Consolidated Credit Canada: Good for Debt Relief? (2026 Review + Comparison)

Photo Credit: Consolidated Credit Canada If you’re feeling buried by debt, I would start with a “one-stop” assessment where you can hear your options clearly in plain English. That’s why I’m comfortable pointing people to Consolidated Credit Counselling Services of...

Read More

Koho Credit Building Review – Is It Legit in 2025?

Need to improve your credit score and access to a quick cash advance at the same time? With KOHO's credit-builder loans aimed to enhance your appeal to potential lenders, you might have just found your answer. Now, does it deliver...

Read More

7 Quebec Debt Relief & Consolidation Programs in 2025

Are you living in Quebec and worried about your high debt? You are not the only one. According to the latest MNP Consumer Debt Index, 54% of Quebec residents “are still concerned with their ability to repay their debts, even...

Read More

LendCare Canada Review: Should You Get a Loan or Financing With Them?

LendCare is a Canadian point-of-sale financing company that partners with businesses across the country to offer fast and accessible loans for big-ticket items—ranging from dental procedures to home repairs and vehicle purchases. But is it the right option for you?...

Read More

Nyble – Legit for Loans & Credit Building? (2025 Review)

Should you consider Nyble (www.nyble.com) instead of a traditional loan? I think you should. Especially if you need a small loan (up to $250) and want to pay 0% interest. Nyble also offers credit building tools. In this review, we'll...

Read More

Spring Financial – We Review Their Loans, Interest Rates & Complaints in Canada.

Spring Financial is a Canadian (Vancouver-based) online lender offering personal loans and credit-building programs to borrowers across Canada. In this review, we'll break down their loans, rates and ratings to help you decide if they are right for you... Struggling...

Read More

What are Bree Loans? Should You Get One? Read Our Review

Thinking of Bree (www.trybree.com) instead of a traditional loan, cash avance or overdraft protection? Well, you're you're onto something, as you will be able to access up to $350 while avoiding interest (you'll pay exactly 0%). In this review, I'll...

Read More

14 Best Debt Consolidation And Relief Programs/Companies in Canada (2025)

When looking for the best debt relief options in Canada, it’s important to consider reputable companies and organizations that offer free counselling and provide a variety of options, not just debt consolidation. In fact, debt consolidation may not always be...

Read More

Farber Debt Solutions – We Review This Canadian Licensed Insolvency Trustee (2025 Update)

Credit: Farber Debt Solutions Dealing with debts can be overwhelming, and many Canadians struggle to find a solution that helps them regain financial stability. One of the most trusted names in debt relief is Farber Debt Solutions. The firm is...

Read More

Credit Counselling Society – Is This a Good Debt Counsellor in Canada for 2025? Let’s Review…

The Credit Counselling Society (CCS) is one of the leading non-profit credit counselling agencies in Canada, which helps people facing debt problems. CCS was founded in 1996 and offers debt counselling, DMPs, and other financial education services. In this article...

Read More

Debt Consolidation or Consumer Proposal: What Should You Choose to Alleviate Debt?

Handling high amounts of debt is never a fun thing, especially when one has to work hard to pay many loans, credit cards or even overdue bills. If you find yourself at a point where you cannot pay your debts...

Read More

6 Alberta Low-Income Benefits You May Qualify For

Living on a low income in Alberta presents significant challenges as the cost of living continues to rise. With increasing housing, groceries, and healthcare prices, many residents struggle to make ends meet. This is compounded by peak inflation of 4.2%,...

Read More

6 Yukon Debt Relief & Consolidation Programs in 2024

Are you stressed about your monthly bills? If you are a Canadian struggling to pay your debts, know you are not alone. Seriously! As per the latest MNP Consumer Debt Index, Canadians have “increasingly negative debt perceptions despite the recent...

Read More

Credit Canada – Legit Debt Relief Solution? Read Our Review…

Credit Canada is one of the most well-established non-profit debt relief organizations in Canada. The firm is known for helping Canadians with debt management and financial literacy. In this review, we’ll explore Credit Canada’s background, services, customer reviews, and whether...

Read More

Debt Consolidation vs Consumer Proposal in Canada: What’s Best?

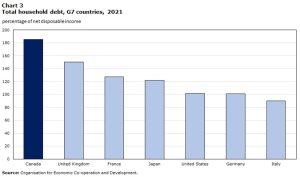

Debt is a reality many Canadians live with. The household debt-to-income ratios have continued to soar. The household debt-to-income ratio reached 184.5% in early 2023, meaning Canadians owed $1.85 for every dollar of disposable income. If you are feeling buried under financial...

Read More

8 Northwest Territories Debt Relief & Consolidation Programs in 2024

Are you struggling to make ends meet? You are not the only one. Surprised? “More than half of Canadians express concern that interest rates may not fall quickly enough to provide the financial relief they need (56%),” according to the...

Read More

6 New Brunswick Debt Relief & Consolidation Programs in 2024

Are you in New Brunswick and feeling buried under debt? I know it may not feel like it, but you are far from alone! Many people in the province and across Canada are facing similar challenges. As per the latest...

Read More

7 Prince Edward Island Debt Relief & Consolidation Programs in 2024

Are you in PEI struggling with an overwhelming debt load? You are not the only one. Many residents in the province are in a similar situation. As per Equifax, in Q1 2024, PEI residents had an average of $22,774 in...

Read More

7 Nova Scotia Debt Relief & Consolidation Programs in 2024

Are you a Nova Scotia resident dealing with overwhelming debt? I know you may feel alone, but you’re not. I promise. Many Nova Scotians are facing rising levels of consumer debt. According to the MNP Consumer Debt Index, 51% of...

Read More

7 Manitoba Debt Relief & Consolidation Programs in 2024

If you are a Manitoba resident saddled with debt, you are NOT alone. Yes, even if it feels that way. The latest MNP Consumer Debt Index found that 57% of Saskatchewan and Manitoba residents were “concerned about their ability to...

Read More