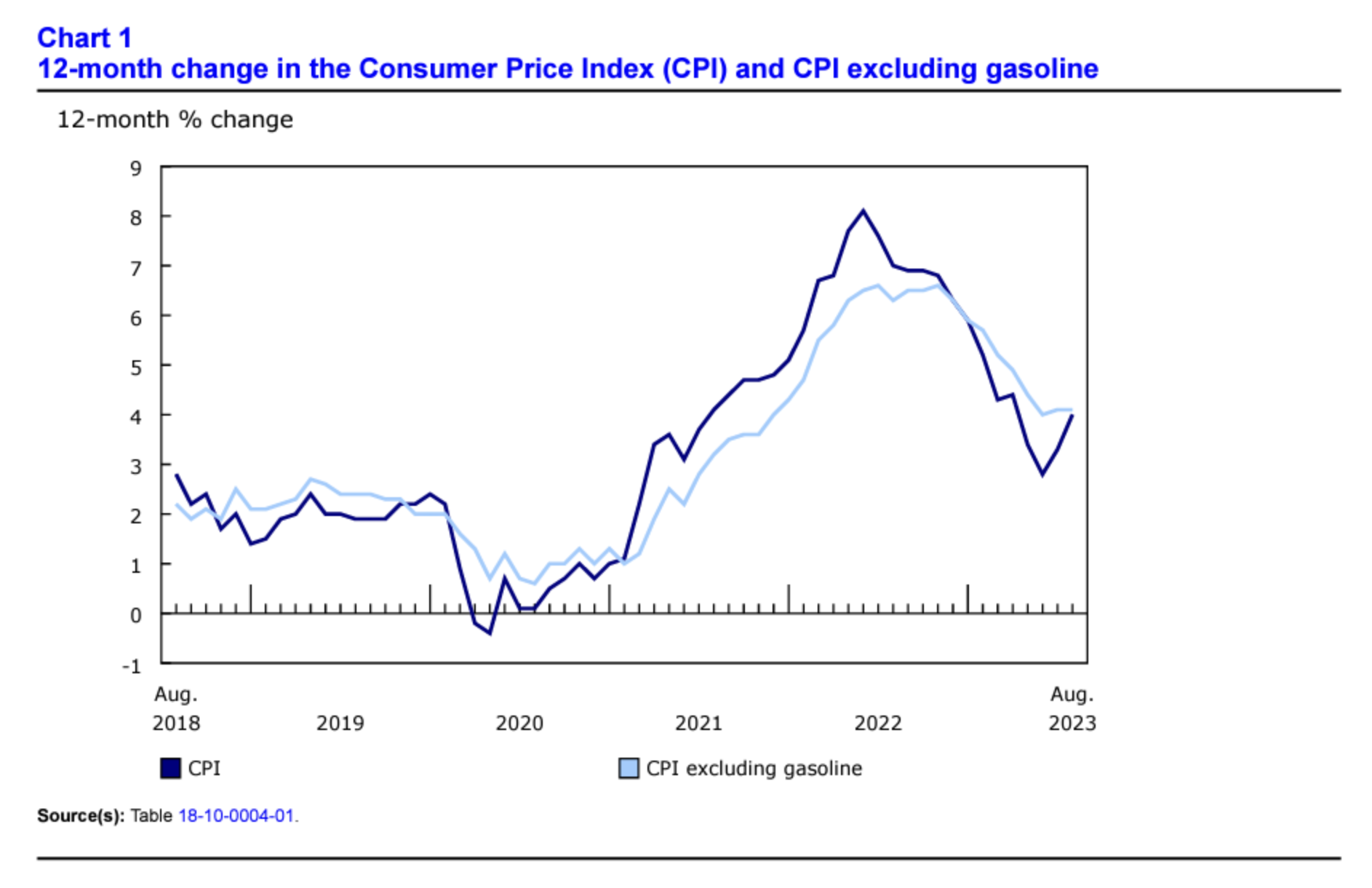

Canada’s consumer price index (CPI) accelerated by significantly more than expected in August 2023, rising by 4.0% year over year (Y-o-Y), per today’s Statistics Canada (StatsCan) The Daily report published at 8:30 a.m. on 19 September 2023. This marks a steep acceleration from July’s 3.3% CPI reading posted the previous month.

The news on Tuesday came as a surprise to market watchers and economists who forecasted a headline CPI rate of 3.8%. As a result, the Bank of Canada’s upcoming interest rate decision in October may now be in doubt, with the possibility of another 25 basis point rate hike appearing as a more plausible outcome. The central bank’s previous rate hike on September 6 held the overnight at 5% and the bank rate to 5.25%.

August’s CPI reading, which builds on the re-acceleration first seen in July, is significant because it contradicts the Bank of Canada’s prediction that inflation would remain around 3.0% for the remainder of the year. This month’s higher-than-expected inflation report suggests that perhaps the central bank’s interest rate policy has not gone far enough to keep inflation around target levels.

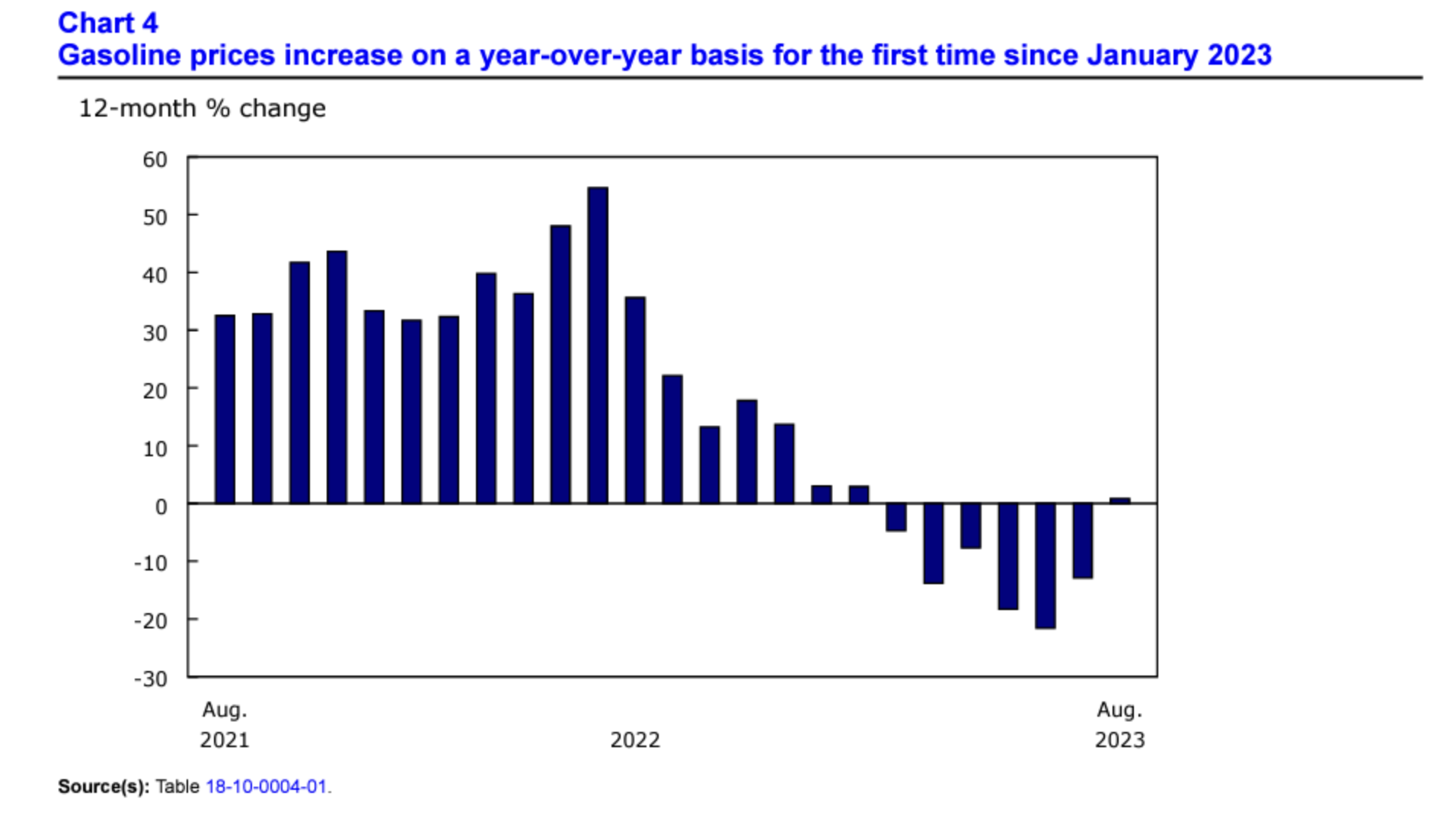

The main driver of inflation in Canada’s August 2023 CPI report was high gasoline prices, which rose 0.8 percent Y-o-Y, marking the first yearly increase since January. In July, gasoline prices fell by 12.9 percent.

In what is surely positive news for many Canadian families, grocery price acceleration slowed to 6.9 percent on the year—down from 8.5 percent in July. Counterbalancing this was shelter prices, which rose 6.0 percent Y-o-Y after posting a 5.1 percent increase in the preceding month.

Source: Statistics Canada (Table 18-10-0004-01)

Core CPI Turns Upward for the First Time in 2023

For the reference month of August 2023, the CPI excluding gasoline rose for the first time this year. The core CPI (including both “CPI-trim” and “CPI-median”) both ticked up in August after trending downward since 2022. The CPI-trim index is 3.9 in August, up from 3.6 in July, whereas the CPI-median index is 4.1 in August, a notable increase from 3.9 during the month prior.

Getting Gouged at the Pump? Canadian Gas Prices Heat Up in August

August 2023 saw gasoline prices rise on a year-over-year basis for the first time since January. Gas prices rose 0.8% in August, an augmentation that was seen as largely responsible for August’s hot CPI reading. However, as reported in the Globe and Mail, gasoline itself is not the problem. The authors note that gasoline price increases were fairly modest in August and other factors such as housing and mortgage costs were of equal or perhaps greater importance.

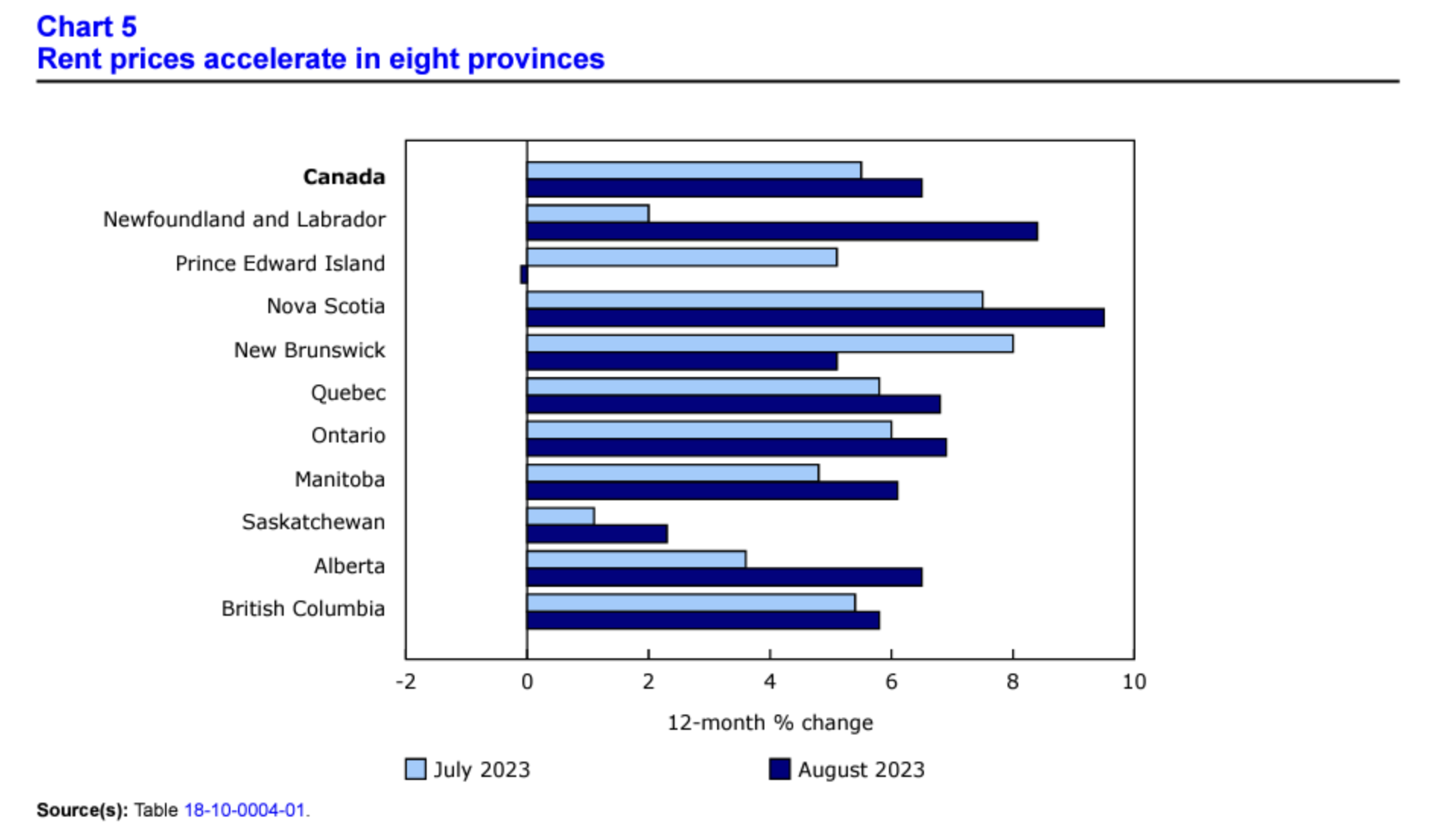

Canadian Rents and Mortgage Costs Rise in August

Canada’s deeply entrenched housing crisis is being aggravated by rising mortgage and rent costs. In all but two Canadian provinces, rent and housing costs increased Y-o-Y in August. Rent prices, on average, increased 6.0 percent in August, up from 5.1 percent in July.

As rising mortgage interest rates are creating barriers to homeownership, demand for rental housing is heating up. This, on top of surging immigration levels, have led to shortages in available housing stock in many Canadian rental markets as supply constraints curtail the availability of inhabitable units.

Beat Inflation’s Autumn Surge—Don’t Let Your Savings “Fall” Apart

Regarding this month’s inflation report, Bank of Montreal economist Doug Porter remarked “Things just got a lot more interesting for the Bank of Canada, and most definitely not in a good way.” Unfortunately, Mr. Porter’s conclusion is true. Given a rapidly accelerating inflation environment, all eyes are now on the Bank of Canada to see whether future rate hikes are once again back in the cards.

If rate hikes materialize, our cost of living crisis may worsen as more Canadians are unable to service their debts, pay their mortgage, or keep a roof over their heads. Should the opposite occur, and rates remain stagnant, we may see uncontrolled inflation heat back up to 2022 levels.

There’s little doubt that Canadians are in a difficult spot. As inflation rises, so too do many Canadians’ hopes of an affordable future.

Given today’s CPI report, many Canadians are wondering how they can protect their retirement savings this fall. With the value of the Canadian dollar quickly diminishing, it is crucial that Canadian families take precautions to safeguard their wealth from the wealth-eroding effects of inflation.

Fortunately, there are options available for risk-conscious investors and retirement savers. Precious metals such as gold and silver have historically held their value more reliably than stocks during times of high inflation. Hard assets such as real estate and precious metals can provide a strategic hedge against adverse market conditions, including high inflation and recessionary activity.

Want to get started with precious metals investing? Browse our free guide to gold buying in Canada in 2023 to see how easy it is to diversify with precious metals in your retirement savings accounts.

Report Cited: https://www150.statcan.gc.ca/n1/daily-quotidien/230815/dq230815a-eng.pdf