Statistics Canada released May’s inflation figures this morning, the consumer price index rose 0.6% in May. On a year-over-year basis, the consumer price index increased by 0.9% compared to 0.8% for the year ending in April and 1.2% for the year ending in March. Analysts had expected a marginally lower annual increase of 0.8% for May.

Higher prices were largely driven by increases in the price of food, which climbed 1% in May alone so that consumers are paying 3.8% more for food and 4.1% more for food purchased from stores compared to a year earlier. The price of meat continues to grow, up 7.9% over the year. In British Columbia, the price of fresh vegetables rose 11.9% in the 12-month period ending in May. Home insurance costs also saw sharp increases, up 8.3% year-over-year, contributing significantly to a higher CPI.

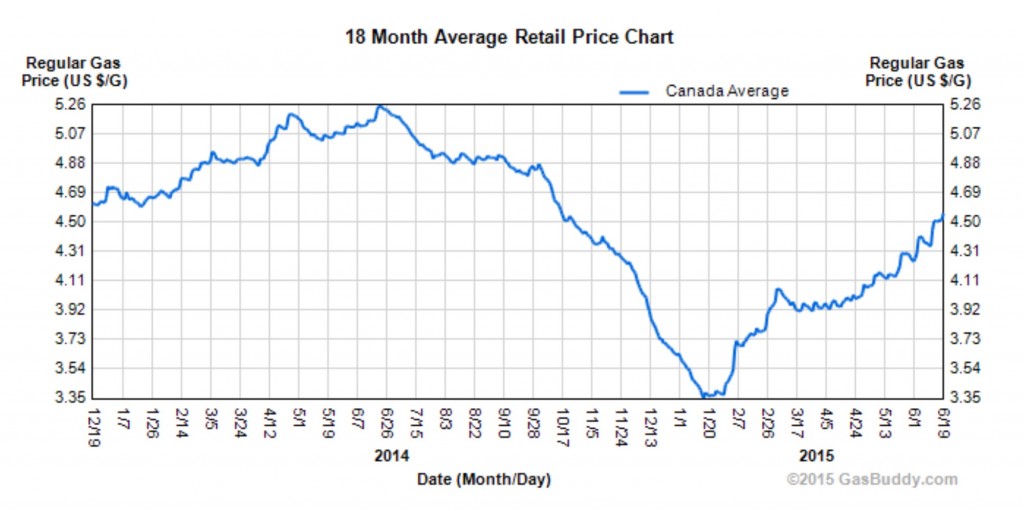

While transportation costs climbed 1.1% in May, they are still down 3.5% for the year ending in May. Canadians are paying much less at the pump as gas prices fell 17.4% over the year. The price of natural gas is also significantly lower, down 14.4%. Excluding energy costs, the CPI was up 2.2% for the years ending in both April and May.

Clothing and footwear was the only component of the CPI to decline in May, a decline of 1.2% for the month means Canadians are now paying only 0.5% more for clothing and footwear compared to May 2014.

Core Inflation and Seasonally Adjusted Monthly Numbers

Core inflation, which excludes volatile items like gas and food and is considered a better indication of underlying price trends, was up 2.2% annually in May, nearly matching the 2.3% increase for the year ending in April. Analysts had expected core inflation to rise by 2.1%.

Seasonally adjusted inflation numbers allow us to compare monthly figures by eliminating the impact of cyclical yearly price fluctuations. May’s seasonally adjusted numbers reveal some underlying inflationary pressures. Clothing and footwear was the only component to post a decline for the month. For May, the seasonally adjusted CPI was up 0.4% versus a fall of 0.1% in April. The seasonally adjusted core index climbed 0.2% in May, after a 0.1% rise in April and 0.4% rise in March.

The seasonally adjusted price of food was 0.4% higher in both April and May. Recreation, education and reading, which accounts for nearly 11% of the CPI saw the largest seasonally adjusted monthly increase of 0.8%, cancelling out a decline of the same amount in April. Transportation, the second largest component of the CPI, saw a seasonally adjusted monthly increase of 0.5%.

| Consumer Price Index, major components – Seasonally adjusted | % Change May | % Change April |

| All-items (100%) | .04 | -0.1 |

| Food (16.41%) | 0.4 | 0.4 |

| Shelter (26.08%) | 0.1 | -0.2 |

| Household operations, furnishings and equipment (13.14%) | 0.2 | 0.4 |

| Clothing and footwear (6.08%) | -0.2 | -0.3 |

| Transportation (19.1%) | 0.5 | 0.1 |

| Health and personal care (4.73%) | 0.3 | 0.2 |

| Recreation, education and reading (10.89%) | 0.8 | -0.8 |

| Alcoholic beverages and tobacco products (2.86%) | 0.3 | 0.5 |

| Bank of Canada’s core index | 0.2 | 0.1 |

| All-items excluding food and energy | 0.1 | 0.1 |

| Source: CANSIM table 326-0022. |

Inflation by Provence

As of May, annual inflation was above the national average in Quebec and Saskatchewan at 1.2% and 1.5% respectively. PEI was the only provence to see prices fall compared to a year earlier, continuing a six month trend of falling annual inflation numbers.

| Consumer Price Index for the provinces (not seasonally adjusted) | % change May 2014 to May 2015 | % change April 2014 to April 2015 |

| Canada (100%) | 0.9 | 0.8 |

| Ontario (38.9%) | 0.9 | 0.8 |

| Quebec (21.6%) | 1.2 | 1.1 |

| British Columbia (13.9%) | 0.8 | 0.5 |

| Alberta (13.2%) | 0.6 | 0.7 |

| Manitoba (3.2%) | 0.5 | 0.9 |

| Saskatchewan (3.0%) | 1.5 | 1.2 |

| Nova Scotia (2.5%) | 0.5 | 0.3 |

| New Brunswick (1.9%) | 0.6 | -0.1 |

| Newfoundland and Labrador (1.4%) | 0.3 | -0.4 |

| Prince Edward Island (0.3%) | -0.7 | -1.2 |

| Source: CANSIM table 326-0022 |

Outlook for Canada’s Economy

May’s inflation numbers are not significantly different than expected. However, they come on the back of disappointing retail sales figures for April. Analysts had expect retail sales to rise 0.7% and instead they fell 0.1% for the month.

In their Financial System Review, released on June 11th, the Bank of Canada identifies key vulnerabilities that the Canadian economy currently faces. Of particular importance is the overvaluation of the housing market and large amounts of household debt. Potentially sharp increases in long term interest rates in both Canada and globally is also a concern. However, Governor Poloz of the Bank of Canada notes that, ‘while risks may have edged higher, safeguards to protect the financial system are stronger than they were before.”

Lacking much encouraging economic data, the Bank of Canada will likely keep interest rates low in the foreseeable future. This should help bolster exports, which have been weak, as well as improve business spending. The downside of keeping interest rates low is that it will amplify the the problem of household debt, which is already at unprecedented levels. This makes Canadians, particularly those in oil producing regions who are already struggling more than the rest of the country, more vulnerable to future interest rate hikes.