In Greece, tax evasion is a cultural norm that goes back to the occupation of the Ottoman Turks and the heavy taxes they imposed. Today, Greeks vehemently and proudly avoid taxes and, to a large extent, are allowed to get away with it. Greek Prime Minister Alexis Tsipras and his left-wing Syriza party used the phrase “I won’t pay” as a campaign slogan, referring to tax hikes and austerity measures imposed by international creditors.

It was not a huge surprise when Greece missed a deadline to pay the IMF $1.8B on June 30th. The country was hit hard by the global recession beginning in 2007/2008. Tsipras’s decision to end talks with creditors over another much needed bailout (with more strings attached) and put it to a popular vote was a surprise, as was the resounding ‘no’ as over 61% of Greeks essentially voted to abandon the Euro, rejecting further austerity. Clearly, there is popular distain for the European creditors and the IMF who have bailed them out to the tune of 240 Billion Euros over the past 5 years while imposing their own rules in an attempt to turn Greece into a straight-shooting, tax-paying nation.

While austerity has take a massive toll on the Greek economy, exiting the EU and reinstating their former currency, the Drachma, could prove to be crippling, and immediately so (think run-away inflation and large scale market failure). In the mean time, the ECB’s liquidity freeze is strangling Greece’s economy. Banks are closed, people are lining up at ATMs, and businesses have shut their doors. The country is quickly running out of cash.

Political Precedents

Canadians, and much of the world can only watch in anticipation. Will Greece be the first country forced to exit the EU? Will other indebted members follow? Will a compromise be reached and debt forgiven? However the situation plays out, precedents will be set. As the dust settles, global markets will be more volatile than usual. However, central banks and global investors have had plenty of time to prepare for a Greek default and it is not going to cause a massive global disruption.

The term Grexit, a Greek exit of the EU, was coined in 2012. Greece’s problems are not unexpected and the possibility of a Grexit is not new. Although the massive debt restructuring and write-offs that will be necessary to avoid such a scenario will not set a good precedent for other indebted members of the EU, they will be necessary to maintain the integrity of the union.

What does this Mean for Canada?

Despite the political drama, the situation in Greece will not have a large impact on Canada’s economy. They are not a major trading partner and Canadians do not have much invested in Greece. The bank of Nova Scotia held about $330 million in Greek corporate debt and besides that Canada has virtually zero exposure to Greek debt – sovereign, personal or corporate. Greece doesn’t even represent 2% of Europe’s economy. The reality is that there are much larger global issues on the economic horizon, such as a dramatic slowdown in China and shaky recovery in the United States. The immediate economic repercussions of a default, Grexit or no Grexit, will not be severe, especially for Canada.

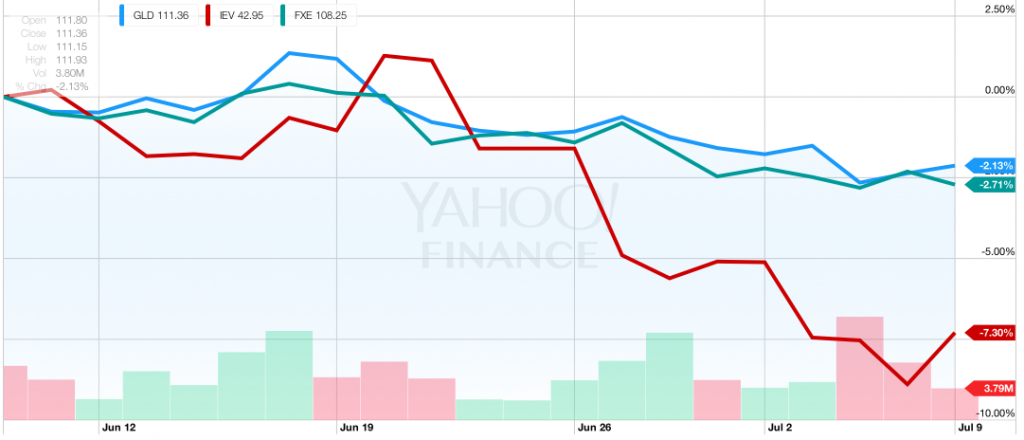

What we are mostly dealing with is uncertainty, which markets do not like. However, the markets have reacted quite modestly to the situation. In fact, the Euro has gotten stronger versus the Loonie over the last month. The price of gold has not rallied despite line-ups at ATMs and limits on available cash. The European Stock Market (STOXX 50) is down over 5% in the past month, but still in the black year-to-date. Clearly, investors are not expecting much global economic upheaval.

According to Lipper data, net flows into oversea stock funds were $600 million for the week ending June 24th. Flows into European equity funds are over $70 billion this year and flows into Greek funds actually hit a 4 month high on June 25th. Why? Most investors realize a last minute deal will be reached.

Until that deal is reached, uncertainty will drive international flows of money. When this happens, investors seek safety in credit markets like government bonds in stable countries. This increases the supply of available money and drives interest rates down. Canadian credit markets have become an international safe haven for investors. The situation in Greece will fuel this trend. 2015 has seen the largest foreign inflow of money into Canadian Government bonds ever, nearly $30 billion. This will keep rates low here and could mean that Canadians will have access to cheap mortgages for a little longer.