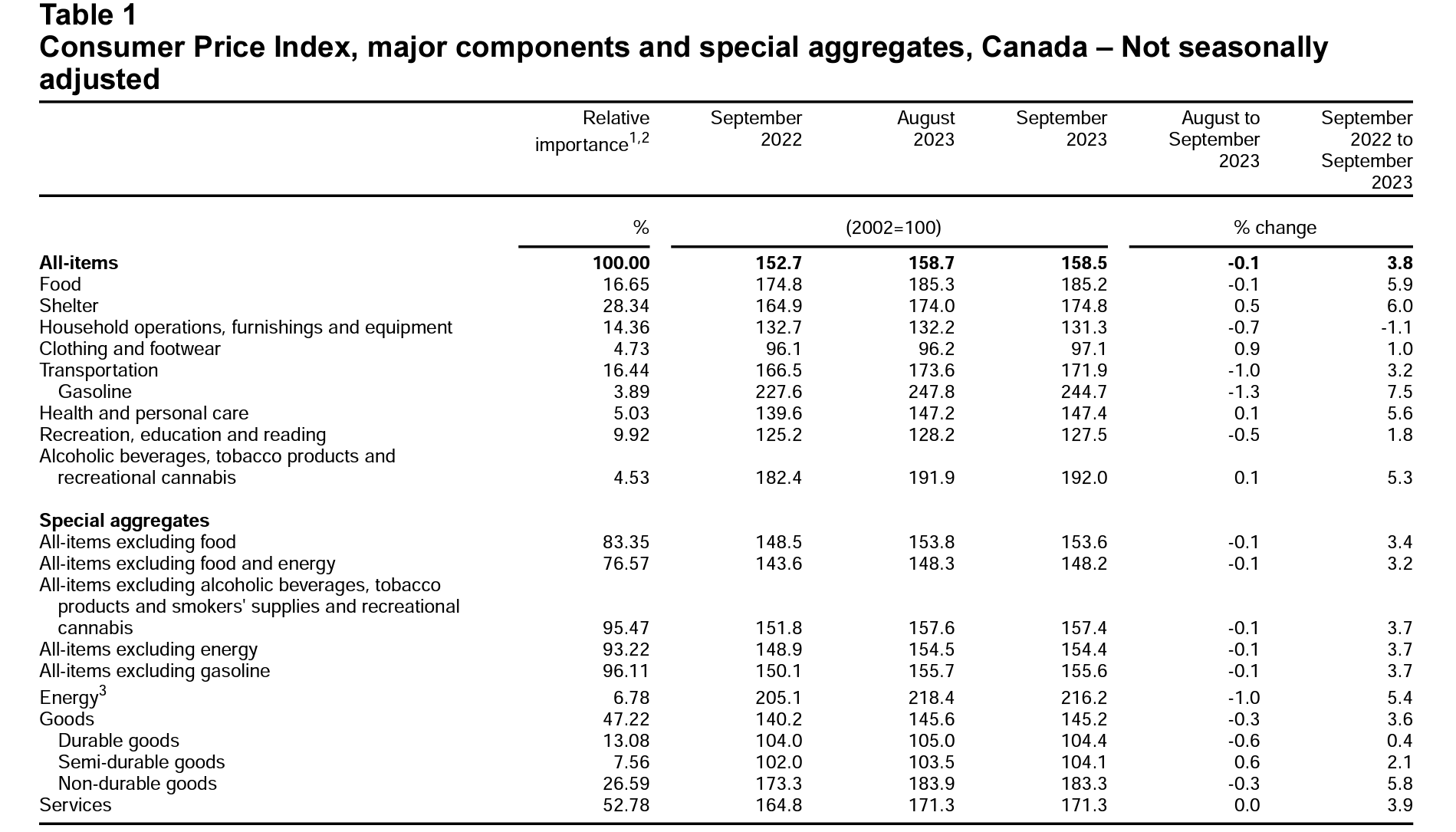

Canada’s consumer price index (CPI) accelerated by less than expected in September 2023, rising by 3.8% year over year (Y-o-Y), per today’s Statistics Canada (StatsCan) The Daily report published at 8:30 a.m. on 17 October 2023. This marks a notable deceleration from August’s 4.0% CPI reading posted the previous month.

The news on Tuesday met some analysts’ expectations, who largely anticipated a slowdown in inflation, including RBC Royal Bank, who accurately foresaw a 3.8% Y-o-Y rate for September. As a result, it appears likely that interest rates will hold at 5% following the Bank of Canada’s upcoming interest rate decision on October 25. The possibility of another 25 basis point rate hike appears less plausible following today’s CPI report. The central bank’s previous rate hike on September 6 held the overnight at 5% and the bank rate to 5.25%.

September’s CPI reading, which follows August’s large spike in inflation, still supersedes the Bank of Canada’s prediction that inflation would remain around 3.0% for the remainder of the year.

The main drivers of inflation in Canada’s September 2023 CPI report were rents and mortgage costs, grocery prices, and gasoline. By contrast, airfares and select grocery categories, such as meat and dairy, decelerated.

Fortunately, Canada’s September 2023 CPI report was “broad-based” and impacted many consumer market sectors, including relief in the grocery aisles as well as price deceleration for furniture and new passenger vehicles.

Source: Statistics Canada (Table 18-10-0004-01)

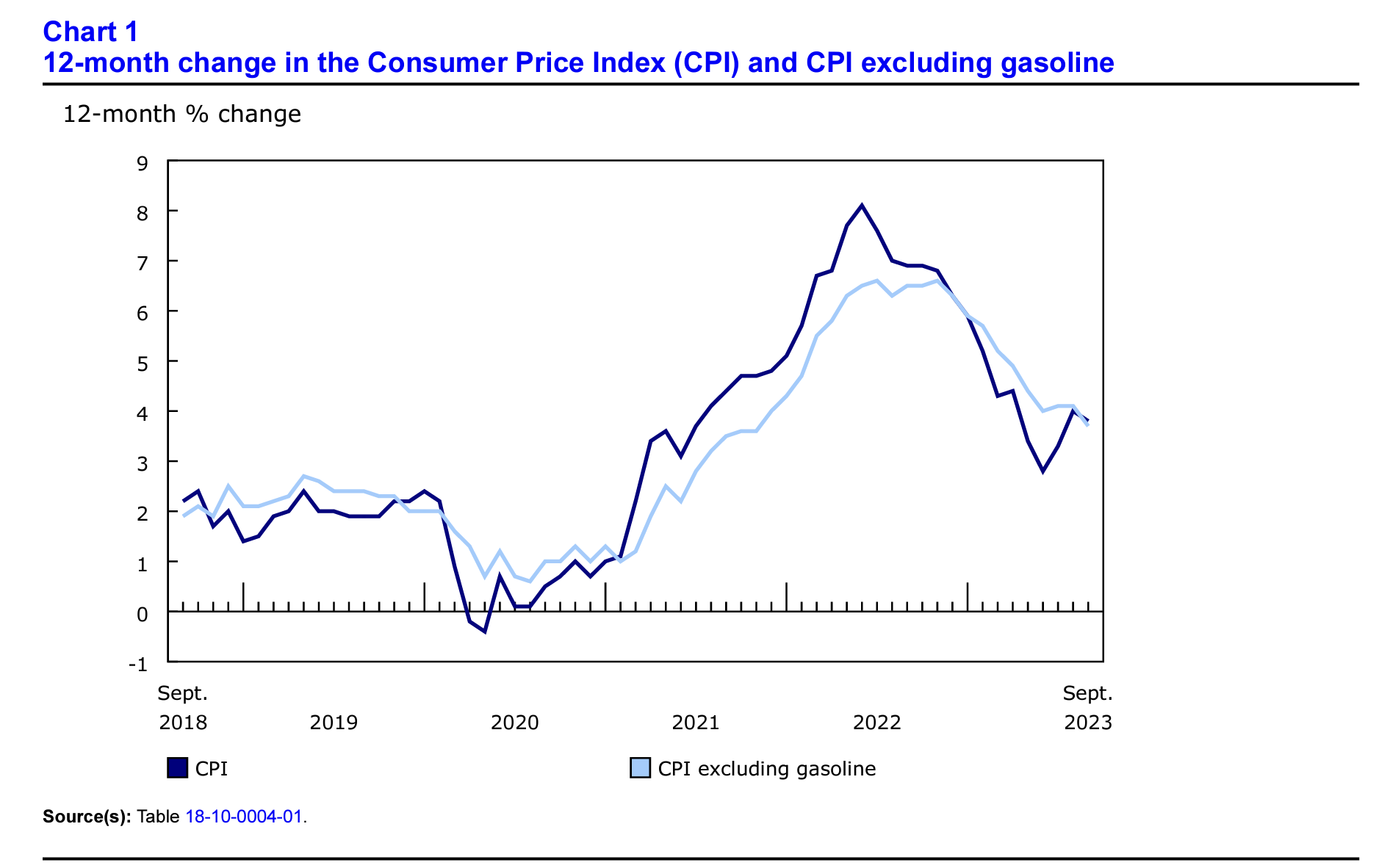

Core CPI Resumes Downward Trajectory

For the reference month of September 2023, the CPI excluding gasoline lowered in September. The core CPI (including both “CPI-trim” and “CPI-median”) both ticked up in August after trending downward since 2022, and has now resumed its downward trajectory. The CPI-trim index is 3.7 in September, down from 3.9 in August, whereas the CPI-median index is 3.8 in September, a notable decrease from 4.1 during the month prior.

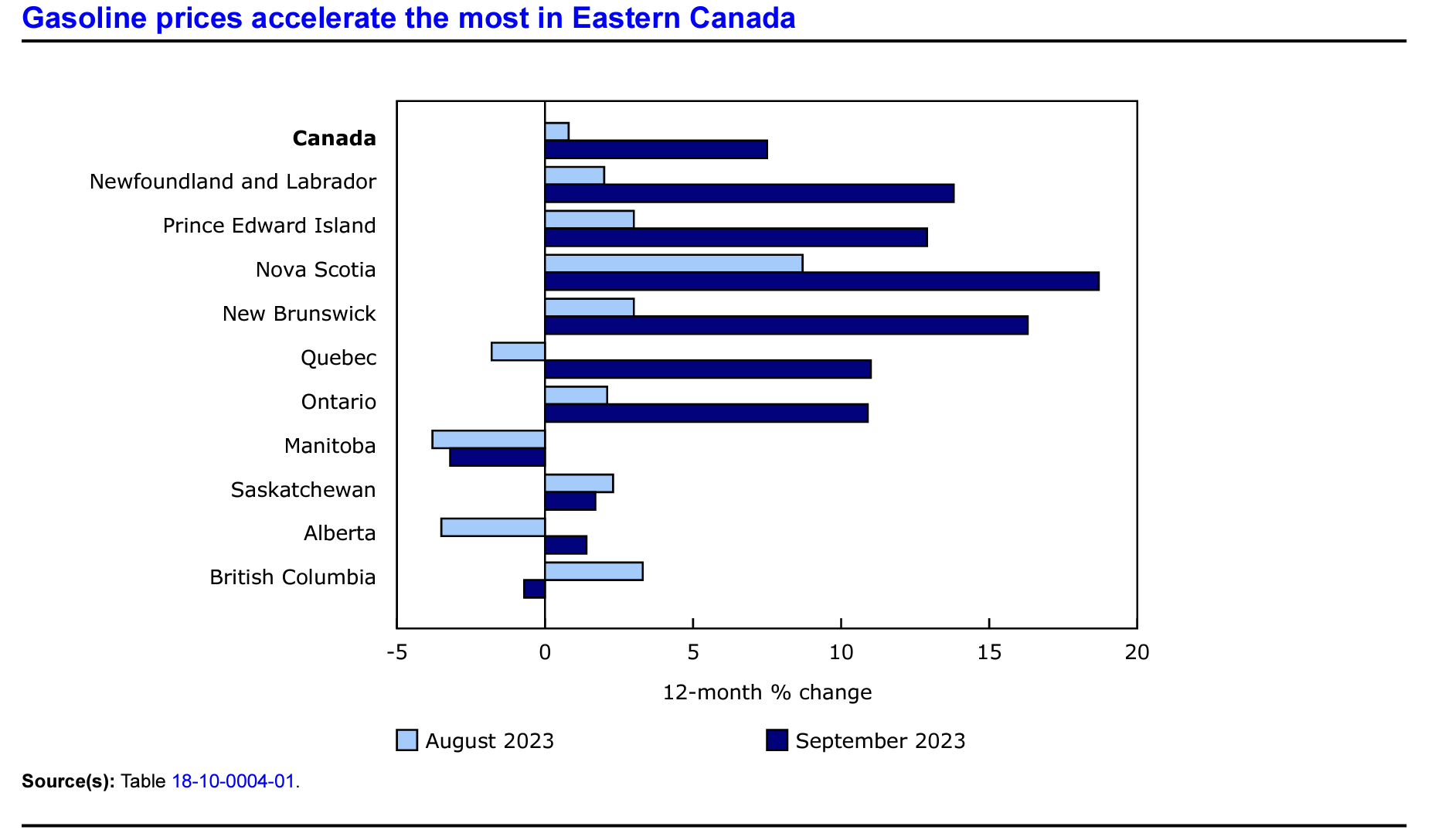

Getting Gouged at the Pump? Canadian Gas Prices Continue to Rise

September 2023 saw gasoline prices rise on a year-over-year basis in every province except Manitoba and British Columbia. Gas prices rose 7.5% in August, following a much smaller 0.8% rise in gas prices in August that was due, in large part, to base year effects. However, as reported in the Globe and Mail, gasoline itself is not the problem. Gasoline greatly contributed to September’s CPI increase in addition to mortgage and housing costs and grocery prices.

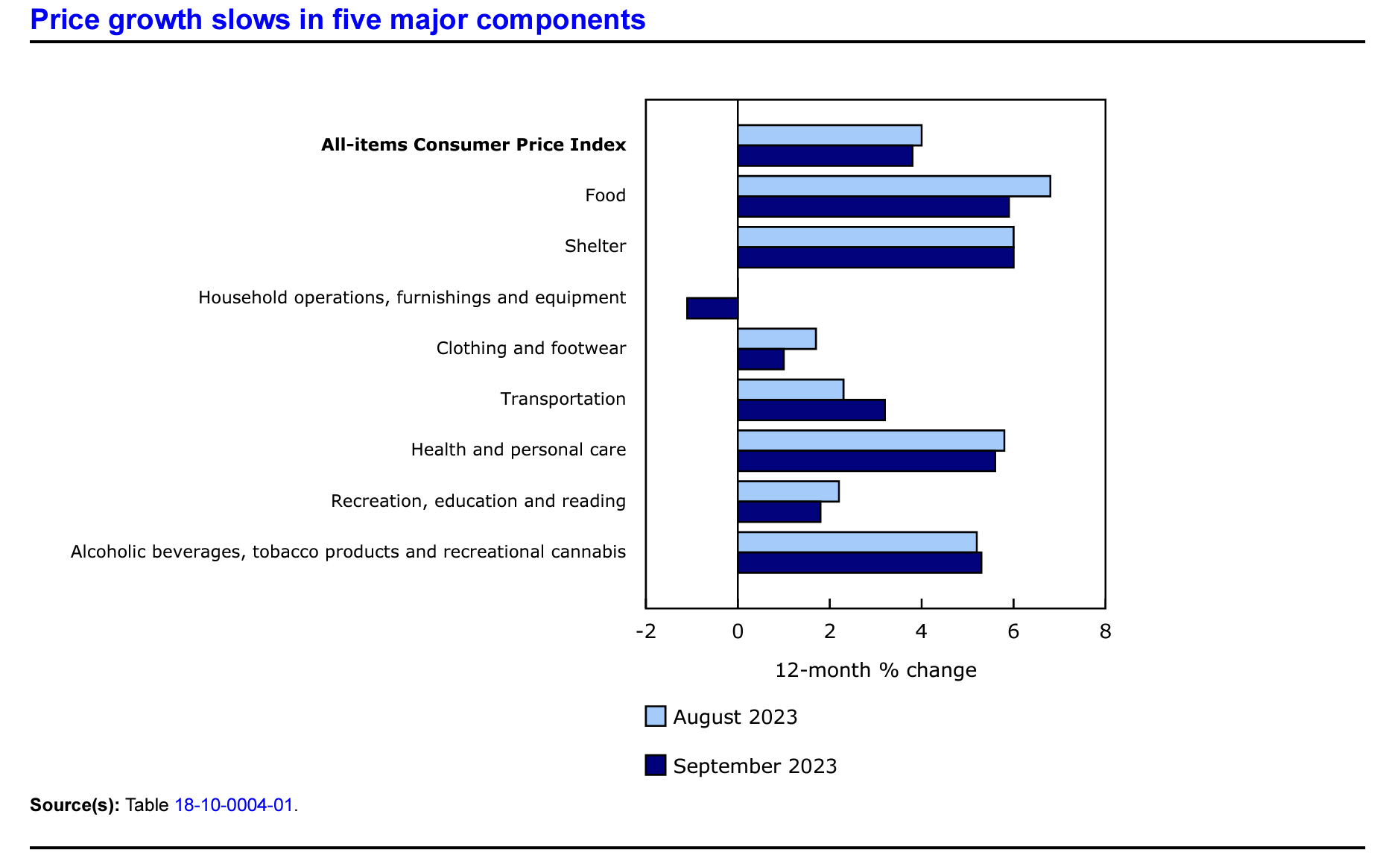

Broad, Economy-Wide Deceleration in September

With the exception of transportation costs, which are deeply intertwined with gasoline prices, most market sectors saw price deceleration in September. The most notable downward price pressure was seen in the food sector, in addition to household operations, furnishings, and equipment.

Alcoholic beverages, tobacco, and recreational cannabis also saw minor price acceleration in September.

Beat Inflation this Autumn: Diversify With Trusted Assets

Autumn’s worrying inflation reports have some analysts concerned about the long-term health of the Canadian economy. About last month’s inflation report, Bank of Montreal economist Doug Porter remarked “Things just got a lot more interesting for the Bank of Canada, and most definitely not in a good way.” Unfortunately, Mr. Porter’s conclusion is true. Given a rapidly accelerating inflation environment, all eyes are now on the Bank of Canada to see whether future rate hikes are once again back in the cards.

If rate hikes materialize, our cost of living crisis may worsen as more Canadians are unable to service their debts, pay their mortgage, or keep a roof over their heads. Should the opposite occur, and rates remain stagnant, we may see uncontrolled inflation heat back up to 2022 levels.

There’s little doubt that Canadians are in a difficult spot. As inflation rises, so too do many Canadians’ hopes of an affordable future.

Fortunately, there are options available for risk-conscious investors and retirement savers. Precious metals such as gold and silver have historically held their value more reliably than stocks during times of high inflation. Hard assets such as real estate and precious metals can provide a strategic hedge against adverse market conditions, including high inflation and recessionary activity.

Interested in precious metals investing? Browse our free guide to gold buying in Canada in 2023 to learn how to diversify with precious metals in your TFSA or RRSP.

Report Cited: https://www150.statcan.gc.ca/n1/en/daily-quotidien/231017/dq231017a-eng.pdf?st=oV1MWaEn