Canada’s inflation and the general erosion of the loonie has to go down as one of the most undersold economic issues in the West.

You’ll hear outlets and pundits talk about how weak the CAD is relative to a year, two or three ago. But nobody will address the elephant – or very large beaver – in the room: why does the CAD act as a sort of mockery of the U.S. dollar? Why do Americans like me look to Canada’s currency and think: “Let’s hope this doesn’t happen to us?”

We’ll attempt to do just that as we try to find why the CAD rests on such flimsy footing, and how one might protect their wealth and savings in an increasingly harsh environment.

The greenback and the other dollars

The more one spends time in finance, the stronger the feeling that the prefix “U.S.” ahead of the U.S. dollar serves, namely to remind onlookers that they’re dealing with the real dollar.

As you know, both Canada and Australia’s currencies share the same moniker. So why are they a pale shadow of the real thing?

We weren’t joking when we said the issue of the loonie is being mostly ignored. If we search around for mentions on the weakness of the Australian dollar, we get no shortage of admissions. For example, The Guardian reminds Brits that each of their pound sterling currency—which has massively collapsed over the last decade and half—can still get them nearly two Australian dollars.

But Canada seems to get little in the way of such concessions. This analysis actually compares the CAD to both the pound sterling and the euro, making it seem as if the three currencies are to be placed in the same category as some rival to the U.S. dollar.

It neglects to mention that the Canadian dollar goes for 0.75 American cents.

In other words, $100 CAD is equal to $75 USD.

It’s not always clear how aware of this weakness the Canadian citizen is. Do they know both Canada’s and Australia’s dollars are three-quarters the price of the U.S. dollar? Do they have any idea why?

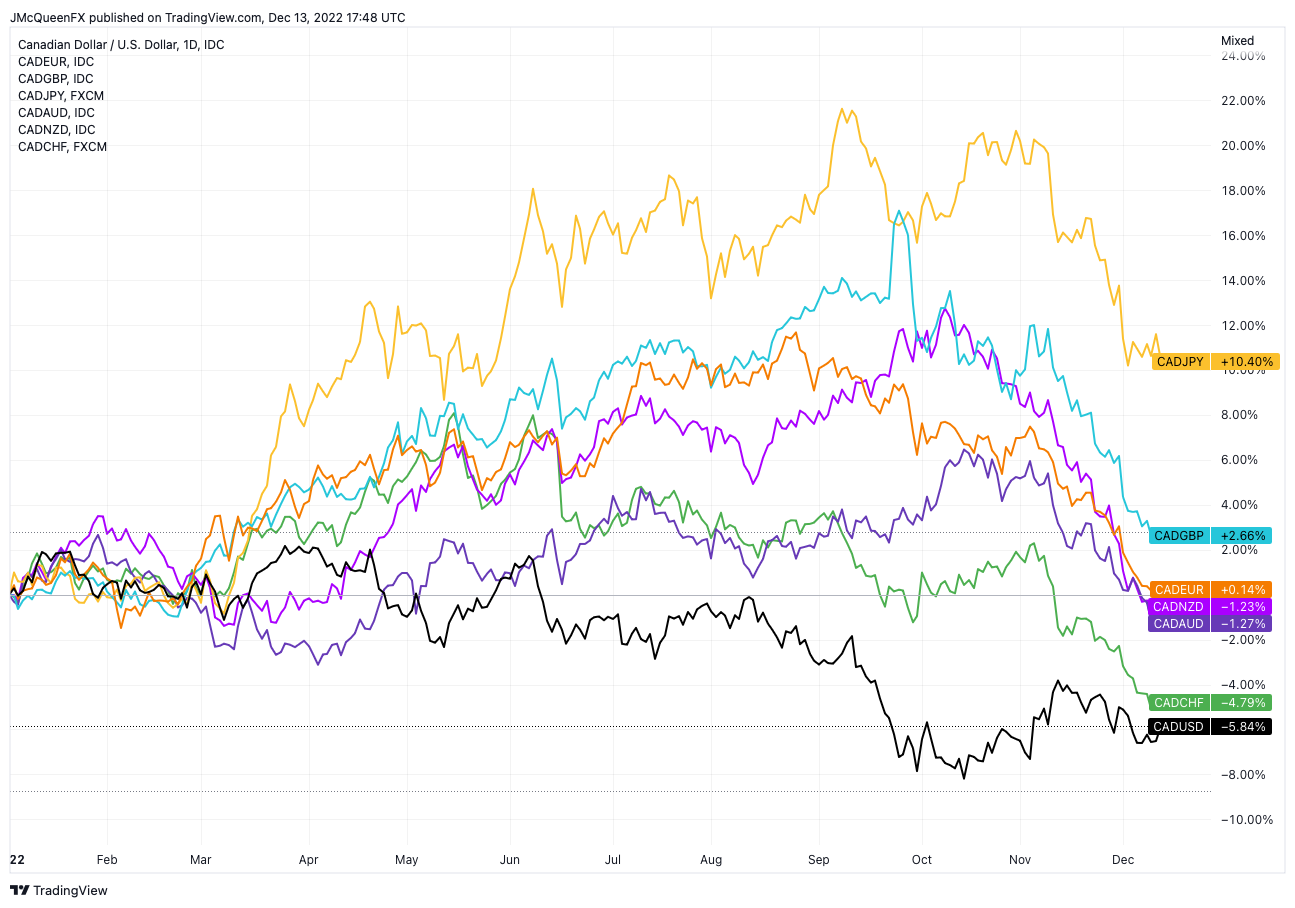

The same analysis tells us that the loonie is a “commodity currency”. Does that justify such gross devaluation against every other major currency besides the hyperinflated yen (which we’ll get to later)? Hardly.

Much of what we cover here references the U.S. dollar for an idea of how outlandish the CAD’s depreciation has been over the last 15 years. Before going into the details of that, let’s start with a primer of why the U.S. dollar is nothing to brag about.

The U.S. dollar has lost 99% of its purchasing power—but we’re still way weaker

Gold is another thing we must reference prominently, and we will. For now, let’s say that gold stands as a very accurate gauge of inflation. The better it performs in a currency, the worse that currency is off.

Ever since the U.S. dollar was untethered from gold by Richard Nixon, its purchasing power has fully went the fiat route. In the 1970s, when the U.S. dollar was still on a soft gold standard and nothing like in the 19th and early 20th century, an ounce of gold went for around $40.

In 1834, for example, an ounce of gold was a little over $20. In 1934, it was $35. It might have taken a century, but the price of gold in U.S. dollar terms nearly doubled.

That means that if you happened to find a century-old stash of U.S. dollars in 1934, they’d be worth nearly half of what they were when they were stashed. Of course, the same scenario now would leave you with a practically worthless find.

For in 1971, even though the U.S. dollar was remarkably holding onto the $40 level, the central monetary authorities that so often dictate our well-being said enough is enough. Gold was removed from the monetary system, and just 50 years later, it’s going for around $2,000.

This amounts to a 99% loss of purchasing power.

Even dating back to 1934, holding gold might have been optional. Why hoard bullion when the U.S. dollar is as good of a store of value as any?

These days, it’s known that you need to own gold to protect your wealth. You can’t afford to store it in currencies because of the ridiculous rate of debasement. You know that in a decade or two, your cash pile will be worth much less.

Considering the weakness of the Canadian dollar, you might think that this was always the case. So you might be surprised to learn that, fairly recently, our loonie traded higher than the U.S. dollar.

2007-2011, when one CAD was worth 1.06 U.S. dollars

This is an interesting piece because it touches on a lot of fairly puzzling things. For example, it purports that Canada’s dollar was stronger than that of the U.S. in 2007 and 2011 because of oil prices. But then it goes on to quote economist Werner Antweiler:

One of the really interesting phenomena that we have seen in the last year or so is the decoupling of our Canadian dollar from the movement in the oil price […] The usual effect was that, when commodity prices were going up, so was the Canadian dollar. That isn’t happening to the same extent.

So we are to believe that Canada had some kind of oil tether with its currency that allowed it to outperform the global reserve currency, but that such magically evaporated and we’re now no longer gaining alongside commodities.

It’s convenient, if nothing else, because it deflects blame from the real perpetrators: the Bank of Canada. It’s the same old claim we’ve heard with the ruble: how it’s intrinsically tied to oil prices.

In case you haven’t noticed, this has only meant that the Russian economy somehow implodes further when oil prices fall. But it’s never translated to the opposite direction. You haven’t heard of a great Russian economic boom in 2007 or 2011, have you? No, of course not.

However oil prices might be fluctuating, it’s one of the most in-demand commodities. But the inflation of the rapidly depreciating ruble has accelerated in recent times despite a massive 16% nominal interest rate.

Consequently, Russia’s central bank is causing enormous suffering for the populace, akin to the recessionary 1970s in the U.S., with little reward. Nobody expects the ruble to shed its toilet paper status unless it’s tethered to gold. If you’re a lower class Russian, you probably aren’t too happy with how money has been managed.

The truth is that you should be no happier with how we’ve done things with Canada, even if the CAD still looks mighty compared to the ruble.

The 2% inflation lie: How central banks destroy your money for “progress”

Ever since fiat money started to rule the global economy, there’s been a persistent lie on behalf of central banks that a 2% annual inflation rate is good for progress and development.

Sounds silly, doesn’t it? There isn’t actually any evidence for that, and how could there be?

An inflationary central bank policy primarily benefits two parties. First is the government which pays less interest on its debt. Second are the wealthy whose money is mostly in assets that appreciate due to inflation. If you don’t happen to be in one of these groups, a 2% annual inflation rate is the last thing you want insofar as money is concerned.

So we have a scenario where the currency depreciates on an annual basis just because, to the tune of 20% in 10 years, and this depreciation spikes massively during any crisis event. But the currency never turns around and gains value.

Forget currency baskets—goods and services are always getting more expensive in every currency regardless of its supposed “strength”. When everyone told you that the U.S. dollar is extremely strong due to the Fed’s hiking cycle, it actually weakened massively. It was not uncommon for prices of goods to double in U.S. dollar terms recently.

So where is the strength?

We weren’t joking when we said that it’s hard to get an admission of how bad things are. How about this overview that says “If it ain’t broke, don’t fix it” in regards to Canada’s central bank policy?

That’s a sound enough quote, but it hardly applies when a currency has depreciated 25% against a currency it was once stronger than. But here’s the thing: since 2007-2011, the U.S. dollar has depreciated over 25% just based on the Fed’s 2% inflation rate target.

So when you see a 0.75 CAD to 1 USD, what you’re really seeing is a depreciation closer to, and perhaps in excess of 50% in only 15 years.

Don’t take our word for it, see what gold is doing

While our American neighbors lamented gold’s temporary inability to pass $1,900, other charts readily displayed it as over $2,700. That was, of course, the gold-CAD chart.

If you’ve paid any attention to gold in Canadian dollar terms, you know it has hit all-time high after all-time high. But more than that, the all-time highs have served to illustrate just how weaker the loonie is compared to the greenback.

If things go as they have so far, we might see 3,000 CAD gold soon. If gold hit 3,000 in U.S. dollar terms, Americans would be abandoning ship, so to speak. So why don’t we care that our once-stronger dollar is reaching the same relative strength in the inflation-tracking asset?

We did mention the Japanese yen, and we indeed need to touch upon it further to show just how far things can be taken with the public’s acceptance.

The yen has always been the only near-worthless lira-esque currency that for some reason everyone insisted is a safe-haven. It has been grouped for decades with the likes of the euro and the pound sterling, both of which are somewhat higher than the U.S. dollar. When we say higher, we mean a 10%-20% difference.

On the other hand, it now takes around 146 Japanese yen to buy one U.S. dollar.

The Bank of Japan is known not only for its ultra-loose policies, but also their near-total disregard for their effect. As far as the BoJ is concerned, the yen’s development is a good thing.

As you might imagine, gold has likewise posted consecutive ATHs in the yen. A January note tells us that gold hit an ATH of 8,977 yen, but it has since surpassed 10,000.

The important thing to understand is that the CAD isn’t really doing that much better. Our central bank definitely doesn’t view currency erosion as a problem. It maintains a 2% inflation target, which has officially moved between 3%-5% lately.

As quite a few gold pundits ask: do you feel that your money is losing only 2% of its value annually?

Don’t speculate—Shield yourself with a Gold RRSP

If the CAD can fall from 1.06 USD to 0.75, what’s the bottom? Is there any?

One good thing about our monetary management system is that we can still invest our retirement savings in gold through a RRSP in order to protect ourselves from massive wealth erosion. A cynical investor might say that there is only an inflationary problem for savers if they aren’t aware of gold. It’s true, if a little lacking in tact.

The only way to present an argument against everything we’ve outlined would be for Canada’s dollar to gain, and gain a lot. It would have to return to U.S. dollar valuations as a minimum. But as any historical lesson in world economics will show, currency devaluation is a one-way street: the only way for the CAD to gain value would be for the U.S. dollar to devalue theirs.

Another positive is that Canadians are finally waking up and acknowledging the problem. You don’t need to look very far to find opinions on how fiat money is coming to a close.

We don’t know what awaits us on the other side, but a gold standard seems more than likely. From Russia to Europe, various corners of the world seem to have growing aspirations to tether their fiat currency to gold in order to avoid collapse.

It’s hard to say exactly what’s coming, but it seems that gold is scheduled to play a central part in it. If we go back centuries or even millennia, we find that it’s actually not uncommon for the world to return to gold after ill-fated monetary experiments.

It would benefit us all to follow in the footsteps of the gold-hoarding central banks around the world and load up on gold—the only “money” that cannot be printed into oblivion by government decree. Open a gold RRSP today and take back control of your money.